Written by: Ignas

Compiled by: Yangz, Techub News

There are 124 L1s listed on Coingecko, but how many do you know about? How many are actually used? I would actually use about 10 L1s (and some L2s), but most assets are actually on Bitcoin, Ethereum, and Solana.

Frankly speaking, during the bear market, I think Ethereum has won the competition among L1s, because the development of the L2 ecosystem is expected to solve Ethereum’s scalability problems, and activities on other Alt-L1s are basically dying, and there are no Ordinals/Runes on Bitcoin yet.

But now it seems that I was very wrong! Not only did Solana outperform most L1s, but the price of ETH is still even lagging behind BTC.

I agree with Arthur that the current market cycle is different from 2021, the returns are very different, and few coins have outperformed Bitcoin since the low on October 23.

Unlike the indiscriminate bull run in 2021, the current market only rewards investors who carefully select token investments and actively manage them. The fundamental shift reduces the possibility of getting rich by luck, but enhances the maturity of the market.

In the face of current market conditions, investors should do their research and look for growth catalysts:

1) Find the track/narrative that is expected to outperform the market in the future

2) Then research the fundamentals and find out the seed token.

Many investors will ask, when Memecoins are so popular, why should we talk about fundamentals? I think Memecoins are too dependent on hype, and it all depends on influential people to push the flames behind the scenes. You can trade memecoin based on "fundamentals", but if you don't have a strategy and like to gamble, then just come directly.

Personally, I think L1 tokens are more attractive. They are typical productive assets that can be directly staked or liquid staked in their DeFi ecosystem and receive corresponding airdrops from DApps.

In comparison, L2 tokens are not that useful. They cannot be used as Gas, and holding them does not get you any eco-airdrops (I think only STRK, MNT, and METIS tokens have decent utility).

The key here is to find a "thriving" L1 ecosystem. "Thriving" means having technological innovation, very attractive narratives, and more and more dApp airdrops that help to raise the price of L1 tokens.

Airdrops are essentially tokens created out of thin air. However, these new tokens can increase the price of L1 tokens because degens can use them as gas to sell airdrops.

However, with 124 L1s, how do we narrow down our choices?

Below is my thought process and the L1 ecosystem that I believe has development potential.

Mindshare

Community plays an important role in the cryptocurrency space. Without a thriving community, token prices will not grow organically. To determine the strength of the community, I used Kaito to quantify community posts and assign them a corresponding "mindshare" score.

It is clear that BTC, ETH, and SOL dominate the discussion on X, with discussions around the remaining ~121 L1s accounting for only 17.8%.

We all know more or less about mainstream L1s like BSC, Atom, Avalanche, and Aptos, but I want to dig deeper and find the real unknown gems.

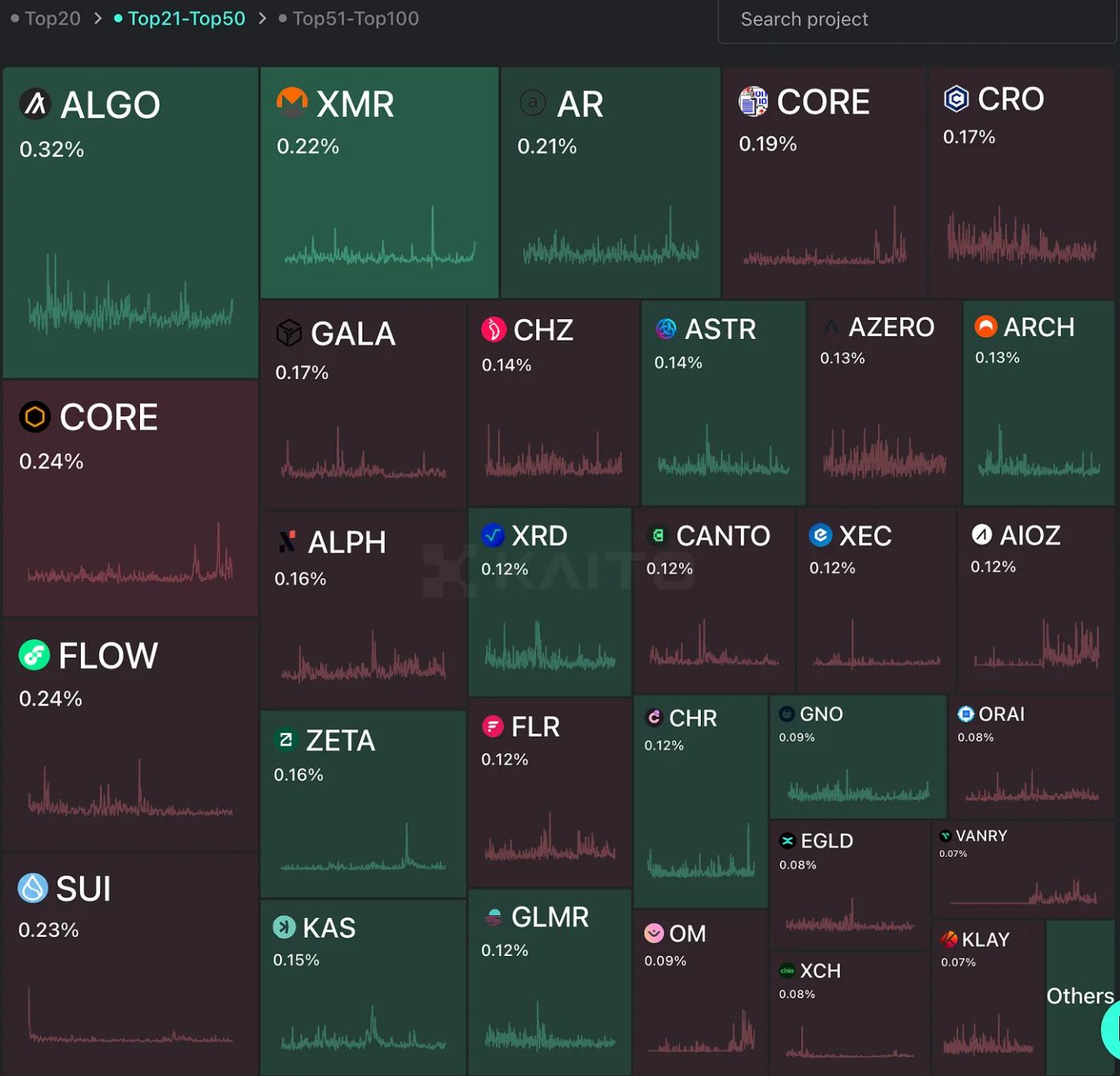

The following are the top 21-50 L1s sorted by mindshare. There are some familiar names among them, such as Algorand, Monero, Cronos chain, Sui, etc.

Interestingly, Sui ($589M market cap) and Cronos ($485M market cap) have more TVL than Aptos ($327M market cap), but Aptos has a much larger mindshare score than both. So does this mean Sui is undervalued relative to Aptos, especially since both are Move-based L1s? Maybe SUI can pull 40% higher to reach APT's market cap. But SUI's FDV is actually 17% larger. So it's not that simple!

In addition to the mindshare score, we can also add developer activity, user growth, transaction volume, etc. Artemis provides comprehensive data on these indicators. For example, in terms of daily active addresses, Aptos and Fantom do very well, while Acala, Flow, and Fuse are simply "ghost towns."

It’s hard to find all the data for small L1s, but the more I think about it, the more I feel that finding undervalued projects depends on a certain degree of intuition, which comes from actively engaging with L1s, evaluating wallets, the quality and uniqueness of dApps, observing the efficiency of team communication, analyzing token economics, etc.

Therefore, the ecosystems I’m going to share below have all caught my attention for various reasons (probably including TVL/users), and I believe they have the potential to thrive.

1. TON

First of all, TON is the 9th largest cryptocurrency project by market capitalization, so there may not be a 10x upside. In addition, the TVL of DeFi projects in the TON ecosystem has increased by 55% in a month. However, strangely, the TON ecosystem does not seem to have received attention on CT.

So, you can try to experience the Ton ecosystem:

- Open Telegram and create a Ton wallet in settings.

- 「Wallet」 is a custodial service

- 「TON Space」 is a non-custodial wallet, so please be sure to create it.

- Deposit a few dollars worth of TON in both wallets (annoying, I know)

- Play some mini games in the Ton ecosystem to understand its potential:

- Try Catizen , raise cats and earn airdrops.

- Paint on Pixel 's big canvas.

- Train Gattomon in this P2E Tamagotchi game. Pets are NFTs!

- Find all games on PlayDeck (similar to an app store)

- Try the DeFi project of Ton ecosystem

- Earn a nice APY on Ston (a major DEX on Telegram with $100M TVL). The APY on TON/USDT is now 90% because TON is giving away $5M USDT as a reward.

- Leverage trading of TON ecosystem tokens on Storm Trade . But be careful with leverage!

- Borrowing on Evaa finance

- Other good DApps:

- Get an eSim for overseas mobile data.

- Find the top liquidity pools by APR on Open League .

- Telegram channels can be monetized by issuing digital items, such as this 1 USDT Proof of Simp NFT .

- Or Tinder (dating app) Ton Dating on TON.

Telegram bots are not new, but issuing tokens through these bots has become an internal thing in the ecosystem. These bots are part of the Ton Space ecosystem and use the Ton blockchain and its native token.

It is not surprising that CT does not pay attention to the Ton ecosystem, as these mini-games may not be of interest to CT whale. However, I believe that Ton has the potential to attract retail investors, and as long as there is a viral Ton application that succeeds, it can greatly promote the development of the ecosystem, just like Axie Infinity promoted P2E games.

In addition, a key catalyst to watch out for is the upcoming launch of Notcoin tokens . With the airdrop event behind us, the successful launch of the token will bring momentum to TON.

2. Arweave

The AR token was launched in 2019 and surged from $1 to $80 in 2 years. However, in September 2023, AR fell to $3.5. Surprisingly, it has since risen 7 times without attracting much attention. At a market cap of $1.8 billion (100% float valuation), AR is not cheap anymore, but there are reasons to remain bullish.

Arweave’s value proposition is simple yet powerful: permanent, secure storage of documents and applications.

You know, this is probably where your Ethereum NFT stores your JPEG.

“Arweave is a protocol for storing data permanently and sustainably for a single upfront fee. The protocol bridges the gap between those with spare hard drive space and those individuals and organizations that need to store data or host content permanently.”

In addition to JPEG, Arweave supports the permaweb as a version of the internet in which everything, from images to full web applications, is permanently stored, quickly retrieved, and decentralized, ensuring it functions as originally designed and is forever searchable.

As regulators continue to crack down on DAOs and front-ends, in order to achieve a truly decentralized future, user-facing interfaces also need to be decentralized.

Filecoin is a competitor of Arweave. I am more optimistic about Arweave for the following reasons:

Arweave announced the launch of Arweave AO on the testnet, aiming to achieve "infinite scalability" that can simultaneously support large-scale computing needs, which is crucial for artificial intelligence and large-scale applications.

"AO is a hyper-parallel computer, a decentralized computing environment that allows any number of processes to run in parallel. Previous decentralized computing systems either supported large-scale computing or verifiable computing. AO can support both at the same time," said Arweave founder Williams in the announcement video.

Additionally, in an interview with The Block , Williams called its scalability “incredible.” “The core idea is to split the three main parts of running a blockchain into independent components that can talk to each other and perform a large number of transactions at the same time.”

He is even confident that he can compete with Ethereum, saying that the era of "Ethereum killers" has not passed. The team built its own operating system AOS using the Lua programming language, and blockchains that support EVM or SolanaVM can also be built on AOS.

You can try the testnet dApp:

- Download the wallet here

In addition, the Arweave team is constantly launching new updates such as bridget and others.

3. MultiversX

Solana and Ethereum are two important players in the battle for modular vs. monolithic blockchain scaling. But which approach will dominate?

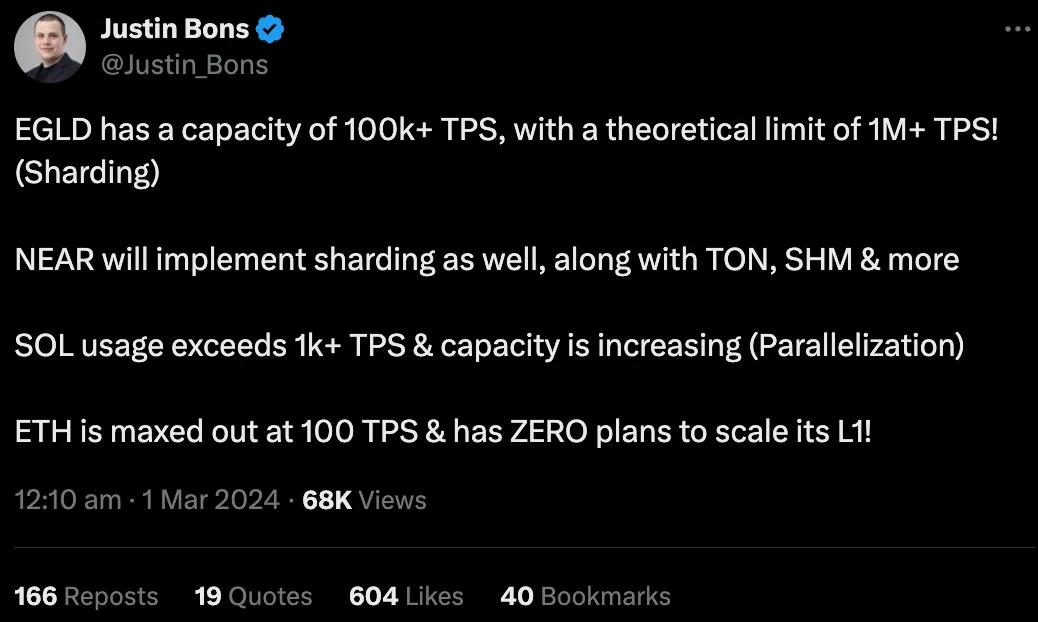

Proponents of monolithic blockchains have criticized Ethereum for abandoning plans for L1 expansion (via sharding). Sharding divides a blockchain network into smaller parts, or shards, allowing transactions to be processed in parallel. This approach speeds up transaction processing by distributing the load across multiple shards. If sharding technology becomes popular, MultiversX will benefit from it. Other sharded chains include Near and Ton.

MultiversX, formerly known as Elrond, uses EGLD for accounting and transactions. It uses "adaptive state sharding and secure subscription proof (SPoS)" to achieve high-speed transactions of up to 100,000 transactions per second through parallel processing and efficient validator selection.

MultiversX ranks 26th with a TVL of $129 million, alongside Stacks, Fantom, zkSync Era, Ton, and Osmosis. Despite this, at a market cap of $1 billion, its price is only half that of FTM, 1/3 that of STX, 1/7 that of Near, and 1/18 that of Ton!

To be fair, two protocols on MultiversX account for 95% of TVL: xExchange ($41 million) and Hatom ($85 million). The NFT ecosystem also seems to be growing, with xoxno exchange having the largest trading volume.

In addition, the xPortal mobile wallet is also a prominent project in the MultiversX ecosystem with the opportunity to gain mass adoption. It provides a stylish and gamified user experience that allows users to set up usernames, trade cryptocurrencies, access news, and use cryptocurrency debit cards. When using MultiversX dApps on a computer, users can scan QR codes with their mobile devices to approve transactions, which seems to be safer than using browser extensions.

Experience MultiversX:

- Download xPortal . Get some EGLD from CEX first.

- Try swapping tokens on xExchange .

- Explore NFTs on Xoxno . Earn airdrop points by trading.

- Lend/borrow and liquidity stake EGLD on Hatom .

The user experience of the MultiversX ecosystem is great. (How does Injective compare to it… and INJ’s market cap is 2.3 times that of EGLD?)

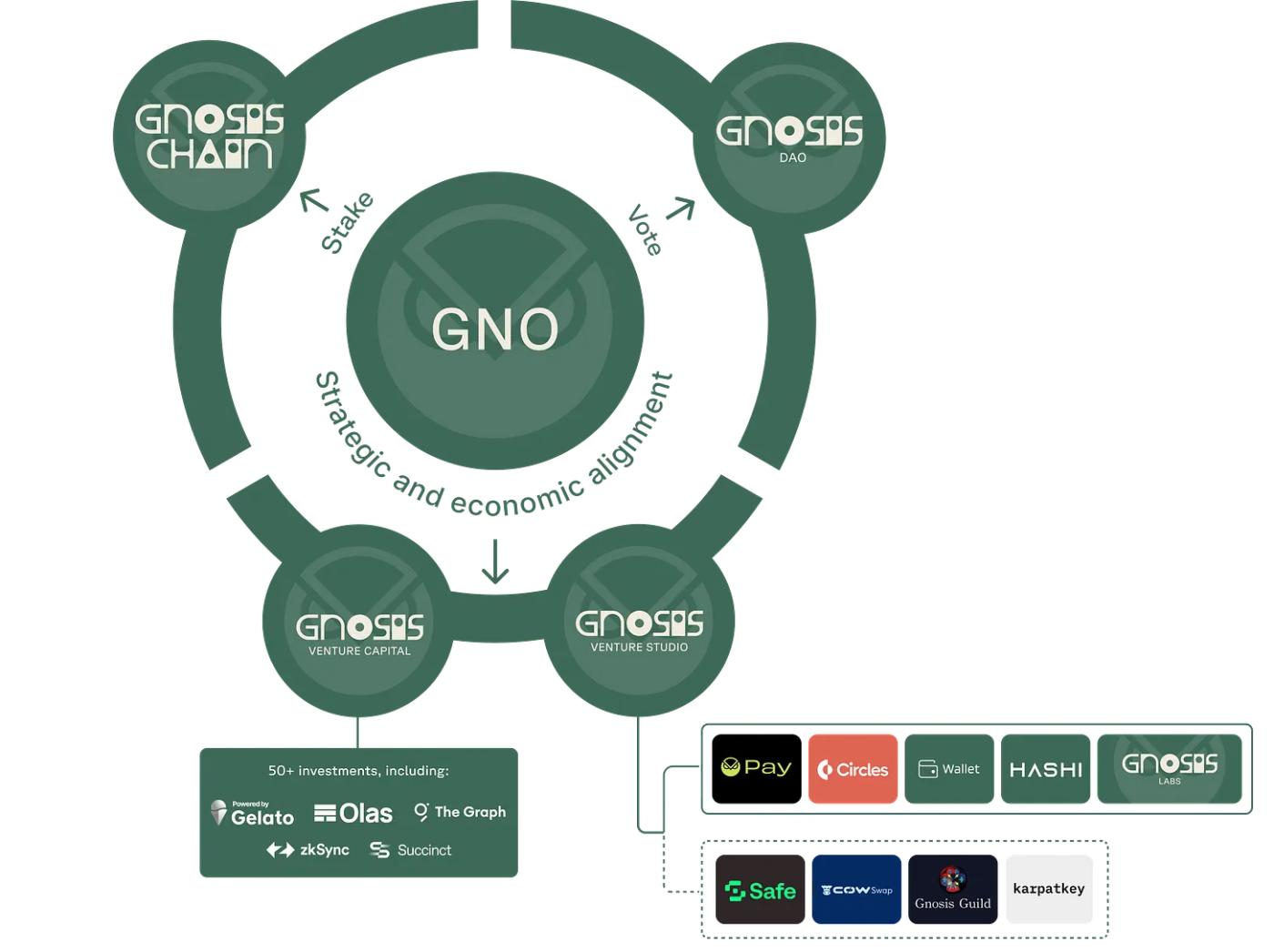

4. Gnosis

Gnosis is also an OG protocol, but don’t think it’s boring. Founded in 2015, Gnosis is part of ConsenSys. Gnosis was the first team to launch an application on Ethereum in 2016.

Gnosis Chain is a sidechain of Ethereum, but functions more like L1:

- Collateralized by GNO.

- Validators stake GNO, transaction fees are paid in xDAI, and GNO tokens are repurchased and destroyed.

Impressively, GNO’s fully diluted valuation is $778m (86% circulation), yet the chain has achieved a TVL of $286m, which is the lowest FDV/TVL ratio (3.1) among major chains (Arbitrum is second at 3.8).

There are many mainstream DeFi DApps on Gnosis, such as Aave, Maker's Spark, Balancer, but the most interesting one is RealT, a protocol designed to tokenize US real estate ownership, with a TVL of $104 million.

In addition, Gnosis launched the Gnosis Pay non-custodial debit card (which I am also using). Gnosis also launched Gnosis 3.0, which focuses more on payment and financial infrastructure based on the previous stages: Gnosis 1.0 was originally a prediction market platform on Ethereum; Gnosis 2.0 expanded to become an Ethereum infrastructure builder, developing tools such as Gnosis Safe, CoW swap, and Gnosis Chain; Gnosis 3.0: Turning to creating applications for daily financial activities, it aims to make decentralized financial tools available to the general public.

The crypto community is tired of overvalued base protocols. With Stripe entering the crypto payment market, discussions about cryptocurrencies may heat up again. And in the current market situation of "rolling" memecoins and airdrops, Gnosis 3.0 is exactly what we need.

A Bit of Alpha: The Gnosis team said they will focus on achieving “economic value-added for GNO holders.”

The way the framework achieves these goals is through a protocol-native AMM (bonding curve) for the GNO/project token pool, implemented as a CoW-AMM on the Gnosis Chain. This means that GNO is not only a governance and staking token, but also an index token for the Gnosis ecosystem. - Gnosis 3.0 Announcement

Finally, Gnosis 3.0 will feature a Venture side, incubating early-stage projects (Bybit’s Manta also does a good job) and bringing value to the ecosystem.

Personally, I’m most looking forward to Gnosis Wallet (a mobile-first banking alternative) which will bring together the products of the Gnosis ecosystem into one place.

5. Radix

Radix is another L1 with a nasty community. Having supporters is good, but it can be nerve-wracking at times. I noticed that their tweets are automated (and replies have very few views) , so I think the team should re-evaluate their marketing strategy.

However, Radix’s slogan “Radically Different DeFi” still resonates with me. How many L1s will put DeFi first?

"Radically Different DeFi" includes adopting the asset-oriented Radix engine, which treats assets such as tokens as "first-class citizens". Unlike the Ethereum environment, which manages assets through complex smart contract code, Radix manages tokens as "physical" objects in user accounts, simplifying interactions and increasing intuitiveness. The end result is that the development of smart contracts becomes simpler and the complexity of the code is greatly reduced.

In addition, Radix also has its own Cerberus consensus mechanism, which supports dynamic sharding and cross-shard atomic transactions. Yes, Radix is the third L1 in the list with sharding capabilities. Notice the trend? (I prefer monolithic chains now)

Its native token XRD can be used for staking and paying fees, with a market cap of $500 million and a FDV of $622 million. The bad thing now is that although the Radix DeFi ecosystem has a big vision, it is small in scale. There are only 6 Radix DeFi projects shown on DeFillama, with a total TVL of $36 million. Here are a few dApps worth trying:

- Trading and liquidity mining on CaviarNine (Radix mainstream DEX).

- Trade NFTs on Trove .

To start using Radix, you need a wallet , and this wallet has a great user experience. Although it may not be as feature-rich as the xPortal on MultiversX, it is smooth to use. To connect to dApps on your computer, you need a browser extension called Radix Wallet Connector. Once connected, you only need to link your mobile wallet with the connector once. Then, every time you connect to a dApp, the wallet connector will send an approval request to the mobile app. This means that you don't have to scan the QR code every time you connect to a new dApp, you can just approve it on your phone.

Overall, if Radix is betting on Radically better DeFi, the chances are probably slim.... The team needs to launch innovative dApps, offer higher yields, and improve their marketing.