The U.S. House of Representatives passes the FIT 21 bill, and the next battleground is in the Senate

The FIT 21 bill passed the House of Representatives on May 22, 2024, but the legislation has not yet been completed.

The United States has a bicameral system. Legislation must be passed by both houses of the House of Representatives and the Senate and signed by the President before it becomes a formal law. Currently, the FIT 21 bill has been passed by the House of Representatives, and the next step depends on its deliberation in the Senate. Although the legislation has not yet been completed, it is still an important milestone in cryptocurrency regulation.

Detailed information and legislative progress of the FIT 21 bill can be seen on the U.S. Congressional Legislative Database website.

Will the passage of the FIT 21 bill be good for the cryptocurrency industry?

There are currently two schools of thought, both of which are considered beneficial or harmful. Supporters believe that the FIT 21 bill provides regulatory certainty that is currently lacking, which will promote innovation and attract investment. Consumer protection measures have also been established, which will make the cryptocurrency market more mature and secure. Those who think it is harmful criticize the FIT 21 bill as still not enough. For example, it still does not fully resolve the dispute between the CFTC and the SEC. There is still a ambiguity in whether cryptocurrencies are commodities or securities, which may continue to lead to confusion in dual supervision. There are also The view is that the current bill is still insufficient in terms of regulatory power. However, these concerns will surely be raised for discussion in the Senate in the future. After all, the FIT 21 bill is still in the legislative process and is not yet the final version.

Is the passage of FIT 21 a victory for the cryptocurrency industry?

You haven’t succeeded yet, you still have to work hard.

After all, it has only been passed by the House of Representatives and has not yet completed the legislative process. It will be a tough battle for the Senate or the President to sign it next. But this still represents some kind of progress. It is a step towards making cryptocurrency more accessible to the world and facing the public. Cryptocurrency is no longer an issue that people dare not mention. It can now be formally discussed in the sun. Members of Congress The discussion of relevant bills to promote the development of the cryptocurrency industry has begun. This is definitely a stage victory for the cryptocurrency industry.

FIT 21 Bill Proposal Process

The FIT 21 bill was introduced in July 2023 by Glenn "GT" Thompson, Chairman of the U.S. House of Representatives Agriculture Committee, and Representatives French Hill, Dusty Johnson, etc. Its main purpose is to provide a regulatory framework for digital assets (such as cryptocurrency).

As an emerging asset class, how should cryptocurrencies be regulated? Supervised by whom? In the past few years, the United States has lacked a specific structure for this. In addition to causing the cryptocurrency market to be flooded with fraud and all kinds of chaos, projects that want to comply are also at a loss, with no specific guidelines to follow, and face dual supervision (different units simultaneously Supervise you).

"SEC considers XXX to be a security"

People in the crypto are no stranger to this kind of news. Whenever the SEC names someone as a securities, it usually means lawsuits, fines, withdrawal from the U.S. market, etc. Whenever it is named, the currency price often drops. If FIT 21 bill can complete the legislation, maybe the crypto will no longer need to worry about such sudden naming in the future.

The FIT 21 bill will bring clear regulatory rules to digital assets

Source: U.S. House Financial Services Committee Twitter

What are the main contents of the FIT 21 bill?

The full name of the bill: " Financial Innovation and Technology for the 21st Century Act ." The entire bill has two major focuses on regulating cryptocurrency:

Tighter consumer protection

- Require cryptocurrency issuers to provide more complete information disclosure - Establish consumer protection clauses to protect consumers from unfair treatment - Establish a dispute resolution mechanism to provide a channel to appeal and enforce rights when encountering disputes - Require exchanges or other relevant agencies to provide regular audit reports to increase market transparency and enhance trust.Clear regulatory structure, responsible regulatory units and judgment standards

Clearly define the regulatory authorities of CFTC (U.S. Commodity Futures Trading Commission) and SEC (U.S. Securities and Exchange Commission). CFTC regulates digital assets that are regarded as commodities, and SEC regulates digital assets that are regarded as securities. It also lists the differences between commodities or securities. Several elements:

-The common Howey Test: Does it have the attributes of an investment contract? If so would it be classified as a security - Functional: as a medium for goods or services? If it is more likely to be regarded as a commodity - the degree of decentralization: including issuance, operation, governance, etc., the more decentralized it is, the more likely it is to be regarded as a commodity. If it is difficult to distinguish, the bill also requires the CFTC and SEC to respond Negotiate together and take a consistent position.

Generally speaking, the FIT 21 bill recognizes that cryptocurrencies belong to a new asset class, some of which are commodities and should be regulated by the CFTC, and some of which are securities, which are regulated by the SEC, clearly separating regulatory authorities. Who is responsible for supervision no longer has to be said by each person, and there are objective judgment standards; if a more complex case is encountered, the two units are required to negotiate and discuss and make a consistent supervision resolution, avoiding double supervision and different supervision rules. question.

More detailed parts, such as the determination of the degree of decentralization, provide some specific criteria:

Control : must be dispersed, with no one entity having absolute control for 1 year.

Holding proportion : Within 1 year, the proportion of assets held by the issuer group or its related parties shall not exceed 20%.

Governance Control : The issuer group cannot have control over governance for 1 year.

Function changes : Within 3 months, the issuer group cannot arbitrarily change the functions of digital assets.

Investment Promotion : The issuer group has not promoted digital assets to the public market as investment products within 3 months.

Distribution method : Within 1 year, the distribution of tokens can only be carried out through automated procedures and not by human operations.

Taking a closer look at these standards, except for a few projects with a high degree of decentralization, it is difficult to fully meet the standards, but at least there are clear standards to work towards; overall, the FIT 21 bill breaks the gray area of cryptocurrency regulation, such as those in the past Question: Are cryptocurrencies commodities or securities? Should it be regulated by the CFTC or SEC? There is always no clear answer, and there are even situations where two agencies compete for regulatory power.

In the past, there were no clear compliance standards. The SEC said that if you are a security, it is a security. Unless you go to court, you can often only be fined.

If the FIT 21 bill can be completed, there will be a clear regulatory structure from now on. Cryptocurrency projects will also know more clearly what regulations they need to comply with, and they will not need to worry about sudden law enforcement requirements. This is very important for the overall cryptocurrency industry and can Provide a more friendly development environment.

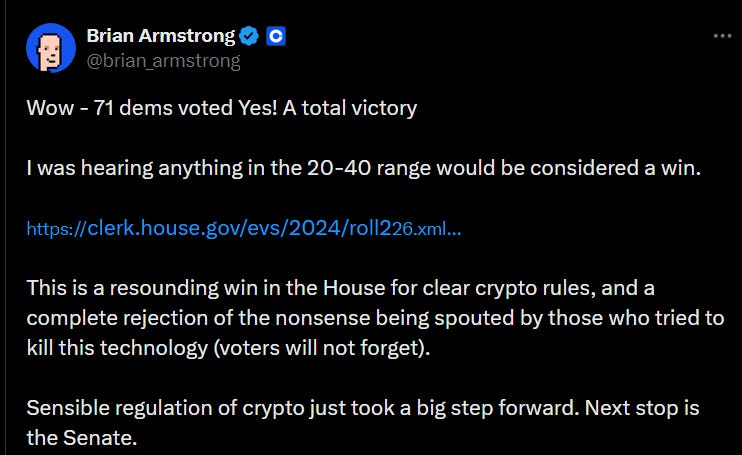

As soon as the bill was passed, Coinbase founder Brian Armstrong issued a message to celebrate:

He said this was a major victory for the House of Representatives and a big step toward smarter regulation of cryptocurrencies.

But the SEC was not so happy about this. On the same day, the SEC issued a statement expressing its concerns about the FIT 21 bill:

The statement mentioned several key points: it believes that the FIT 21 Act does not provide sufficient protection for consumers, is inconsistent with the existing legal structure, and will create more difficult enforcement challenges, etc.

But judging from the history of disputes between the SEC and cryptocurrency in recent years, if the SEC is unhappy with FIT 21, then we should be happy? At least the international status of the encryption industry is slowly improving.

The impact of FIT 21 on cryptocurrencies

For those of us who are not U.S. citizens, the consumer protection part of the FIT 21 bill will only have an indirect impact; the more direct impact is on the regulatory part.

For example, in the past, due to regulatory gray area issues, certain cryptocurrency projects (such as exchanges and DeFi) encountered difficulties in promotion, resulting in certain restrictions on the overall adoption of cryptocurrency; or whenever a project was named Securities, currency price fluctuations when there is a lawsuit crisis with the SEC, these may gradually improve after the implementation of the FIT 21 bill, the overall ecological development will be more stable, and the market environment will have better transparency. For us as cryptocurrency investors, In other words, the most direct impact is a better cryptocurrency ecosystem and a more mature market.

Specifically, the FIT bill may have the following impacts on the cryptocurrency industry:

Clarify regulatory roles : The bill clarifies the regulatory responsibilities of the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). The CFTC is responsible for supervising the commodity part of digital assets, and the SEC supervises those digital assets that are not decentralized enough and are deemed to be securities. This will reduce regulatory uncertainty and bring more transparency to the market.

Promote innovation and investment : With a clear regulatory framework, it is possible to attract more funds and talents into the cryptocurrency market, which will help the development of innovation in the cryptocurrency field.

Enhance consumer protection : The bill also strengthens consumer protection, sets standards for digital asset issuance and trading, and reduces fraud and market manipulation. This helps increase trust in the cryptocurrency market.

Although this seems to be a very good progress and breakthrough for cryptocurrency, the FIT 21 bill still has many problems to face in the future:

Political and Legislative Challenges :

The bill passed the House of Representatives, but will face more challenges in the Senate. The House of Representatives, which has just passed the FIT 21 bill, has the Republican majority. The Republican Party is currently a party with a more friendly attitude towards cryptocurrency, while the Democratic Party has adopted a more stringent attitude. The Senate that will review the bill next has the Democratic Party as the majority party. It is conceivable that The FIT 21 bill will face tougher discussion in the Senate.

Even if it is passed in the Senate and signed by the president, the United States is about to hold a new presidential election at the end of the year. The current candidates on the table have very different attitudes towards cryptocurrency.

Not long ago, the House of Representatives and the Senate passed resolutions to repeal the SAB 21 accounting bill, which is a stricter accounting standard for financial institutions holding cryptocurrency assets. Repealing it will bring a more relaxed development environment for the cryptocurrency industry, but President Biden has He has previously said he would veto the bill when it reaches his desk. Relatively speaking, Biden has a stricter attitude towards cryptocurrency, while Trump, the other candidate, has shown a strong embrace.Potential dual regulatory regime :

Although the FIT 21 bill proposes clear regulatory units and scope, it also acknowledges that there will be certain situations that are difficult to determine and must be supervised jointly by the CFTC and SEC. This will bring about some regulatory complexity and difficulty and requires the cooperation of the two agencies. coordination and cooperation.

Summary - Even if FIT 21 has not yet completed legislation, its impact has already begun

A while ago, Uniswap, the leading DeFi exchange, received a Wells Notice from the SEC. This usually means that the SEC has completed its investigation and believes that Uniswap violated securities laws and may face prosecution next.

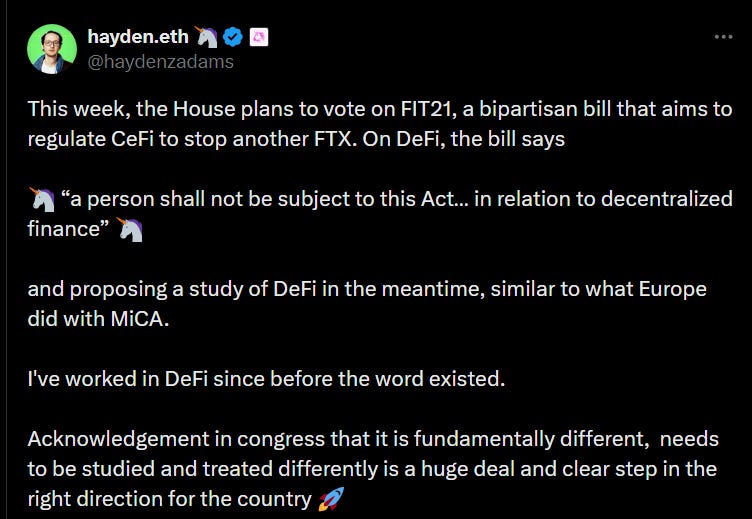

On 5/21, before the House of Representatives passed the FIT 21 bill, Uniswap founder Haydenz Adams tweeted that this is an important bill and that Congress is aware of the differences between CeFi and DeFi and is moving in the right direction.

Q: What is the Wells Notice? (Wells notice)

A: A Wells Notice is a formal notice issued by the U.S. Securities and Exchange Commission (SEC) to the other party before deciding to take enforcement action against a company or individual, letting the other party know that the SEC is considering filing charges against it and giving the other party a way to respond. Chance.

On 5/22, Uniswap responded to the Wells Notice, stating that DeFi is a decentralized innovation, the SEC’s accusations are not established, and they will continue to provide services and be ready for battle.

Days after FIT 21 passed, Coinbase filed a new appeal in its ongoing dispute with the SEC, citing the FIT 21 act:

Although the FIT 21 bill has not yet completed the formal legislative process, its impact has already begun. More and more cryptocurrency projects accused by the SEC will take a firmer stance. The political tendency may also have begun to tilt, with this time the House of Representatives Judging from the number of votes passed, a total of 279 votes were cast in favor, with 208 votes coming from Republican members and 71 votes coming from Democratic members, indicating that the bill has begun to gain cross-party support.

Is the U.S. cryptocurrency regulatory bill important to us in Asia?

Putting aside some indirect effects, such as the overall market being safer, the direct impact is that this shows that cryptocurrency continues to move towards the world, gradually becoming a more mature industry, entering more people's vision, the overall market will be more stable, and uncertainty will be reduced. In the long run, the advantages to industrial development outweigh the disadvantages.

And in the shorter term, this means that the issue of cryptocurrency will receive more and more attention in American politics. In the upcoming US election, the attitude towards cryptocurrency may be one of the major issues that can influence the election. Cryptocurrencies will be discussed more in the coming months and will have a more direct impact on the market.