After a series of turbulent events, including a drop in the Consumer Price Index (CPI) and expectations of interest rate cuts, all in the space of 24 hours. Nothing is more powerful in this market than the ability to cut anyone at will. The Base project continues to be popular, and Arbitrum has also entered the memecoin game. Overall, there is a lot to cover, and it will become tiring to keep up with the changes in this industry. If possible, be sure to choose your area of expertise and build a team, because it is difficult to cover everything alone.

Despite this brief summary, it is vital to trust this: we don’t encounter a bull market every day, so make sure you are getting value for your money.

let's start.

Industry News:

- WOOFi announced that it will airdrop 7.5M FLC to WOOFi stakers, click here to find out if you are eligible.

- Uniswap received a Wells Notice from the SEC.

- Our resident on-chain detective, Zachxbt, is under investigation by IRS agents.

- Eigenlayer launches its mainnet.

- Origin Protocol proposed a merger of OGV and OGN.

- Picasso Network deploys IBC on Ethereum.

- Terraform Labs and Do Kwon were found guilty of defrauding investors.

- Karak announced that they are launching multi-asset staking as an Eigenlayer competitor and raised $48M.

- Bittensor is listed on Binance.

fluidity:

Capital continues to flow from Solana to Ethereum and Base, mainly due to increased congestion on the network, resulting in over 70% transaction failure rates, which is extremely frustrating. Although Solana is cheap and fast, not being able to sell or buy assets in a pinch is not more ideal than paying high gas fees because you can always push transactions through. Hopefully they can resolve these issues soon, although the current situation is not ideal.

More and more capital is pouring into Arbitrum, and crypto Twitter is not paying enough attention to this at the moment. See this as a good opportunity to seize the opportunity.

DEX Volume:

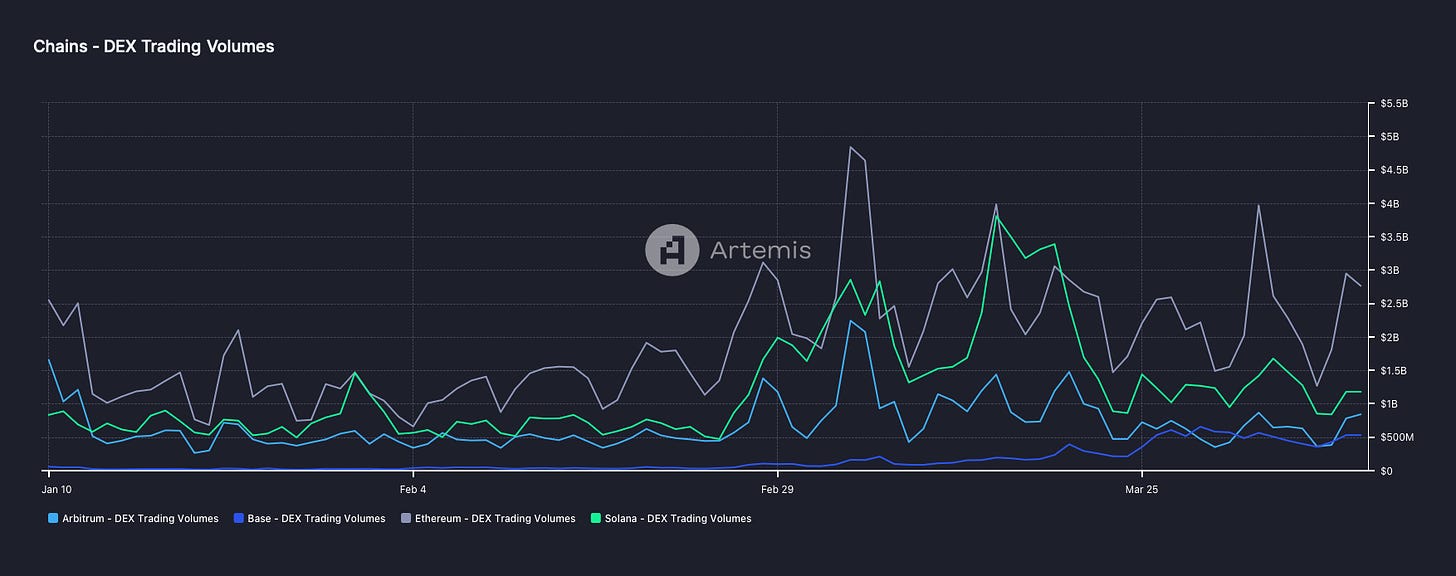

Volumes dropped significantly last week and are starting to pick up as most participants reduce risk and wait for Bitcoin value to climb to 71k again. We are still in a brutal market environment and we are experiencing another downturn just when on-chain activity is starting to heat up. Current market conditions are not for the weak.

Paired Volume:

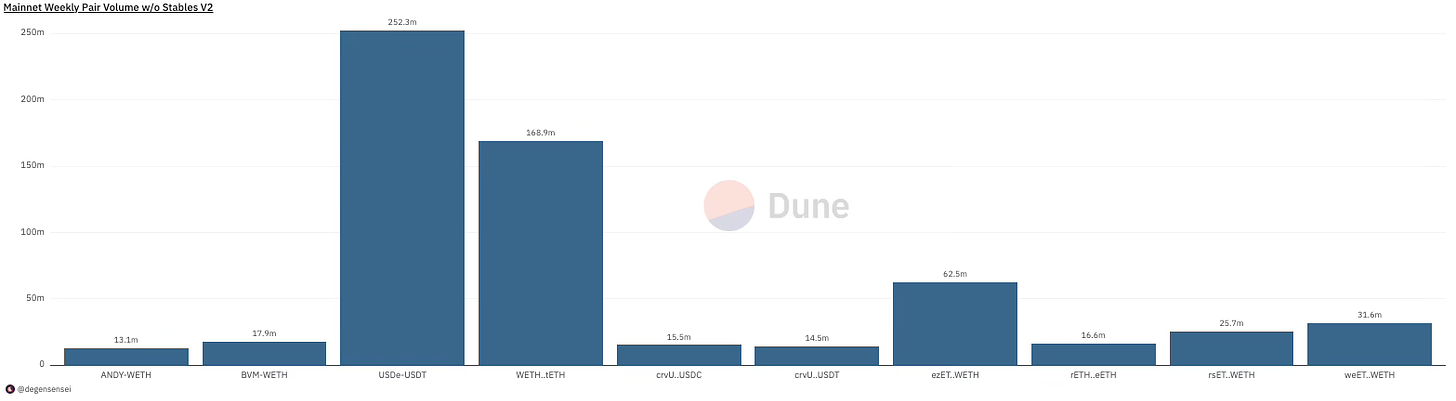

Price volatility is high, and altcoins are also extremely under-capitalized on-chain. BVM and ANDY continue to contribute the largest share of action as investors currently prefer to protect their capital. With the Bitcoin halving approaching, people expected BVM to take the lead as a Rollup-as-a-Service (RaaS) protocol for Bitcoin, and so far they are right. At the same time, when people feel the market is boring, they will bid for memes, and ANDY has proven this, although APU also deserves attention.

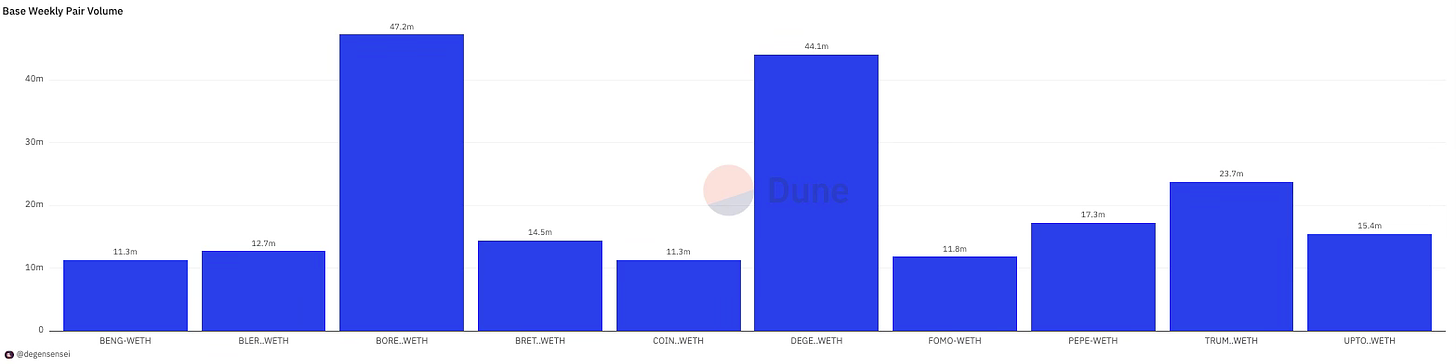

Last week, trading volume reached an absolute peak, and this week has slowed down somewhat. Nevertheless, most alternative operations are likely to continue on Base until some major event (such as the emergence of runes?) triggers a change in the narrative. DEGEN tokens continue to lead on Base, and TRUMP tokens have recently been bridged to Base, although with relatively low liquidity in the trading market.

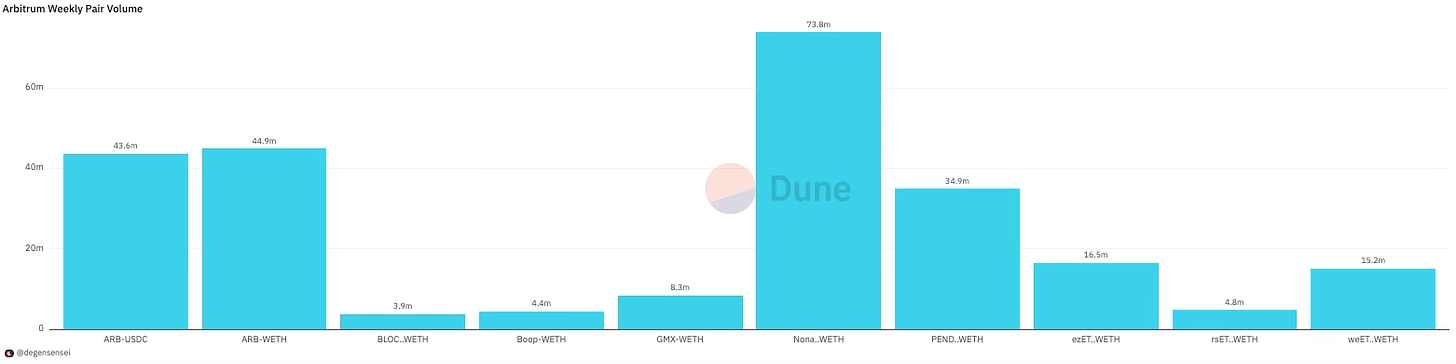

As for the “Noname” token, I don’t know what it is at this point, whether it’s a system error or some form of testing. However, PENDLE tokens continue to perform strongly on Arbitrum, setting new all-time highs again. In addition, Arbitrum’s meme Boop made its debut on the volume chart, undoubtedly becoming a new highlight worth paying attention to in the ecosystem.

NFT Trading Volume:

Bored Apes continues to be weak while Milady, Azuki's, and Remilios continue to gain ground in the rest of the NFT market. With Milady and Emilio continuing to announce new airdrops, they are really well positioned right now as their brand culture is embedded in the lore of crypto Twitter. This could very well be the most comfortable bull run NFT of this cycle.

Interesting coin minting platform

For NFTs, I highly recommend investing your time on Farcaster, as you can find the latest and best performing NFTs on this platform, and they are often minted for less than $10.

Transfer some funds to Base and start investing in NFTs. Your portfolio will benefit from it. If you haven't created a Farcaster account yet, you might as well sign up now. You can sign up through this link .

DegenRock — This is one of the NFTs that is currently mintable. I have mentioned it before in the article, so some of you may have already minted it while it was active. You can mint it here.

Net Inflow

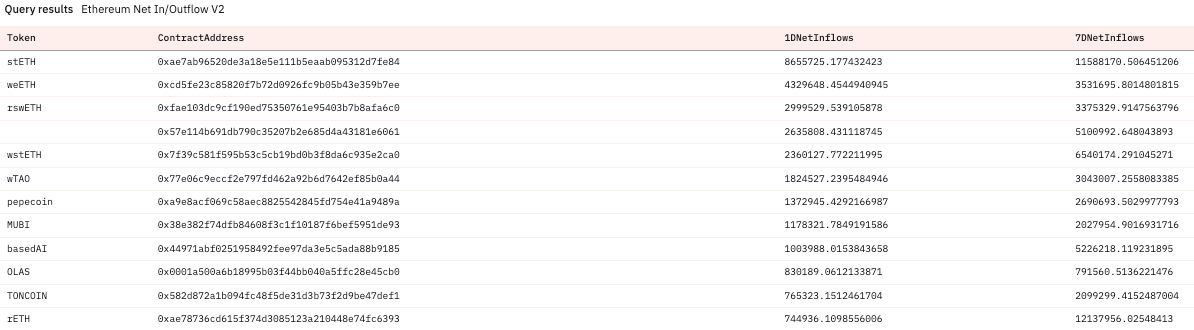

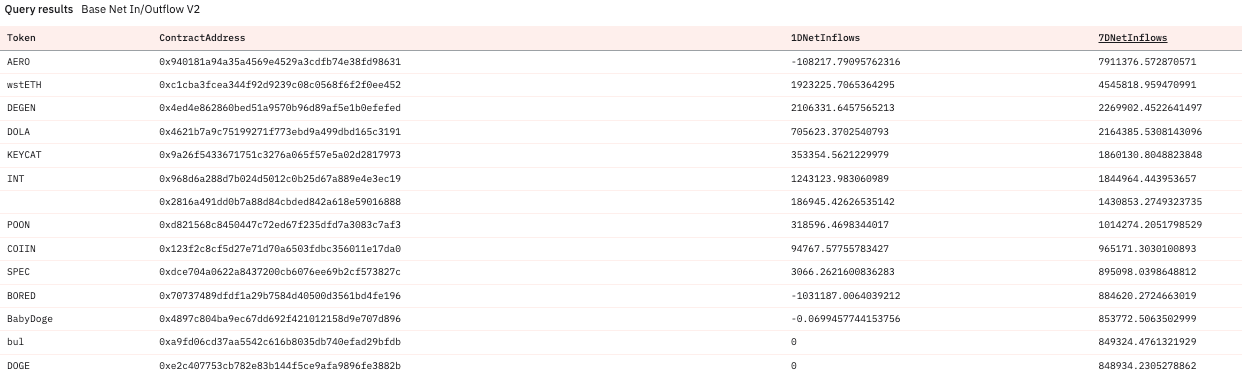

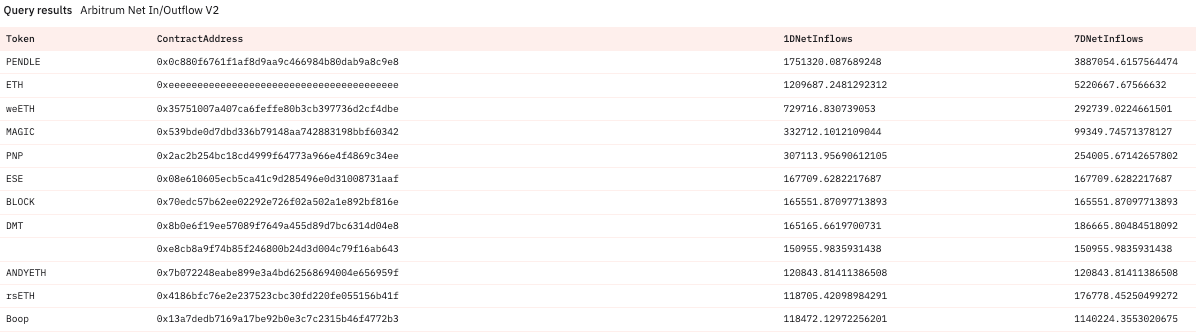

Despite the market volatility, the most accumulated altcoin in the past week is still TAO, which has shown strong momentum and has successfully listed on Binance. Pepecoin continues to perform well in a low-key manner, while MUBI leads the recovery of BRC20 tokens. Whenever AI tokens become active again, OLAS often follows TAO. TONCOIN, as a token of the Telegram ecosystem, has been detailed in this article about its upgraded functions.

AERO remains the strongest token on Base, generating huge fee income as the undisputed DEX leader. DEGEN is taking a break after a strong run, but continues to accumulate value as the Degen chain ecosystem successfully surpasses Avalanche in daily activity. KEYCAT has been the strongest cat meme coin so far, while INT is seeing an uptick in social activity as a decentralized lottery.

PENDLE is currently the clear leader of Arbitrum tokens, having taken the throne from GMX and MAGIC. However, MAGIC is starting to gain momentum, while PNP, a beta version of Pendle, is benefiting from strong price action on the token. BLOCK is another recently launched GameFi ecosystem on Arbitrum, while DMT is getting closer to launching their L3 Sanko Chain. Boop is an exciting entry as the chosen meme coin on Arbitrum.

investigation

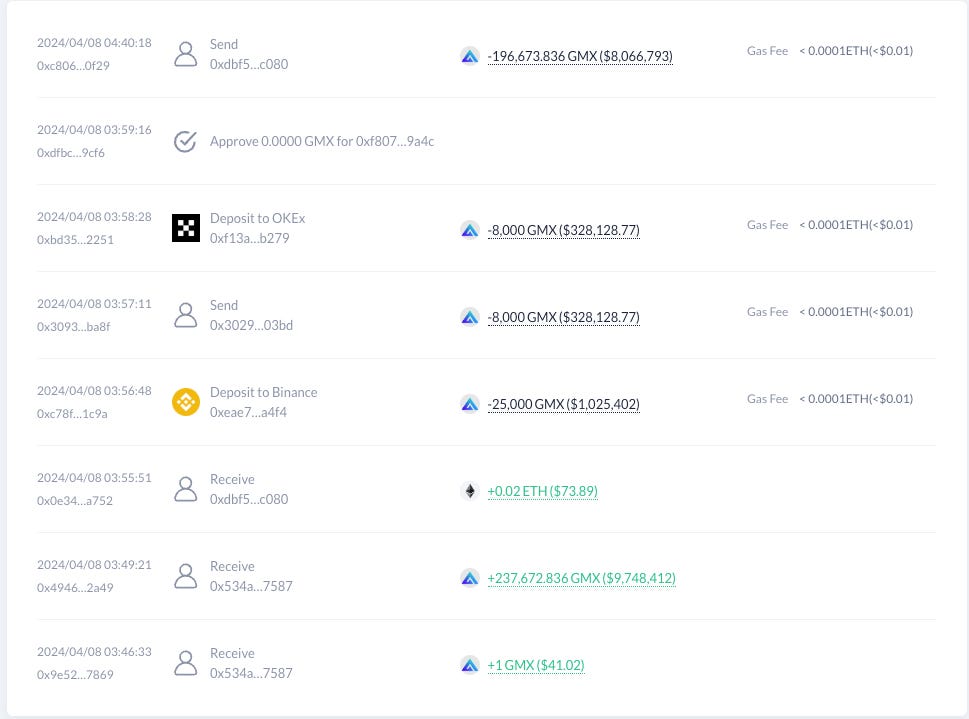

Arthur Hayes, one of the early investors in GMX, decided to reduce his holdings and resell to Binance. Does this action mark a market low for GMX or does it indicate that the protocol will face challenges and gradually lose its strong position in the market, while emerging perp DEXs are gradually taking over with their lucrative airdrop activities? It has indeed been a challenging year for GMX holders, however, time will be the best proof of truth.

The following are the wallet addresses investigated:

0x534a0076fb7c2b1f83fa21497429ad7ad3bd7587

0x3035f73caab91e4f59476ce2dc559381abbe6bf2

Token Unlock

- Aptos : 1.13% of the supply will be unlocked on April 12, worth approximately $139 million.

- WingRiders : 2.67% of the supply will be unlocked on April 14th, worth approximately $124,294.

- Rare : 0.3% of supply will be unlocked on April 14th, worth approximately $399,750.

- UXD : 2.05% of the supply will be unlocked on April 14, worth approximately $630,088.

- CyberConnect : 0.89% of the supply will be unlocked on April 14, worth approximately $12.28 million.

- starknet : 5.01% of the supply will be unlocked on April 15th, worth approximately $946 million.

- Arbitrum : 0.93% of the supply will be unlocked on April 15, worth approximately $136 million.