Macroeconomic contraction. Economic data continues to suggest that the global economy is contracting further. How will policymakers respond, and what impact will their decisions have on your portfolio?

The United States released a series of key US economic data; the most important of which was the revised estimate of Gross Domestic Product (GDP) for the first quarter of 2024.

U.S. economic growth for the first three months of 2024 was revised down to an estimated 1.3% annualized rate, down from 3.4% in the fourth quarter of 2023 and slightly lower than the initial forecast of 1.6%. At the same time, these estimates significantly lowered corporate profits from a month-on-month increase of 3.9% to a decrease of 1.7%!

Another worrying factor was the GDP deflator (a measure of changes in the price level of domestically produced goods and services), which remained unchanged from the initial estimate of 3.1%, indicating that inflation remained elevated in the first quarter as the real economy shrank.

Although there is a lag between first-quarter statistics and current data, more evidence suggests that the economy is continuing to decline.

Globally, many countries are already experiencing deflation, and although Germany has been a bastion of growth in the European Union, monthly inflation was barely positive in May, increasing by just 0.1%, suggesting that the country is on the verge of deflation.

Major U.S. retailers are slashing prices on a range of goods to keep their goods affordable for consumers — a move driven by deflationary price pressures — while low-cost leaders such as Walmart are reaping revenue gains from higher earners, suggesting that even the wealthiest consumers are being squeezed.

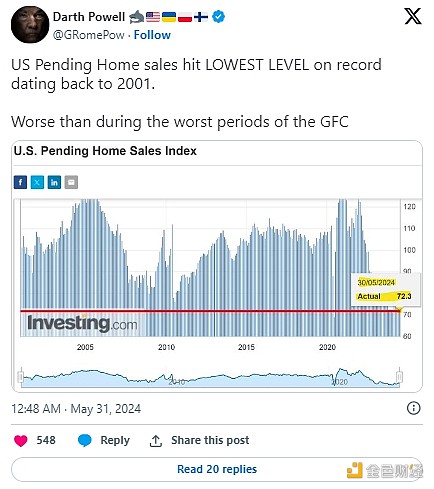

Pending home sales unexpectedly grew in March but took a big hit in April, experiencing the largest month-over-month drop since February 2021 and pushing the pending home sales index to a record COVID low.

Given the enormous pain that would be caused by runaway inflation in the post-pandemic era, market participants would naturally welcome deflation with open arms.

Given that rate hikes appear to be successful in curbing inflation, it is understandable that many also believe that the inevitable rate cuts will be able to mitigate further economic downturns.

While there is no doubt that coordinated monetary and fiscal stimulus (i.e., lower interest rates and government cash transfers) would certainly have the potential to reverse the decline in asset prices and avoid defaults, such a move would be reactionary and would most likely not be undertaken while inflation is rampant across the country.

All business cycles eventually end, and deteriorating economic data suggests the current cycle is drawing to a close, with risk assets likely heading for cheap lows.