Disclaimer: The author of this report did not use undisclosed material information to purchase or sell related tokens while researching or drafting this report. The content of each report reflects the opinions of each author of the report and is provided for informational purposes only, and is not intended to recommend buying or selling tokens or using the protocol. Nothing contained in this report constitutes investment advice and should not be construed as investment advice.

1. Entering

Starting with the explosive popularity of $DOGE in 2021, the memecoin trend has sprouted in the cryptocurrency industry. Meme coin refers to a compound word of meme and coin, which mainly refers to content such as photos, characters, and videos that are popular on the Internet.

The popularity gained as a simple character rather than as a native token for a specific product that developed a solution based on technology did not last for a long time, and as the market entered a general decline, it recorded an even steeper price drop and the enthusiasm was lost. It seemed to be fading away.

However, at the end of February 2024, $DOGE, $SHIB, $PEPE, $FLOKI Following the surge in prices of memecoins in the first year, an explosive memecoin craze was observed centered around Solana and Base after the Dencoon upgrade was applied on March 13th. And what is noteworthy here is that the current meme coin trend is moving beyond its existing role and status of providing a high-risk, high-reward opportunity and is emerging as a distinct mainstream sector and phenomenon in the blockchain industry.

In this article, I would like to shed light on the evolution of the meme coin sector, which I was able to discover through this meme coin craze, and the potential of meme coins hidden there.

2. Expansion of Memecoin role, from retail to projects

It is necessary to break away from the existing image of being treated as a simple speculative product and look at meme coins from various angles, as they perform various roles such as a marketing tool, expression of individual opinion, and expression of community belonging. Therefore, we will largely divide the evolution of the role and status of MEMCOIN into the retail aspect, which is individual investors, and the project aspect of creating products, and look at the strategies of each market participant using MEMCOIN.

2.1. retail

2.1.1. High volatility stimulates speculation

Memecoin, which shows very high price volatility even in the highly volatile cryptocurrency market compared to the traditional investment market, has gained explosive popularity among retail investors who prefer risk, as it is seen as an opportunity. Whenever a meme coin with a price increase ranging from tens of times to tens of thousands of times appears, investors who have made huge profits with the meme coin post the returns on social media such as Twitter, leading to FOMO in many people. , which soon became the driving force behind the influx of new investors into the memecoin market and the emergence of numerous memecoin projects dreaming of becoming second and third success stories.

In particular, in this memecoin craze centered on Solana and Base, we were able to witness very active trading activities by retail investors, to the extent that the memecoin narrative or specific token that attracted attention changed on an hourly or minutely basis. Based on this high volatility and unpredictable price ceiling, Memecoin has become the most intuitive and interesting game that so-called 'Degen' who are into blockchain and cryptocurrency can enjoy.

Furthermore, meme coins are popular in DEXs that respond sensitively to trends, such as Hyperliquid, as well as several CEXs, such as Gate.io , Kucoin, and even Binance. With continued listing, the memecoin trading environment for retail investors is steadily improving.

However, as meme coins aimed at attracting people's one-dimensional attention are mushrooming and competition is intensifying, the market continues to search for more provocative and intuitive meme coins, which can lead to controversies such as racism, disaster, and excessive caricature. There have also been situations where meme coins recorded a momentary high price increase rate. In particular, on Solana, the network where meme coins were most actively traded, meme coins with racial discrimination were popular for a while.

Seeing the situation in which meme coins featuring morally incorrect memes are gaining popularity, a position has emerged that the situation and, by extension, meme coins are hindering the healthy development of the blockchain industry. In particular, researcher Polynya, who has been contributing to the Ethereum layer and infrastructure for a long time, declared the end of his work, referring to the current memecoin craze as ' cryptocurrency's broken moral compass '.

2.1.2. The most powerful means of uniting a community

Because meme coins are based from their inception on specific people, characters, or phenomena, there are clear images and means to instill a sense of belonging in the community. And since these images are subject to a wide variety of variations, such as dogs, cats, and hats, the production of goods using these images and secondary creation by community members are carried out very freely. In addition, Meme Coin's representative image, which is simple and easy to understand, lowers the barrier for holders to enter the community and can be applied in a variety of ways, leading to voluntary and active participation from community members.

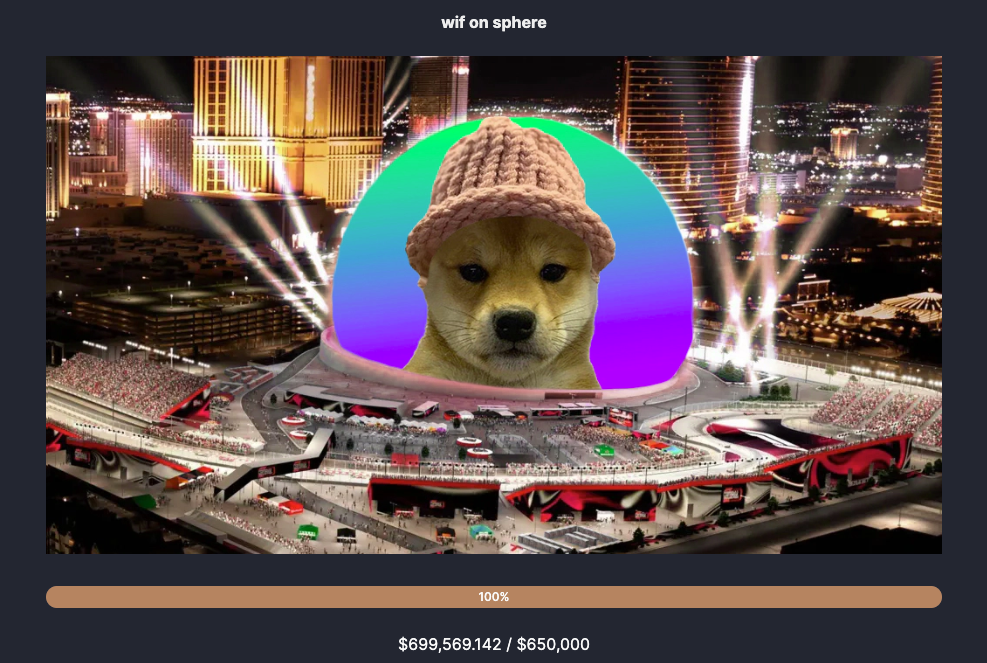

As a representative example, the meme coin $WIF, whose logo is 'DogWifHat', differentiates itself from other meme coins by putting a furry hat on the most common symbol, a dog, and has created various secondary memes using the hat. created and expanded the community. In addition, on March 10th, $WIF The community is located at the Sphere in Las Vegas, a dome performance hall that can accommodate 18,000 audiences $WIF We proposed posting a logo and succeeded in raising the target amount of $650,000 in just 4 days. The case of $WIF can be seen as a major turning point that proves that a meme coin-based community can go beyond creating and uniquely creating new memes on SNS and strengthen community solidarity offline.

2.2. project

The changes in the role and status of Memcoin in retail as seen above can be seen as expanding its scale and influence without significantly departing from what it has had since the beginning when Memcoin began to attract attention. However, in terms of how projects utilize memecoins, numerous cases of memecoin use that were not found before were discovered, and this is a means of contributing to the growth of the project in various ways, breaking away from the perception that memecoins are simply a highly speculative opportunity. It became the main basis for considering that it had made a leap forward.

2.2.1. Opening a new horizon in crypto marketing

According to ‘ Memecoins as the new GTM strategy’ written by Li Jin, co-founder of famous cryptocurrency VC Variant Fund, the emergence of Memecoins was due to the Web3 marketing process. brought about a change in the successive relationship.

The traditional GTM (Go-to-Market) strategy first creates a product and then builds a community to use the product through marketing. However, after the emergence of meme coins, the GTM strategy changed to preemptively build a community based on meme coins and then develop products using the meme coins.

The above method is similar to the strategy used when NFTs gained high popularity in 2021. However, Memecoin has higher liquidity and accessibility compared to NFTs, and has the distinction of being able to more easily grant utilities such as adoption of payment methods.

As a representative project that adopted the GTM strategy $BONK Bonkbot, a Telegram trading bot launched by the team, $SHIB Examples include Shibarium, the Ethereum layer 2 released by the team, and $DEGEN, the representative meme coin of social DApp Farcaster. And each team designed the project to help increase the price of the memecoin through buyback, incineration, gas token adoption, etc.

- $BONK : Part of the trading fee $BONK Used for buyback and incineration

- $SHIB : Ethereum Layer 2 Sybarium Development

- $DEGEN : Payment of Farcaster tips, adoption as a payment method, and construction of layer 3 using $DEGEN as a gas fee.

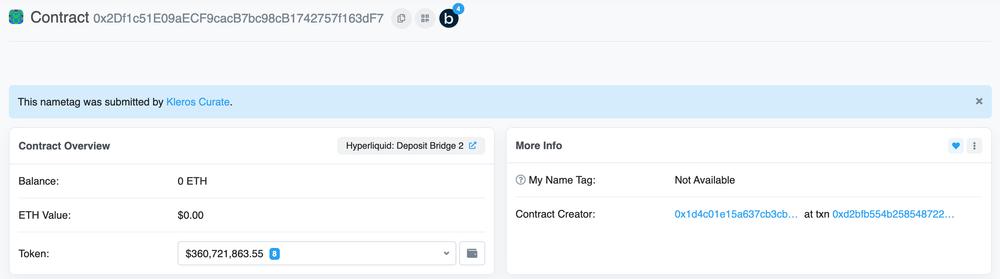

In particular, Hyperliquid, a perpetual futures decentralized exchange, achieved success in expanding scale and securing users by first launching the meme coin $PURR before launching the native token. $PURR, which has a cat as its logo, is the first token supported for spot trading based on Hyperliquid's fungible token standard HIP-1. Last April 16th, $PURR Since trading began, more than $360 million in funds has been collected in Hyperliquid Bridge, showing tremendous enthusiasm in the market, with deposit delays occurring. Afterwards, when Hyper Liquid distributes new tokens using HIP-1, a certain portion of the token is distributed to holders of other tokens based on HIP-1, matching the growth of the project with Meme Coin. showed.

MEMCOIN has greater autonomy than native tokens in tokenomics design, including distribution planning, governance, and utility. Therefore, I expect that after $PURR's success story, there will be more cases where the project first launches the memecoin, expands its scale, gathers sufficient market interest, then improves the project and launches native tokens.

2.2.2. High profitability of MEMCOIN specialized projects

The success of Pump.Fun, a memecoin creation platform, confirmed that memecoins contribute to project profitability. Pump.Fun is a platform that allows anyone to create tokens on the Solana network at a low cost of 0.02 SOL, and contributed significantly to the creation of approximately 455,000 new tokens on Solana in May.

Pump.Fun provides a simple and free meme coin creation service, and as of June 5, approximately 850,000 tokens have been created. The platform charges users a fee of 1% of the transaction amount, and the cumulative revenue earned to date exceeds 209,000 SOL, reaching approximately $36 million.

The performance of memecoin-related protocols, including Pump.Fun, is notable not only based on net revenue but also based on total sales (commissions). The graph above shows the top 5 fees for Solana DeFi protocols based on fees over the past month, of which Pump.Fun, a memecoin creation platform, and Trojan, a Solana trading bot, rank 2nd and 3rd, respectively. . In particular, Pump.Fun's performance is at a high level compared to other chains' representative DeFi protocols, and has generated more sales and profits than Ethena, an Ethereum-based synthetic dollar (USDe) issuance protocol that has recently been attracting attention.

3. Memecoin being chosen by the market

3.1. Memecoin craze in numbers

The fact that the current memecoin craze is stronger than ever can be confirmed through several indicators indicating the interest of market participants.

According to Coinglass, a cryptocurrency derivatives data analysis platform, four of the top 10 cryptocurrencies were MEMCOINs based on open interest (OI) volume as of May 28, 2024. Open interest refers to the number of derivatives contracts that have not yet been traded against. Therefore, an increase in open interest means an increase in interest from market participants and potential inflow of funds, which is mainly interpreted as a positive signal that market activity will increase.

In addition, $BTC (1st), $ETH (2nd), and $SOL (3rd) are ranked higher than MEMCOIN, respectively, including the world's largest financial derivatives exchange, CME (excluding $SOL). While 14, 14, and 11 exchanges handle derivatives, the four memecoins mentioned above, $PEPE (4th), $DOGE (5th), $BONK (6th), and $WIF ( In the case of 8th place, it is handled by only 4, 11, 5, and 10 exchanges, respectively. This shows the high market interest and capital inflow toward meme coins even in a situation where accessibility is relatively poor.

Beyond just investment-related data, MEMCOIN continues to be a hot topic among general retail investors. According to Kaito, an AI-based cryptocurrency analysis platform, the memecoin sector has beenconsistently ranked high since March of this year based on Mindshare, an indicator that quantifies the influence of specific tokens on SNS. Except for January and May, when the Bitcoin spot ETF and Ethereum spot ETF absorbed most of the market's attention, the memecoin sector ranked 2nd and 3rd along with AI, including most of DeFi, Layer 2, and GameFi. It was a higher performance than the existing sector.

The explosive popularity of meme coins can be seen more directly in the returns by sector. According to Delphi Digital researcher Ceteris , MEMCOIN showed an overwhelming difference compared to other sectors in the rate of return by cryptocurrency sector from January 1 to May 14, 2024, at 525.5%. Considering that previously existing sectors such as Layer 1, Ethereum DeFi, and Modular show low or negative returns, the enormous returns of the Mimcoin sector take into account the fact that Mimcoin's market cap is small compared to other cryptocurrencies. Even so, it is worth paying attention to.

3.2. Changes in the status of MEMCOIN

Above, you can see the inflow of capital towards Mimcoin, the high amount of mentions on social media, and the overwhelming rate of return that Mimcoin actually recorded. In this chapter, we will discuss the background of how Memcoin was able to receive such market attention and the recent changes in market trends and public opinion related to the status of Memcoin.

3.2.1. Attention Economy: Attention Makes Money

The attention economy, commonly translated as attention economy or attention economy, is an economic approach that views human attention as a scarce resource. The concept was first presented by economist Herbert Simon in 1971, and was theorized in earnest in Professor Thomas H. Davenport's book 'The Attention Economy' in 2006.

The attention economy has been an approach mainly used in the social media industry such as Instagram, Netflix, and Facebook, but in Delphi Digital's article ' Attention Is All You Need ' published on May 13, it was identified as the driving force behind the meme coin craze. By highlighting the attention economy, the attention economy has also received attention in the cryptocurrency industry. Michael Rinko, the author of the article, argued that Memcoin's strong intuitiveness compared to other tokens was persuasive to market participants as follows.

“Memcoin takes the ‘attention is value’ approach to the extreme. MEMCOIN provides the purest way to purchase tokens based on the interest they will generate in the future, and investors only need to consider interest without having to worry about the project's roadmap. Memecoins transparently show the absence of intrinsic value, which paradoxically provides freshness to many people (Memecoins take the “attention is value” framework to its logical extreme. They offer the purest way to buy a token because of the future attention you think it will command. You don't have to worry about product roadmaps or technical milestones, just attention. Memecoins are transparent about their lack of intrinsic value, which, funny enough, many people actually find refreshing.”

Considering the methods previously used to evaluate the appropriate value of a specific token, the value of all memecoins where the project does not generate revenue and do not provide a portion of the revenue to token holders should converge to 0. However, currently, three of the top 25 cryptocurrencies by market capitalization are Memecoins ($DOGE, $SHIB, $PEPE), and enormous capital and interest are flowing into Memecoins. The attention economy is considered one of the approaches to explaining this ‘uncommon sense’ phenomenon, and the market is now paying more attention to the ‘interest’ that tokens will generate rather than the ‘profit’ that tokens will generate.

⚠️ Attentionomics: A retardio's framework for valuing memecoins ⚠️

— redphone ☎️🧙🏻♂️ (@redphonecrypto) May 29, 2024

By most "tokenomic" measurements, memecoins should be worth about tree fiddy (if not 0 dollas)

And yet, 3 memecoins are already in the Top 25 ( $DOGE , $SHIB and $PEPE ), and that ratio looks likely to grow

So…

3.2.2. Low MC/FDV: The need for fair investment emerges

Recently, as most cryptocurrencies listed on major centralized exchanges have experienced a downward trend since listing, the discussion on so-called low MC/FDV tokens, which have received high valuations but have low initial circulation, is receiving attention again in the cryptocurrency industry.

MC (Market Capitalization) : Market capitalization, current circulation volume multiplied by current token price

FDV (Fully Diluted Valuation) : Fully diluted value, the total supply multiplied by the current token price

Retail investors are concerned that by investing in tokens with low MC/FDV, they may become a liquidity outlet for insiders, including VCs and teams. According to Binance Research, the size of the private market, in which only qualified investors, including VCs, can participate, is growing, and along with it, the size of VCs' investments is also increasing. Accordingly, in order to realize profits, internal investors naturally set a high valuation for the project and limited the initial circulation, leading to the release of tokens at a high price.

As can be seen in the graph above, MC/FDV has been decreasing over the past three years, and the initial circulation volume of newly released tokens this year ranges from as little as 6% to as much as 18% . According to TokenUnlock, a token distribution data analysis platform, it is estimated that approximately $15.5 billion worth of tokens will be unlocked from 2024 to 2030, and if corresponding purchases are not made in the future, this may act as downward pressure on the price.

MEMCOIN stands in complete opposition to the tokens with low MC/FDV mentioned above. Since most meme coins are released without token lockup, MC and FDV are identical. Therefore, retail investors, who were skeptical about the aggressive valuation of internal investors, the decline in token prices in the public market due to token unlocking, and the inflated token price due to low circulation, are interested in MEMCOIN, which has no VC and no risk of token unlocking. The phenomenon of turning over can be seen as a natural way to find fair investment assets.

The reason why retail investors are flocking to Memecoin was also found in the rate of return based on circulation volume. In the graph above, the Additionally, the age legend indicates the number of months that have passed since the token was released, meaning the older the token is. The top 200 tokens based on current market capitalization are recorded in the graph above: $BOME, $PEPE, $WIF Memecoins with no lock-up volume are showing overwhelming returns, including $MANTA, $W, $DYM It can be seen that recently released tokens have low returns due to high lock-up ratios.

3.2.3. Skepticism Surrounding Governance Tokens: Memecoin in a Suit

Outside of Ethereum, the utility of today's altcoins is mostly limited to governance, or the ability to vote on a project's roadmap by holding tokens. However, a significant proportion of the tokens are concentrated in insiders, including VCs and teams, and a small number of whales, making it difficult for most general investors to exert meaningful governance influence even if they hold the tokens. In addition, it is difficult to expect additional utility due to regulatory risk, where many projects launch tokens without attaching utilities such as project profit sharing in addition to governance participation in order to avoid securities issues from the SEC.

Accordingly, if governance influence, which is the only utility, cannot be practically exercised, there is virtually no difference between governance tokens and memecoins, and governance tokens are memecoins with only the pretense of roadmap, utility, governance, etc., meaning 'memecoins in suits'. ' An opinion even emerged. This, combined with the ‘low MC/FDV’ mentioned above, spread skepticism about tokens led by VCs, and memcoin emerged as an investment asset with a fair and high price increase potential.

3.2.4. Financial Nihilism: Becoming a Gateway to High-Risk Investments

Financial Nihilism is a way of thinking in which individuals believe that fiat currency, investment assets, and even the financial system as a whole are devoid of intrinsic value. Financial nihilism tends to be supported when economic instability, such as job instability and rising prices, increases, and even in Korea, as inflation and real estate prices continue to rise among the young generation in their 20s and 30s, there is an opinion that earned income alone cannot solve food, clothing, and shelter. As a result, financial nihilism is emerging.

As financial nihilism deepens, individuals, except for a small number of capitalists, tend to prefer relatively high-risk assets such as stocks or cryptocurrencies over stable traditional investment assets such as deposits, savings, and bonds. Previously, Bitcoin and Ethereum were major investments as high-risk assets, but as the size of the cryptocurrency market grows and it becomes more difficult to expect the same huge returns as before, investors suffering from financial nihilism look for more volatile assets. We are moving from Bitcoin to altcoins, and now from altcoins to memecoins.

4. Potential of Memecoin

4.1. Forming a fan culture that is not restricted by platforms

The success of Iggy Azalea's $MOTHER demonstrated the potential of meme coins as a medium for freely forming fan culture without being restricted by the platform. $MOTHER is a meme coin created by famous rapper and model Iggy Azalea, and was launched after Caitlyn Jenner's $JENNER, the first celebrity-related token to appear during the meme coin craze, attracted great attention.

Unlike $JENNER, which did not attract much attention other than immediately after its release, Iggy Azalea appropriately utilizes memes on Twitter and $MOTHER Actively interacted with holders, $MOTHER We have opened a Telegram chat room for holders and are actively working to revitalize the community by creating a website where you can buy t-shirts using $MOTHER.

The $MOTHER case has accelerated the ‘platformization of the individual’, where celebrities do not need to rely on a specific platform to monetize their brand and social attention. And this is not limited to celebrities but can be expanded to specific campaigns, social ideologies, and movements. An issuer can envision a unique ecosystem being created by launching a meme coin representing the brand and establishing a community of participants who support it or predict that the token will receive a lot of attention.

4.2. Expectations for influx of institutions

4.2.1. Memecoin fund launched

In addition, interest from financial institutions in memecoins is increasing. VanEck, a leading asset management company, launched the Memecoin Index Fund (MEMECOIN) on April 22nd, which tracks the prices of six famous memecoins, including $DOGE, $PEPE, and $WIF.

It is true that it is difficult to expect the same institutional inflow influence from VanEck's Memcoin Index Fund as when listing the Bitcoin spot ETF because there are shortcomings in terms of accessibility and transaction volume. However, it is worth noting that MEMCOIN, which grew based solely on the community without any utility, received the attention of institutions and was even launched as an actual product, and this case served as an opportunity for other institutions and more general investors to become interested in MEMCOIN. It can act as

Additionally, cryptocurrency-based fund companies are more actively trying to incorporate memecoins into their portfolios. Stratos, a California-based cryptocurrency fund company, last December $WIF Liquid fund launched. At the time, the price of $WIF was $0.01, and Stratos recorded a return of 137% in the first quarter of 2024 through the fund. Additionally, according to Bloomberg , in addition to Stratos, European hedge fund Brevan Howard also revealed that it invested in $WIF.

This move shows that financial institutions recognize the potential of memecoins. As MEMCOIN begins to move beyond a simple community-oriented asset and become part of the portfolios of institutional investors, the perception and valuation of MEMCOIN is changing.

4.2.2. Expectations extend to Memecoin ETF

Last May, when expectations for the approval of the Ethereum spot ETF were at their peak, the market was heated with discussions about cryptocurrency, which would be the third spot ETF to be launched after Ethereum. While OG projects with high market capitalization, such as Solana and Ripple, were mentioned as candidates, the Dogecoin spot ETF was actively mentioned by several influencers.

In particular, Kaito founder Yu hu discussed onTwitter why Dogecoin could become the third cryptocurrency spot ETF underlying asset and six reasons for a positive evaluation of $DOGE.

- High decentralization with token distribution not concentrated in a few hands

- Coinbase Derivatives Exchange, one of the exchanges regulated by the CFTC $DOGE gift product listing

- Mindshare in $DOGE has not yet reached its peak

- Much of the mindshare and sentiment recovered during the memecoin craze in March

- The representative meme coin that new retail investors are most familiar with.

- Ample profit opportunities

However, considering the basis on which the SEC approved the Bitcoin spot ETF last January, it appears that the Dogecoin spot ETF will be difficult to realize due to the size of the forward spot market and lack of transaction data. Even if it is listed, it is highly likely that it will not happen within the next one or two years (for a detailed explanation on this, please refer to the author's Twitter ). Nevertheless, I think the fact that Dogecoin is mentioned as the third spot ETF along with representative altcoins that have been in place for a long time, such as Solana and Ripple, clearly shows that the status of memecoin among investors is changing.

5. Conclusion

Although the role and use of meme coins are diversifying and the ecosystem is becoming richer, it is not always moving in a positive direction. As an environment has been established where anyone can easily create and trade memecoins, cases of investor damage such as pump and dump, insider trading, and honeypots are occurring frequently.

In addition, as the market's search for more provocative and intuitive meme coins heated up, meme coins featuring memes that could cause controversy, such as racism, disaster, and excessive caricature, were created in droves. Eddy Lazzarin, CTO of a16z, a famous cryptocurrency VC, said of the current memecoin craze, “Memcoin makes cryptocurrencies perceived like casinos or products that guarantee false promises, which will lead to the introduction of future Web 3, “It affects both regulations and the behavior of builders (At best, it looks like a risky casino. Or a series of false promises masking a casino. This deeply affects adoption, regulation/laws, and builder behavior),” he said. expressed concern.

In this memecoin craze, both positive and negative aspects of memecoin were confirmed. However, it is worth noting that MEMCOIN places value on factors that have been difficult to quantify, such as public opinion of market participants and narratives that attract attention. There are many modifiers that express the value of MEMCOIN, such as the fairest token, challenge to insiders, and reflection of community culture, but the intrinsic value of MEMCOIN that market participants can feel most directly is the 'interest' of investors such as public opinion and mind share. It exists in quantification through the price of the token. The current situation in the cryptocurrency market is such that intangible assets such as how active the community a particular meme coin represents, how well it is received by market participants, and how hot the topic the meme it represents are reflected in the value of the token in real time. It is a new value creation process that only can be shown, and it can be said to be a positive change that appears in the development of the Web 3 industry.

<Reference materials>

- Li's Newsletter, Memecoins as the new GTM strategy , 2024

- Delphi Digital, Attention Is All You Need , 2024

- Yash Agarwal, Memecoins > Governance Tokens , 2024

- Binance Research, Low Float & High FDV: How Did We Get Here? , 2024

- Bloomberg, Hedge Funds Are Succumbing to Mind-Boggling Returns of Memecoins , 2024

- Joo-Hyuk Park, Why do we buy MEMCOIN: Analysis of MEMCOIN Supercycle | Casual Crypto Podcast Episode 54 , 2024

- Wikipedia, Attention Economy