In a notable shift in the cryptocurrency market, BlackRock's iShares Bitcoin Trust (IBIT) has surpassed Grayscale Bitcoin Trust (GBTC) to become the world's largest Bitcoin spot exchange-traded fund (ETF).

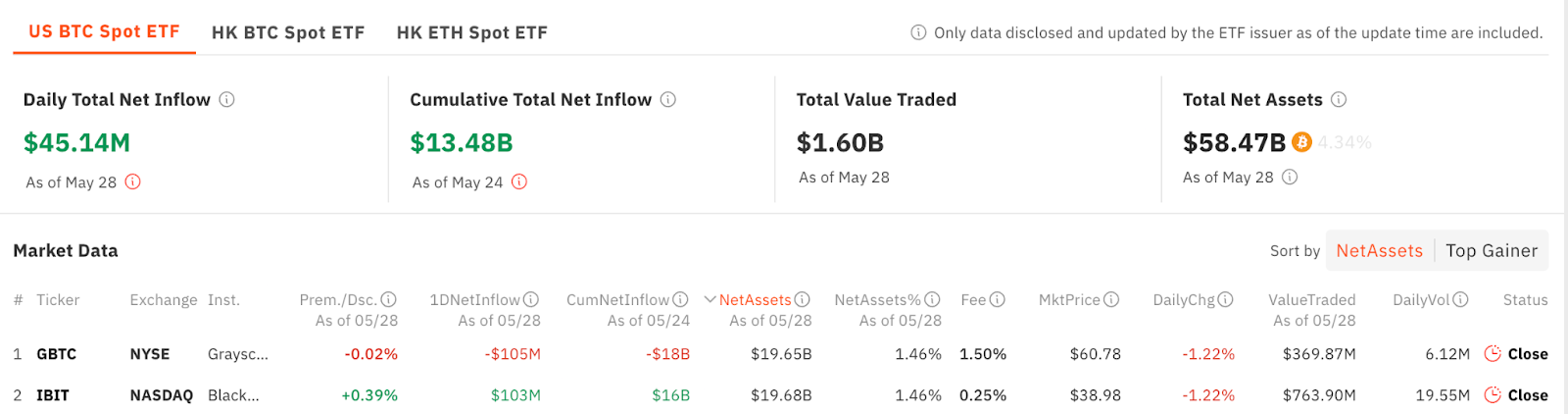

According to recent data from SoSoValue, IBIT currently holds $19.68 billion in Bitcoin (BTC), slightly ahead of GBTC's $19.65 billion.

How did Grayscale's GBTC lose first place to BlackRock's IBIT?

This milestone, which comes nearly five months after the Bitcoin spot ETF was approved, marks the beginning of a significant era for cryptocurrency financial products.

Grayscale charges a 1.5% fee for the GBTC ETF, which is significantly higher than its competitors. Therefore, Grayscale gradually lost its appeal among investors as they preferred alternatives such as BlackRock's IBIT.

“Grayscale held 620,000 BTC at the time of conversion (January 10, 2024), which was over 3% of its circulating supply, but even after investors withdrew more than 330,000 BTC, it received a fee reduction (1.5% vs. its peers). 0.2%) were rejected. So much for the “differentiation” strategy,” said HODL15Capital.

Read more: How to Trade Bitcoin ETF: A Step-by-Step Approach

As a result, BlackRock's performance demonstrates the growing institutional interest in Bitcoin and the competitive dynamics within the ETF market.

Meanwhile, GBTC experienced its largest single-day outflow, totaling $105 million over 18 trading days. However, this decline contrasts with the overall positive trend in the Bitcoin ETF sector, which saw net inflows of $45.14 million on May 28, 2024. This extends net inflows for 11 U.S. Bitcoin ETFs to 11 consecutive days.

BlackRock also invested in IBIT using its own income and bond-focused funds. BlackRock Strategic Income Opportunities Fund ( BSIIX ) and Strategic Global Bond Fund ( MAWIX ) purchased $3.56 million and $485,000 worth of shares, respectively, according to recent filings with the Securities and Exchange Commission (SEC). Nonetheless, these investments represent only a small portion of each portfolio.

To put things into perspective, the ETF's total Bitcoin holdings now exceed 1 million BTC, accounting for nearly 5% of the total Bitcoin supply. This milestone demonstrates the ETF’s size and influence within the broader Bitcoin market.

By region, the United States remains the center of Bitcoin inflows, reaching $1.03 billion last week. There have also been significant influxes from other European countries, such as Germany and Switzerland.

Read more: Cryptocurrency ETNs and Cryptocurrency ETFs: What's the Difference?

CoinShares data reflects the overall positive mood in the market despite volatile price movements. Digital asset investment products recorded total inflows of $1.05 billion for the third week in a row. This surge in activity brought the total value of digital asset exchange-traded products (ETPs) to nearly $98.5 billion.

Trusted

The information contained on the BeInCrypto website is published in good faith and for informational purposes only. Users are solely responsible for any consequences arising from their use of information on the website.

In addition, some content is an AI-translated version of the English version of BeInCrypto articles.