In a recent report, Juan Leon, senior cryptocurrency research analyst at Bitwise, demonstrated the transformative potential of the intersection of artificial intelligence (AI) and the cryptocurrency industry.

According to Leon, the convergence of these two emerging sectors could have a major impact on the global economy. This convergence can potentially advance a variety of industries and revolutionize our interactions with technology and digital assets.

Synergy between AI and Cryptocurrency: The Next Step in Innovation

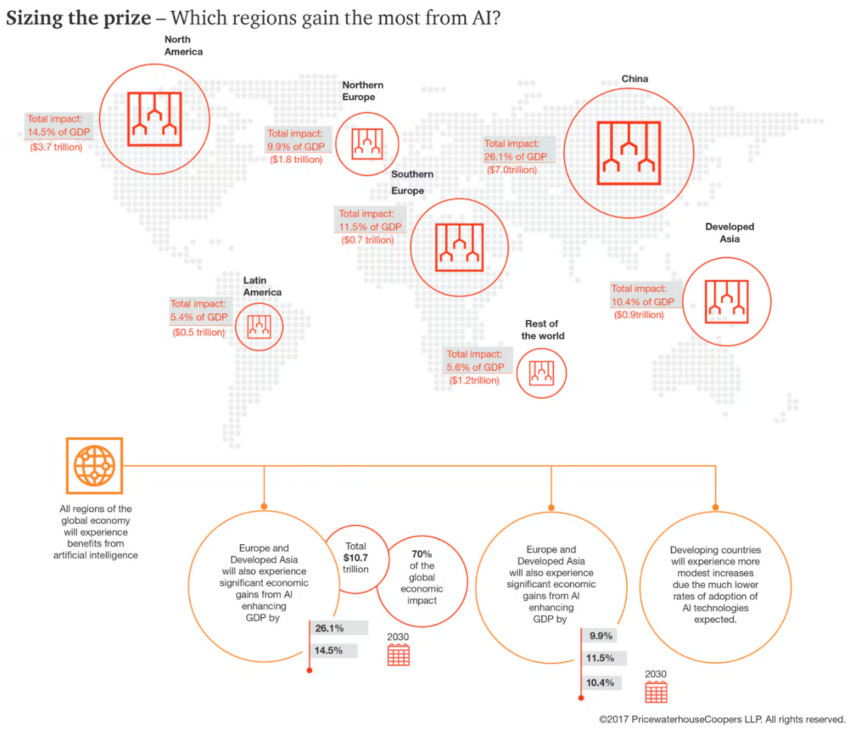

Leon emphasizes that the convergence of AI and cryptocurrency will occur on a much larger scale than currently anticipated. He estimates it could add a total of $20 trillion to global GDP by 2030.

“PwC estimates that AI and cryptocurrencies could add $15.7 trillion and $1.8 trillion, respectively, to the global economy by 2030. That amounts to a total of $17.5 trillion, but I wouldn’t be surprised if the synergies between the two could add up to a combined value of more than $20 trillion,” he said .

Read more: How will artificial intelligence (AI) change cryptocurrency?

One key area of this intersection is Bitcoin mining, and the infrastructure used for mining is becoming increasingly valuable to AI companies. The current AI boom, driven by demand for data centers and powerful chips, has led to a shortage of these resources.

Bitcoin miners with the necessary hardware and cooling systems are filling this gap. As an example, he cited CoreWeave's proposal to acquire Bitcoin miner Core Scientific .

“The same week that Core Scientific announced its largest miner-AI partnership ever, CoreWeave signed a $3.5 billion deal to host CoreWeave’s AI-related services in its data centers for the next 12 years.” he mentioned.

Felix More, Managing Partner at Morewolf, also shared his perspective on the potential of AI adoption in the Bitcoin mining industry. More pointed out that introducing AI could generate additional revenue for Bitcoin mining.

“Smaller Bitcoin miners merging with larger miners can make profits more predictable. However, this results in bottoming out for the Bitcoin mining industry. Adopting AI can create new revenue streams or make existing revenue streams more profitable,” Mohr explained to BeInCrypto.

Leon is also exploring long-term opportunities, such as information verification, at these intersections. Artificial intelligence has created problems such as deepfakes and biased content , but blockchain technology, with its transparency and immutability, can solve these problems.

“Let me give you an example: A startup called Attestiv creates digital ‘fingerprints’ of videos based on metadata. […] […] In theory, we could see a similar way to verify everything from original research to official government communications. This is why many experts are confident that blockchain will play a pivotal role in bringing checks and balances to AI,” he says.

Additionally, Leon believes that the integration of AI and cryptocurrency could revolutionize virtual assistants . By combining AI-based tools with smart contracts and digital currencies, these assistants can perform more complex tasks efficiently, improving productivity.

Read more: Top 9 Artificial Intelligence (AI) Cryptocurrencies in 2024

These expert insights are consistent with a broader trend of cryptocurrency companies entering the artificial intelligence space. Last March, BeInCrypto reported that stablecoin issuer Tether announced a strategic expansion into AI technology, focusing on developing open source multimodal AI models. Tether will also integrate AI solutions into its market-driven products, transforming how cryptocurrency and AI solve real-world problems.

Trusted

The information contained on the BeInCrypto website is published in good faith and for informational purposes only. Users are solely responsible for any consequences arising from their use of information on the website.

In addition, some content is an AI-translated version of the English version of BeInCrypto articles.