[1/3]

[Crypto/TradFi Merge Update] 2026-02-08 00:00 (Beijing Time)

━━ Important News ━━

1. China issues regulatory guidelines for “Responsible Vacancies (RWAs) issued overseas by domestic assets”: The guidelines clarify the division of regulatory responsibilities based on the principle of “same business, same risk, same rules.” This means that RWAs issued overseas by domestic assets will be subject to the following regulatory framework: Foreign debt RWAs will be regulated by the National Development and Reform Commission (NDRC); equity RWAs and asset securitization RWAs will be regulated by the China Securities Regulatory Commission (CSRC); RWAs involving the repatriation of funds raised overseas will be regulated by the State Administration of Foreign Exchange (SAFE); and other forms will be regulated by the CSRC in conjunction with relevant departments according to their respective responsibilities.

(BlockBeats | PANews(Caixin) | Odaily)

2. Vietnam plans to tax the transfer/trading of crypto assets: 0.1% of the transaction amount for individuals, and 20% for institutions or corporations; crypto transactions are exempt from VAT.

Vietnam's Ministry of Finance has proposed a draft tax law that would subject individuals (regardless of whether they are residents or non-residents) to a 0.1% personal income tax on the transfer of crypto assets through licensed platforms (similar to the securities tax system); related income of institutional investors might be subject to a 20% corporate income tax; and the transfer/trading of crypto assets would be exempt from value-added tax (VAT). The draft law also proposes setting high thresholds for digital asset exchanges, such as a legal capital of 10 trillion Vietnamese dong (approximately US$408 million) and a foreign ownership limit of 49%.

(Hanoi Times | BlockBeats | Foresight News | TechFlow)

3. Tether assisted Türkiye in freezing approximately $544 million in crypto assets involved in illicit gambling/money laundering.

Tether CEO Paolo Ardoino stated that the freeze was executed at the request of the Istanbul Prosecutor's Office. Disclosed information shows that Tether has assisted law enforcement in over 1,800 cases in 62 countries, freezing approximately $3.4 billion in USDT. Elliptic data indicates that by the end of 2025, Tether and Circle have blacklisted approximately 5,700 wallets, freezing a total of approximately $2.5 billion (about two-thirds of which is USDT).

(PANews | BlockBeats | Foresight News | Cointelegraph)

4. Strategy (formerly MicroStrategy) reported a huge loss in its Q4 earnings report: unrealized losses of approximately $17.4 billion and a net loss of $12.4 billion. The company stated that it holds approximately $2.25 billion in cash reserves to cover interest and dividends and that there is currently no pressure to sell liquidity. However, Michael Saylor stated in a conference call that "selling Bitcoin is also an option," prompting the market to reassess potential selling pressure.

(PANews | Odaily)

5. Bithumb "accidental Bitcoin sending" incident: Customers are expected to lose approximately 1 billion Korean won. The company has launched a compensation and rectification program and established a 100 billion Korean won guarantee fund.

Bithumb apologized and stated that it would compensate users who panic-sold at low prices during a specific period with "the transaction price plus an additional 10%", and would also provide compensation to users who visited the site during the incident and offer 7 days of zero transaction fees across the entire site. At the same time, it would cooperate with regulatory investigations, upgrade asset verification/multiple payment/anomaly detection and external auditing, and establish a 100 billion won "customer protection fund".

(PANews | BlockBeats | Foresight News | TechFlow)

6. Hong Kong Securities and Futures Commission (SFC) Digital Asset Advisory Group Meeting: Discussion on Enhancing Liquidity and Expanding Product and Service Offerings for Licensed Platforms. The SFC and licensed virtual asset trading platforms discussed the “Strengthening the Digital Asset Ecosystem Plan,” focusing on enhancing liquidity, promoting the expansion of product and service offerings, and emphasizing the balance between innovation and investor protection.

(BlockBeats | Foresight News | TechFlow)

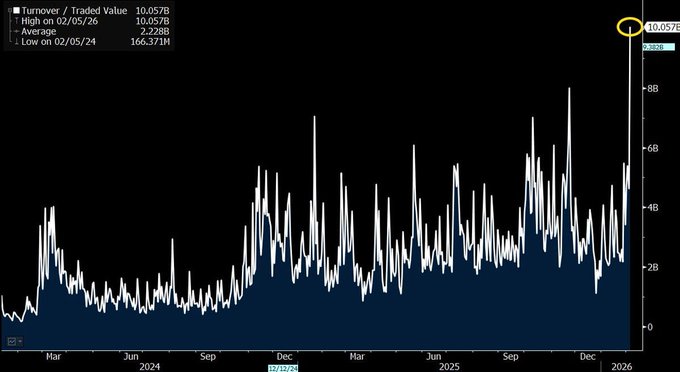

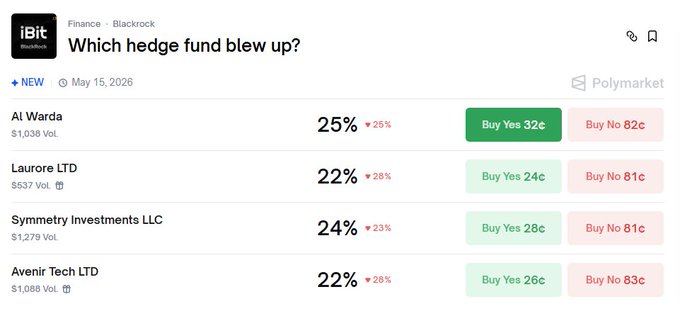

7. Market rumors of "institutional collapse" are gaining traction: Winternute CEO expressed strong skepticism, stating that the current market is more orderly and the risks are controllable. Historically, risk signals from 3AC, FTX, and other institutions have often been exposed quickly through industry channels, but no similar signs have been observed so far. Most of the related rumors come from anonymous accounts with insufficient credibility.

(PANews | Odaily)

Market Analysis

1. Next week's macroeconomic "high-density risk window": a concentration of data and official speeches may amplify cross-asset volatility and transmit it to cryptocurrencies. The US non-farm payrolls, CPI, and retail sales will be released in quick succession, and several Federal Reserve officials will speak out; coupled with geopolitical and policy variables (such as US-Iran negotiations, the Japanese general election, etc.), the risk of volatility spillover increases.

(BlockBeats | TechFlow | PANews)

2. 10X Research: Selling pressure may mainly come from the selling and forced liquidation of spot ETFs; a short-term rebound/consolidation is possible, but new lows may still be reached in the summer.

CNBC, citing 10X Research, believes that selling pressure this week may come from Bitcoin spot ETF sell-offs, sharp drops triggering forced liquidations, and being dragged down by weaker risk assets; however, further declines this summer cannot be ruled out, with the low point potentially pointing to the $40,000–$50,000 range.

(BlockBeats | PANews | Odaily)