Yesterday, the Bitcoin spot ETF had a net outflow of US$121 million, of which GBTC had a net outflow of US$130.4 million and IBIT had an inflow of 0. Grayscale has been in a state of outflow. Now institutions are waiting for Grayscale to distribute, which is a good thing. The market will be healthier after sufficient turnover.

Bitcoin did not hold steady near 66,500 and began to fall at 20:00 last night. The market interpreted this as Israel’s action against Rafah, so it fell. In fact, this is not entirely true. The real reason is that Bitcoin is still in a weak adjustment. As mentioned in previous analysis, it will adjust repeatedly and will repeatedly test the bottom support many times.

At the 4-hour level, the strong support position near the bottom of 60,000 is re-verified. In the short term, the main focus is on verifying the support and weak fluctuations.

I believe that people who can enter this industry are here to make money, and want to make a lot of money.

When we come to the financial market, we must be clear that the first step is to "not lose money". Only when we do not lose money can we talk about making money. The key to getting big gains is to "know what not to do".

I have summarized the following things that you should not do in the current market. I hope it will be helpful to you.

1. Do not use leverage or contracts. Once we come into contact with contracts, it is like gambling. We become addicted and lose the mood to do anything. We are affected by the ups and downs of the market every day. We cannot sleep and our mentality changes drastically. Even if the trend is judged correctly and the market is still there, the balance in the account is getting smaller and smaller.

2. Options scam. There is a scam that is rampant now. The scammers say that they are awesome and have made a lot of money, and then they say they will take you and ask you to transfer U to the exchange they provide, and they will let you make money. You can withdraw small amounts of money, but people are greedy, so you will increase your chips. Once you put in more money, they will not let you withdraw it, and they will have various reasons to ask you to top up money to unfreeze it.

3. Buy when the market goes up and sell when the market goes down. If you don’t understand the technology and the market, it is difficult to make money in this market. If the market goes down, you don’t know when to buy and you are afraid, or even sell at a loss. If the market goes up, you start to buy without thinking because of your high emotions.

If you cannot identify the bottom and enter the market, you will not make a lot of money. Maybe you can make some money by buying in when the price goes up, but you will end up losing money because you don’t know when to sell and you will be afraid to cut your losses when the price goes down.

4. Stay away from negative emotions. Complaining will only make people fall into a vortex of negative emotions, making them accustomed to looking for problems in others and ignoring the efforts they should make.

You will find that people who invest based on news always complain that what others say is wrong and causes them to lose money, but they never think that if they mastered the technology, they would not listen to the opinions of these so-called "big guys".

Whether in real life or in the financial market, complaining does not solve problems. Instead, it will wear down our fighting spirit, consume our energy, and make us become discouraged.

As long as you avoid the above points, I believe the probability of losing money will be greatly reduced, so that you will have more energy and mood to calm yourself down and find the direction to make money in the future.

What results will the ETH spot ETF usher in in May?

In the past two days, many people have begun to discuss whether the SEC will approve the ETH spot ETF.

Many opinions tend to think that it is going to pass! Buy the dips of ETH, ETF reverses BTC, buy the dips of Ethereum assets, and "earn money together".

May is very important. According to current information, the SEC will indeed make approval decisions on multiple ETH spot ETF applications by the end of May, including VanEck, Ark 21 Shares and Hashdex. The earliest specific date is May 23.

Why do people think it can pass this time? Mainly because there have been some "clues" recently that seem worthy of attention.

First of all, Brother Sun has recently entered a phase of "buying, buying, buying". According to the data, since April 1 alone, a single address suspected to be Brother Sun has accumulated 154,570 ETH through Binance withdrawals and on-chain purchases, equivalent to approximately US$490 million, with an average price of US$3,140.

Who is Brother Sun? When did he suffer a loss? The top indicators for escaping the top and buy the dips the bottom.

Some people believe that Sun Yuchen went to LRT protocol to Airdrop Hunting. Previously, he easily got the wool from ETHFI. According to Dune data, the real-time deposit amount ranking of EigenLayer shows that three Justin Sun addresses, 0x176, 0xdC3, and 0x79ac, currently occupy the second, third, and fourth places on the list respectively. The total amount exceeds 200,000 ETH.

In fact, there has been a lot of news about the US ETH spot ETF recently. For example, the SEC said that it would postpone the decision on the Grayscale Ethereum Trust's application to convert to an ETF, and Grayscale immediately started working on it and submitted an application called the Ethereum Mini Trust ETF. For another example, after the SEC postponed the decision on the Franklin Spot Ethereum ETF application, the SEC said it would solicit public opinions on the revised proposal for the BlackRock Ethereum Spot ETF.

In short, it was quite lively going back and forth.

In addition, on the 24th, the official website of the Hong Kong Securities and Futures Commission has listed the BTC and ETH spot ETFs of three fund companies, China Asset Management, Bosera and Harvest, and will officially start trading on April 30. This means that Hong Kong has officially approved the ETH spot ETF, and the United States is not far away.

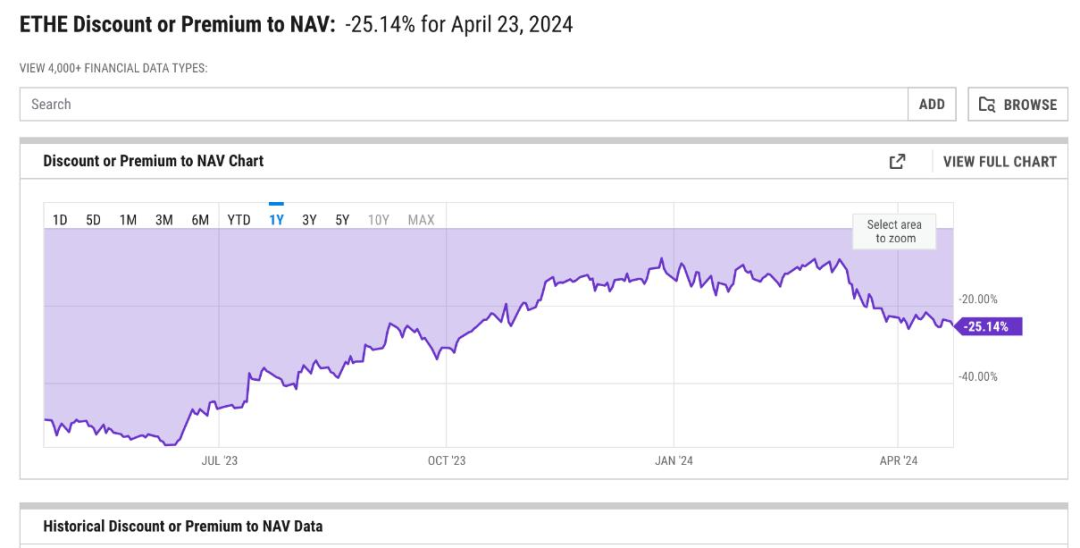

In fact, there is an interesting indicator, which is the discount rate of Grayscale's ETH Trust. As can be seen from the figure below, this discount rate has not only not increased recently, but has fallen instead.

This shows to some extent that at least the funds are not optimistic about Grayscale's Ethereum spot ETF. It is only a few days away from May. If there is any gossip, the well-informed Wall Street tycoons will have to "start performing".

Recently, Standard Chartered Bank stated in a report that the spot Ethereum ETF is unlikely to be approved by US regulators in May. At the same time, they reiterated that the price target for Bitcoin by the end of the year is $150,000 and the target for Ethereum is $8,000.

An interesting point may be that the current mainstream view does not support the approval of the ETH spot ETF in May, but this does not affect everyone's belief that ETH will have a good market performance in May.

Optimism is not a bad thing because we are in a bull market!

Create a high-quality circle

Spot mainly

I will share some content: as shown below:

Tentative 50 people

The overall position is ≥ 10,000u. If you want to join, scan the QR code below!

(A few hundred or a few thousand is too small to operate. If you don’t have it, you can also send a private message. You can also join after passing the screening.) Purpose: To become bigger and stronger, and create a brilliant bull market turnaround!

This is the end of the article. I will do a more detailed analysis in the communication group. If you want to join my circle, please contact me directly through the WeChat below!

Want to join the VIP spot group! Welcome to chat with me! Welcome to join us to grasp the next hot spot and maximize the return on investment together!