Author: @malloyberac 3

Mentor: @CryptoScott_ETH

Bitcoin laid the foundation for the value of cryptocurrencies because it cannot be issued additionally. Ethereum triggered an ICO frenzy through smart contracts. Inscription and Memecoin attracted massive funds because of their fair distribution. The change of new technologies has made the audience scope of crypto applications continue to expand; and the differences in emerging token issuance mechanisms further reflect the changes in the audience's investment value concept.

Different from old meme coins such as $DOGE $SHIB $FLOKI and other old meme coins trying to combine with practical applications, since the beginning of this year the Memecoin market has presented a new business format under the leadership of $BOME |_20241111120234_|. From issuance to trading, around the upper, middle and lower reaches of the Memecoin ecosystem, many innovative applications worthy of attention have emerged on the track.

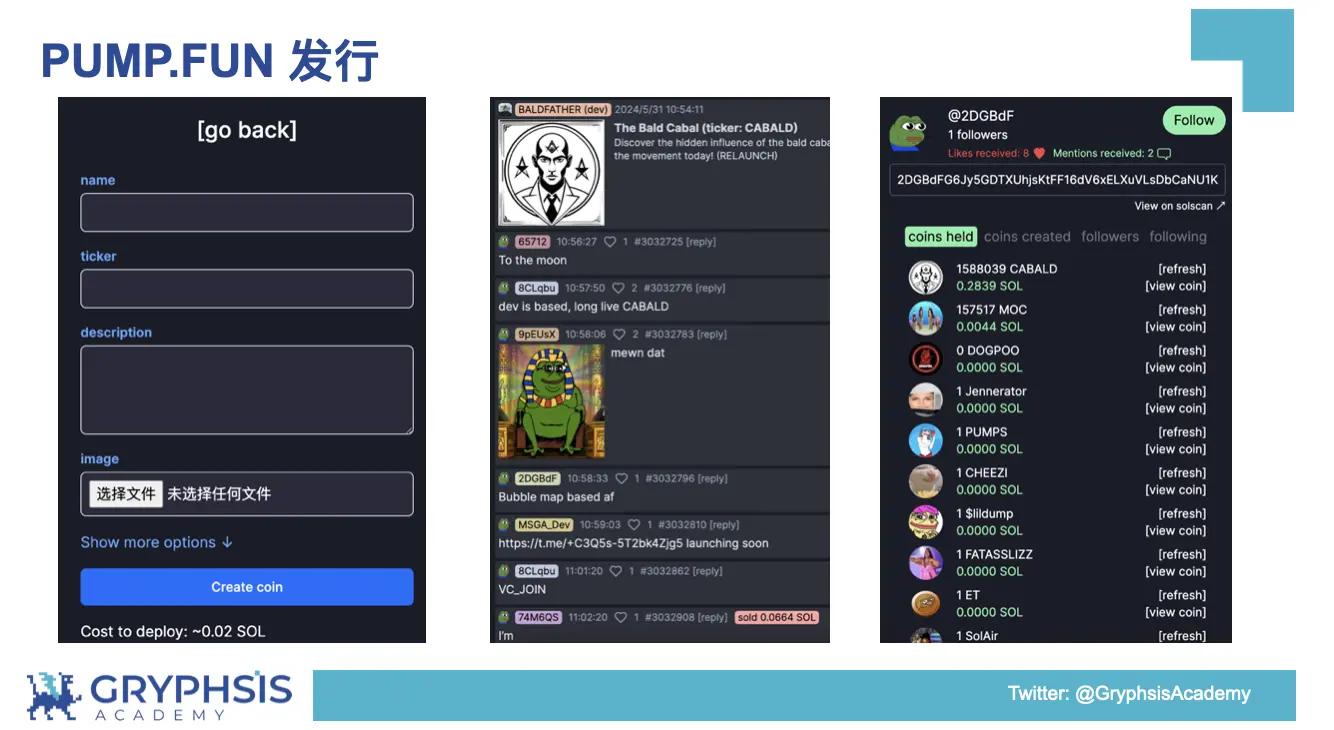

PUMP.FUN is a decentralized Memecoin issuance platform. Users only need to provide ideas, and they can publish their own Memecoin on the platform with one click at a very low cost (0.02 sol); users can also participate in tokens issued by others and witness a Memecoin’s process from scratch to large-scale emergence.

PUMP.FUN, as a phenomenal performance application on the track, has research value and deserves repeated discussion. The PUMP.FUN Dune signboard can explain the new business formats on the track in terms of platform, users, product behavior, activity, growth trends, etc., and is worthy of long-term tracking.

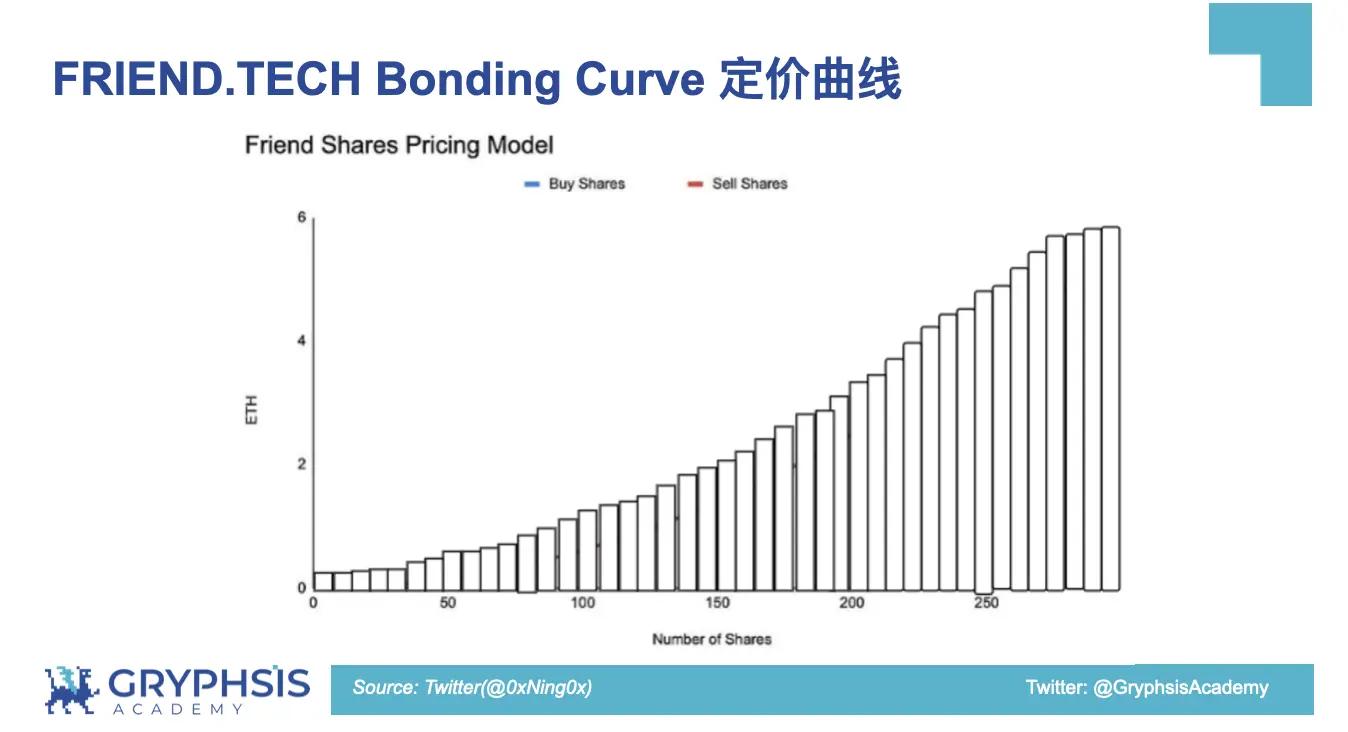

Let’s start with a comparison. In the author’s opinion, PUMP.FUN and PUMP.FUN, which were launched last year, The market performance of FRIEND.TECH is very similar. First, it attracted attention in the on-chain Degen player circle in a small area. After a large-scale exit, the track and platform data showed a spiral upward trend. The two quickly occupied a very high market share as industry pioneers, with real user and protocol revenue increasing day by day. Fud, who is never absent from the encryption world, has almost no impact on the ecological status of the two.

From the perspective of product design, the two platforms are similar but still have certain differences. Both platforms use the PAMM (Primary Automated Market Makers) mechanism for asset issuance to provide convenience to users, but their assets and specific pricing curves are still different. different. Taking PUMP.FUN as an example (the same applies to FRIEND.TECH), PAMM is divided into two mechanisms: Fund-to-Mint and Burn-to-Withdraw. The former can deposit the user's $SOL into the PAMM smart contract reserve pool. The smart contract The reserve pool mints the appropriate amount of Memecoin based on the pricing currently reported by Bonding Curve and sends it to the user; the latter can exit by selling Memecoin to the PAMM smart contract. Different from Memecoin on PUMP.FUN, FRIEND.TECH token has the characteristics of integer Mint and theoretical "infinite issuance" (establishment of social relationships). In addition, the FRIEND.TECH asset is a token representing the user's social account, and PUMP.FUN is the Memecoin issued by the user.

The two projects have very different approaches in entering the market and subsequent play. Behind FRIEND.TECH is the top encryption institution Paradigm. The Pointsfi user incentives adopted by the NFT market Blur and the Ethereum Layer 2 network Blast in its portfolio have also been copied to help FRIEND.TECH carries out user retention; FRIEND.TECH V2 launches airdrop tokens and Club Key gameplay, triggering a new round of market hype; while PUMP.FUN implements the tonality of Memecoin's civilian and fair launch, and the investment and financing background is difficult to check, even if you make daily profits Even after spending hundreds of thousands of dollars, no token plan was released, and the platform functions were expanded in a low-key manner. For more in-depth research on FRIEND.TECH, please refer to previous sharings: Friend Tech — Gryphsis Academy Sharing Session

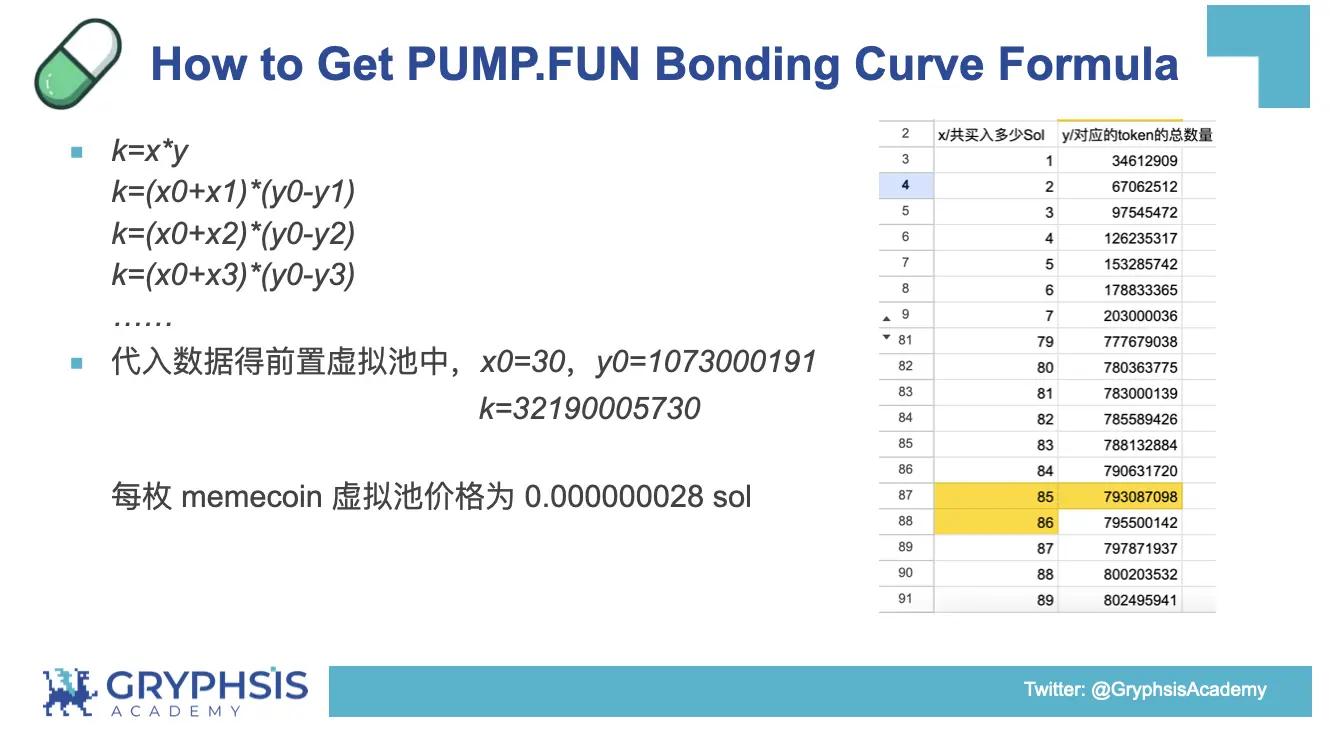

Since the project contract is not open source, the products launched by PUMP.FUN only announced the gameplay and fees, and the official did not mention a word about the mechanism and product details used. During the research process, it is necessary to build a product model and conduct data comparison and verification. The specific research on PUMP.FUN Bonding Curve is as follows:

(1) Product model construction

Compared with other track tokens, Memecoin focuses on the design of community consensus and group trading sentiment. Generally, the total number of tokens is large and fully circulated, which can match different publicity and issuance strategies; the initial price will not be set too high, and the early price curves are relatively Steep and violent price fluctuations attract funds to enter.

PUMP.FUN Products:

- When users think of a good idea, they first Select the ticker you want to publish on PUMP.FUN and publish a new Memecoin with one click.

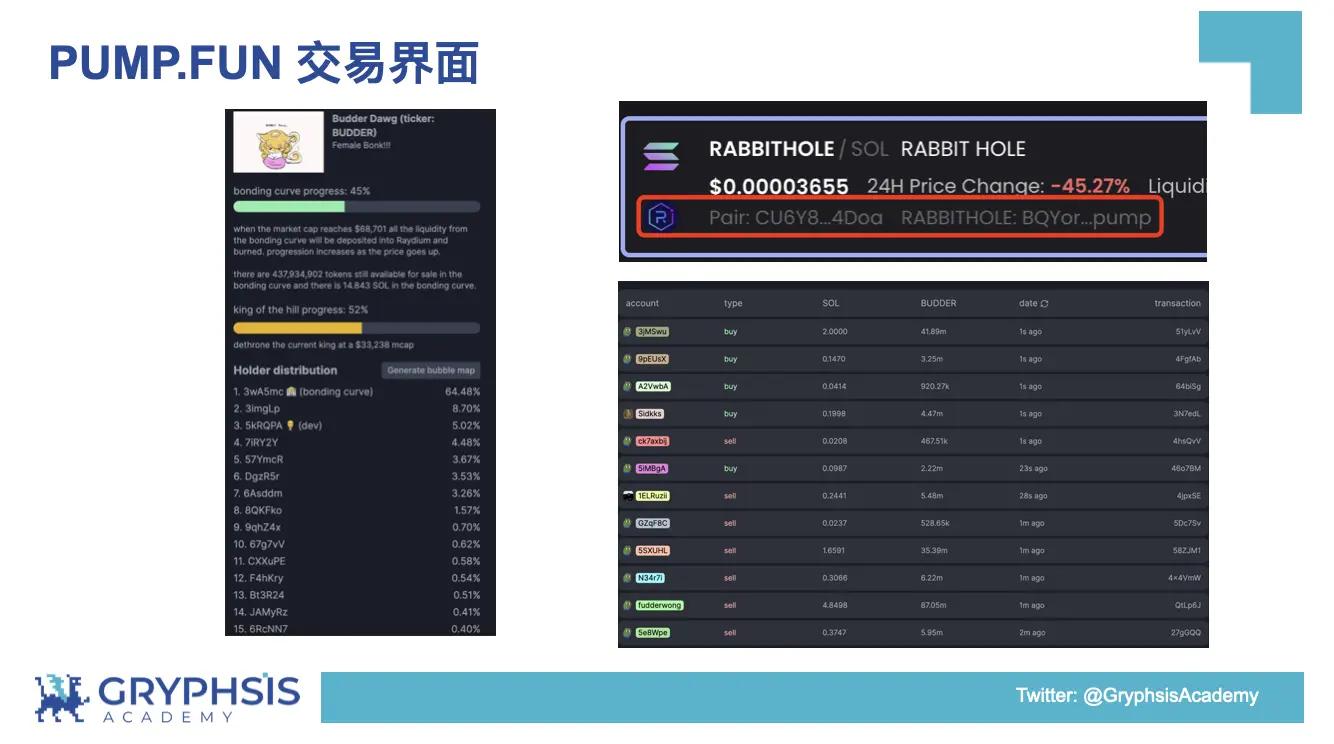

- Other users of the platform continue to buy and sell Memecoin tokens on the pricing curve.

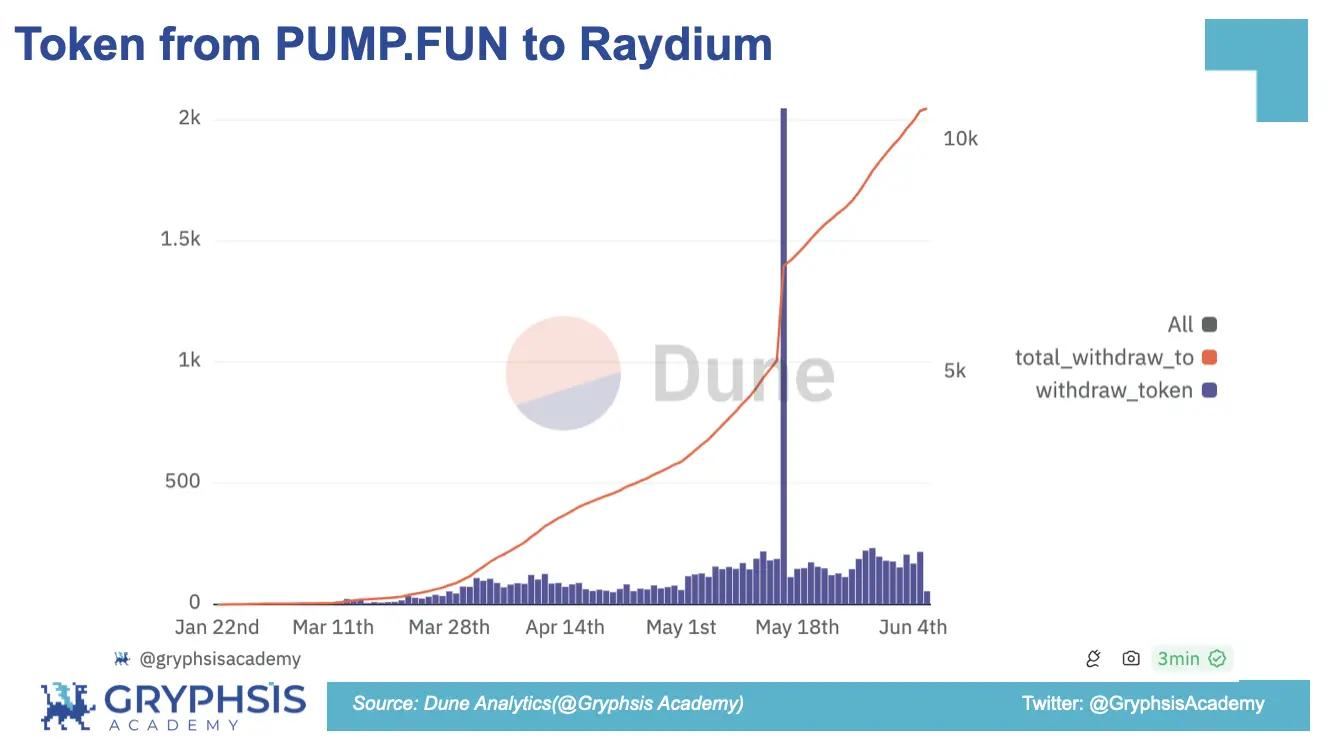

- subsequently PUMP.FUN sends newly created Memecoin to Raydium.

- The new Memecoin is further out of the circle. Users can trade one by Created by PUMP.FUN users and raised by other PUMP.FUN users, the new Memecoin has a total supply of 1 billion and an initial market value of $69k (410 $SOL).

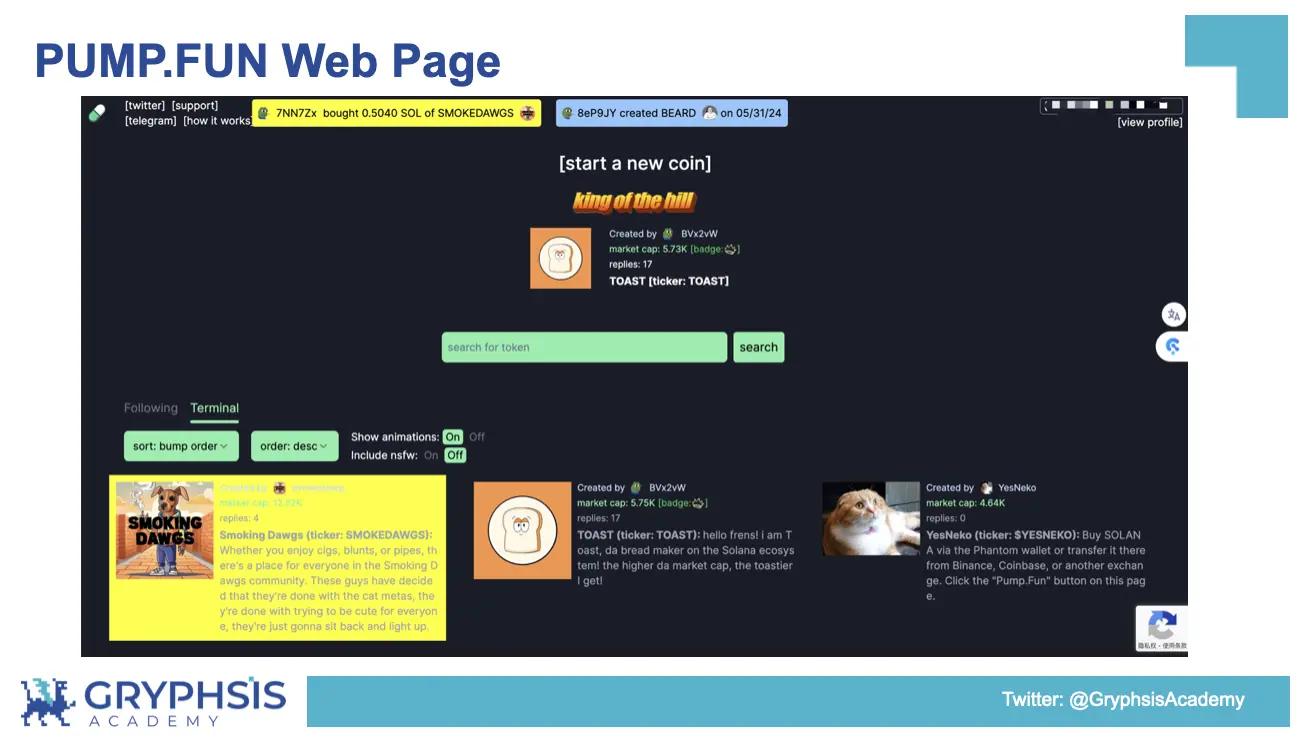

Users only need to think of a ticker, upload a picture, write an introduction, and easily create Memecoin for a small fee; other users can comment below, and the similar message board function set up by PUMP.FUN also facilitates the establishment of Memecoin communities; click By opening the user address, the platform can display the tokens held/created by the user and the objects they follow.

Other users can trade this token, and when the transaction reaches the fundraising limit, the token will be sent to Raydium.

(2) Pricing curve

Unlike the FRIEND.TECH pricing system which only accepts integer inputs and outputs, the token pricing system on PUMP.FUN is a smooth curve; different from the theoretical unlimited issuance of FRIEND.TECH tokens, all Memecoins on PUMP.FUN share the same economic model and tokens The total amount is constant, users mint part of the tokens at a reasonable price on Bonding Curve, and the remaining tokens and raised funds form the LP pool.

After parsing the front-end code, a function call named virtualSolReserves is obtained. The PUMP.FUN pricing system has a front-end virtual pool. The number of $Sol in the virtual pool is x 0 and the total amount of tokens is y 0 . By collecting data on the number of platform users buying $SOL and obtaining the corresponding tokens, and fitting it with the x*y=k formula, the front virtual pool is obtained to be 30 $SOL and 1073000191 tokens, with an initial k The value is 32190005730 and the price per coin is 0.000000028 $SOL,

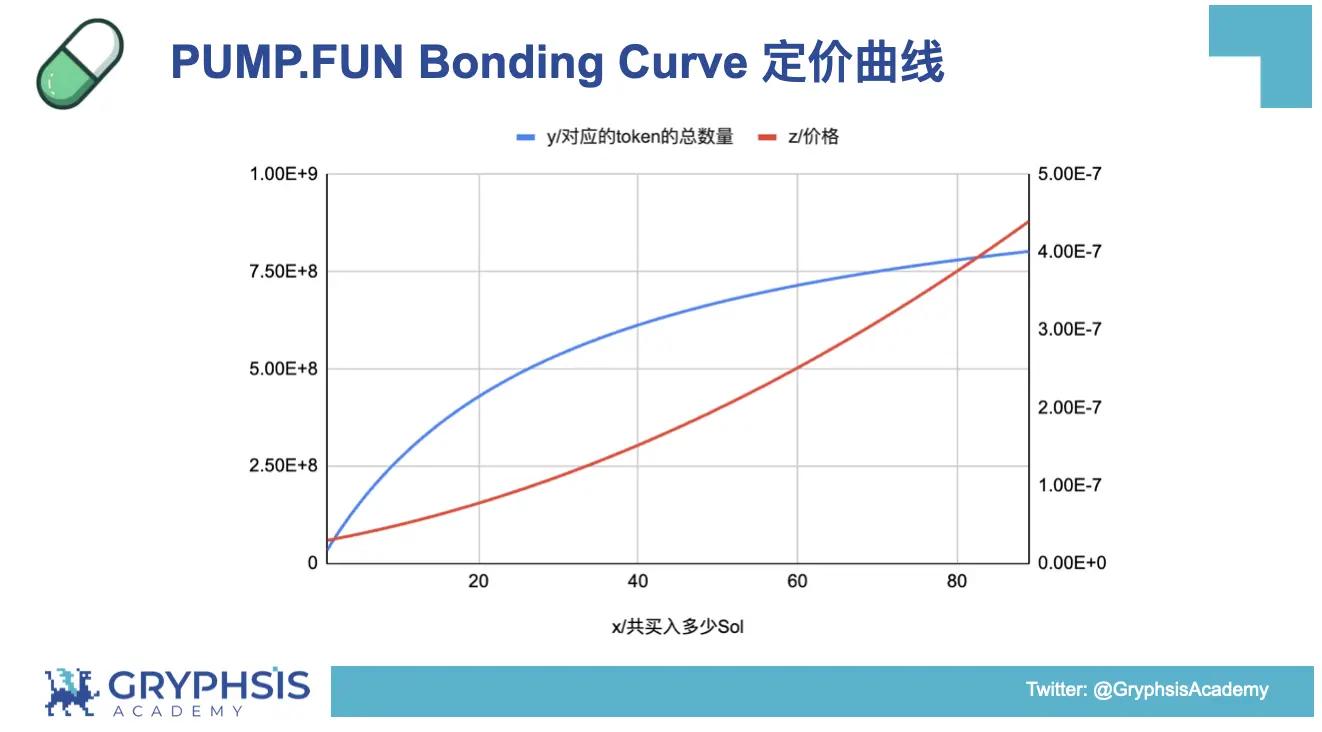

The figure below shows the calculation process:

The bonding curve pricing function is y= 1073000191 - 32190005730/(30+x), x is the quantity of $SOL bought, y is the corresponding number of tokens obtained, and the price of each token can be obtained by derivation. The following is the function curve, blue is the pricing curve, and red is the price curve. According to the curve, it can be found that it conforms to the steep early characteristics of the newly issued Memecoin.

(3) Case comparison analysis

- Users bought and sold and finally raised 85 $SOL, and obtained 800 million Memecoin tokens after replacement, which is in line with reality.

- The raised funds 79 $SOL (6 $SOL as the listing fee) and an additional 200 million tokens were added as the initial liquidity trading pool and sent to Raydium. The final total number of tokens was 1 billion, which is realistic.

- The price of each Raydium token listed at the moment the fundraising is completed is 0.00000041 $SOL, which is 14.64 times higher than the initial virtual pool price, which is in line with the actual situation.

At this point, the details of the PUMP.FUN product are clear. Users can spend 0.02 $SOL to release Memecoin with one click. The initial virtual market value of this Memecoin is 30 $SOL . Other users raised 85 $SOL to obtain 800 million tokens, and PUMP.FUN then minted it. 200 million tokens are combined to form trading pairs and are added to Raydium. When finally launched, a decentralized Memecoin with a market value of 410 $SOL and a total token amount of 1 billion can be obtained. During the entire process, PUMP.FUN charges 1% of the platform transaction fee before listing on Raydium, and a “listing fee” of 6 $SOL during the packaging and listing process on Raydium.

For people outside the crypto world, Bitcoin has no practical use and only exists for speculation, and the soaring price only represents the success of Meme attributes in communication; for the Ethereum ecosystem under smart contracts, $UNI has nothing in front of the voting mechanism. Empowerment, like Dogecoin, the investment logic is only based on the recognition of industry pioneers and the spread of the encryption spirit. Crypto users who have experienced the on-chain money making craze of Meme Season, Summer of Inscription and Memecoin Pre-sale already have a unique understanding of Memecoin without any utility. The lack of mainstream narrative, the misallocation of funds in the time dimension, and the continuous pursuit of fair launch by crypto users who invest in Memecoin have made the Memecoin market increasingly reflexive. For more views on Meme, please see the public account article: Deconstructing memes, why are MEMEs performing so well this cycle?

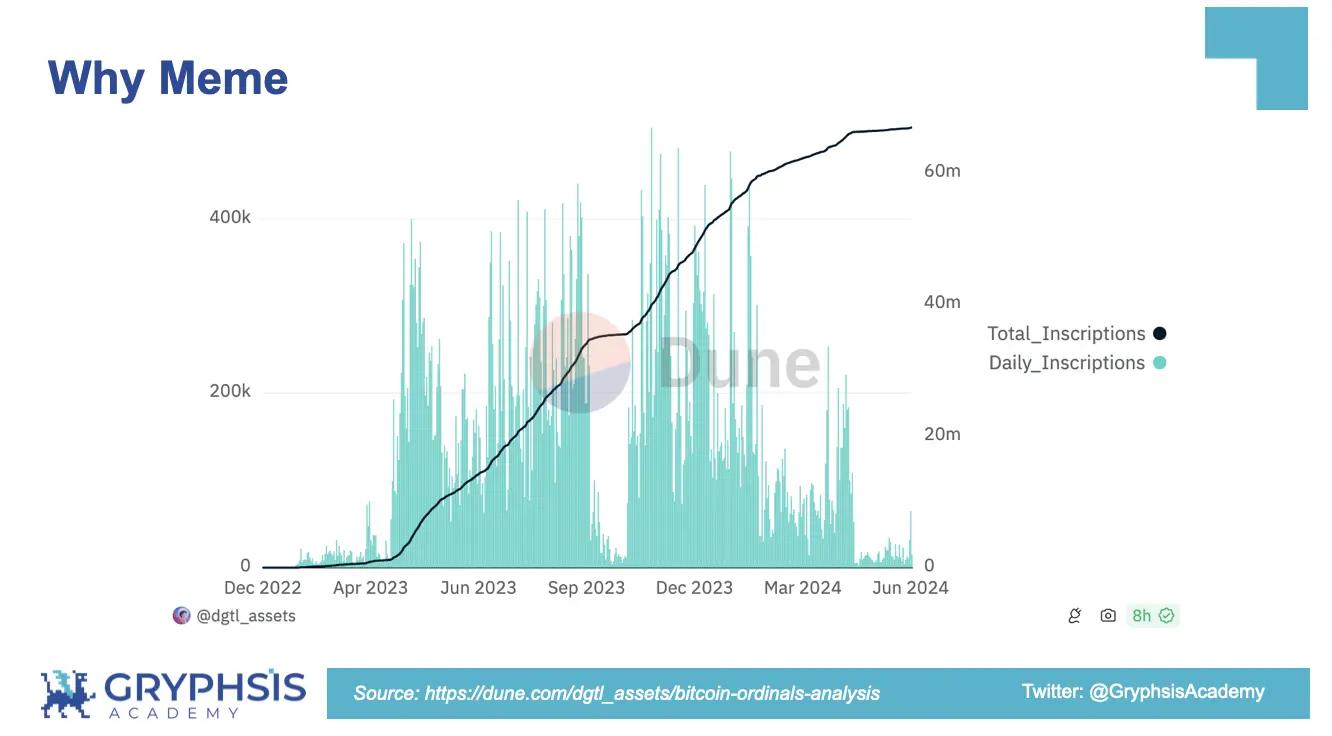

Last November $ORDI was launched on the leading exchange to start the Summer of Inscription. The new assets that emerged during the change of encryption cycle injected a new narrative into the market. At present, the number of Bitcoin inscriptions has exceeded 66 million, and the cumulative contribution has been more than 470 million US dollars.

The last time Meme Coin $GME gained market attention was three months ago, the recent GME incident protagonist’s activity on social media has brought stocks and related cryptocurrencies back into the public eye. The Solana chain $GME has increased by as much as 30 times. Related concept imitations on PUMP.FUN have exploded, and the popularity has also shown explosive growth.

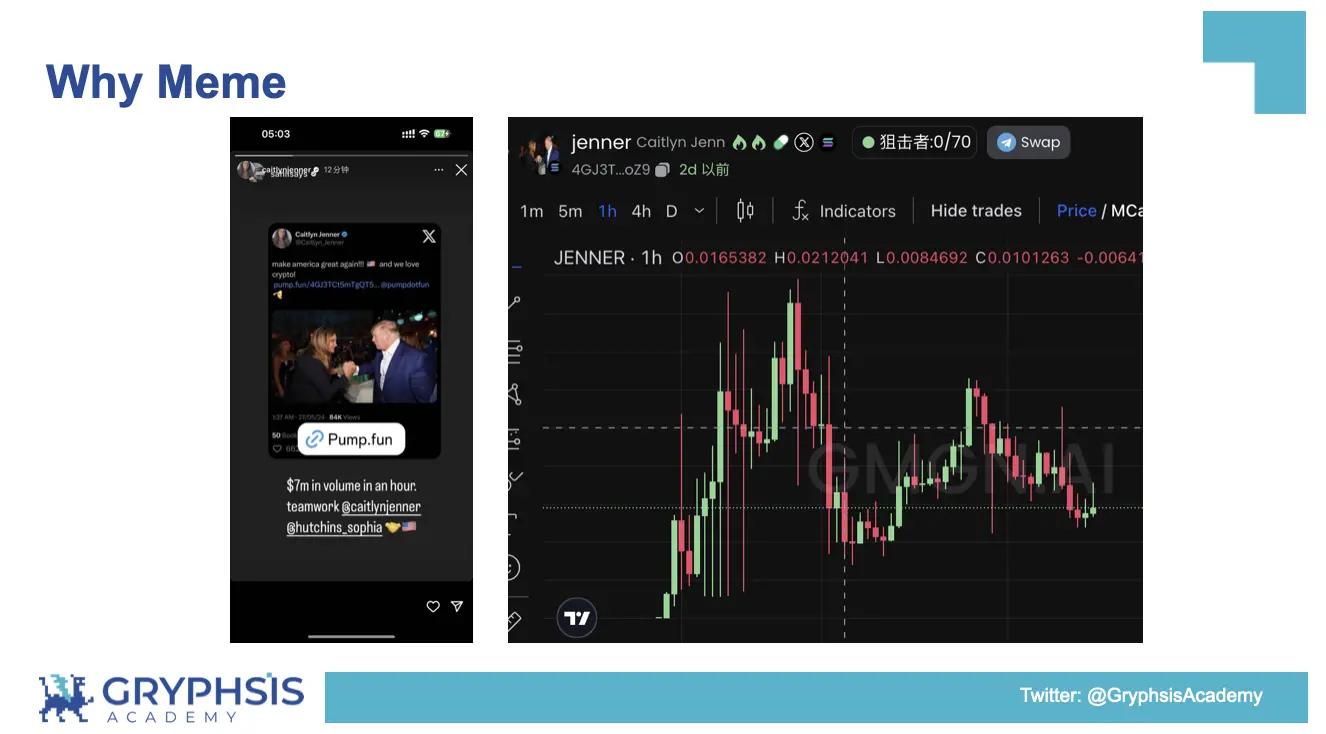

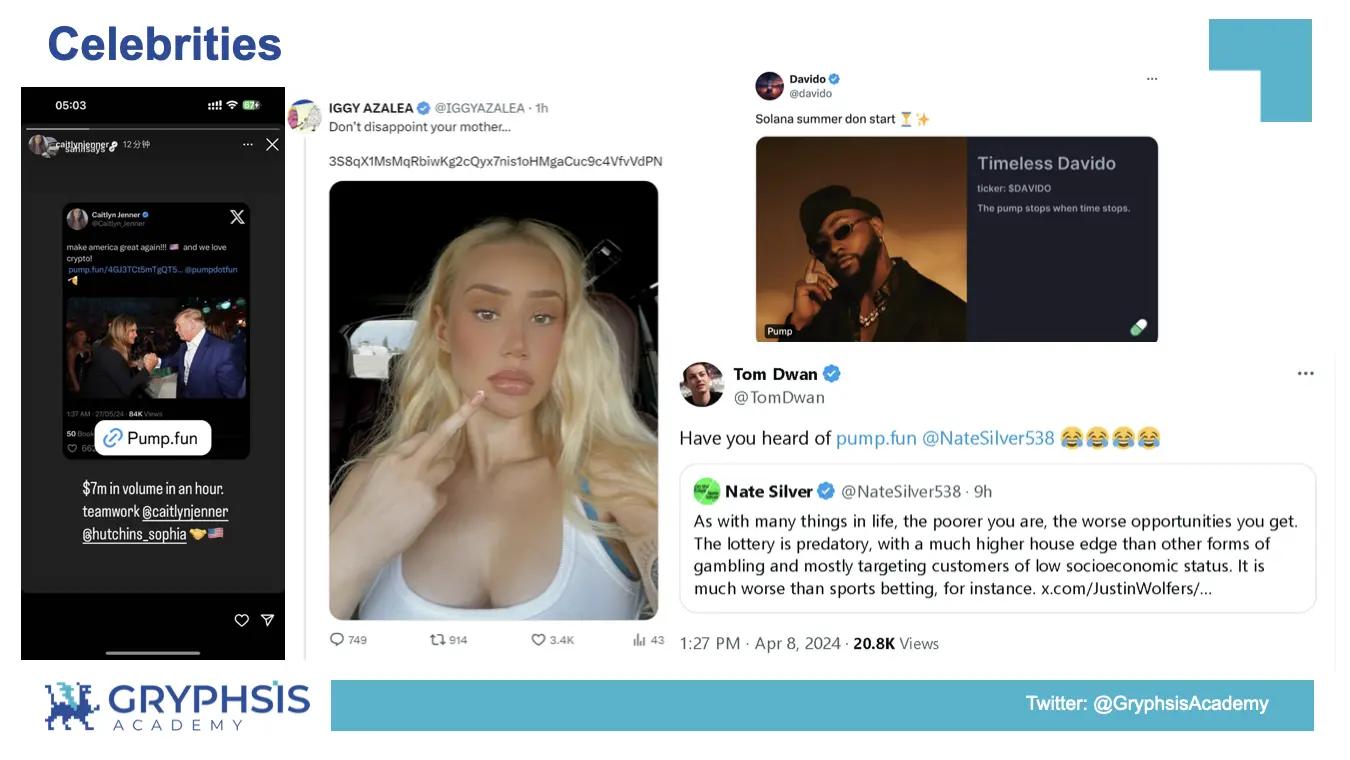

Celebrities chose to issue tokens on PUMP.FUN, linking up with people in the crypto industry to further break the circle. The token $JENNER released by the Kardashian family Caitlyn Jenner also brought Drama to the crypto world, completing a 160-fold increase in one night, the highest The market value came to US$30 million.

Why pay attention to Meme? To borrow the definition from the aforementioned article, "Memes spread through imitation; any piece of information that can be copied through imitation can be called a meme." As human beings who are essentially repeaters, the spread of Meme is both a phenomenon and a result. It is a process in which the evolving gene collection searches for order in disorder. Pay attention to Memecoin, in addition to the wealth-making effect of the Memecoin track, many crypto assets themselves also have Meme attributes, whether it is Bitcoin, which builds the value foundation of the crypto world, or decentralized tokens issued in combination with smart contracts, or based on Simple logic launches the inscription meme coin celebrity coin.

The Memecoin that PUMP.FUN users and the platform have passed will have a copycat effect after being verified by market logic, and the transaction volume will continue to increase; all the information on the token will be marked on PUMP.FUN, and hot events will bring benefits to the platform when they are repeatedly mentioned. Come huge profits. After verification and comparison with the constructed Dune dashboard, we believe that the amplified data results can explain most of the phenomena of the new Memecoin business format established by PUMP.FUN. The Dune data dashboard includes platform users, platform revenue, token creation status, and high-frequency trading activities. It can analyze the behavior, activity, and growth trends of the platform, users, and products based on the data. Dune Board Website: PUMP.FUN by Gryphsis Academy

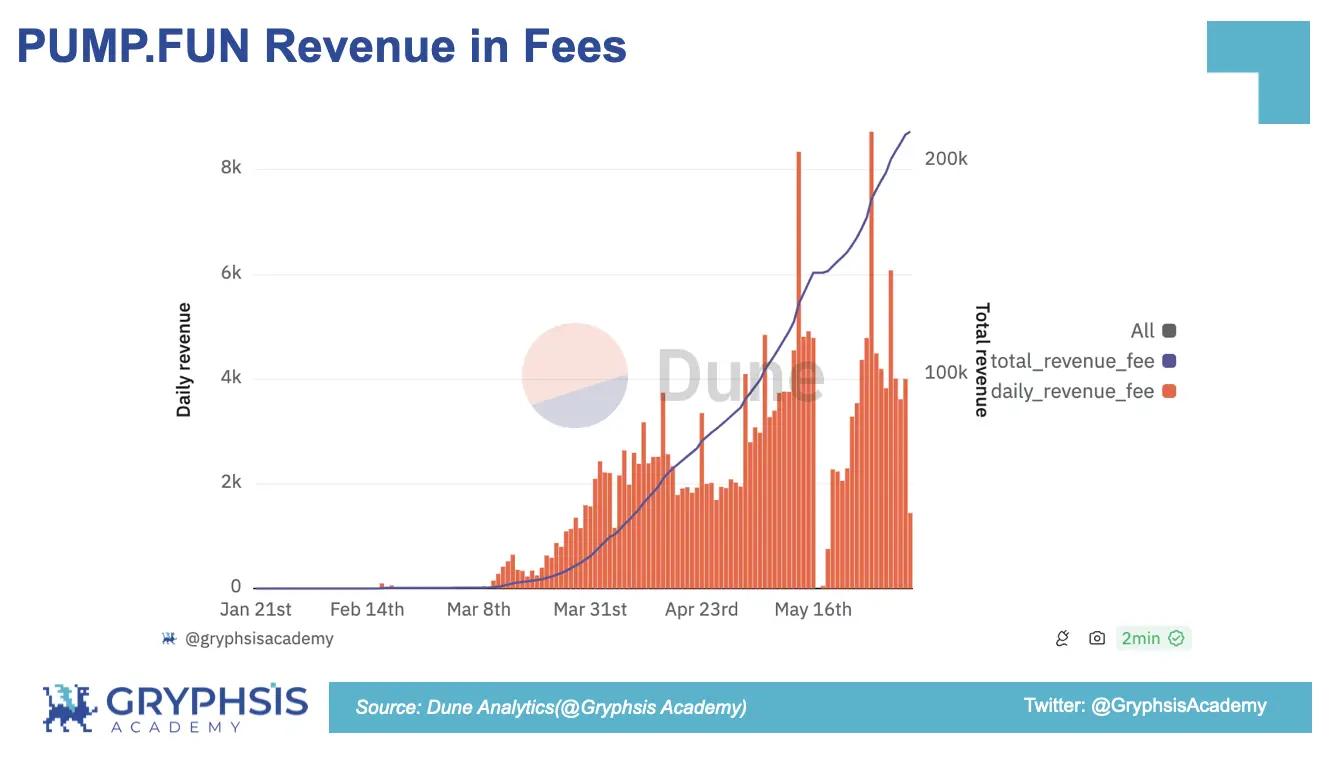

(1) Platform income

According to the Dune data dashboard, the PUMP.FUN platform ushered in its first wave of growth in mid-March. As the track was not the first player to occupy the ecological niche, users were gradually accepted during this period, and several Memecoins screened out by the platform also created There are many wealth-making stories. $SC, which was launched on March 26, reached a market value of hundreds of millions within a few days. Since Memecoins created by other users are in their early stages, they also have varying degrees of wealth creation effects. The platform’s daily income reaches 1,000 $SOL and continues to grow.

PUMP.FUN ushered in an explosive period from April to early May. $MICHI, which was launched on April 8, exceeded 200 million in market value, igniting market sentiment. The narrative of Memecoin changes rapidly, and imitations emerge in endlessly. From national coins brought by the Summer Olympics to religious coins to Trump concept coins, tens of thousands of Memecoins are created and traded every day. The average daily revenue of the platform exceeds 2,000 $SOL.

From mid-May to the end of May, while GME stocks rose sharply on May 13, the related Memecoin created by users on PUMP.FUN also created a record revenue for the platform, reaching 1.2 million US dollars . After experiencing attacks from former employees, PUMP.FUN ushered in a further breakthrough after a brief decline in popularity. The popularity brought by Memecoin created by celebrities raised the platform revenue to US$1 million again. After breaking out of the circle, the average The daily income reaches 700,000 US dollars, and the total platform income reaches nearly 37 million US dollars.

In addition, on May 16, the wallet account permissions for creating trading pairs on the PUMP.FUN platform were stolen by a former employee. As a result, a large number of Memecoins could not be listed on Raydium after completing the fundraising. Users lost US$2 million. PUMP.FUN took the platform to regain users. Earnings relief measures.

(2) User growth

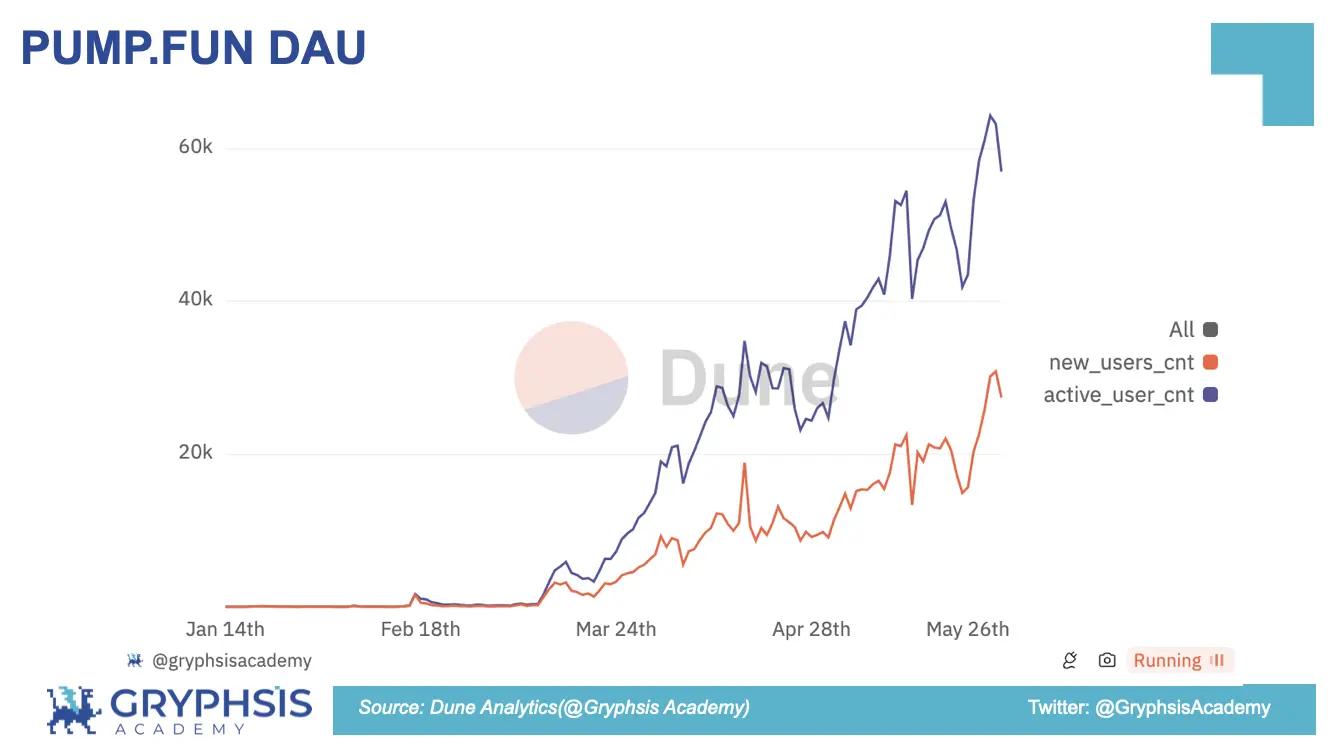

According to Dune data, the number of PUMP.FUN users has been on the rise so far. There have been occasional setbacks, but the popularity brought by users to the platform has not diminished. Before April 16, the number of new users on the platform increased sharply every day, with nearly 35,000 active users gathering within a month. The user habits cultivated by the platform products gradually laid the foundation for subsequent retention. From late April to May, the number of daily new users on the platform slowed down. Later, after the celebrity effect broke the circle, the number of active users on the platform peaked at 64,378 on May 30. The number of new daily users will continue to slow down in the future. The platform will most likely face its first user growth bottleneck.

(3) Memecoin products

If the Memecoin issued and traded by each user on PUMP.FUN is regarded as a platform product, the data on the platform product can reflect the user's behavior and facilitate the improvement of corresponding problems.

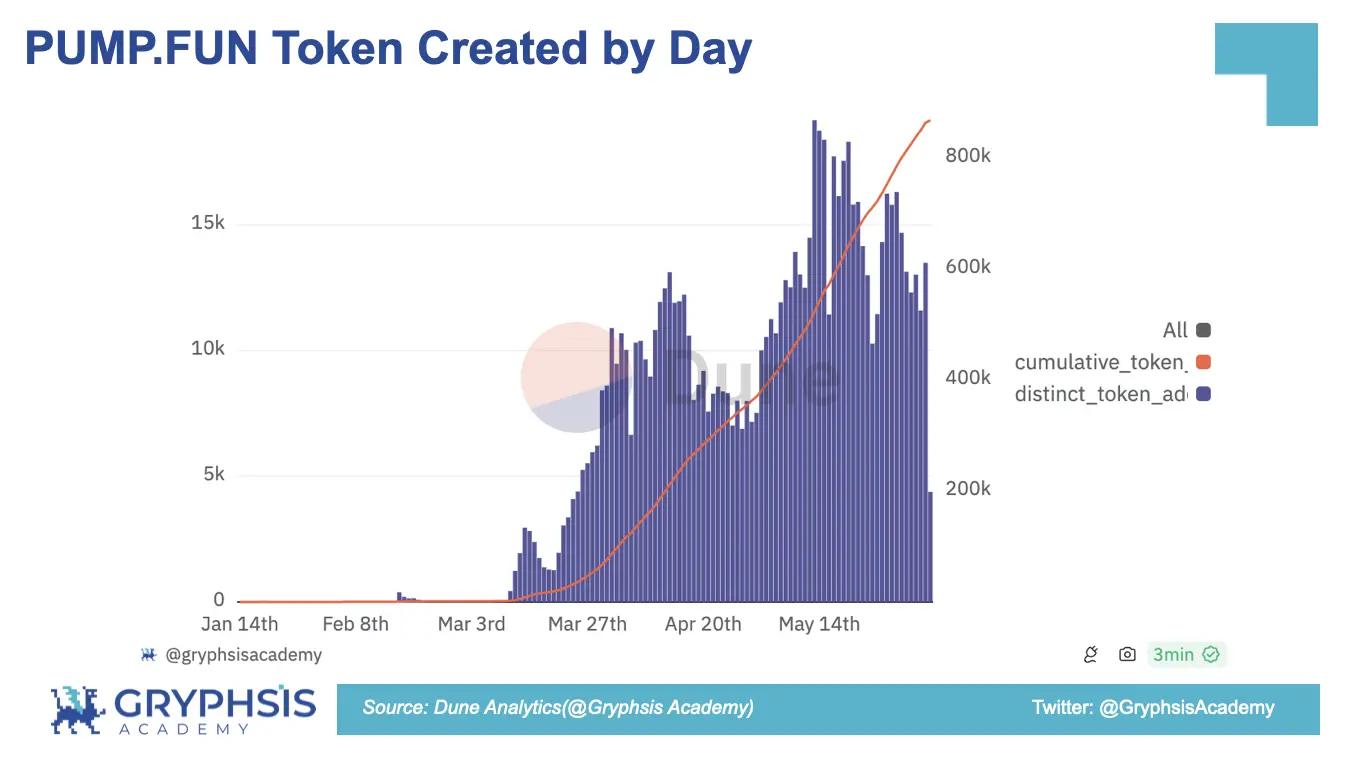

The number of Memecoins created on PUMP.FUN changes with the number of active users. A total of 862,988 Memecoins have been created since the platform was launched, with an average of 15,000 new Memecoins added every day since May.

Only 10,707 of them can be launched to Raydium for wider trading, which shows that the platform's revenue mostly relies on transaction fees, with token creation fees and currency listing fees accounting for a smaller share.

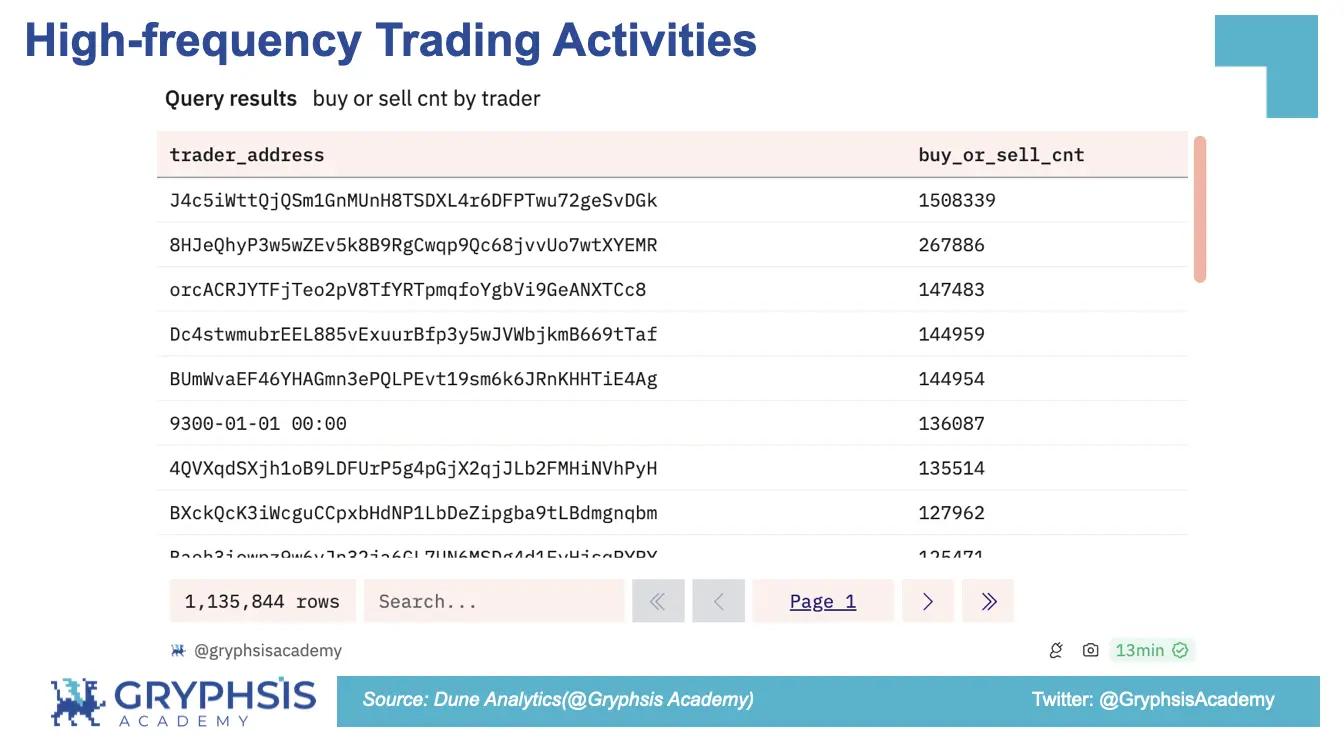

At present, PUMP.FUN has not yet disclosed financing information, and the platform is still on the rise. Dune data shows that there are many addresses with high-frequency trading behavior, and it cannot be ruled out that there may be wash trading behavior.

The current platform has also added a live broadcast function to display the issuance and operation of emerging Memecoins in the form of live broadcasts and videos, providing a suitable way to break through the circle of traffic and funds.

PUMP.FUN also cooperates with @bubblemaps. By generating trader association bubbles, you can check the association of token holding wallets and whether they will be sniped by Dev's burning token wallet, reducing the possibility of Rug Pull. The effects of new features on the platform still need to be verified by data, and the constantly changing narrative of Memecoin and the launch of new features also reflect the team's ability to make timely adjustments.

In general, the PUMP.FUN platform has ignited the market since its launch. Without institutional endorsement, it has met the needs of users through the Bonding Curve mechanism, and the platform also relies on the wealth effect brought by users' issuance of Memecoin to complete traffic diversion and publicity. Subsequent meme narratives switched rapidly, and the serious user PVP phenomenon did not structurally affect data growth. Instead, it continued to break the circle due to several hot events. In the future, there may be growth bottlenecks due to external competitive platforms, but for applications that occupy dominant ecological niches, there are only many more choices to be made.

Compared with other Memecoin Launchpad competing products, PUMP.FUN is better able to build the underlying value of Memecoin derived from community consensus and group trading sentiment. The Memecoin launched by the platform has an absolute advantage in market performance. As of June 6, the final date of this article, PUMP There are 16 .FUN tokens with a market value exceeding US$3 million, and the $SC token has a market value of up to US$300 million.

The reason why PUMP.FUN performs well while other competing products are weak can be attributed to the product and the ecosystem behind it.

(1) Different from other competing products that give users a peaceful and static feeling, when you click on the PUMP.FUN website, the most intuitive feeling is the jumping numbers and dynamic pictures. The high-saturation design stimulates the user’s senses and arouses emotions as if they are facing Memecoin transactions are as fanatical and magical as the transaction; the introduction to the gameplay only has five simple sentences, which is in line with the characteristics of Memecoin trading users who are short-term and fast. However, the other pages introduce the token-related information in great detail, making it easier for new buyers to quickly form a community consensus. The platform's logo is a small green pill, which seems to express the idea that a healing pill is addictive, and platform users cannot extricate themselves.

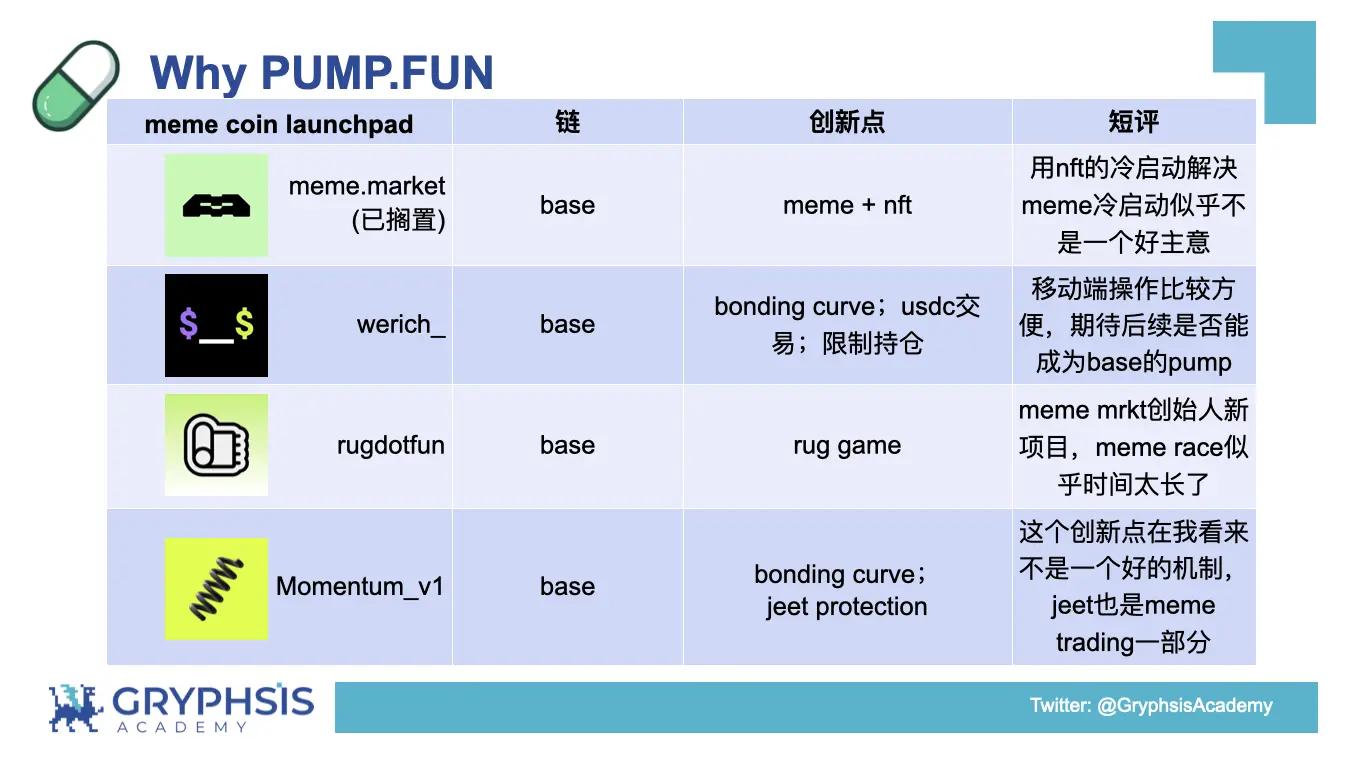

(2) Unlike PUMP.FUN, which relies on the Solana ecosystem, meme.market / werich_ / rugdotfun / Momentum_v1 all choose to be developed on the Base chain. While the funds and attention on the Base chain are diverted by FRIEND.TECH and Farcaster, Memecoin relies on the Socialfi platform , the cold start problem has been solved, and the token market values of $DEGEN and $FRIEND are very large, which can give the two platforms room for imagination of other Memecoins. On the Memecoin Launchpad track of the Base chain, users have become accustomed to the echo wall built by FRIEND.TECH and Farcaster through social models, and the funds and traffic have been divided up.

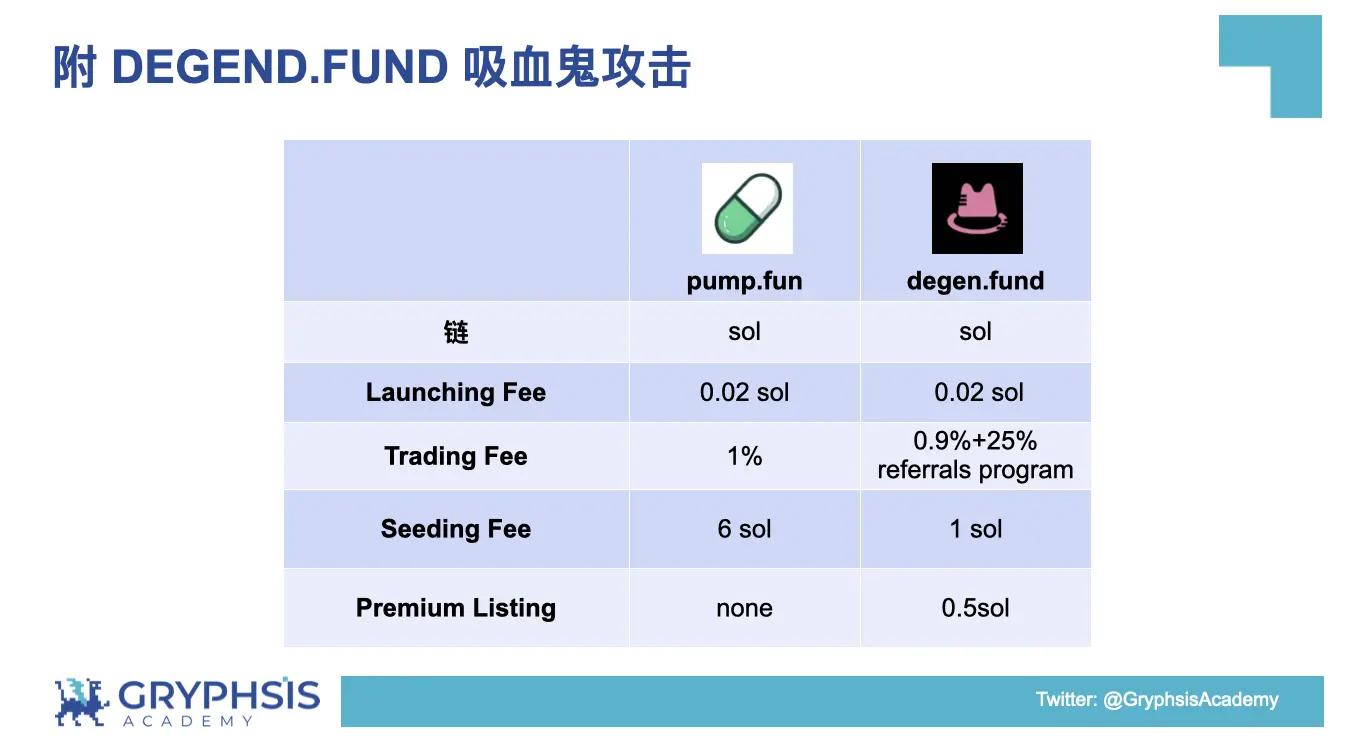

(3) During the attack on PUMP.FUN, DEGEN.FUND was launched on Solana. Similar Bonding Curve and attempts to use cheaper platform fees did not continue to attract the market and form enough scale. As the leading target of speculation, the $IYKYK token also After short-term speculation by players on the chain, it has become dull.

For the new segment of Memecoin Launchpad, PUMP.FUN should be the target of investment research and in-depth participation. We divide the users of the platform into three roles, namely Memecoin Creator, Memecoin Trader, and Memecoin Opportunist. Roles can be fluid, and users will have different opportunities to choose from the same Memecoin when switching roles.

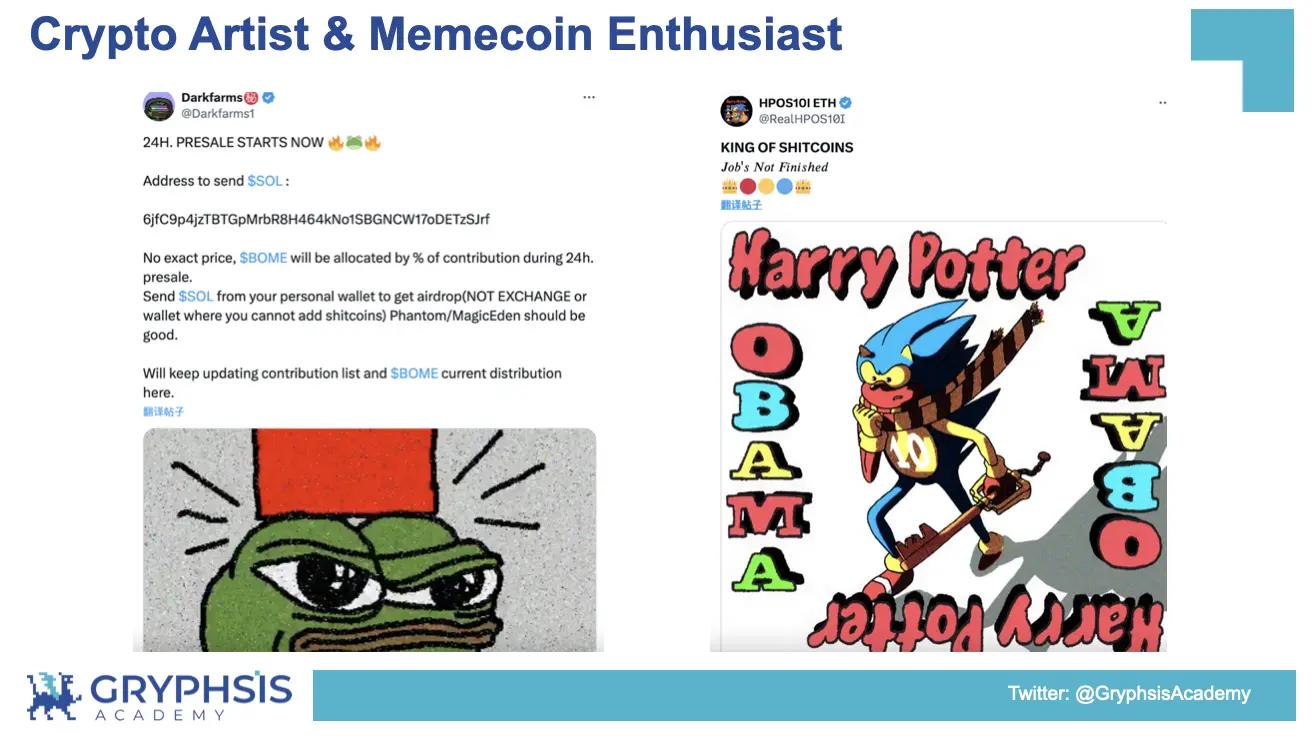

Memecoin Creator can be a crypto artist, an early evangelist of the Memecoin narrative, or a project party that uses the platform for publicity. Now that it breaks out of the circle, it can even be a celebrity from all walks of life. As their role needs to release/discover new Memecoins worth trading, they need to master certain communication knowledge and have a certain influence. A good Memecoin Dev can cooperate with social media to screen out tickers with strong performance for the market. A Dev that is not too sensitive to the market can also reduce the cost of trial and error with the help of PUMP.FUN. And if you have a special identity like Caitlyn Jenner and Iggy Azalea, the decentralized issuance platform PUMP.FUN can help you save the intermediate links and bring enough funds and funds to your tokens in a very short time. Traffic support.

Crypto Native crypto artists and Memecoin enthusiasts can use PUMP.FUN to reduce token issuance costs after selecting good Tickers.

Early discoverers use their knowledge and influence to form a new Memecoin narrative for a specific Memecoin platform, and the community established under the narrative has the opportunity to further break the circle.

Celebrities issued tokens on PUMP.FUN, interacting across circles and participating in the Memecoin craze with crypto users. The last crypto concept to break the circle was NFT assets. Compared with FRIEND.TECH, celebrity tokens and NFT assets can be used as one of the products of celebrity IP; tokenization of social relationships will not attract people with certain influence because their public social resources are very rich. Private social relationships satisfy the needs of the self.

As the most active player on the chain recently, Memecoin Trader needs to build his own trading strategy while tracking wallets, using tools, and following social media in order to make profits in a high-risk, high-yield game. Compared with other risky assets, traders' profits on Memecoin are more unstable, and the winning rate is generally not high. Moreover, due to the characteristics of the platform, the trading pace becomes faster and faster, and changes in direction increase the probability of losses.

The Memecoin Trader experience on PUMP.FUN made the author realize that in addition to the need for continuous improvement of the trading system, the strength from the team is very important. Even if players on the chain face huge opportunities, they still need the cooperation of community members, which is formed by transactions. The tacit understanding of the community can eventually return to the consensus on the transaction target. The following is @0x SunNFT and community members reviewing the process of issuing tokens $MOTHER by celebrity Iggy Azalea.

Whether it is the arbitrage target of scientists on the chain or the high-frequency behavior of robots looking for Alpha opportunities, compared to the previous two platform roles, Memecoin Opportunist is the object that smart wallets should focus on. How to choose the appropriate strategy to become a Memecoin Opportunist in PUMP.FUN is worth pondering. Using the analogy of Texas Hold'em, you should enter the pot when the poker table is hot. You can choose a sniper robot with good market conditions and sufficient liquidity to grab the opening strategy to increase participation and magnify profits; when the poker table is not so hot or the market is relatively When the market bottoms out or is stable, you can choose a reverse sniping strategy to generate income while remaining sensitive to the market.

(1) Memecoin Opportunist sniper strategy

PUMP.FUN Every time a new Memecoin is launched, the snipe bot will complete the first few buy transactions within a few seconds after being filtered by indicators. Because the entry position is low enough, the early pricing curve is relatively steep, and the overall Memecoin market continues to be hot, this strategy has been able to capture several targets with huge gains in the past few months.

From left to right, they are $DONALDCAT with the highest market value of 15 million US dollars, $JAPAN with the highest market value of 5 million US dollars, and $NIGI with the highest market value of 12 million US dollars.

The sniper robot's opening strategy needs to be sensitive enough to market sentiment. Unlike the Solana Sniper Bot that ordinary users may use, there is no contract for sniping in PUMP. The interactive behavior between users and the platform is clearly monitored, and tokens issued by Devs with Rug behavior can be isolated; after the sniping is completed, parameters that can adjust the stop loss or take profit in a timely manner are set, and the backtest data is used to adjust the sniping occupancy funds.

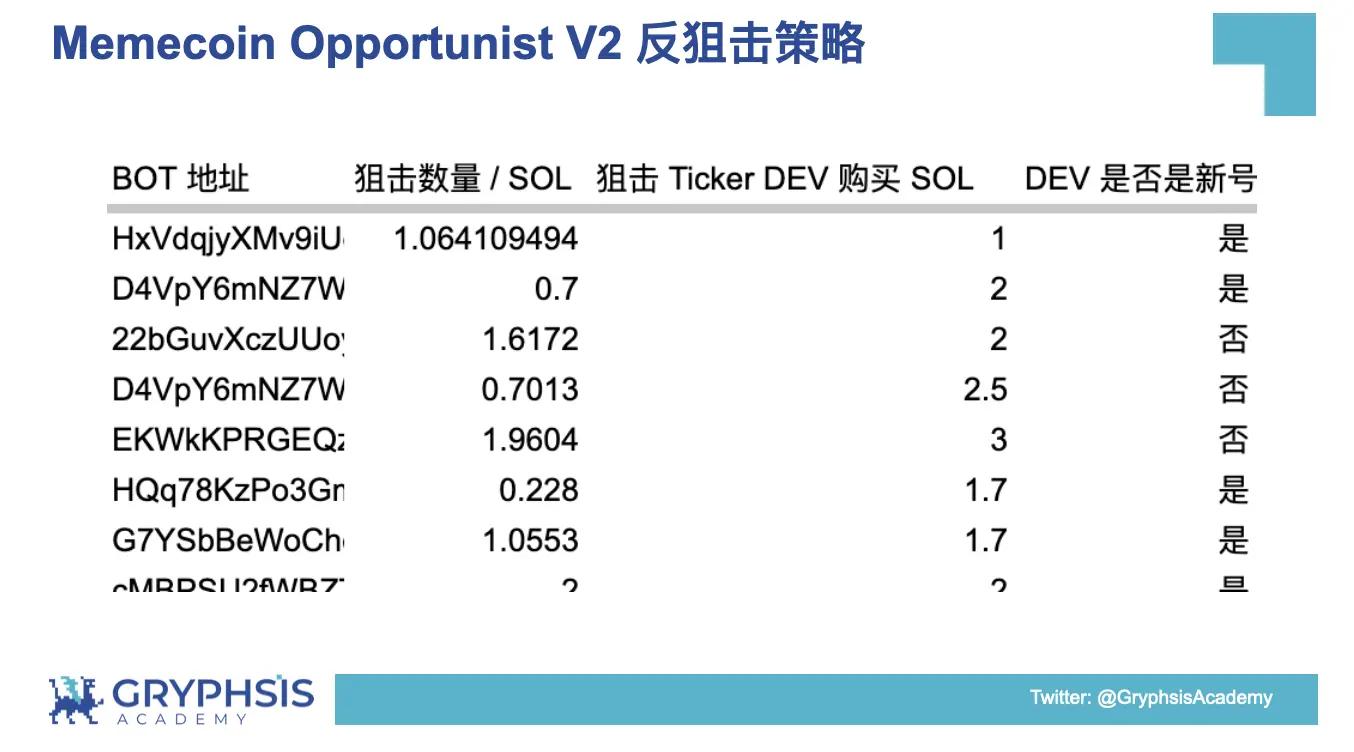

(2) Memecoin Opportunist anti-sniper strategy

The sniper robot's strategy of grabbing the market opening relies more on the overall market situation. The mode of casting a wide net will increase the number of opportunities and also require funds. Competitors with the same strategy will continue to emerge, further compressing profit margins, and those who can escape in the process of competing with each other will Memecoin is also gradually decreasing, and the emergence of the Memecoin Opportunist anti-sniper strategy is in response to this change in the market. The specific implementation is as follows:

- Regularly summarize market hot spots and establish a currency material library

- Test the snipe bot's sniping behavior and organize the bot's strategies (ticker, amount, time...)

- Automate the coin issuance process and build an anti-sniper process

- Adjust parameters to improve fund utilization

Reverse sniping takes advantage of the low-cost currency issuance characteristics of PUMP.FUN. The reverse sniping strategy with well-adjusted parameters in the actual process can bring a single income ranging from 2% to 20% in a very short period of time.

The construction of parameters requires the analysis of sniper Bot address behavior. Imitation of short-term hot spots in the market will continuously trigger signals for the strategy. Being able to automate the entire anti-sniper strategy process is the key to improving the efficiency of fund use and expanding profits. The reverse sniper strategy can not only achieve low-risk arbitrage, but also screen out good Memecoin narratives at a low cost and win potential airdrops in the future.

The BSC chain attracts traffic and funds through the Meme-Innovation-Program activity to complete the initial layout of the Meme track; the Base chain is also currently launching the Base Onchain Summer activity under the leadership of the founder, and Base's Memecoin will definitely gain traffic tilt. Public chains lay out Memecoin and related tracks through organizing campaigns, while PUMP.FUN, as a unicorn application on the emerging track, currently only runs on Solana. While believing in the PUMP.FUN team and products, the track participation strategy should also consider the hot cycle. In the author's opinion, the way for institutions to enter the market has almost been determined. Whether it is a strong acquisition at a low point or a participation in construction as an investor, the leader of the track will return to its due value whether in the primary or secondary market. Therefore, the author It is believed that adopting the Memecoin Opportunist anti-sniper strategy is the best way to lay out the entire track in advance through PUMP.FUN.

From Ethereum to Solana, from Shiba Inu to frogs, from crypto enthusiasts to celebrity breakers, people’s pursuit of traffic hot spots never stops, from sloths burning pools to the innovation of PUMP.FUN issuance transactions, people are looking for ways to go in Memecoin Continue to explore centralization and fair mechanisms.

PUMP.FUN, as the leader of the emerging track, has completely changed the Memecoin ecosystem with its extremely low-cost distribution model, and has built an application ecosystem that meets the needs of users. It is a unicorn project in the encryption field. As the most Crypto Native narrative application, it has not even released its own platform tokens. What kind of economic flywheel it can eventually form needs to be continuously explored by pioneers on the track.

According to Defillama, the PUMP.FUN protocol, as the Memecoin issuance platform on Solana, has surpassed Uniswap Labs in monthly revenue, becoming the fourth largest protocol among all blockchain networks. In the face of this unicorn application without additional information disclosure, we need to figure out what it is. Some people will think it is a large casino, and some people will think it is another PVP platform where liquidity is exhausted in the crypto world. The author believes that in addition to In addition to the above characteristics, it should be a revolutionary product for new crypto assets, embodying the spirit of decentralization to the extreme in a very low-cost way. Just as Bitcoin rewards early miners and evangelists, it is built on community consensus and trading sentiment. Why can’t Memecoin on the Internet reward users who discover its value through the gaming process? Is it just because Bitcoin consumes electricity, while PUMP.FUN consumes brainpower and physical strength?

"Before you learn to construct, don't regard what you deconstruct as the final answer to the problem." Facing the turbulent wave of Memecoin reform in the crypto-MATRIX world, the author will take the green pill of PUMP.FUN with a peaceful mind.

References:

[ 1 ] https://foresightnews.pro/article/detail/59863

[2] https://messari.io/report/analyst-discussion-pump-fun

[3] https://www.theblockbeats.info/news/53703

[ 4 ] https://x.com/lukema95/status/1788858814420382121?t=A2CvlJFGTTlxko7Ymtpojw&s= 05

[ 5 ] https://mp.weixin.qq.com/s/JwqVcjY0ENUFFk9oI79VfQ

[ 6 ] https://www.youtube.com/watch?v=losZU4qcs-M&t=4s