EigenLayer has issued a token, but it seems that it is better not to issue one. (Attached is a tutorial on how to bypass geo-blocking and query airdrops)

By Alex Liu, Foresight News

EigenLayer announced the launch of the token EIGEN last night and will conduct a "Stakedrop" airdrop. Currently, EIGEN is quoted at 9.94 USDT on AEVO, corresponding to nearly 16 billion US dollars in FDV. Users who participate in re-staking directly through EigenLayer and holders of LRT can now check the number of airdrops on the official claim website, while participants in DeFi protocols such as Pendle will have to wait until the second phase.

The EigenLayer airdrop finally arrived, but it brought unexpected controversy.

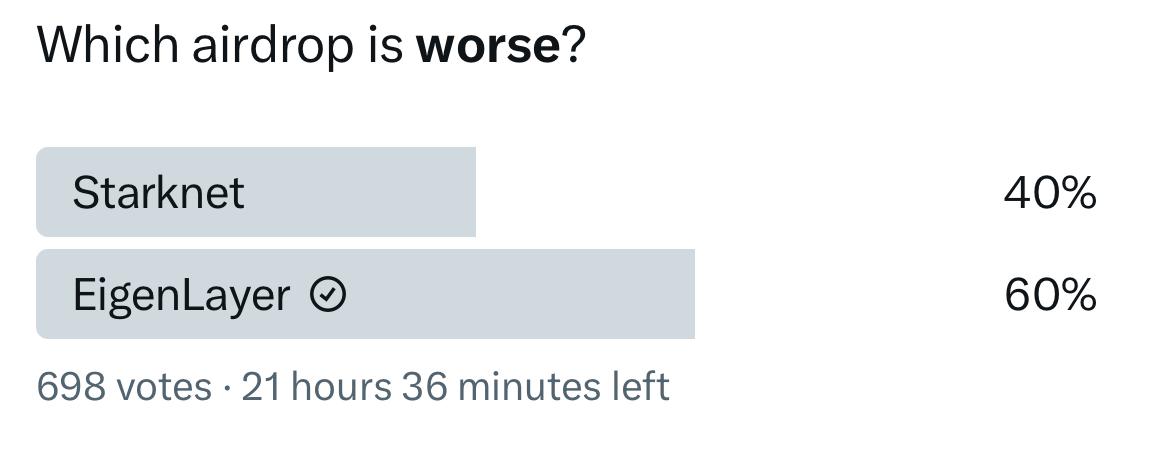

Community vote on who has the worse airdrop

Project attracts much attention

If you ask what is the most watched project this year, EigenLayer, which has set off a wave of "re-staking" on its own, is the undisputed answer in many people's minds. When alt L1s such as Solana continue to be popular and the large MC memecoin meme is flying all over the sky, LRTfi based on EigenLayer has stabilized the Ethereum ecosystem and absorbed a large amount of TVL, allowing users to look forward to future excess returns and keep their funds and confidence in Ethereum.

According to DeFiLlama, EigenLayer has nearly $16 billion TVL, ranking second in the entire chain

Many people believe that "EigenLayer will be the largest airdrop this year, or even in history."

But last night, when the Eigen Foundaton X account, domain name, airdrop claiming website domain name, Eigen token white paper, and airdrop qualification query function were successively exposed and launched, many people became increasingly disappointed and even angry. What exactly happened?

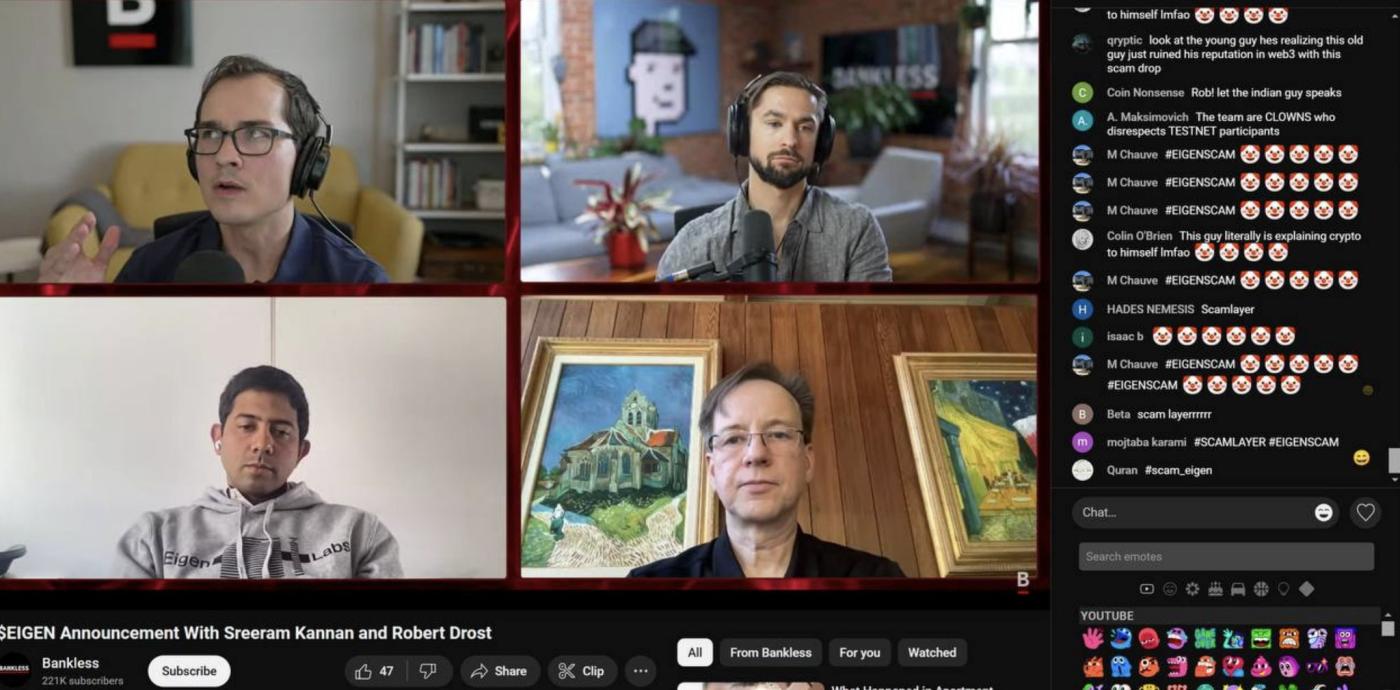

Due to the continuous abuse from users who were dissatisfied with the airdrop, Bankless, who was live streaming with the founder of EigenLayer, closed the comments

Disappointing results

Distribution: More VCs and teams, fewer users

From the first deposit opening in June last year to the snapshot on March 15 this year, all re-staking participants who have invested nearly $16 billion in EigenLayer in the past year will share the first quarter "Stakedrop" reward of 5% of the total tokens. At the same time, the combined share of early contributors and investors (ie VC and team) is as high as 55%.

Newsletter with token distribution details

The 40-page white paper gives such Tokenomics, in which the airdrop share in the first quarter is not only lower than some users' expectations, but also lower than the market pricing (the LRT-related YT on Pendle plummeted after the announcement). The community does not seem to buy it - many users said that they only received a minimum living allowance of 10 EIGEN, and the majority of community members responded that the number of tokens was small and lower than expected.

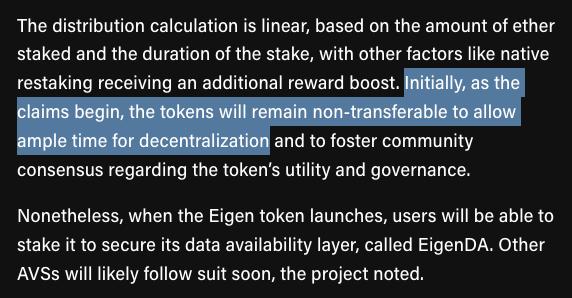

“Non-transferable” tokens

Yes, it has been officially announced that 90% of the tokens in the first season of "Stakedrop" can be claimed by stakers and LRT holders who directly participated in EigenLayer on May 10. But it seems useless? Because the tokens cannot be transferred at this time, which means they cannot be sold. The document states: In order to ensure sufficient time for decentralization, the tokens will remain non-transferable.

Relevant part of the document

In addition to causing further dissatisfaction in the community, Ethena, which had previously carried out a large-scale airdrop, also posted a message saying: "Our tokens are transferable, we love you." This is suspected to be a mockery of the matter.

Tweet from Ethena Labs

It is worth noting that someone explained on behalf of EigenLayer that the tokens are temporarily untransferable in order to confirm the share of DeFi users in the first quarter before officially launching in the second phase. So whether the criticism on this point is reasonable remains to be discussed.

These people seem to know the snapshot time?

Whenever a project conducts an airdrop, whether someone has inside information or whether there is so-called "rat trading" will become a hot topic. This is because it is related to the two most critical standards of airdrops: fairness and transparency. And this time, there seems to be some strange "coincidences".

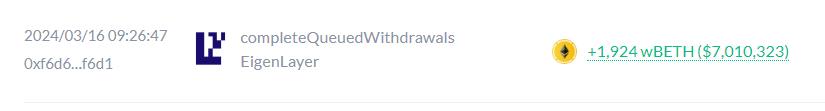

The snapshot date for the first season’s airdrop was March 15th, and GSR, the “legendary trader” who had made a comeback and posted a post during the sharp drop a few days ago, withdrew his wBETH worth $7 million on March 16th, just one day after the snapshot.

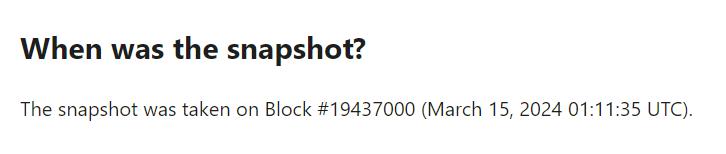

Snapshot Date

GSR withdrawal records

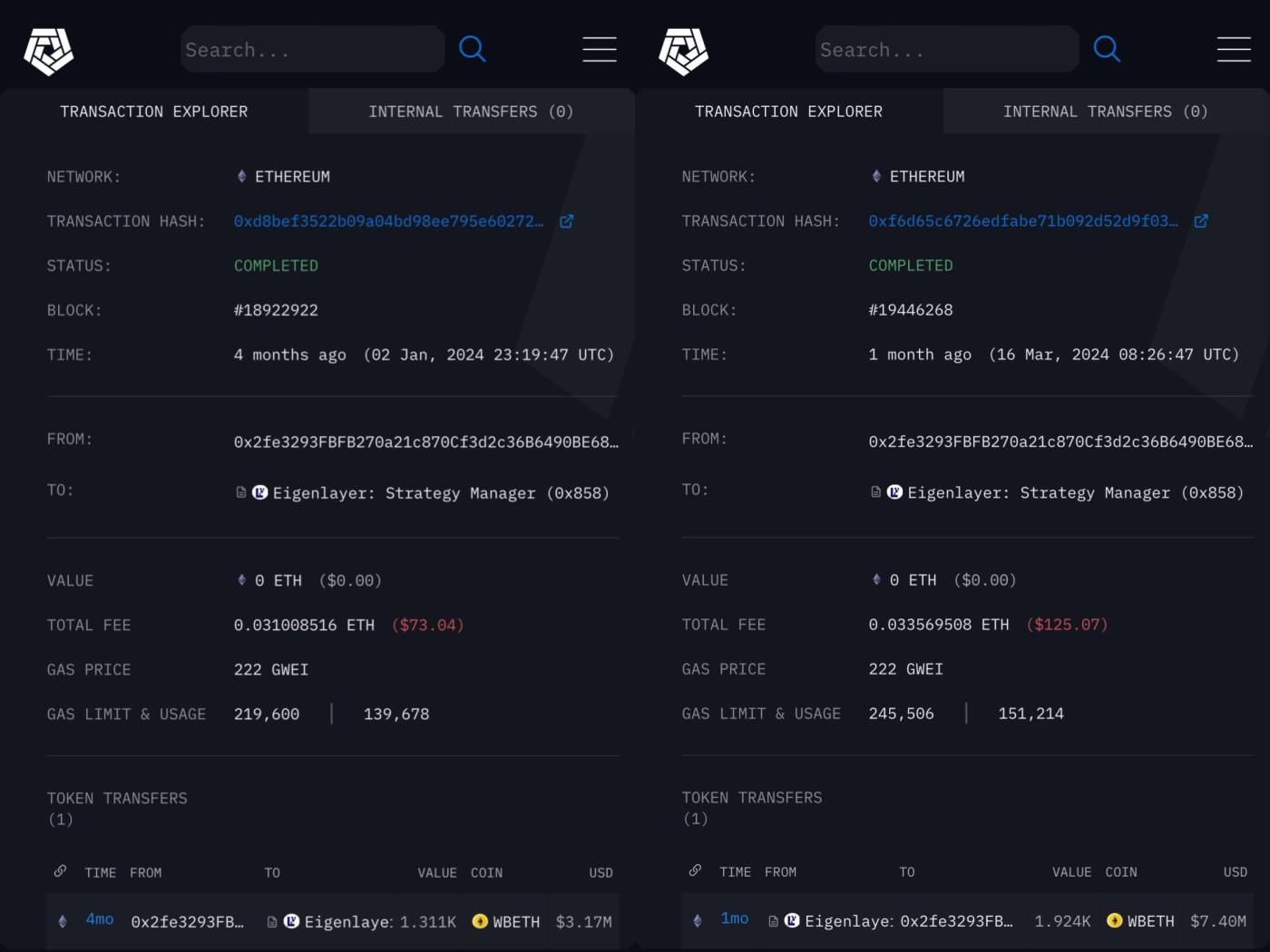

This is not an isolated case. On January 2, this wallet newly funded by Binance deposited about 4,000 wBETH, about $13 million, into EigenLayer, and accumulated nearly 3.5 million Eigen points in the next 3 months. On March 16, one day after the snapshot, it withdrew all of it.

Deposit and withdrawal records of this wallet

Are these people "insiders" with inside information? Some people in the community believed it and they were very angry.

Strict geo-blocking

The geographical location is restricted and the airdrop page cannot be opened

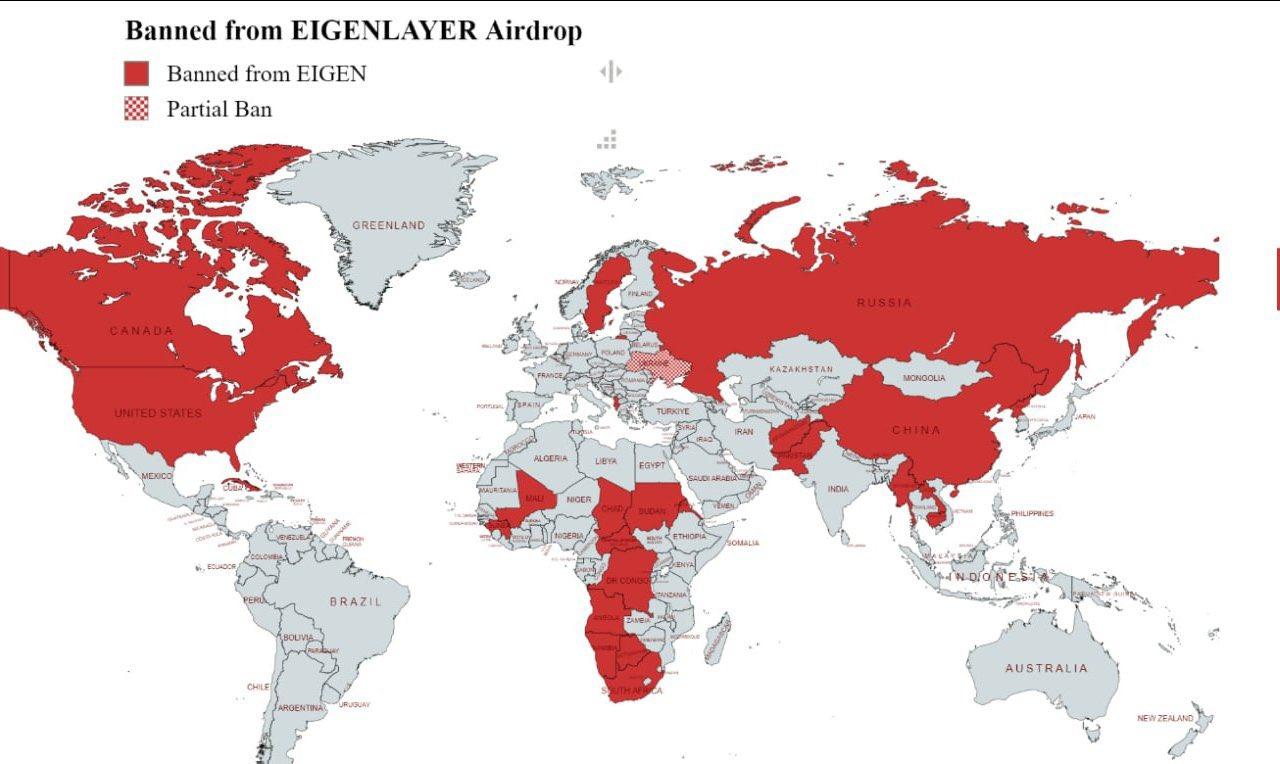

It is not uncommon to restrict air investment qualifications based on geographic location, but they usually stop at banning the United States and surrounding territories and a few sanctioned countries. EigenLayer's list of restricted countries is definitely long, and the first restricted country written is China.

Long list of countries banned from receiving airdrops

The red areas are prohibited by Eigen

In addition, the previous geo-blocking was often superficial. You could still claim tokens normally by using a VPN from another country. But EigenLayer is different. It is "serious". I personally experienced that the proxy that used to be successful was actually detected and blocked. This was the first time it failed. It took a lot of trouble to bypass the geo-blocking and query the shares. (Tutorial at the end)

Another point of controversy in the community is: since it has such powerful geographical detection and blocking capabilities, why didn’t it use it when the protocol was opened for deposits, and only enabled it when receiving rewards? Is it because they don’t like it?

Users complained that the United States was not a "restricted location" when "depositing money"

Bypass Geo-blocking and check airdrop tutorial

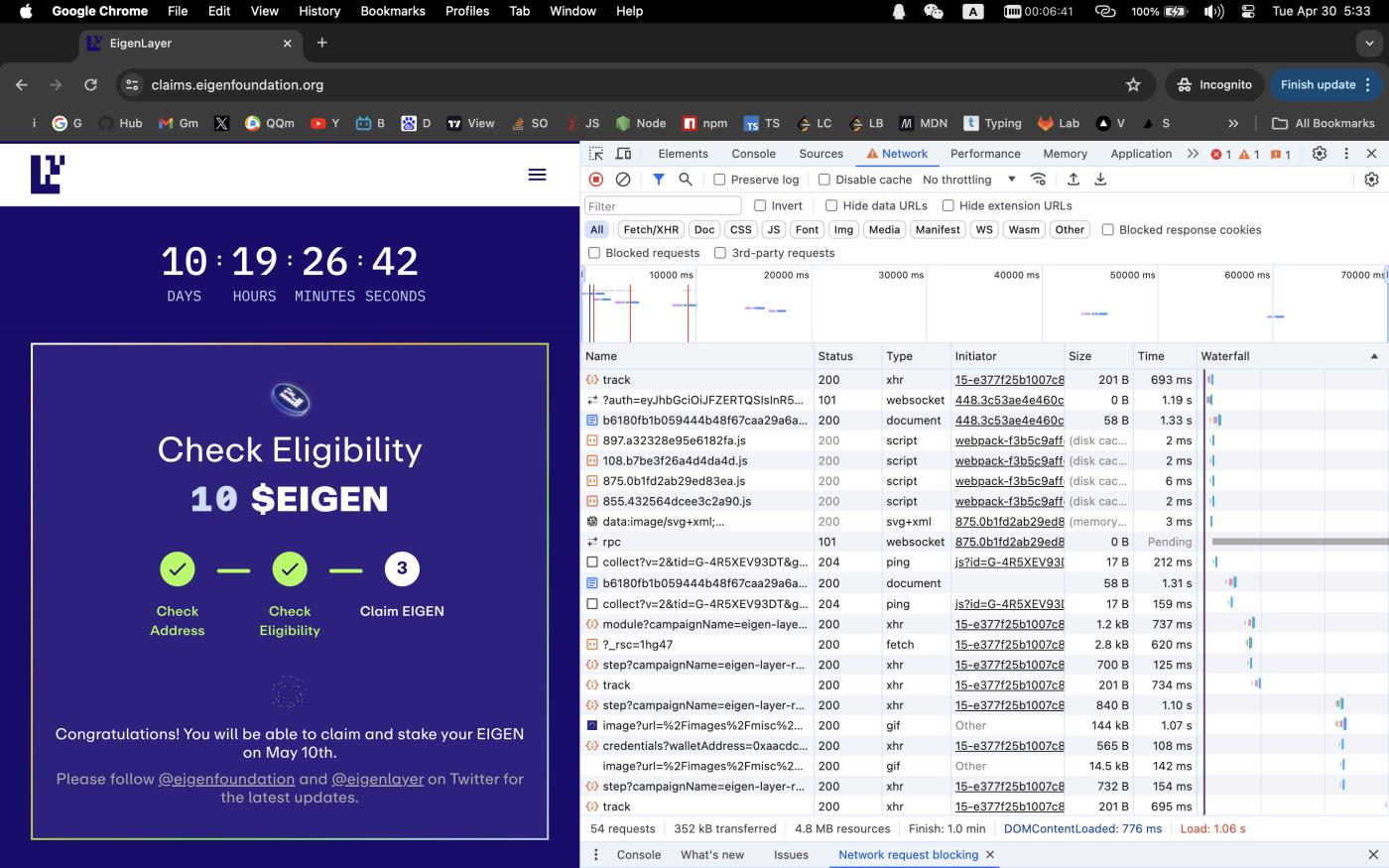

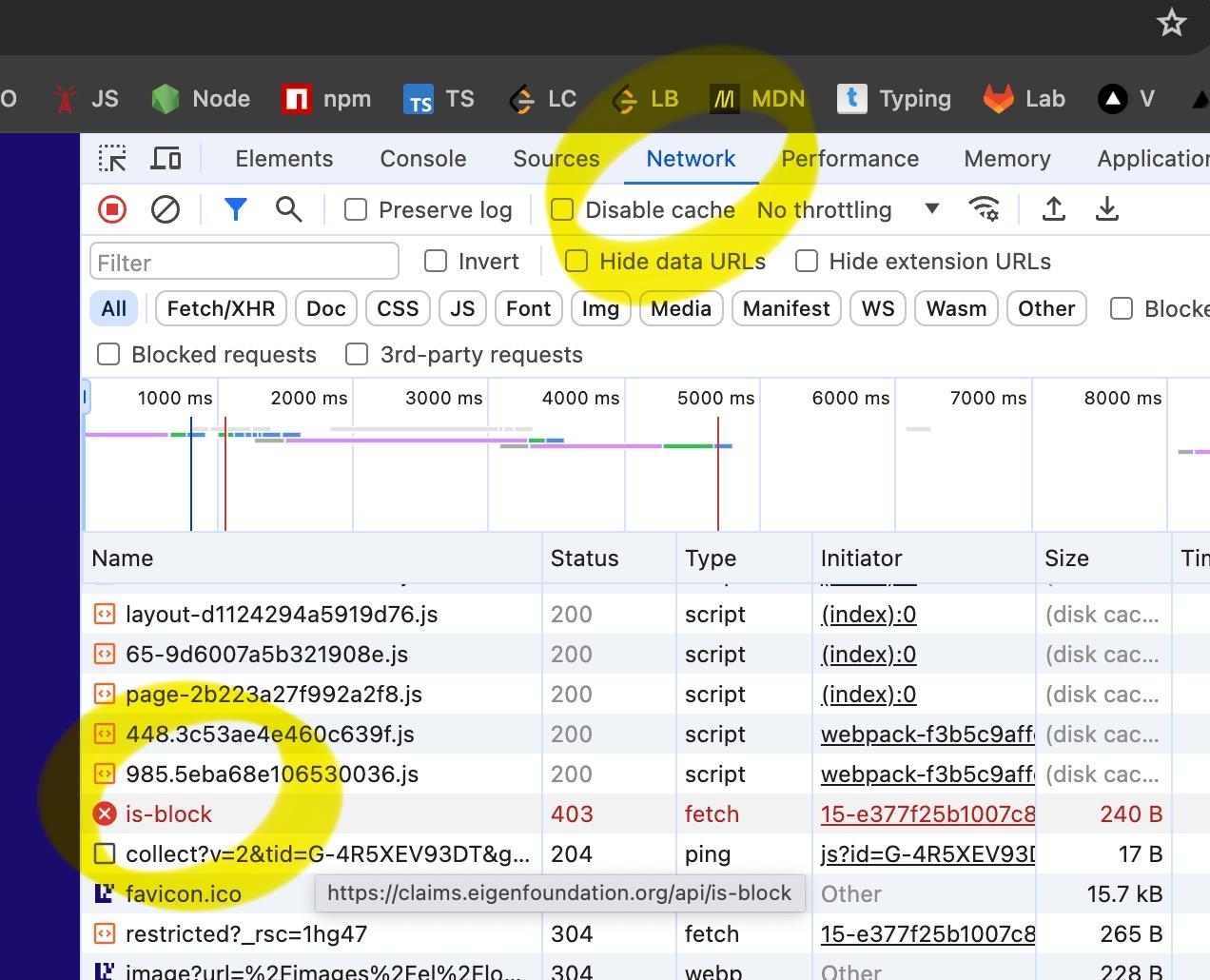

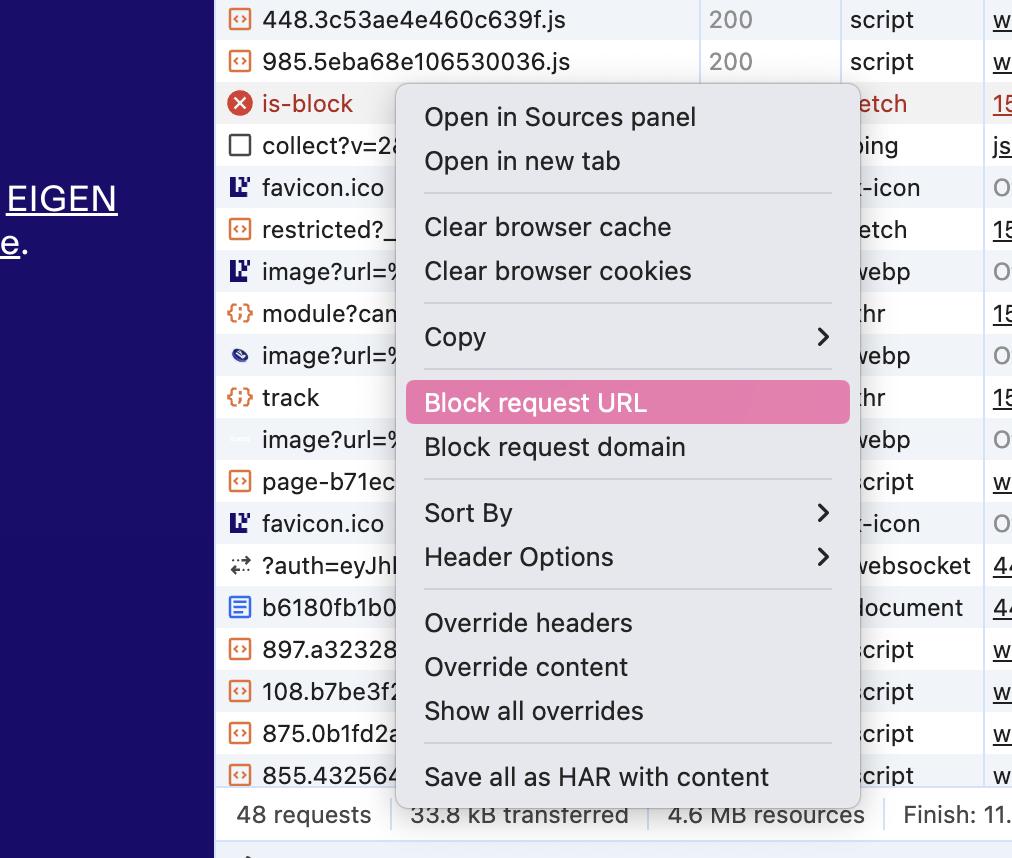

- Open an Incogtino Tab in a browser, enter the URL to the page, right-click inspect or press F12 to display the debugging interface

- Delete /restricted from the page link Refresh, in the Network column, find is-blocked

- Right click and select Block requst URL

- Delete /restricted in the page link, refresh, success, follow the prompts to query