Author: ardizor , Cryptography Researcher

Compiled by: Felix, PANews

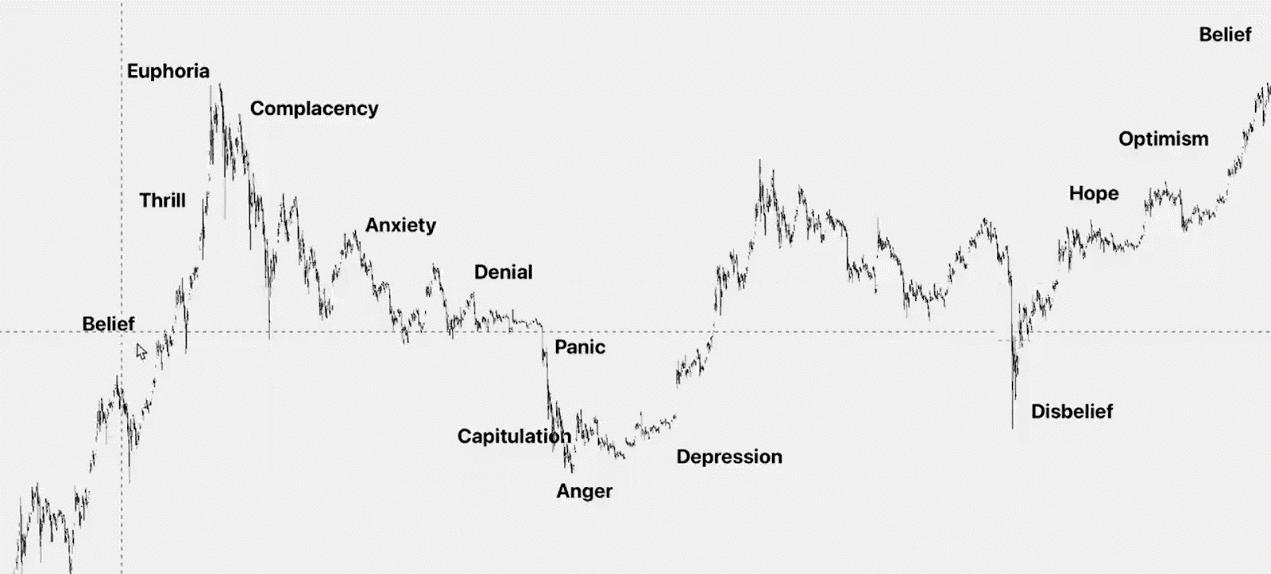

Each crypto bull run tends to follow the same pattern: 99% of people either lose everything or simply leave the market at breakeven without taking profits in time. This happens because the crypto market is dominated by emotions such as fear, greed, and FOMO.

Many people can tell you when to buy, but no one can tell you when to sell. Crypto researcher ardizor summarized the strategy of how to sell at the highest price. Although it is impossible to accurately predict every trend, you can deepen your understanding of market structure and rules, help ensure profits, and close positions at the best time.

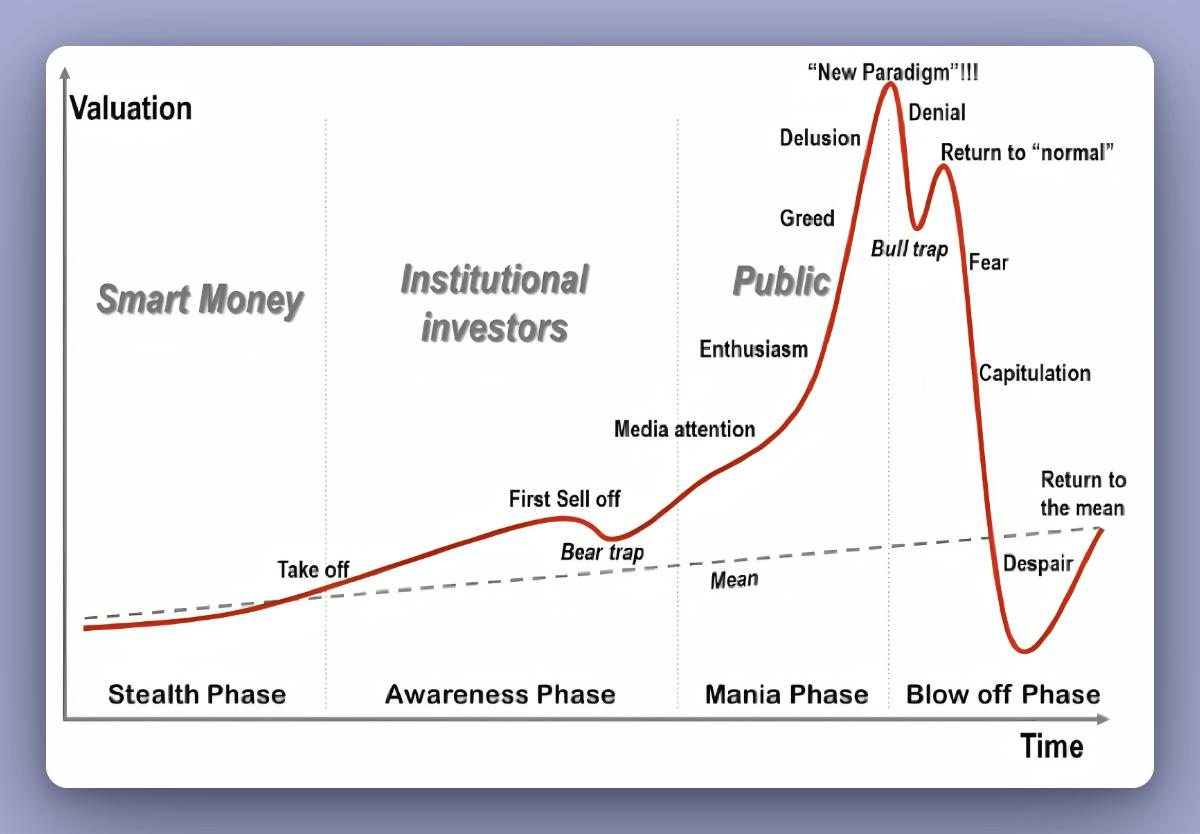

Like any other asset, the price of Bitcoin follows a specific pattern. This pattern repeats itself due to human emotions, especially FOMO. The chart below illustrates the sentiment of traders over different time periods. While there may be slight changes in each coin, the underlying sentiment is consistent.

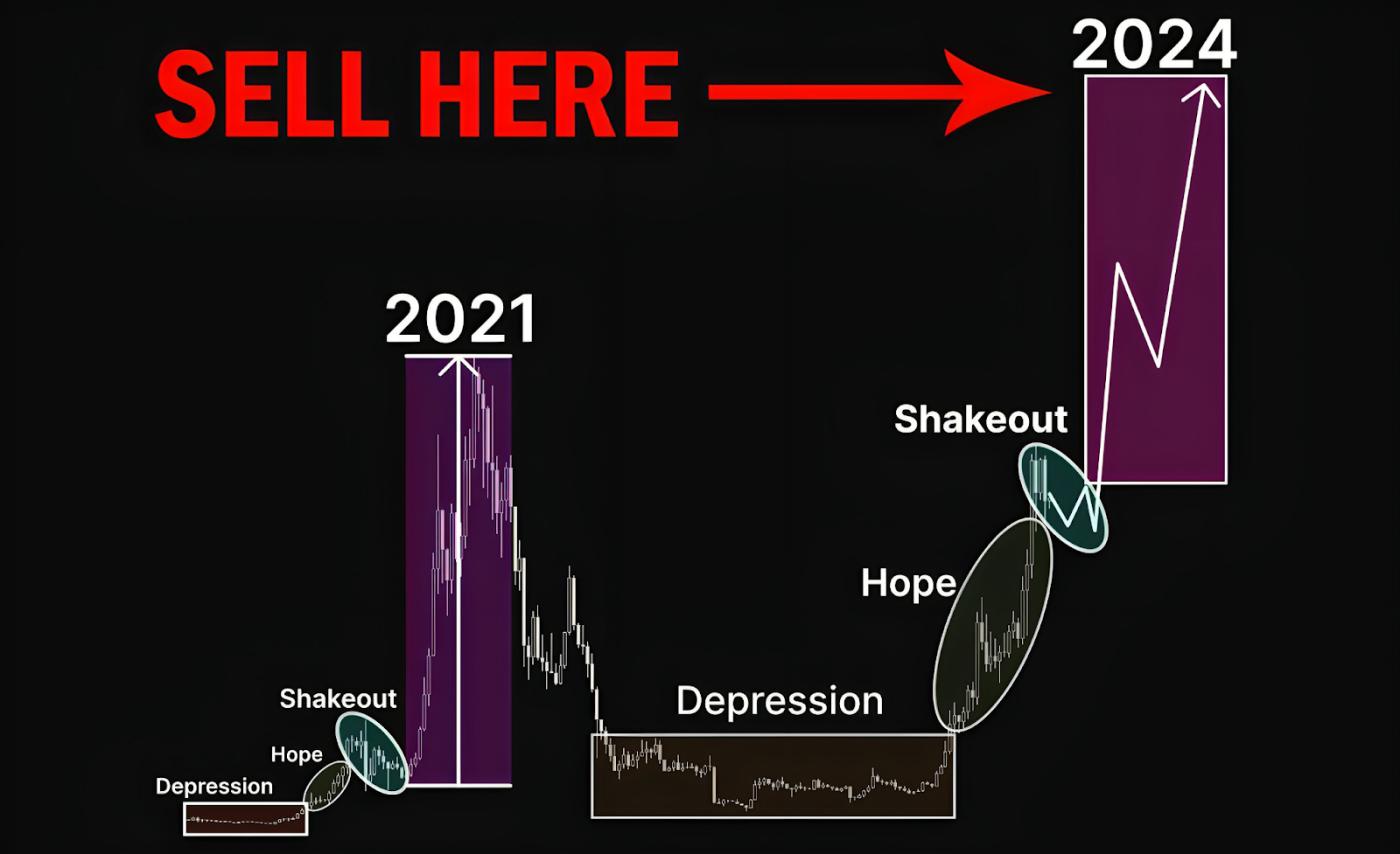

Take the market cycle model in the 2021 bull market as an example. In order to maximize profits, investing in Altcoin should be done during the depression phase. Remember: "Buy when the market is bleeding, even if it is your own blood."

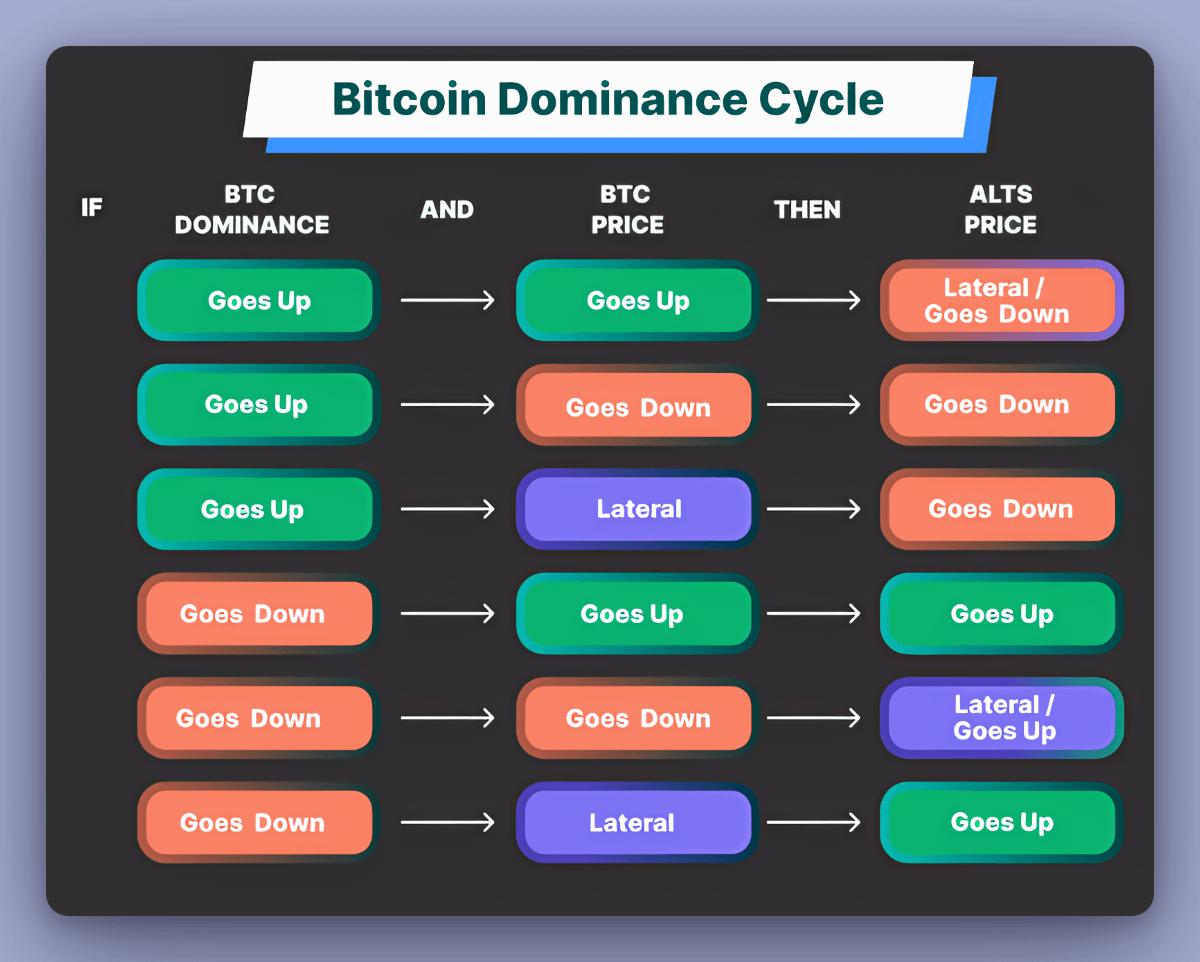

It is crucial to recognize when Altcoin start to really surge. During the Altcoin bullish phase, the gains could be 100x that of Bitcoin or Ethereum, as the upside potential could be not just 2x, but up to 1000x. In a Bitcoin-led cycle:

- If Bitcoin's market share increases and Bitcoin's price rises, the price of Altcoin will go sideways or fall;

- If Bitcoin's market share increases and Bitcoin's price falls, then the price of Altcoin will fall;

- If Bitcoin's market share increases and Bitcoin's price moves sideways, the price of Altcoin will fall;

- If Bitcoin's market share decreases and Bitcoin's price increases, the price of Altcoin will increase;

- If Bitcoin's market share decreases and Bitcoin's price falls, the price of Altcoin will move sideways or rise;

- If Bitcoin's market share decreases and Bitcoin's price moves sideways, the price of Altcoin will rise;

You may already know how the market works, but without a system, you cannot effectively manage your emotions. Here are the trading rules you need to remember:

Treat market profits like a paycheck, not a lottery win

Respect your money and don't waste it. There is no way to get rich overnight in this world. Only steady and steady wins the day.

Buy on expectations, sell on news

Don't show up after the party is over. When the news comes out, it's time to sell, not to buy. If you buy late, you'll only satisfy those who bought early and are now laughing in their new Lamborghinis.

If you don’t already own the token, would you immediately buy it from your portfolio?

Even if the investment is bad, people are usually reluctant to accept the loss or realize that they made a bad investment. They often come up with countless reasons to explain why they hold these coins. If you ask yourself the above question when there is a loss, you may be surprised at the amount of junk assets in your portfolio.

To achieve truly high returns, consider the following when analyzing promising tokens:

- What is the upside potential? (Compare this token to other tokens in the space)

- Who are the largest holders and top venture capitalists?

- Roadmap, partnerships, team, and more

- Is the token about to be listed on a CEX? (Listings often lead to an increase in liquidity and price, especially when an announcement is made)

Related reading: From $100 to $100 million, explore the trading experience and positions of legendary trader GCR