In the past few days, the capital inflow of BlackRock ETF has been zero, which is one of the main reasons for the current weakness of the market. Bitcoin received a brief support near 62,800 last night, but it is still a bit weak. At present, the market is exchanging time for space and slowly adjusting to the weakness. Yesterday, the purchase of BlackRock ETF also stagnated.

The market does face huge risks in the short term, but as Thirteen has repeated countless times in previous articles, investing in Bitcoin must be a long-term behavior. You can just play with short-term speculation, but don’t take it seriously. If you take it seriously, you will only become a leeks.

Next is May, which is a very important month because whether Ethereum can pass the ETF is a big event in the crypto.

But the outcome has already been decided, and the market will most likely not approve it.

Ethereum has been quite weak this round and has been digesting various negative factors. Although it is highly unlikely to pass the ETF, it does not mean that Ethereum will not rise.

Bigwigs like Justin Sun have bought a huge amount of Ethereum at the current position and are madly absorbing funds in the market. All the panic chips of retail investors have been taken away by these guys.

Later, the price of Ethereum skyrocketed, and a bunch of people came out to say that Sun was cutting the leeks.

If you have Bitcoin or Ethereum in your hands now, please hold on to it and don't lose it.

I personally think that cyclical investment is more suitable for most people:

There are many common mistakes about leeks. Here are a few:

1. Fixed investment. If you choose the wrong target, you will be in pain. How long can you hold it for 1 month, 2 months, 1 year, or 2 years? Most people don’t have that patience.

2. Follow the news and chase highs. Why do you often make money but lose money later? Because you have been pua-ed. Pulling up the price and then plummeting it is the trick of the market makers.

3. Without your own judgment, you will never outperform the market. The so-called money you earn beyond your cognition will eventually be returned to the market.

Okay, now let me talk about what cyclical investing is.

1. You'd better make a plan for 3-6 months. Most of the time is waiting. The crypto has ups and downs. Most of the time is waiting. If there is no opportunity, we just wait. Can you bear it?

2. Extreme market panic is an opportunity to enter the market. Is there any entry signal? I can say for sure that there is, with at least 90% accuracy. But judging the degree of panic is also enough to make you profitable in the cycle.

3. I usually judge the market trend through Bitcoin. Only when Bitcoin reaches the buying point can I deploy Altcoin. This is the principle. Otherwise, you may easily end buy the dips at the bottom halfway up the mountain.

4. The selling point is generally when Bitcoin shows a stage top signal. Bitcoin must be cleared immediately, and Altcoin must be cleared within 10 days.

There is good news in the market:

Hong Kong approved the Bitcoin and Ethereum spot ETFs of China Asset Management, Harvest Fund and Bosera Fund at one time.

It will be officially launched on the 30th of this month. This is a belated benefit for the crypto, especially Ethereum. Hong Kong is all in web3.

Hong Kong is a part of us, and what he can do is indirectly equivalent to recognizing its legitimacy.

Not only should we have "one country, two systems" in terms of system, but this also applies to web3.

The higher-ups have their own considerations, and opening the loophole for Hong Kong is enough.

Of course, mainland investors cannot participate directly, and it is expected that people in the web2 world will not go to Hong Kong to invest in Bitcoin and Ethereum ETFs.

Because as an insider investor, buying Bitcoin and Ethereum directly is more direct and will not lead to farting without taking off your pants.

The short-term market situation will depend on how big Hong Kong can open its market and how much capital it can attract on April 30.

The same is true for the previous market. It is not a big market that can burst out in one day, a few days or a few weeks. It also takes time to brew. Many times, we need to understand the cyclical nature of the market. In the market where it is not so easy to make money, we must learn to be conservative and learn to feel the pulse of the market! At present, the BTC is in the process of shock, and there are still relatively few varieties of independent market! Therefore, now is not the time for us to play the big market or the speculative market, but a conservative or defensive stage!

When BTC is still above 60,000, I personally suggest that you should not be too aggressive in bottom buy the dips! Just like everyone thought that it would not fall below 25,000 before, it still broke later! Or the bottom of this wave of market will also occur after BTC falls below 60,000. In any case, don't buy it all.

Before the trend comes, I personally think that preserving the principal is always the most critical thing. As long as the principal is there, when the trend rises, it is more appropriate to speculate with heavy positions. However, it is not suitable for heavy positions at present. Instead, you should patiently wait for the bottom to form. Do not chase highs and sell lows. The current trend actually does not have much logic. Therefore, short-term players should remember to exit in time!

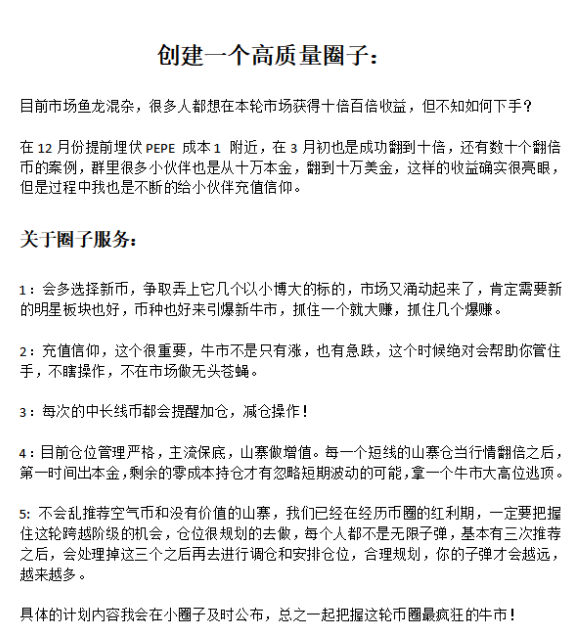

Create a high-quality circle

Spot mainly

I will share some content: as shown below:

Tentative 50 people

The overall position is ≥ 10,000u. If you want to join, scan the QR code below!

(The operating space of a few hundred or a few thousand is too small. If you don’t have it, you can also send a private message. You can also join after passing the screening.) Purpose: To become bigger and stronger, and create a brilliant bull market turnaround!

This is the end of the article. I will do a more detailed analysis in the communication group. If you want to join my circle, please contact me directly through the WeChat below!

Want to join the VIP spot group! Welcome to chat with me! Welcome to join us to grasp the next hot spot and maximize the return on investment together!