Binance Labs has made a strategic investment in Rango, a cross-chain decentralized exchange (DEX) and bridge aggregator. However, neither party disclosed the terms of the investment, including the size of the investment.

Rango facilitates transactions across various blockchain ecosystems. These capabilities are essential to fostering the growth of decentralized finance.

Cryptocurrency community looking forward to Rango airdrop after investing in Binance

Rango supports major blockchains such as Bitcoin (BTC) , Solana (SOL ), Tron (TRX) , Cosmos Ecosystem, and Starknet (STRK ). This comprehensive support is critical for multichain wallets that require reliable cross-chain functionality.

You can access Rango through popular wallets and decentralized applications (dApps) such as Trust Wallet , Exodus, Binance Web3 Wallet, and Compound. Rango currently supports 60+ blockchains, 70+ decentralized exchanges, and 20+ bridges. It boasts a trading volume of over $3 billion.

Read more: Best airdrops scheduled for 2024

To date, the platform has processed over 2.5 million swaps for 590,000 unique wallets. Additionally, we manage over 3,000 organic cross-chain swaps every day. Processing over 2 million swap quotes every day, Rango guarantees fast response times for its growing user base.

“Rango’s suite of services aligns with Binance Labs’ goal of supporting projects that strengthen cross-chain development and innovation,” said Binance co-founder Lee He.

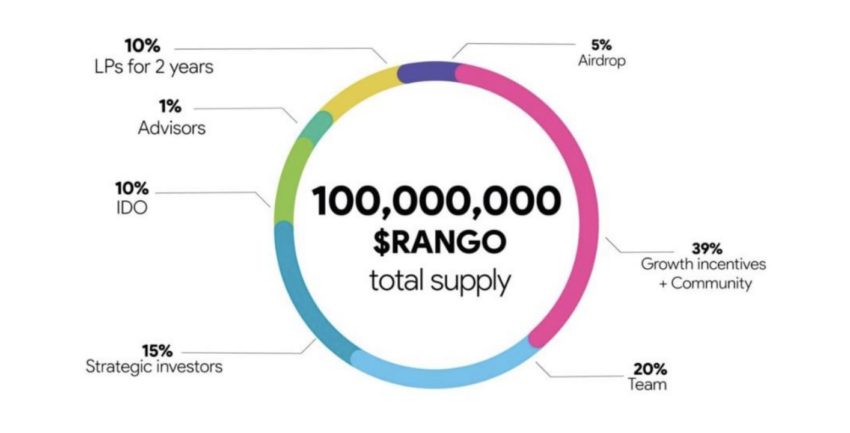

Binance's recent investment has sparked speculation about a possible airdrop and token generation event (TGE). In particular, Rango raised community expectations by allocating 5% of Rango token supply for the airdrop.

This investment comes shortly after Binance Labs joined the layer 2 network, Jerkit . Jerkit combines zero-knowledge rollup and artificial intelligence (AI) to enhance security. The goal is to protect users from smart contract vulnerabilities and other security threats.

Read more: The Complete Guide to P2P Decentralized Exchanges (DEX)

Recent attacks on the Ethereum blockchain that resulted in massive financial losses clearly demonstrate the need for increased security. In May 2024, Ethereum accounted for 43% of all damage across the entire network. Zerkit plans to secure more than $3.39 billion in staking assets to address these issues ahead of its mainnet launch this summer.

Trusted

The information contained on the BeInCrypto website is published in good faith and for informational purposes only. Users are solely responsible for any consequences arising from their use of information on the website.

In addition, some content is an AI-translated version of the English version of BeInCrypto articles.