Author:BM

Editor: Huanhuan

For the Ethereum ecosystem, the narrative related to staking has always been a hot topic in the market. After all, the Ethereum network adopts the PoS consensus mechanism, and the increase in the staking rate can enhance the security of the Ethereum network.

According to data from the dune platform, the total amount of staked ETH has reached more than 30 million ETH, accounting for more than 27% of the total ETH, and the market value of staked ETH has exceeded 100 billion US dollars.

Such a large amount of ETH has been pledged in the Ethereum network in various forms, which not only improves the security of the Ethereum network, but also spawns various gameplays, such as liquidity staking, re-staking, DVT (Distributed Validator Technology), etc., which undoubtedly enriches the Ethereum ecosystem.

Recently, the restaking track has become more and more popular in the market. Although the restaking narrative started in January this year, it has developed very rapidly and continues to erode the market size of Staking.

Compared with traditional liquidity staking, the re-staking yield is significantly higher, and stakers can even receive multiple returns.

The market’s emphasis on the re-staking track can also be seen from the investment layout in the primary market. For example, Binance has invested in the two leading re-staking protocols, Puffer and Renzo , and the Binance Launchpad platform has also launched the re-staking leader ETHFI.

Therefore, friends who pay attention to the Ethereum ecosystem must pay attention to the development of the re-staking track. In this track, in addition to the leading ETHFI, the second dragon Renzo is also worth paying attention to. It has been launched on Binance Launchpad on April 24 and will be launched for token trading on April 30.

What is so unique about Renzo?

1. Introduction to Renzo

Renzo is a re-staking project that was created in the summer of 2023, and mainnet was launched in October. It is a liquidity re-staking protocol based on the EigenLayer ecosystem, which aims to simplify complex staking mechanisms for end users and achieve rapid cooperation with EigenLayer node operators and Active Verification Services (AVS).

According to the project team, unlike traditional staking, Renzo allows users to obtain higher returns. By introducing the derivative token ezETH, Renzo effectively releases the liquidity of re-staking ETH tokens. Secondly, it uses advanced algorithms to balance returns and risks in real time, thereby automatically making the best configuration choices for users and ensuring a stable and substantial return on investment.

2. Project Team and Financing

Renzo's three founders (Lucas Kozinski, James Poole and Kratik Lodha) are also veterans in the blockchain industry and have 6 to 7 years of full-time work experience in Web3.

Lucas Kozinski has served as project leader at the Tezos Foundation, business strategy and COO at Tokensoft, and is the founder of Moonwell.

Kratik previously worked at Woodstock Fund (which invested in Moonwell), and James is the third founding member of Renzo.

It is worth mentioning that Renzo started his business last summer, relying entirely on his own funds. He survived until November when he met Maven11 in Turkey and then received financing.

According to Rootdata platform data, Renzo has received two rounds of financing. On January 15 this year, it announced a financing of US$3.2 million, led by Maven11, with participation from OKX Ventures and IOSG Ventures. On February 22, Binance announced its investment in Renzo, but did not disclose the specific investment amount.

3. Development Status

According to founder Lucas, Renzo's current plan is divided into three phases. The first phase is to increase liquidity and allocate liquidity, the second phase is to improve efficiency, and the third phase is portfolio construction risk management. The three phases will take approximately one to one and a half years.

Renzo is currently in the first phase, which is the stage of TVL and DeFi integration.

Renzo has integrated more than 50 DeFi protocols in 13 weeks and launched native re-staking on five Layer2s: BNB Chain, Mode, Linea, and Blast.

According to data from the defillama platform, Renzo TVL has grown from more than 10 million US dollars at the beginning of this year to 3.2 billion US dollars now. The TVL has increased more than 100 times in 4 months.

In the Restaking track, Renzo TVL ranks second, only behind ETHFI.

Token Economic Model

The Renzo platform token is EZ (Binance has changed it to REZ), which uses a single-coin model. The total supply of EZ will be 10 billion, and the circulating supply when the token is listed will be 1.05 billion, accounting for approximately 10.50% of the total token supply.

Binance Launchpool will allocate 2.50%;

The airdrop will allocate 10.00%;

Investors and advisors will be allocated 31.56%;

The team will be allocated 20.00%;

The foundation will allocate 13.44%;

The DAO Treasury will be allocated 20.00%;

2.50% will be allocated to the liquidity budget.

From the token distribution plan, it can be seen that the share of the team, foundation, investors and consultants has reached more than 60%, while the share allocated to the community is relatively small, which is contrary to the decentralized spirit advocated by the project party. In addition, the airdrop application time starts on May 2nd.

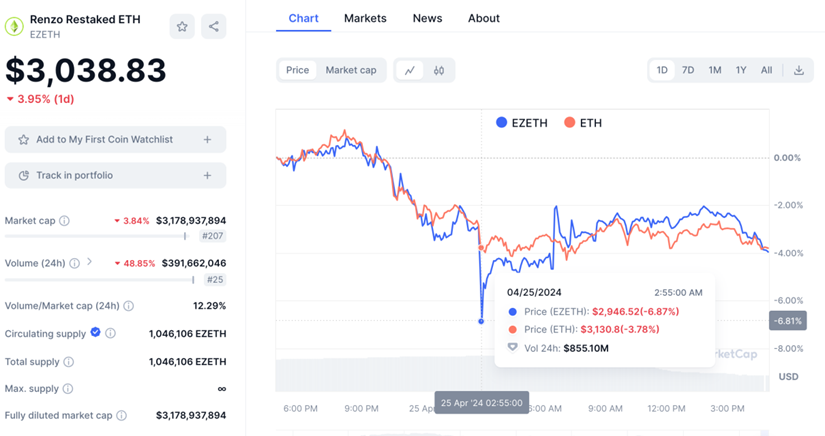

A series of actions by the Renzo project team caused dissatisfaction among some community users, so some big players began to dump ezETH, causing ezETH to be seriously decoupled and fall to more than US$2,900 at one point (while the price of ETH was more than US$3,100).

The project team may also be aware of the seriousness of the problem. After listening to the opinions of the community, they updated the token claiming time and token economics information on April 25. For example, the airdrop claiming time was updated to one hour before Binance’s launch on April 30, and the token allocation to the community was increased from 30% to 32%, and the airdrop allocation ratio was increased from 10% to 12%.

Judging from the progress of token unlocking, the circulation of EZ tokens will basically maintain relatively low liquidity (no more than 20%) in 2024. This part of the tokens is mainly composed of Binance Launchpad and airdrop shares. The accelerated unlocking of tokens will not be until the end of the first quarter of next year.

5. Token Valuation

For the valuation of ez tokens, you can refer to the average annualized rate of return of previous Binance Launchpad projects. Based on the amount of BNB invested and the amount of ez mined, you can roughly estimate the launch price of ez tokens.

According to the Binance Launchpad platform, the ez mining cycle is 6 days and will last until the 29th. The current total BNB investment is 18 million. For the convenience of calculation, it is assumed that the final total BNB investment, and the BNB investment in recent periods has not exceeded 18 million.

According to statistics from the Odaily platform, the average yield of Binance Launchpad in recent periods was 1.8%, with a minimum of 0.5% and a maximum of 3%.

Then, based on the average rate of return of 1.8% in the past, as well as the total amount of BNB invested, the BNB price at the time of mining ($608), and the total amount of mining rewards, we can estimate the approximate launch price of the ez token.

18008680 x 608 x 1.8% ÷ 212500000 ≈ 0.92 USD.

Given the current crypto market conditions, a 1.8% return is basically difficult to achieve, so the listing price of 0.92 is obviously too high.

In addition, the recent market response to the Renzo project has not been good, and the community has some strong opinions. If the rate of return is revised to 1%, the estimated ez price will be US$0.52.

Of course, for the valuation of ez tokens, we can also refer to ETHFI. After all, both are Restaking track projects, one is the first in the track, and the other is the second in the track, and the first launch platform is Binance Launchpad.

After several days of market competition, ETHFI's current market value is 405 million, which represents a relatively reasonable valuation of ETHFI in the current market environment. If the same MC (circulating market value) is used as the benchmark, the initial circulation of EZ is 1.05 billion, then the price of EZ tokens is: 4.14 ÷ 10.5 ≈ 0.386 US dollars.

If calculated by FDV (full flow value), the token price of EZ is $0.359.

Therefore, on the whole, the price of ez token will most likely fall between 0.3 and 0.5 US dollars.

Of course, this is just a static estimated price calculated based on the current market value of ETHFI, but the market sentiment and market trends today and on April 30 (EZ was listed on Binance trading) are bound to be different, and there are certain differences in the business logic, TVL, investors and other factors of the two projects. Therefore, the valuation price calculated above is only a relatively rough reference.

PS This article does not constitute any investment advice