Opinion: Bitcoin's Decline Revives Four-Year Cycle Fears, But a Deep Bear Market Unlikely to Repeat

According to The Block, research firm K33 analysis points out that although Bitcoin's decline of approximately 40% from last year's high has revived concerns about the past four-year cycle of decline, several structural factors make it unlikely that the market will repeat the deep bear market of 2018 or 2022, which saw declines of up to 80%.

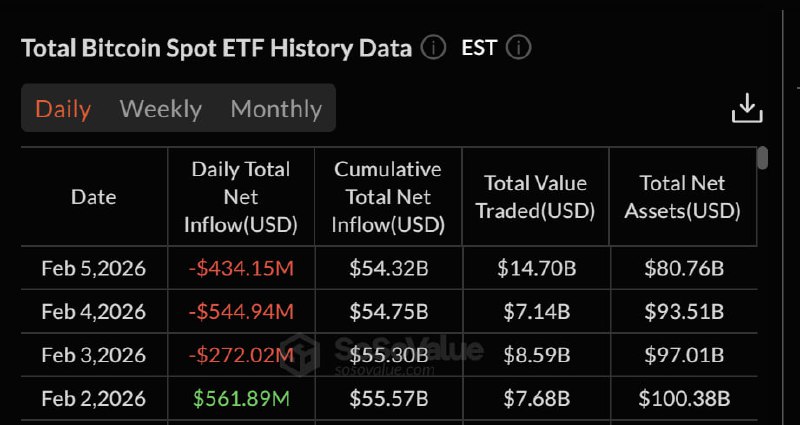

The report argues that the key differences between the current environment and previous cycles are: increased institutional adoption, continued inflows into regulated products (such as spot ETFs), and a loose interest rate environment. More importantly, there has been no forced deleveraging event that triggered a systemic market collapse, similar to GBTC, Luna, or FTX.

Technically, analysts consider approximately $74,000 to be a key support level. If this level is breached, downside risks could intensify, potentially targeting $69,000 or even $58,000 (near the 200-week moving average). Meanwhile, some common bottoming signals began to emerge: Bitcoin recorded a high spot trading volume of over $8 billion on February 2nd, while open interest and funding rates in the derivatives market entered extreme negative territory. These signals, coupled with prices remaining above support levels, may indicate that the market is attempting to bottom out.