Millennium Management, a global investment firm with over $60 billion in assets, disclosed its Bitcoin exchange-traded fund (ETF) holdings for the first quarter of 2024.

Millennium holds about $1.9 billion in various Bitcoin spot ETFs traded in the U.S., according to a recent 13F filing with the U.S. Securities and Exchange Commission (SEC).

Institutional Bitcoin ETF investment surges

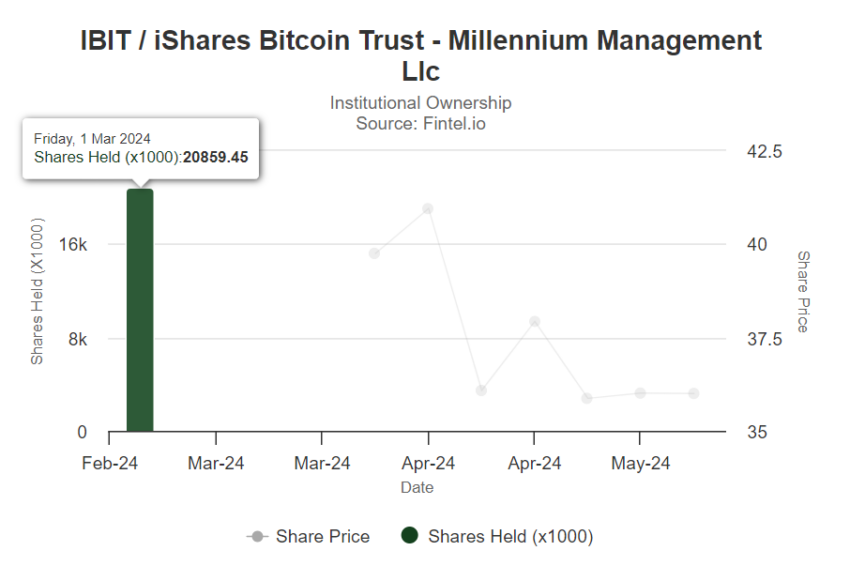

The ETFs most held by millennials include BlackRock's iShares Bitcoin Trust (IBIT), Fidelity's Wise Origin Bitcoin Fund (FBTC), and Grayscale Bitcoin Trust ETF (GBTC). Millennium also holds small holdings in the ARK 21Shares Bitcoin ETF (ARKB) and the Bitwise Bitcoin ETF (BITB). Specifically, the filing details Millennium's investments as $844.2 million in IBIT, $806.7 million in FBTC, $202 million in GBTC, $45 million in ARKB, and $44.7 million in BITB.

Other prominent asset managers are also increasing their holdings in Bitcoin ETFs . Pine Ridge reported holding $250 million in IBIT, FBTC, and BITB. Meanwhile, Schoenfeld Strategic Advisors disclosed $248 million in IBIT and $231.8 million in FBTC, for a total of $479 million.

Matt Hogan, Chief Investment Officer at Bitwise, highlighted important trends in institutional investment in Bitcoin ETFs . According to Hogan, on Thursday about 563 professional investment firms reported holding $3.5 billion worth of Bitcoin ETFs. He expects there will be more than 700 professional investment firms and total assets under management (AUM) approaching $5 billion by the filing deadline.

“This is truly huge. For those wondering whether they are the only financial advisor, family office or institution considering exposure to Bitcoin, the clear answer is that you are not alone,” asserts Hogan.

Hogan compared the interest in Bitcoin ETFs to the hugely successful gold ETFs that launched in 2004. The gold ETF attracted over $1 billion in its first five days, with only 95 professional firms investing in its initial 13F filing.

“From a broad ownership perspective, the Bitcoin ETF is a historic success,” he said.

Hogan noted that while most Bitcoin ETF investments are currently coming from individual investors, there is likely to be an increase in investment from institutional investors as well. For example, Hightower Advisors is allocating $68 million, or just 0.05% of its total assets, to a Bitcoin ETF. Hogan predicts that this allocation will grow over time, reaching a significant percentage within institutional portfolios.

“Multiply this by the number of professional investors involved in this space and you can see what lies behind my passion,” he explains.

In fact, significant investments from institutions such as Millennium Management show that cryptocurrencies are becoming increasingly integrated into mainstream financial portfolios. Increased support from these institutions signals long-term confidence in the potential of digital assets and could potentially lay the foundation for broader cryptocurrency adoption.

Trusted

The information contained on the BeInCrypto website is published in good faith and for informational purposes only. Users are solely responsible for any consequences arising from their use of information on the website.

In addition, some content is an AI-translated version of the English version of BeInCrypto articles.