By Jay Jo & Yoon Lee, Tiger Research

Compiled by: Felix, PANews

1. Introduction

Japan has recently become one of the most dynamic Web3 markets in the world, and is undergoing rapid changes with strong support from the government. The Japanese government recognizes the importance of the Web3 industry and has been actively taking steps to revitalize the industry. Since the Mt. Gox hack in 2014, Japan has taken a conservative approach to the Web3 industry and implemented stricter regulations. However, this is changing rapidly. As Japan begins to relax its cryptocurrency policies from 2023, there is increasing potential for further market development.

Although deregulation has indeed expanded the potential of Japan's Web3 market and raised people's expectations for the market, true market revitalization goes far beyond regulatory adjustments. Market revitalization includes a variety of factors, including:

- Practical Application of Technology

- Increased number of users applying the technology

- Integration of various industries

Although policies have a significant impact on the market, the prerequisites for a truly active market are by no means limited to regulatory considerations.

This report aims to comprehensively analyze the current status of Japan's Web3 industry, including the details of Japan's Web3 revitalization policy, its impact on local Web3 ecosystem participants, and identify the tangible changes resulting from it. In addition, the report will also explore business opportunities in Japan's Web3 market, assessing potential short-term gains and long-term growth prospects.

2. Market changes begin with industrial revitalization

The relaxed regulation promoted by the Fumio Kishida Cabinet and the Liberal Democratic Party (LDP) could significantly change the Web3 market in Japan. With less regulatory uncertainty and clear guidelines establishing the “rules of the game,” the market will change dramatically. This section will explore the impact of three major policies introduced by the Kishida government on the Web3 industry.

2.1. Japanese companies enter Web3

Source: Tiger ResearchAs pointed out in previous reports , the participation of large Japanese companies in the Web3 field is particularly noteworthy. At this summit, major large companies such as SBI, NTT, KDDI, Hakuhodo, etc. attended the meeting and expressed their expectations and vision for the future of the Web3 industry.

Japan’s major corporations are actively involved in the Web3 space and play a vital role in the development of the ecosystem as they bring the massive amounts of capital and R&D capabilities necessary to advance Web3 technologies.

For example, NTT Digital, a subsidiary of the famous telecommunications company NTT DoCoMo, has invested heavily in developing a Web3 wallet. During the development process, NTT Digital worked with Accenture Japan, a large consulting company. Some analysts believe that through the trickle-down effect generated by this cooperation, some large companies have gained the motivation to enter the Web3 market. (Note: The trickle-down effect refers to the fact that in the process of economic development, no special preferential treatment is given to the poor, vulnerable groups or poor areas, but the priority groups or areas benefit the poor through consumption, employment and other aspects, driving their development and prosperity)

The participation of major Japanese companies is expected to significantly boost the development of the Web3 market. Although the market is in its early stages, the active investment and R&D efforts of these major players are essential to building a solid foundation that will not only enhance the current market but also lay the foundation for the emergence and development of more Web3 native companies.

2.2. Green light for stablecoin issuance

Source: Japan Financial Services Agency- In June 2022, the stablecoin issuance and brokerage guidelines will be released

- In June 2023, the amendment to the Currency Settlement Act allowed funds transfer institutions, banks, trust companies, etc. to issue stablecoins.

The Japanese government's permission to issue stablecoins is an important step in promoting the development of the Web3 industry. This policy change has sparked market interest in stablecoin-related businesses, and many companies have entered this field amid increasing regulatory clarity.

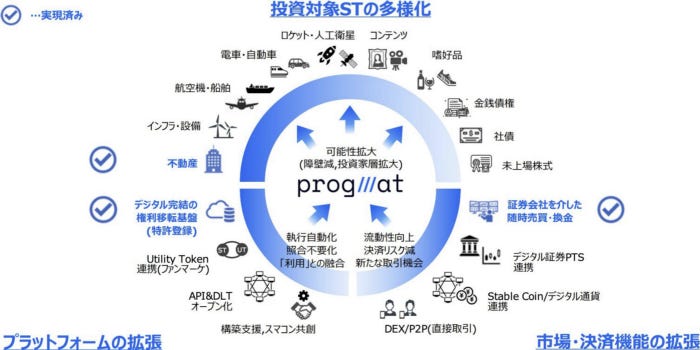

For example, digital asset platform Progmat is actively exploring stablecoin opportunities. Binance Japan revealed plans to launch a new stablecoin in partnership with Mitsubishi UFJ. In addition, Circle, the issuer of USDC, is seeking to work with SBI Holdings to expand the issuance of USDC in Japan. Considering the huge potential of Japan's B2B payment market (worth about $7.2 trillion per year), integrating stablecoins into this market can greatly increase business opportunities.

2.3. Allow venture capital to invest in cryptocurrencies

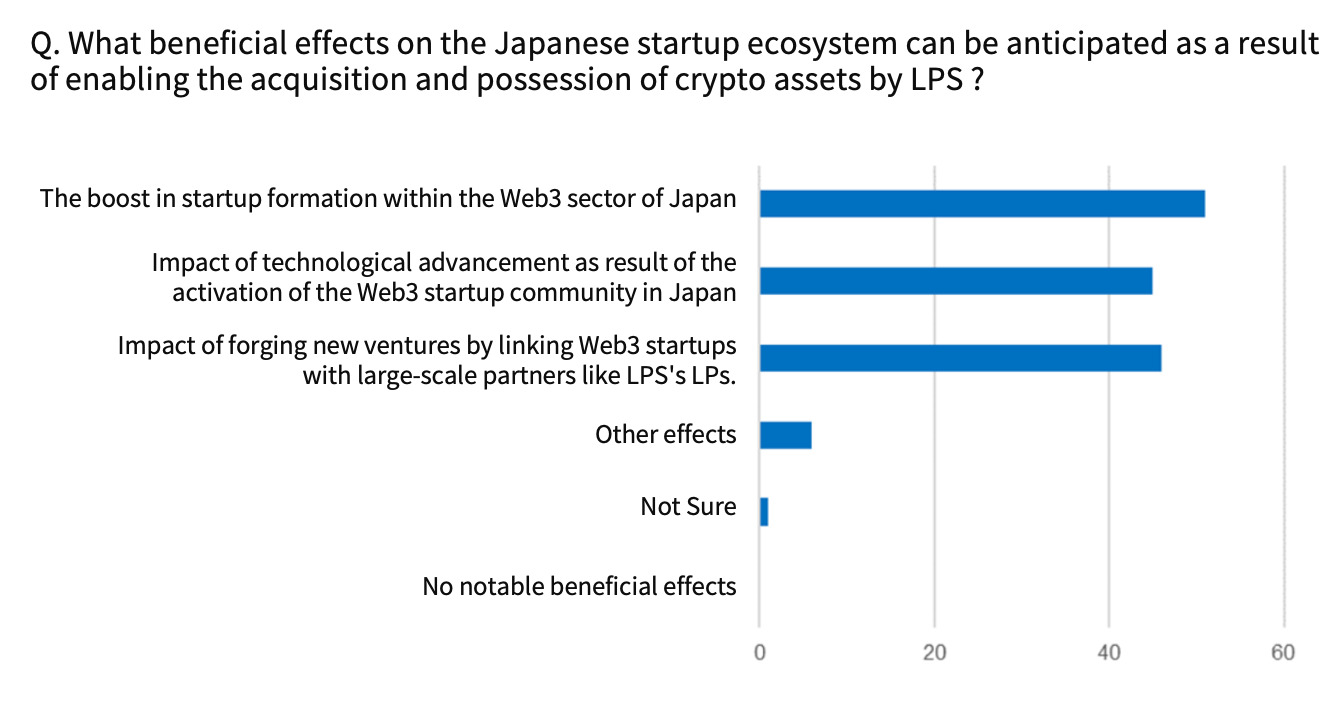

Source: JCBA, TigerResearch- In February 2024, limited partnerships (LPS) and investment trusts will be able to invest directly in cryptocurrencies, and legal entities will be able to raise funds from venture capital funds in exchange for non-stock tokens.

The Ministry of Economy, Trade and Industry of Japan recently voted to allow venture capitalists to invest directly in crypto assets. The move is intended to stimulate investment in domestic Web3 startups and ensure that the most promising projects can flourish in Japan rather than move abroad. The resolution will be submitted to Congress in June this year.

- In June 2023, it was decided not to tax the year-end appreciation of the tokens held by the company.

- In April 2024, it was decided that appreciation gains will not be taxed when there are technical processing restrictions on tokens issued by third parties.

The Japanese government has made strides in easing taxation on virtual assets held by companies after high tax rates on crypto assets held by Japanese Web3 companies prompted many to relocate their headquarters to countries with more favorable tax regimes, such as Singapore and Dubai.

Japan’s taxation issues have been widely criticized for forcing Japanese Web3 companies to expand overseas. In response, the Japanese government has gradually relaxed taxation rules on companies holding virtual assets. These policy adjustments are expected to encourage the growth and development of local Web3 companies by facilitating smoother capital flows into Japan, thereby invigorating the market.

3. Is Japan really “ back ” ?

It is too early to draw conclusions now.

3.1. Excessive taxation of crypto investors

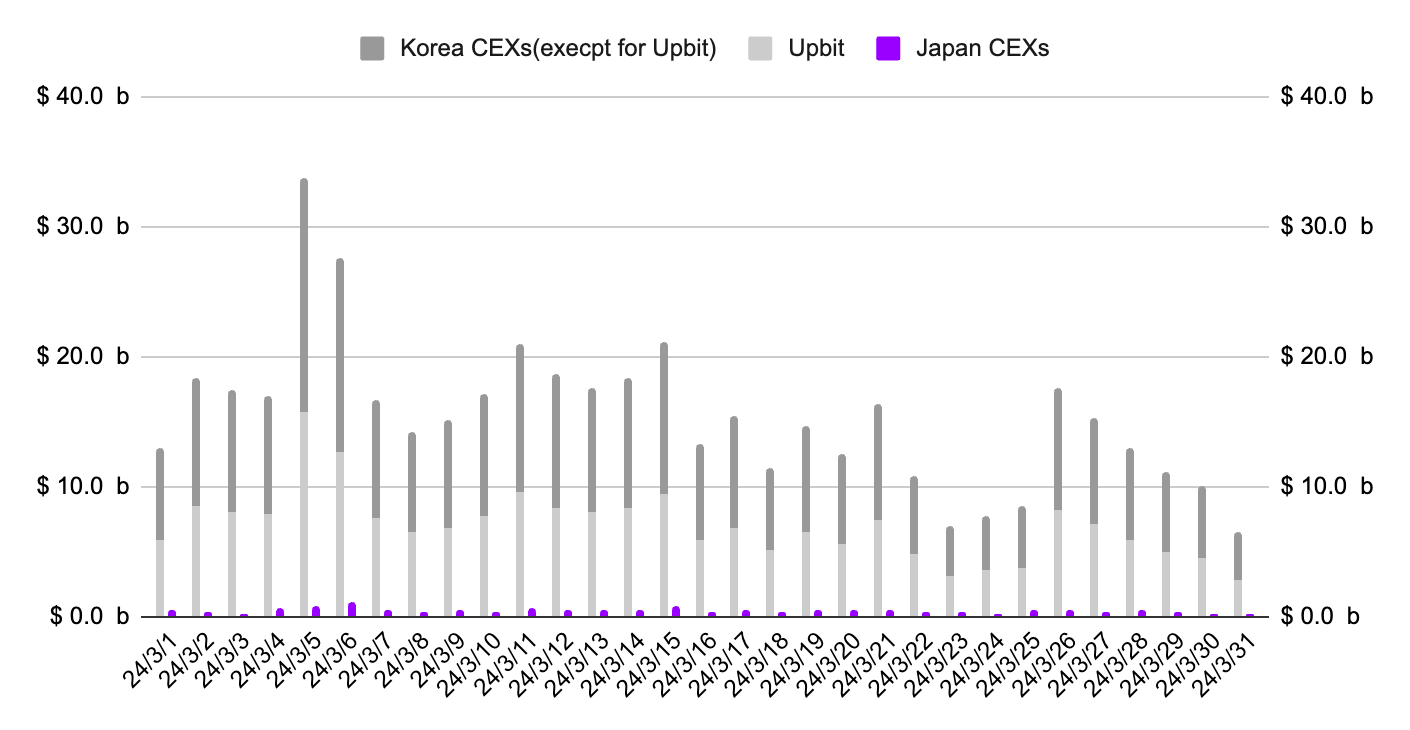

CEX trading volume in March 2024, source: Coingecko, TigerResearchJapan is gradually relaxing restrictions on corporate investment and holding of cryptocurrencies. However, the tax system for individual investors remains strict. Japanese retail investors face a progressive tax rate of up to 55% on their crypto gains , one of the highest rates in Asia. This heavy taxation has severely discouraged retail investment and active trading in cryptocurrencies.

The tax policy has led to low enthusiasm among retail investors, which is obvious when comparing trading volumes: for example, in March this year, Japan's cryptocurrency trading volume was 18 times lower than South Korea.

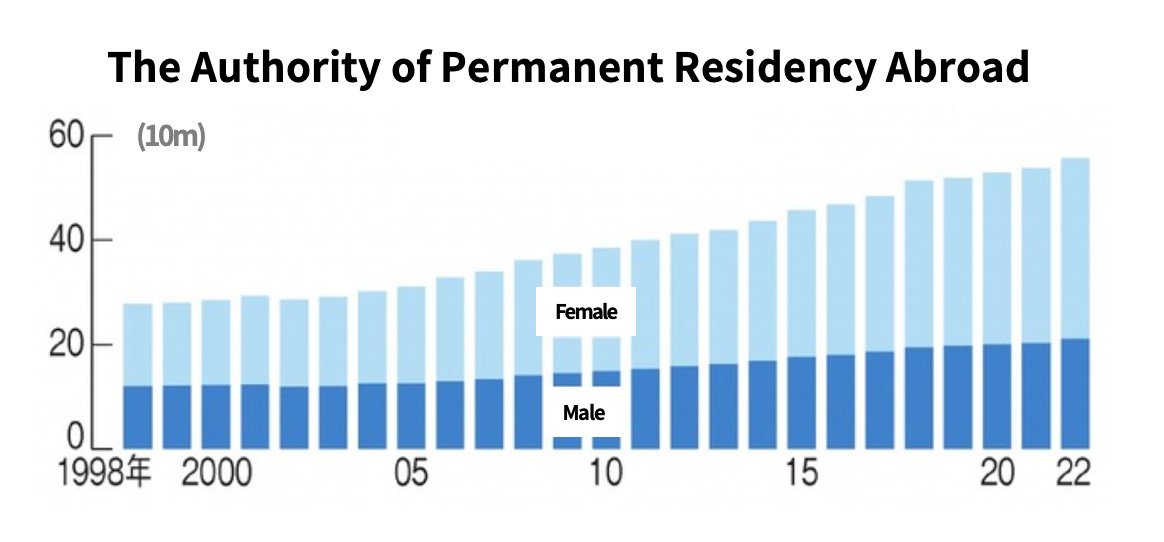

Number of permanent residents leaving Japan each year, Source: Japanese Ministry of Foreign Affairs, Tiger ResearchFor the Japanese crypto market to truly thrive, deregulation efforts need to extend to individual investors beyond corporate entities. Promoting a balance between supply and demand is essential for a thriving market. Despite this, there are no signs that Japan plans to relax restrictions on individual investors. The lack of regulatory flexibility has forced many Japanese Web3 startups and developers to relocate to more regulatory-friendly environments, such as Dubai , which offers more business opportunities and liquidity.

The trend was highlighted by data from Japan's Ministry of Foreign Affairs, which showed an increase in the number of Japanese citizens moving overseas. Specifically, migration to Dubai rose by about 4% from last year. The trend highlights the broader impact of Japan's strict regulatory framework on talent and the startup ecosystem. If policies remain unchanged, it could lead to a brain drain in the industry.

3.2. Isolated market environment

The Japanese Web3 market presents a "Colonial" environment, a term that describes a highly localized business ecosystem that is somewhat isolated and has limited scalability to global markets. This stems from the conservative regulatory framework that evolved in response to the 2014 Mt. Gox hack, which has greatly influenced the development of Japan's cryptocurrency regulatory approach.

One unique aspect of this localized approach is the process of listing virtual assets in Japan. The Japan Virtual Currency Exchange Association (JVCEA) is a government-approved self-regulatory organization that manages the listing of cryptocurrencies through a white/green list system.

Japan's Web3 ecosystem is primarily oriented toward meeting local needs. Traditional companies, local governments, and banks primarily leverage blockchain technology to benefit domestic consumers, and entities like Astar Network are similarly focused on the domestic market rather than the global market. This inward-looking approach creates significant barriers for international Web3 companies seeking to enter the Japanese market, limiting industry diversity and stifling dynamic growth and innovation.

Therefore, if the Japanese Web3 industry wants to achieve substantial growth and become a major player on the world stage, it must break away from this "Colonial Islands" market environment. Taking a more open and global perspective will not only facilitate the entry of multinational companies, but also encourage a greater diversity of ideas and practices.

3.3. Shortage of scientific and technological talents

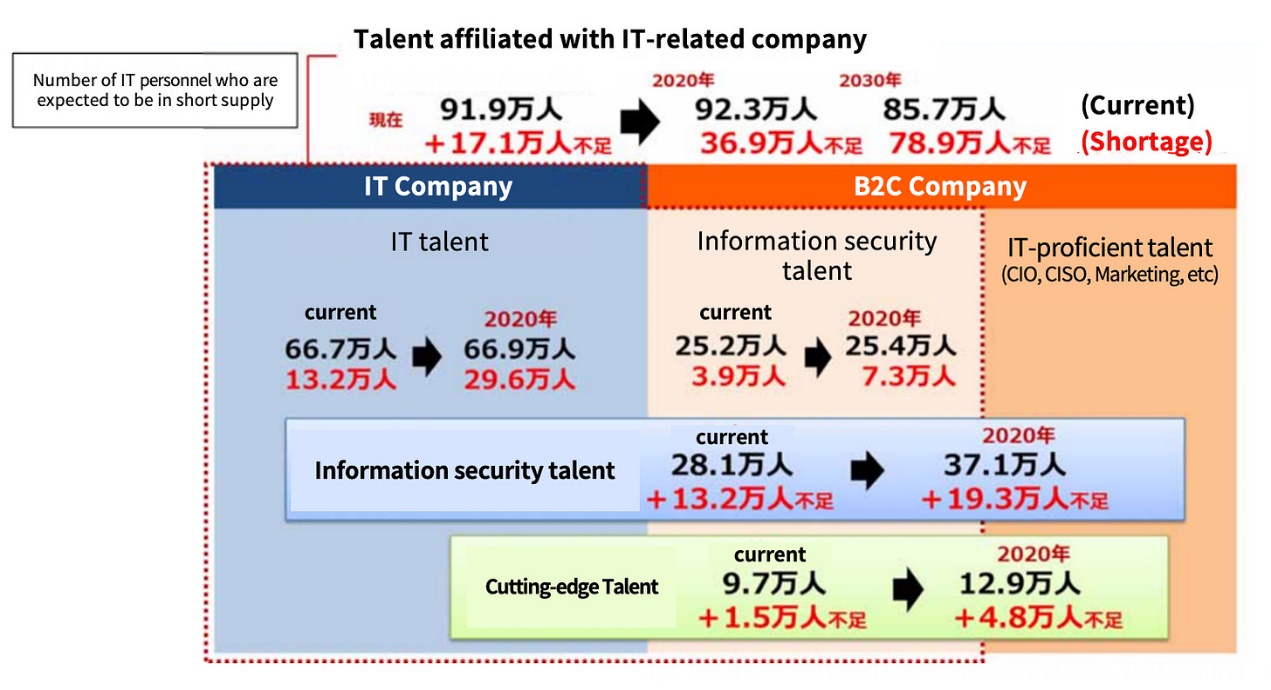

Estimated number of IT talent shortages, Source: Ministry of Economy, Trade and IndustryAn important obstacle hindering the growth of Japan's Web3 market is the severe shortage of IT talent. This problem is currently worsening: in 2020, Japan faces a shortage of about 370,000 IT professionals, and it is expected that by 2030, this shortage will double to around 790,000.

Even large Japanese telecommunications companies, which are at the forefront of technology, find themselves in the early stages of the development of the Web3 industry and have yet to make significant progress. The Web3 industry is essentially a high-tech industry that requires a lot of manpower and expertise to effectively promote innovation and development. Currently, Japan faces a significant shortage of Web3 builders, and there are even fewer projects dedicated to developing Web3 infrastructure . This shortage not only hinders the field's ability to innovate, but is also a key factor limiting the development of Japan's Web3 market.

4. What can we expect from the future Japanese Web3 market?

4.1. Globalization Capabilities

The global capabilities of Japanese Web3 project founders have recently come into the spotlight, highlighting a significant shift in their approach to business. From the outset, these entrepreneurs have incorporated a global perspective into their strategies, actively pursuing international expansion. A key element of this globalization effort has been improving English language skills. At the 2024 TEAMZ Summit, this shift was evident as many Japanese leaders confidently delivered presentations and discussions in fluent English.

The current vitality of the Japanese Web3 industry is a product of the younger generation’s perspective and the inherent global nature of the Web3 industry. Many Web3 projects in Japan have been designed with global markets in mind from the outset. This marks a major cultural shift, as for the first time since the Meiji Restoration more than a century ago, Japanese entrepreneurs are actively pursuing opportunities abroad.

4.2. Capital injection from enterprises and other institutions

As mentioned earlier, Japan's decision to relax regulations on corporate holdings and investments in crypto assets will boost the development of Japan's Web3 market. Since large investments have already been made, such as NTT DoCoMo and SBI Holdings raising Web3 funds totaling 600 billion yen (about $3.8 billion) and 100 billion yen (about $100 billion), respectively, the relaxation of regulations is expected to stimulate capital inflows.

Additionally, the Government Pension Investment Fund ( GPIF ) , the world’s largest pension fund, recently announced plans to invest in Bitcoin. While the impact of the new regulations may take some time to be felt, GPIF’s move is a positive sign for the Japanese Web3 market.

4.3. Use case accumulation

Source: JPYCIn the context of the broader global Web3 industry, practical applications and meaningful results of blockchain technology are often scarce, and the Japanese market is beginning to demonstrate impactful use cases. Notably, the Japanese yen-pegged stablecoin JPYC is being incorporated into the "hometown tax system", a unique way of local financing. In addition, some local governments in Japan are exploring the use of DAO and NFT technology to revitalize underdeveloped areas.

Source: Japan Financial Services AgencyFurthermore, Japan is actively sharing its accumulated expertise and know-how internationally. By educating others and exporting innovation, Japan is positioning itself as a key player in shaping the future of the industry.

Based on these factors, the future development prospects of Japan's Web3 industry are promising. Although many Japanese Web3 founders have moved to Dubai to seek business opportunities and a more relaxed regulatory environment, people are still optimistic about the potential of the Japanese market in the long term. Many founders have expressed their desire to participate in the Japanese Web3 field business in the next decade, indicating confidence in Japan's future growth.

5. Market scope of Japan’s Web3 industry

5.1. Short-term outlook: research, consulting and investment business

Source: ProgmatThe rapidly evolving regulatory landscape of Japan's Web3 industry stands in stark contrast to the inherent caution of Japanese companies in their decision-making process. This caution often leads to slow business progress as companies invest a lot of time in thorough market research and project verification before getting involved. Therefore, in the short term, the demand for research and consulting services in the Web3 market may increase. This is exemplified by the entry of data analysis and research company Messari into the Japanese market. Japanese research institutions such as Hash Hub and Next Finance Tech are becoming increasingly active.

As investment regulations are relaxed and venture capital firms begin to hold crypto assets, the investment prospects of the Japanese Web3 market are expected to recover. In this emerging field, Hyperithm has stood out through various strategic investments, including stablecoin issuer JPYC and Web3-based live broadcast company Palmu. These investments indicate the development trend and potential of Web3 technology.

5.2. Long-term Outlook: Stablecoins, Web3 Games

Source: ProgmatIn the long term, stablecoins and Web3 games represent the most promising areas in Japan's Web3 industry. The stablecoin market, in particular, is expected to achieve substantial growth. As the framework for institutional participation solidifies and regulatory uncertainty decreases, expectations for the industry are rising. The yen-based stablecoin JPYC is at the forefront of potential expansion.

Currently in Japan, stablecoins can only be used as a prepayment method for deposits, but not for withdrawals. This limits the widespread application of stablecoins in the financial ecosystem. However, JPYC, the issuer of the yen-based stablecoin, is seeking to obtain an EPISP (Electronic Payment Instrument Service Provider) license, which will enable JPYC to release a new version that supports withdrawals. This version is scheduled to be released this summer.

It is expected that the withdrawal capability of JPYC will greatly increase the utility of stablecoins in Japan, making them more versatile and integrated into daily financial transactions. In the long run, stablecoins may become a viable alternative to all transactions that currently rely on cash or bank deposits.

While stablecoins are not currently listed on Japanese crypto exchage, several are taking steps to obtain the necessary licenses. This development suggests that there is a bright future for the accessibility and utility of stablecoins in Japan.

OSHI3 project, source: gumiJapan is the third largest gaming market in the world, and its entry into the Web3 gaming space is also worth noting. Major gaming companies such as Square Enix, SEGA, and Gumi are actively participating in Web3 projects.

However, the user base of Web3 games in Japan is still relatively small and the market liquidity is limited. Due to the high taxes imposed on virtual asset investors, participation and investment in this emerging industry may be hindered. Therefore, it may be challenging to achieve substantial growth in the short term. However, Japan has obvious advantages that can drive the long-term growth and development of the Web3 game market. Japan's strong game industry and rich content creation capabilities provide a solid foundation for the development of Web3 games.

Conclusion

During the TEAMZ Summit 2024 in Japan, we observed the booming development of the Japanese Web3 market. It is clear that this market is still in its early stages but has great potential for growth. This potential is driven by several key factors: the proactive efforts of Japanese government authorities to revitalize the industry, the global orientation of Japanese Web3 project founders, and strong content intellectual property (IP). These factors are expected to promote further development of the market.

While challenges such as high taxes for individual investors remain, the long-term outlook for the Japanese Web3 market is bright. It will be interesting to see whether the combined efforts of the Japanese government, businesses, and investors can make Japan a global leader in the Web3 space. Developments in this space are certainly worth watching.