Author: Brayden Lindrea, CoinTelegraph; Translated by: Tao Zhu, Jinse Finance

Ethereum, the world’s second-largest blockchain network, is expected to be the focus of the next spot cryptocurrency exchange-traded fund, but it may have a publicity problem.

While Ethereum has been described in the past as the “internet of money,” the “world computer,” and “digital oil,” some worry that Ethereum doesn’t have the right publicity, and its highly technical roadmap may be difficult for Wall Street to grasp and could dampen demand for a spot Ethereum ETF.

Markus Thielen, head of research at 10x Research, notes that the best investor pitches avoid using technical jargon. Here’s how Thielen and several commentators think Ethereum can be pitched.

The future of finance

Thielen said Ethereum, as a "network that empowers the future of finance," is easier for Wall Street investors to understand.

Ethereum already houses nearly all of the world’s largest decentralized finance protocols, tokenized real-world assets, and stablecoins.

However, Thielen noted that Ethereum has lost many users and recent network upgrades have been quite slow, which could affect this claim.

“While Ethereum’s staking yield is lower than Treasury yields, the fact that Ethereum generates minuscule revenue relative to its market cap does not make it a viable, cash flow-generating investment.”

Integrated decentralized ecological platform

Henrik Andersson, chief investment officer at investment management firm Apollo Crypto, said Ethereum could also be called a platform for "decentralized services," providing support for everything from finance to social networks to artificial intelligence.

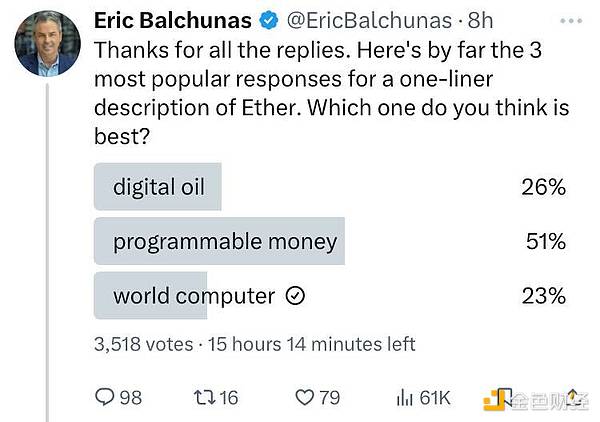

Source: Eric Balchunas

In addition to decentralized financial applications, the Ethereum ecosystem also includes decentralized autonomous organizations, social networks, and identity solutions.

Ethereum has more room to rise than Bitcoin

Andersson suggested that a simpler pitch is that Ethereum is a cryptocurrency with more upside than Bitcoin.

“Others may simply view Ethereum as a smaller, faster-growing crypto asset,” he said.

Ethereum’s market cap currently stands at $453 billion, while Bitcoin’s market cap of $1.34 trillion is roughly three times that.

Andersson said others will be attracted by Ethereum’s potential price gains, and he is confident that Wall Street investors will not be bothered by Ethereum’s complex six-phase technical roadmap.

Regardless of the technology, Ethereum’s price relative to Bitcoin (BTC) has steadily declined from 0.085 in December 2021 to 0.055 today.

CK Zheng, investment director at cryptocurrency hedge fund ZX Squared Capital, explained that this would make it more difficult to convince investors to buy into an Ethereum ETF that is identical to the Bitcoin investment products already on the market.

ETH/BTC chart over the past 12 months. Source: Coingecko.

Zheng pointed to the Ethereum Foundation’s investigation by the U.S. Securities and Exchange Commission and the rise of Solana as a competitor to Ethereum as two other factors that could hinder the performance of a spot Ethereum ETF.

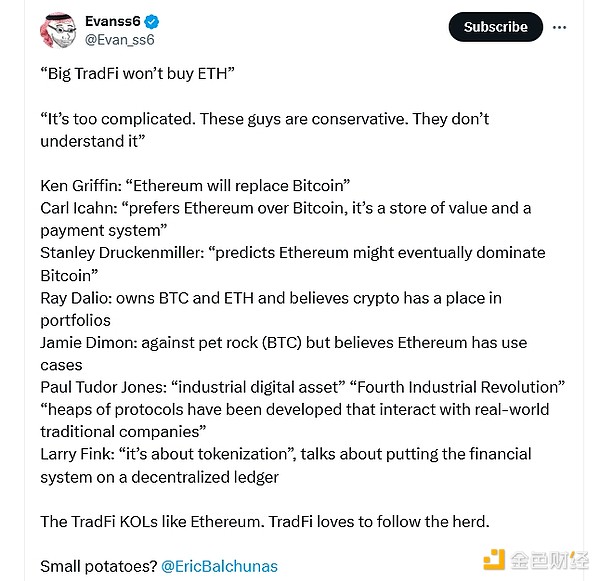

Larry Fink believes it, and so should you

That being said, some of Wall Street’s biggest firms have begun exploring use cases for Ethereum, with considerable success.

BlackRock (one of the approved spot ether ETF issuers) used Ethereum to tokenize its BlackRock USD Institutional Digital Liquidity Fund in March, which has amassed $470 million in assets.

BlackRock CEO Larry Fink said that every stock and bond will eventually be tokenized on the blockchain. 21Shares analysts said that if Fink's prediction comes true, Ethereum could benefit because it already accounts for 71.9% of all tokenized financial assets on the chain.

Source: Evanss6

On May 23, the SEC approved 19b-4 applications from VanEck, BlackRock, Fidelity, Grayscale, Franklin Templeton, ARK 21Shares, Invesco Galaxy, and Bitwise to issue spot Ethereum ETFs.

Approved ETFs must wait until the SEC approves their Form S-1 filing before the ETF can begin trading.

If that happens, Bloomberg ETF analyst James Seyffart expects the ETF to absorb 20% of the flows seen by spot bitcoin ETFs , with Balchunas’ estimate being smaller, between 10% and 15%.