Disclaimer: The contents of this report reflect the opinions of the author and are provided for informational purposes only. It is not written with the intent to recommend the purchase or sale of tokens or the use of protocols. Nothing contained in this report is investment advice and should not be construed as such.

1. Introduction

Since the explosive popularity of $DOGE in 2021, the crypto industry has witnessed the rise of the memecoin trend. Memecoins combine the word "meme," which refers to popular internet content like images, characters, and videos, with "coin."

Unlike the native tokens of projects developed as solutions based on certain technologies, memecoins gained popularity due to their characters. However, this popularity was short-lived. The overall market downturn led to a sharp decline in their prices, making it seem that the excitement around them was fading.

Nevertheless, in late February 2024, the prices of older memecoins such as $DOGE, $SHIB, $PEPE, and $FLOKI surged. Following the Dencun upgrade on March 13, a massive memecoin boom centered around Solana and Base was observed. Notably, the current memecoin trend has evolved beyond merely offering high-risk, high-reward opportunities. It is now establishing itself as a significant sector and phenomenon within the blockchain industry.

This article aims to shed light on the evolution of the memecoin sector, highlighted by the recent memecoin craze, and to explore their hidden potential.

2. Expansion of Memecoin Roles: From Retail to Projects

Memecoins, once regarded merely as speculative assets, have expanded their roles to include marketing tools, means of personal expression, and symbols of community belonging. Therefore, we'll divide the evolution of their roles and status into two parts: the retail side, represented by individual investors, and the project side, which creates the product.

2.1. Retail Side

2.1.1. Stimulate Speculation with High Volatility

Compared to traditional markets, memecoins have exhibited extremely high price volatility in the already volatile crypto market. This has made them a popular opportunity among risk-tolerant retail investors, leading to explosive interest. Some memecoins have shown price increases ranging from 10 to 10,000 times their original value. When these coins achieve such remarkable gains, investors often share their returns on social media platforms like Twitter, inducing FOMO among others. This, in turn, drives new investors into the memecoin market, spurring the creation of numerous new memecoin projects aiming for similar success.

The recent memecoin frenzy, particularly centered around Solana and Base, demonstrated the highly active trading behavior of retail investors, with prominent narratives or specific tokens changing every hour or even every minute. Due to this unpredictability and high volatility, memecoins have become an intriguing and straightforward form of entertainment for those deeply dedicated to blockchain and cryptocurrency, often referred to as 'Degens'.

Furthermore, the trading environment for memecoins has been continuously improving, with popular decentralized exchanges (DEXs) like Hyperliquid, as well as centralized exchanges (CEXs) such as Gate.io, KuCoin, and even Binance, listing these trending memecoins to cater to retail investors' interests.

However, as competition intensifies and the market continually seeks more provocative and straightforward memecoins, there have been instances where memecoins causing controversy—due to themes of racism, disasters, or excessive mockery—have experienced sudden price surges. Notably, on Solana, the network with the most active memecoin trading, there was a period when memecoins promoting racism gained popularity.

The rise of memecoins with morally questionable themes has led to concerns that these developments could hinder the healthy growth of the blockchain industry. Notably, Polynya, a researcher who has long contributed to the Ethereum layer and infrastructure, described the current memecoin craze as "Crypto's broken moral compass" and announced his withdrawal from the scene.

2.1.2. The Most Powerful Means of Uniting the Community

Memecoins, inherently based on specific people, characters, or phenomena, provide a strong sense of identity and belonging for their communities through distinctive images and brands. These images often involve highly variable subjects like dogs, cats, or hats, making them easily adaptable for merchandise creation and secondary artistic endeavors by community members. The simplicity and relatability of a memecoin’s representative image lower the entry barriers for holders, fostering voluntary and enthusiastic participation through various creative applications.

A prime example is $WIF (DogWifHat), which uses a dog with a yarn hat as its logo. By combining the universally recognizable symbol of a dog with the unique twist of a yarn hat, $WIF differentiates itself from other memecoins and generates numerous secondary memes that help expand the community. Moreover, on March 10th, the $WIF community proposed to display the $WIF logo at the Las Vegas Sphere, a dome concert hall with a capacity of 18,000. They successfully raised the target amount of $650,000 in just four days. This instance demonstrates a significant turning point, proving that a memecoin-based community can transcend creating and sharing memes on social media to forge strong offline bonds.

2.2. Project Side

The role and status changes of memecoins in the retail sector, as previously examined, show that they have expanded in scale and influence while staying true to their initial characteristics. However, numerous new cases of projects utilizing memecoins in unprecedented ways have emerged. This shift indicates that memecoins have evolved beyond being mere speculative opportunities and are now considered a means to contribute to the growth of projects in various ways.

2.2.1. Opening New Horizons in Crypto Marketing

According to Li Jin, co-founder of the prominent cryptocurrency VC firm Variant Fund, in her article "Memecoins as the New GTM Strategy," the advent of memecoins has transformed the sequential order of the Web3 marketing process.

Traditionally, the Go-to-Market (GTM) strategy involved creating a product first, followed by marketing efforts to build a community around that product. However, with the emergence of memecoins, the GTM strategy has shifted towards first establishing a community centered around a memecoin and then developing products that leverage that coin.

This approach is somewhat reminiscent of the strategies employed during the 2021 NFT boom. However, memecoins differ from NFTs in that they offer higher liquidity and accessibility and can more easily incorporate utilities such as payment adoption.

Prominent projects adopting this GTM strategy include Bonkbot, a Telegram trading bot released by the $BONK team; Shibarium, an Ethereum layer 2 solution by the $SHIB team; and $DEGEN, the flagship memecoin of the social dApp Farcaster. Each of these teams has designed their projects to support memecoin price increases through mechanisms like buybacks, burns, and gas token adoption.

- $BONK: Utilizes part of its trading fees for $BONK buybacks and burns.

- $SHIB: Developed Shibarium, an Ethereum Layer 2 solution.

- $DEGEN: Tip payment in Farcaster, payment method adoption, and built layer 3 adopting $DEGEN as a gas fee.

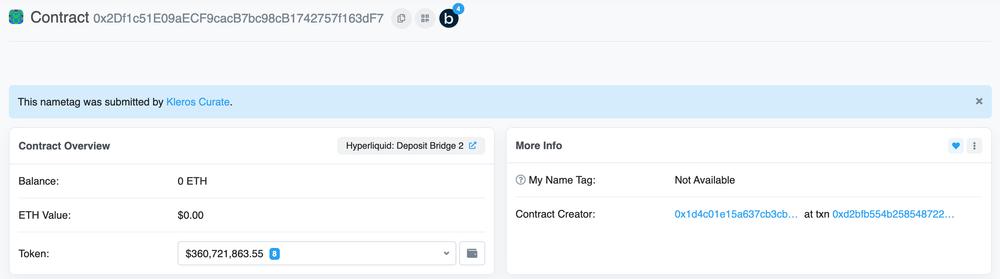

Notably, Hyperliquid, a perp DEX, launched its memecoin $PURR before releasing its native token and achieved significant scale and user acquisition. Featuring a cat logo, $PURR is the first token to support spot trading based on Hyperliquid's HIP-1 token standard. Since its trading began on April 16, over $360 million was funneled into the Hyperliquid bridge, causing deposit delays due to high demand. Hyperliquid has since enhanced its HIP-1 standard so that a portion of new tokens distributed will be allocated to holders of other HIP-1 based tokens, thereby aligning memecoin and project growth.

Memecoins offer greater flexibility in the design of tokenomics, including distribution plans, governance, and utility, compared to native tokens. Consequently, following $PURR's success, it can be anticipated that more projects will initially launch memecoins to expand scale and capture market interest before improving their projects and releasing native tokens.

2.2.2. High Profitability of Memecoin-Specialized Projects

The success of Pump.Fun, a memecoin generator, demonstrates that memecoins can significantly contribute to the profitability of projects. Pump.Fun allows anyone to create tokens on the Solana network at a low cost of 0.02 SOL. In May alone, this platform contributed substantially to the creation of approximately 455,000 new tokens on Solana.

Pump.Fun offers a simple and flexible service for creating memecoins. As of June 5, around 850,000 tokens have been created using the platform. The platform charges users a 1% fee on transaction amounts, and to date, it has generated cumulative revenue exceeding 209,000 SOL, equivalent to approximately $36 million.

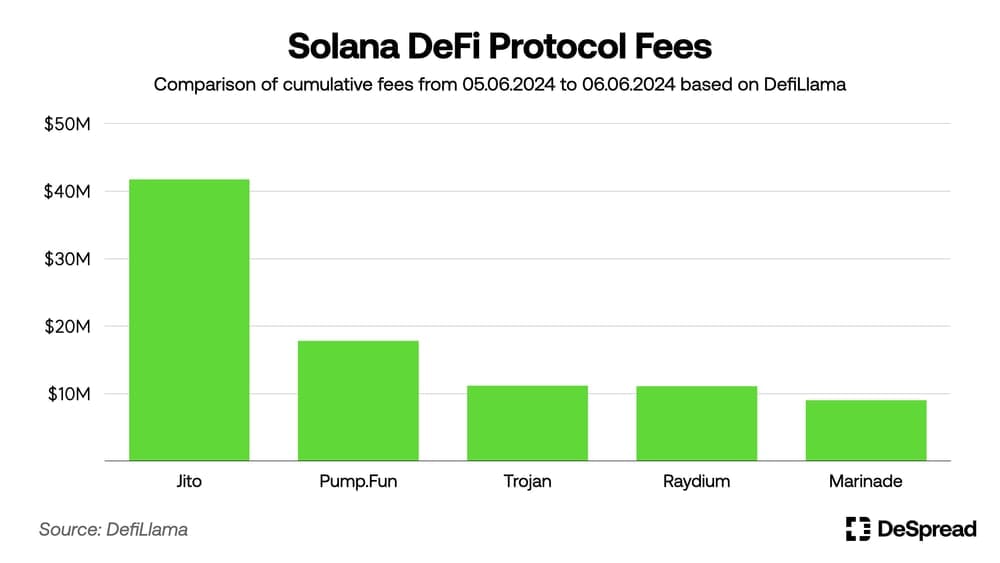

The success of Pump.Fun and other memecoin-related protocols is evident not only in revenues but also in fees. The graph above shows the top five Solana DeFi protocols by fees over the past month, with the memecoin creation platform Pump.Fun and the Solana trading bot Trojan ranking second and third, respectively. Notably, Pump.Fun's performance surpasses even prominent DeFi protocols on other chains, such as Ethena, an Ethereum-based synthetic dollar (USDe) issuance protocol, in terms of both revenue and fees.

3. Memecoin Favored by the Market

3.1. The Memecoin Craze by the Numbers

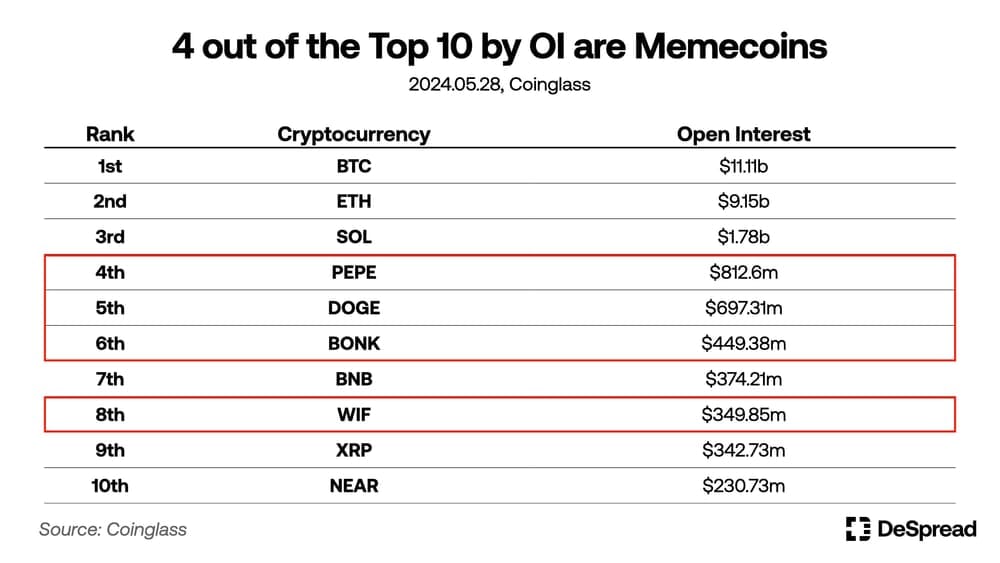

The current memecoin craze is stronger than ever, as evidenced by various indicators reflecting the interest of market participants. According to Coinglass, a cryptocurrency derivatives data analysis platform, as of May 28, 2024, four out of the top ten cryptocurrencies by open interest (OI) volume are memecoins. Open interest represents the number of outstanding derivatives contracts that have not been settled, and an increase in open interest typically signals heightened market participation and potential inflows of capital, often interpreted as a positive indicator of market activity.

Moreover, the cryptocurrencies ranking higher than memecoins—$BTC (1st), $ETH (2nd), and $SOL (3rd)—are listed on the world's largest financial derivatives exchange, CME (excluding $SOL), and are traded on 14, 14, and 11 exchanges respectively. In contrast, the four memecoins—$PEPE (4th), $DOGE (5th), $BONK (6th), and $WIF (8th)—are traded on only 4, 11, 5, and 10 exchanges respectively. This demonstrates significant market interest and capital inflows into memecoins, even with relatively limited accessibility compared to more established cryptocurrencies.

Beyond investment data, memecoins remain a persistent topic of interest among general retail investors. According to Kaito, an AI-based cryptocurrency analysis platform, memecoins have consistently ranked high in "mindshare" since March of this year. Mindshare quantifies the influence of specific tokens on social media. Except for January and May—when Bitcoin spot ETFs and Ethereum spot ETFs dominated market attention—the memecoin sector has consistently ranked 2nd or 3rd, often surpassing sectors like DeFi, Layer 2, and GameFi.

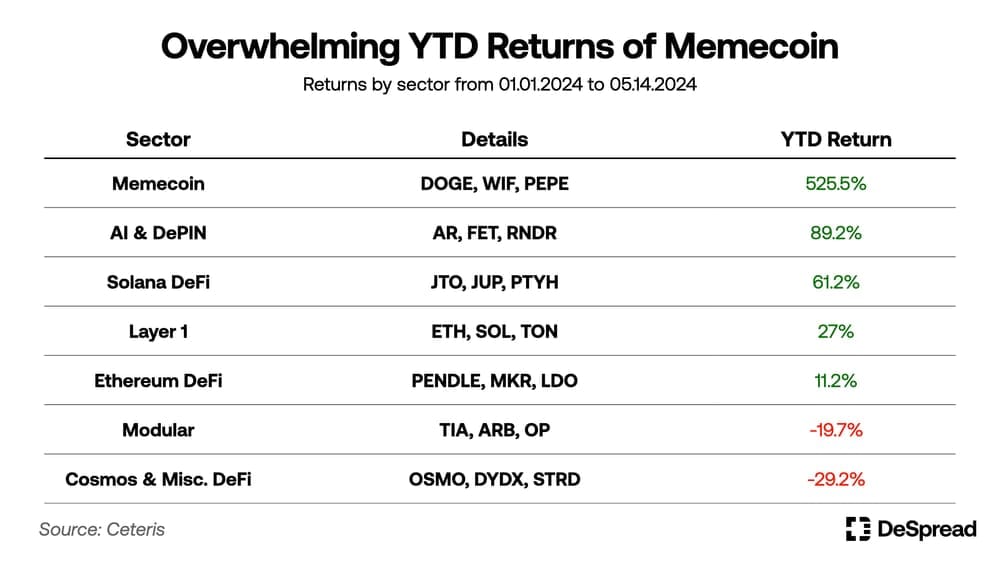

This explosive popularity of memecoins is further underscored by sectoral returns. According to Ceteris, a researcher at Delphi Digital, from January 1 to May 14, 2024, memecoins delivered an astounding 525.5% return, significantly outperforming other sectors. In contrast, longstanding sectors like layer 1, Ethereum DeFi, and modular networks posted low or even negative returns. This remarkable profitability of the memecoin sector is noteworthy, even considering the relatively small market capitalization of memecoins compared to other cryptocurrencies.

3.2. The Changing Status of Memecoin

We have observed the influx of capital into memecoins, the high volume of mentions on social media, and the impressive returns that memecoins have recorded. In this chapter, we will explore the background that has enabled memecoins to garner significant market attention, focusing on recent market trends and shifts in public opinion regarding memecoins.

3.2.1. Attention Economy: Turning Interest into Revenue

The attention economy is an economic approach that views human attention as a scarce resource. This concept was first introduced by economist Herbert Simon in 1971 and was further developed by Professor Thomas H. Davenport in his 2006 book, "The Attention Economy."

Traditionally, the attention economy has been applied primarily within social media industries such as Instagram, Netflix, and Facebook. However, the Delphi Digital article "Attention Is All You Need," published on May 13, highlights the role of the attention economy in driving the memecoin craze, bringing this concept to the forefront of the cryptocurrency industry. In this article, Michael Rinko argues that memecoins have a strong intuitiveness compared to other tokens, which makes them highly persuasive to market participants.

Rinko's assertion underlines how the visual appeal and viral nature of memecoins can captivate and maintain the interest of a broad audience, turning attention into substantial market engagement and investment. This ability to attract and retain attention has been crucial in the meteoric rise of memecoins, reinforcing the notion that in today's digital age, attention truly is money.

"Memecoins take the “attention is value” framework to its logical extreme. They offer the purest way to buy a token because of the future attention you think it will command. You don’t have to worry about product roadmaps or technical milestones, just attention. Memecoins are transparent about their utter lack of intrinsic value, which, funny enough, many people actually find refreshing." - Michael Rinko

Traditionally, valuation methods would dictate that a token with no revenue generation and no profit-sharing mechanism for holders should be worthless. Yet, we observe significant capital inflows and interest in memecoins, as evidenced by the fact that three memecoins ($DOGE, $SHIB, $PEPE) are currently among the top 25 cryptocurrencies by market capitalization and their high ranks in open interest. The attention economy provides a suitable framework for understanding this anomaly. It emphasizes that market participants are now prioritizing the potential "attention" a token can attract over its direct "revenue-generating" capabilities.

⚠️ Attentionomics: A retardio’s framework for valuing memecoins ⚠️

— redphone ☎️🧙🏻♂️ (@redphonecrypto) May 29, 2024

By most "tokenomic" measurements, memecoins should be worth about tree fiddy (if not 0 dollas)

And yet, 3 memecoins are already in the Top 25 ( $DOGE, $SHIB and $PEPE), and that ratio looks likely to grow

So…

3.2.2. Low MC/FDV: The Rising Need for Fair Investment

With many newly listed cryptocurrencies experiencing declines after being listed on major centralized exchanges, the discussion around low MC/FDV tokens has regained prominence in the crypto industry.

- MC (Market Capitalization): The value calculated by multiplying the current token price by the current circulating supply.

- FDV (Fully Diluted Valuation): The value calculated by multiplying the current token price by the total supply of the token.

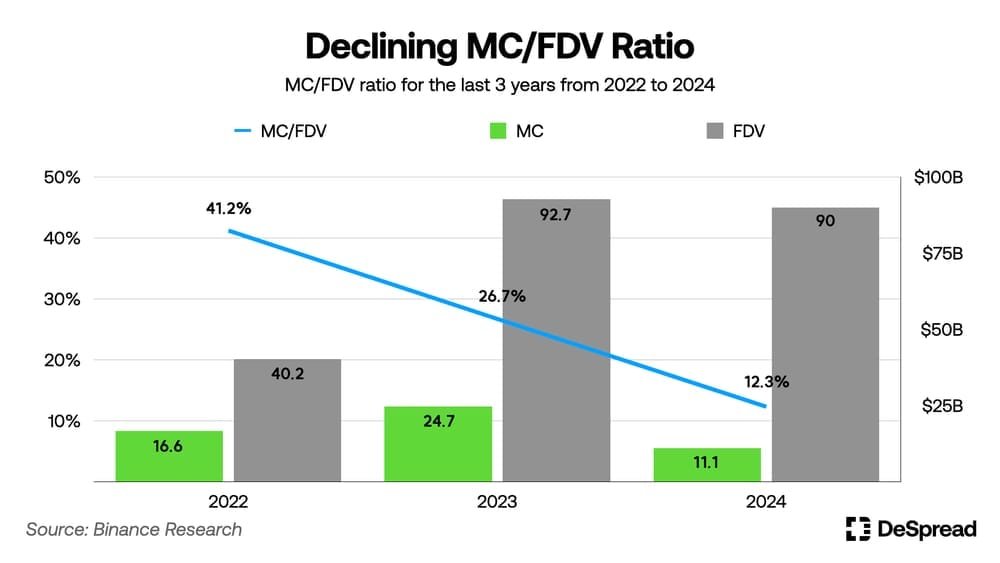

Retail investors are increasingly concerned that investing in tokens with low MC/FDV ratios may render them mere exit liquidity for insiders, including VCs and project teams. According to Binance Research, the size of the private market, accessible only to accredited investors like VCs, is expanding. Consequently, VCs' investment volumes are also growing. To maximize returns, these insiders often assign high valuations to projects and restrict initial circulating supply, leading to tokens launching at high prices.

As observed in the graph, the MC/FDV ratio has been decreasing over the past three years, with newly launched tokens in 2024 having an initial circulating supply ranging from 6% to 18%. According to the token distribution data analysis platform TokenUnlock, an estimated $15.5 billion worth of tokens will be unlocked from 2024 to 2030. If corresponding buying pressure does not materialize, this could exert downward pressure on token prices.

Memecoins stand in stark contrast to tokens with a low MC/FDV ratio. Most memecoins are launched without token lockup, resulting in their MC and FDV being identical. This leads retail investors, disillusioned by inflated token prices due to aggressive valuations by insiders, price drops following token unlocks, and low circulation, to turn their attention to memecoins. These coins present no risk of token unlocks and no presence of venture capitalists, representing a natural shift towards a fairer investment asset.

The high returns on memecoins also explain why retail investors flock to them. In the graph provided, the X-axis represents the percentage of total supply that is locked up, while the Y-axis shows the token's returns over the past three months (February to May 2024). Additionally, the legend indicates the age of the token, with darker colors representing older tokens. The graph, which includes the top 200 tokens by market cap, shows that memecoins without lockup periods, such as $BOME, $PEPE, and $WIF, have shown overwhelming returns. In contrast, recently launched tokens with high lockup rates, such as $MANTA, $W, and $DYM, have shown poor returns.

3.2.3. Skepticism Surrounding Governance Tokens: Memecoins in Suits

Aside from Ethereum, the utility of most altcoins today is mainly governance, which allows token holders to vote on the project's roadmap. However, a significant portion of these tokens is concentrated among VCs, the team, insiders, and a few whales, making it difficult for most retail investors to exert meaningful governance influence. Moreover, many projects launch tokens without additional utilities, such as revenue sharing, to avoid SEC scrutiny and regulatory risks, making it difficult to expect further utilities from these tokens.

As a result, if investors cannot effectively exercise governance influence, governance tokens are essentially no different from memecoins. This has led to the opinion that governance tokens are just "memecoins in suits," adorned with the pretense of a roadmap, utility, and governance. This sentiment, coupled with the aforementioned low MC/FDV issue, has fueled skepticism towards tokens dominated by VCs and driven the rise of memecoins as fairer investment assets with higher potential for price appreciation.

3.2.4. Financial Nihilism: The Gateway to High-Risk Investments

Financial nihilism is the belief that legal currency, investment assets, and even the entire financial system lack intrinsic value. This mindset tends to gain support during times of economic instability, such as rising employment uncertainty and inflation. In South Korea, financial nihilism is emerging among the younger generation (20s and 30s), who believe that wages alone cannot afford basic living expenses amidst rising prices and real estate costs.

As financial nihilism deepens, individuals, excluding a few capitalists, show a preference for riskier assets like stocks and cryptocurrencies over traditional, stable investments like savings and bonds. Initially, high-risk assets like Bitcoin and Ethereum were the main investment destinations. However, as the cryptocurrency market grows and it becomes increasingly difficult to expect the same massive returns as before, investors driven by financial nihilism are seeking even more volatile assets, moving from Bitcoin to altcoins, and now from altcoins to memecoins.

4. Potential of Memecoins

4.1. Building a Platform Independent Fan Culture

The success of Iggy Azalea's $MOTHER demonstrates the potential of memecoins as a medium for creating fan culture without platform constraints. $MOTHER, a memecoin created by the renowned rapper and model Iggy Azalea, emerged following the significant attention garnered by Caitlyn Jenner's $JENNER, the first celebrity-related token in the latest memecoin craze.

Unlike $JENNER, which failed to maintain interest beyond its initial launch, Iggy Azalea has effectively used memes on Twitter to actively engage with $MOTHER holders. She has opened a Telegram chat room for $MOTHER holders and even created a website where $MOTHER can be used to purchase T-shirts, showing a proactive approach to community activation.

The success of Iggy Azalea's $MOTHER highlights the acceleration of the "personal platform" trend, where celebrities monetize their brand and social presence without relying on specific platforms. This phenomenon is not limited to celebrities; it can extend to specific campaigns, social ideologies, and movements. Issuers can release memecoins representing their brand, and communities of supporters or those predicting significant interest in these tokens can form unique ecosystems.

4.2. Anticipation of Institutional Inflow

4.2.1. Launch of Memecoin Funds

The growing interest from financial institutions in memecoins is also notable. On April 22, VanEck, a leading asset management company, launched a memecoin index fund (MEMECOIN) that tracks the prices of six popular memecoins, including $DOGE, $PEPE, and $WIF.

While it is unlikely that VanEck’s memecoin index fund will attract institutional inflows comparable to the impact seen with the launch of Bitcoin spot ETFs, due to its limitations in accessibility and trading volume, the mere fact that memecoins—assets that have grown solely on the strength of their communities—have garnered institutional interest and led to the creation of actual financial products is significant. This development could spark increased interest in memecoins from other institutions and individual investors.

Furthermore, cryptocurrency-based fund companies are showing a keen interest in incorporating memecoins into their portfolios. For example, California-based cryptocurrency fund company Stratos launched a $WIF liquidity fund last December. At that time, $WIF was priced at $0.01, and the fund achieved a 137% return in the first quarter of 2024. Additionally, Bloomberg reported that European hedge fund Brevan Howard also invested in $WIF.

These movements indicate that financial institutions recognize the potential of memecoins. As memecoins begin to be included in institutional investors’ portfolios, the perception and valuation of memecoins are evolving, signifying their transition from mere community-driven assets to recognized investment opportunities.

4.2.2. Expanding Expectations Towards Memecoin ETF

In May, amidst peak anticipation for the approval of an Ethereum spot ETF, the market was abuzz with discussions about which cryptocurrency might be next in line after Bitcoin and Ethereum. While OG projects with high market caps like Solana and Ripple were often mentioned as potential candidates, there was a notable surge in discussions around a Dogecoin spot ETF, particularly among some influencers.

Yu Hu, the founder of Kaito, discussed on his Twitter six reasons why Dogecoin could be the third cryptocurrency to have a spot ETF, highlighting the following points:

- High decentralization

- Listing of $DOGE futures on Coinbase Derivatives Exchange, a CFTC-regulated exchange

- The untapped mindshare of $DOGE

- Significant recovery of mindshare and sentiment since the memecoin craze in March

- $DOGE being the most familiar representative memecoin to new retail investors

- Ample opportunities for profit realization

However, considering the SEC's rationale for approving a Bitcoin spot ETF in January, it appears that a Dogecoin spot ETF may be challenging to realize due to the insufficient size and trading data of its spot and futures markets. Even if it were to be listed, it is unlikely to happen within the next one to two years (for more details, refer to the author's Twitter). Nevertheless, the fact that Dogecoin is being considered alongside long-established altcoins like Solana and Ripple for a spot ETF underscores the changing perception and rising status of memecoins among investors.

5. Conclusion

While the roles and applications of memecoins are diversifying and their ecosystems are becoming richer, the trend is not without its downsides. The ease of creating and trading memecoins has led to frequent investor harm such as pump and dump schemes, insider trading, and honeypots.

Additionally, the market's heightened demand for more provocative and straightforward memecoins has resulted in the proliferation of controversial memecoins featuring themes of racism, disasters, and excessive mockery. Eddy Lazzarin, CTO of prominent cryptocurrency VC firm a16z, expressed concerns about the current memecoin frenzy, stating, "At best, it looks like a risky casino. Or a series of false promises masking a casino. This deeply affects adoption, regulation/laws, and builder behavior."

This memecoin surge has highlighted both the positive and negative aspects of memecoins. However, it is crucial to recognize that memecoins have brought value to previously hard-to-quantify elements like public sentiment and trending narratives. While there are many descriptors for the value of memecoins—such as the fairest tokens, challenges to insiders, and reflections of community culture—their most intrinsic value, as directly experienced by market participants, lies in quantifying investor interest into token prices. The activity level of a memecoin’s community, the engagement it garners from market participants, and the relevance of the meme it represents are intangible assets currently reflected in the token’s value in real time. This unique process of value manifestation, where intangible assets are immediately and transparently translated into a token's market value, is something only the cryptocurrency market can showcase.

<References>

- Li’s Newsletter, Memecoins as the new GTM strategy, 2024

- Delphi Digital, Attention Is All You Need, 2024

- Yash Agarwal, Memecoins > Governance Tokens, 2024

- Binance Research, Low Float & High FDV: How Did We Get Here?, 2024

- Bloomberg, Hedge Funds Are Succumbing to Mind-Boggling Returns of Memecoins, 2024

- 박주혁, 우리는 왜 밈코인을 살까: 밈코인 슈퍼사이클 분석 | 캐쥬얼 크립토 팟캐스트 54화, 2024

- Wikipedia, Attention Economy