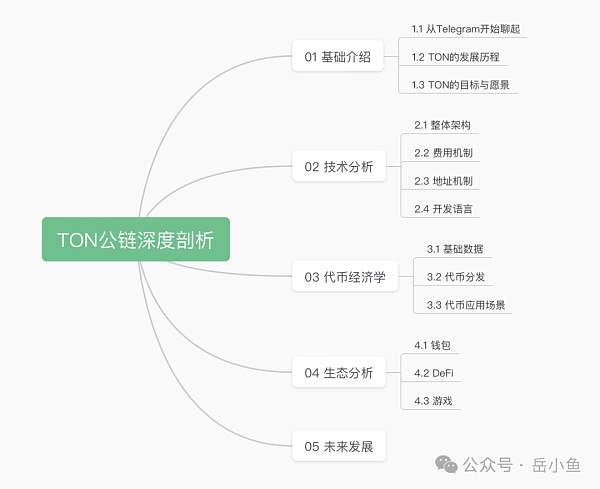

The TON (The Open Network) public chain ecosystem is exploding, and this is a new world where you can make money.

In order to better understand TON public chain and Telegram, we can analyze it by comparing it with WeChat, the largest social application in China.

WeChat uses social networking as its basic platform and combines WeChat Pay and WeChat Mini Programs to build a very large application ecosystem.

But what is WeChat’s biggest problem?

In fact, users’ data and assets are controlled by the platform, lacking privacy and freedom.

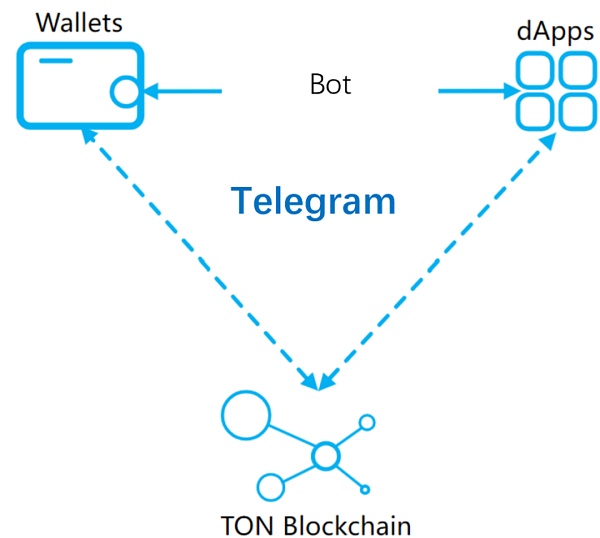

Telegram can be said to be the Web3 version of WeChat.

Telegram is an encrypted communication tool with extremely strong privacy. Combined with its TON public chain (financial infrastructure, which can be compared to WeChat Pay) and Bot capabilities (robots, which can be compared to WeChat applets), it is building a more open, free and autonomous Web3 application ecosystem.

Therefore, the TON public chain is a very special existence. Backed by Telegram, an encrypted social application with more than 900 million monthly active users worldwide, among all public chains, TON has a clear landing scenario and a large number of seed users.

This article will conduct an in-depth analysis of the TON public chain, gain an in-depth understanding of the current status of the TON public chain ecosystem and its future development trends, which will help us seize new opportunities in the new ecosystem.

01 Basic Introduction

1.1 Start chatting on Telegram

If we want to analyze the TON public chain, we must start with Telegram.

Telegram is an encrypted communication application that supports end-to-end encryption and does not censor content. In order to avoid the influence of a single government, its servers are distributed in many countries around the world, so it has a strong "freedom" label.

Telegram was founded in 2013 by a Russian founder, and the project was originally intended to serve the cryptocurrency industry.

Therefore, Telegram has carried the genes of the encryption industry since its appearance, and can be said to be born for encryption.

Telegram currently has more than 900 million monthly active users worldwide and advertising revenue of approximately US$4.56 billion. Telegram is another social application giant besides WeChat, Facebook, and WhatsApp.

More importantly, Telegram is very different from other social applications. Other social applications will strictly censor the content, while Telegram attaches great importance to user privacy, focuses on encrypted social networking, and basically does not censor content. Therefore, it can be said to be a "non-mainstream" social application and a supplement to other social applications.

Take Facebook as an example. As of 2023, Facebook has more than 7,500 reviewers, while Telegram has only about 50 core employees in total.

Currently, many projects in the Web3 industry use Telegram for community operations.

Another commonly used community tool in the Web3 industry is Discord. Discord originated from the gaming community and later expanded to the Web3 industry community.

Discord has more features, which makes it very complicated to use, while Telegram is very simple and lightweight, with an overall smoother user experience. It has built a more free and powerful application ecosystem through robot functions (equivalent to WeChat mini-programs).

Telegram is further integrating with the encryption industry and truly transforming into a Web3 application. Building a blockchain that can be closely integrated with its own applications is an important ecological puzzle for Telegram.

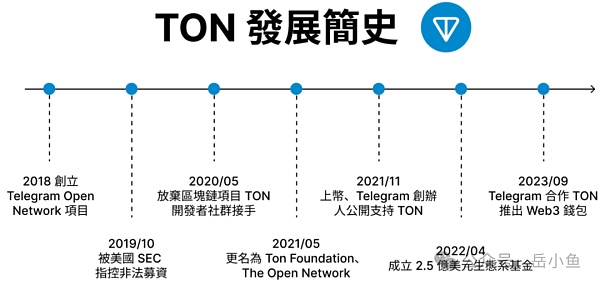

1.2 Development History of TON

The development history of the TON public chain is actually very tortuous.

In 2019, Telegram attempted to launch the TON (Telegram Open Network) public chain.

However, during the ICO (Initial Coin Offering) stage of the project, the U.S. Securities and Exchange Commission (SEC) intervened, and after a series of legal disputes, the project was canceled in 2020.

The TON project was originally planned to be promoted by Telegram. After reaching a settlement with the SEC, Telegram announced that it would no longer participate in the TON project.

However, the community and other developer teams decided to continue the project and launched several branch projects based on TON. The TON public chain we are familiar with is actually called: The Open Network. It is the most mature public chain project that has grown after the abortion of Telegram's official encryption plan.

Although TON has no direct relationship with Telegram, Telegram officials and founder Pavel Durov have repeatedly supported the project in recent years and emphasized the business relevance between Telegram and TON.

Therefore, it can also be said that TON is the only public chain officially recognized by Telegram and has legitimacy.

1.3 TON’s goals and vision

TON’s latest goal is to attract 30% of Telegram’s users to join TON by 2028.

This means that TON needs to be able to accommodate 300 million new users into the Web3 world.

TON’s vision is to create a TON-based Web3 mini-program ecosystem within Telegram.

Through Telegram's Bot technology (robot, equivalent to WeChat mini-programs), decentralized applications built on the TON public chain can be implemented in the form of Bot and organically integrated with the Telegram ecosystem.

Most of the current decentralized applications exist in the form of web-based versions. The biggest problem with this form is that the user experience is poor and it is not smooth enough to use.

Telegram's Bot is an application form with a very good user experience. It can be used directly in Telegram and the experience is consistent with the APP, allowing Telegram users to easily transition to the world of Web3.

Unlike the WeChat Mini Program ecosystem, the WeChat Mini Program is suitable for applications that combine online and offline, such as restaurant ordering, e-commerce, food delivery, taxi-hailing, etc.; while Telegram's robot ecosystem is more suitable for pure online scenarios, such as games, finance, etc., and is therefore a natural fit with the pure online attributes of Web3 applications.

The Web3 industry is currently full of speculation, but there are very few projects with solid fundamentals.

What are fundamentals?

User usage scenarios are the fundamentals. Only high-frequency scenarios with actual needs can bring the user base of the entire Web3 industry to the billion level.

Regardless of Web1, Web2, or Web3, they are all Internet businesses in the final analysis. The basic foundation of Internet business should always be “starting with traffic and ending with transactions.”

Telegram has traffic, and now it needs TON public chain to bring transactions. This is also something that other social application giants cannot do, such as WeChat and Facebook, which cannot enter the Web3 industry due to policy compliance constraints.

Telegram was born for encryption and is a natural fit with the encryption industry. Now it needs a key to open this treasure chest with a large number of native encryption users. The TON public chain is the key to this treasure chest.

02 Technical Analysis

2.1 Overall Architecture

TON currently consists of four main components: TON Blockchain, TON Payment, TON Proxy and TON Storage (decentralized storage).

(1) The TON blockchain is a general-purpose blockchain that includes a standard execution layer that allows permissionless transactions;

(2) TON Payment is a low-fee micropayment platform that allows instant and fast payments between users. It is currently accessible through the Wallet bot on Telegram, benefiting from in-app convenience;

(3) TON Storage allows files to be stored and distributed on TON, similar to a decentralized Dropbox;

(4) TON Proxy ensures censorship resistance by allowing users to run .ton websites independent of fixed IP/centralized domains;

Here we mainly analyze the TON blockchain itself.

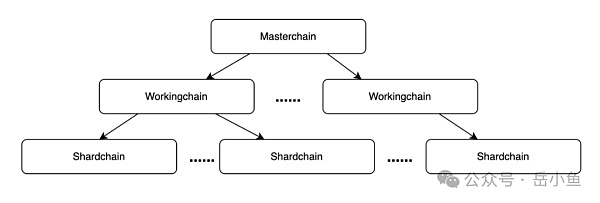

The architecture of the TON public chain is divided into three layers: Masterchain, Workingchains and Shardchains.

The main chain is responsible for overall coordination and acts as the central brain, while the work chain and shard chain are responsible for specific transaction processing and have high performance and scalability.

The most distinctive and competitive technology of the TON public chain is sharding technology.

Ethereum, the king of all chains, has been mentioned for a long time, but the progress has been very slow. Currently, it has achieved layering and modularization in disguise through Layer2, but it is still far from the sharding of a layer of network.

The TON public chain goes even further:

The TON blockchain consists of a main chain and up to 2^32 work chains. Each work chain is an independent chain with its own rules. Each work chain can be further divided into 2^60 shard chains or sub-shards, which contain the state of a part of the work chain. Currently, there is only one work chain running on TON - basechain.

2.2 Fee Mechanism

The transaction fees paid by users are mainly to obtain block space storage transactions, which is essentially a competition for block space. Therefore, it can also be said that the business model of blockchain is a business about block space leasing.

For most public chains, including Ethereum, a permanent lease model is used. Users pay a transaction fee, and the transaction is permanently stored on the blockchain.

But the TON public chain is completely different.

First of all, the block fee is not paid by users, but by each smart contract. In other words, each smart contract needs to pay the cost of the resources it consumes.

Each smart contract holds a balance of TON tokens and uses this balance to pay rent. If a smart contract runs out of money, it will eventually be deleted (which can be restored).

Therefore, in the TON public chain, the payment for on-chain storage is not a one-time payment, and the rent for block space is continuous.

If you only store data for a certain period of time, you will pay significantly less. This fee economic model is actually more in line with the cost of the node, so it is easier to scale.

2.3 Address mechanism

Most public chain wallets are implicit, that is, you can use a private key to generate a public key, and then generate an address from the public key. The private key, public key, and address are corresponding. As long as you save the private key, you can use this wallet.

But on TON, wallets are not implicit, if you want to get a wallet, you have to deploy a separate smart contract like any other smart contract.

This address is composed of the wallet contract code and various initialization parameters (such as the user's public key), which means that a user can deploy multiple wallets, each with its own address.

This also means that in TON, even if users know their private keys, they must remember their wallet addresses.

The wallet usage mechanism is also different:

Like Ethereum, when you use an application (i.e. a smart contract), you actually sign a message with your own private key and then send the message to the application;

But on TON, the transaction is not sent to the application's smart contract first, but to the user's wallet contract, which then forwards the message to the application's smart contract.

2.4 Development Language

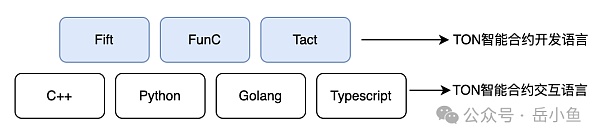

TON has three smart contract programming languages: Fift, FunC and Tact. Tact is a new statically typed high-level programming language launched by TON, which aims to reduce the difficulty of developing smart contracts and improve security.

Tact has two important features:

(1) Asynchronous calls: Tact supports asynchronous calls, so that smart contracts can run in parallel without waiting for other contracts to complete, which enhances the performance and responsiveness of the TON blockchain.

(2) Message-oriented programming: This design eliminates the coupling between callers and receivers. Objects can subscribe to and unsubscribe from messages at any time, which makes dependencies and updates between objects easier.

Although new programming languages can bring many features and give full play to technological advantages, they will hinder the entry of developers and ultimately affect the development speed and prosperity of the ecosystem.

They created an independent development language, which is more complete and advanced than the Solidity language of the Ethereum ecosystem. However, the Ethereum ecosystem already has a relatively mature developer ecosystem, so it is difficult for these developers and mature applications to migrate directly and quickly to their own public chain.

A typical example is Starknet, Ethereum's ZK-based second-layer network. It has a very luxurious financing background and a very strong technical team, but after several years, the ecosystem is still very poor.

The most important thing for a public chain is the ecosystem. It is best to directly migrate applications and developers from the existing ecosystem. New development languages are actually invisible barriers in the process of starting a new ecosystem.

03 Token Economics

3.1 Basic Data

Several core data of TON tokens are as follows:

(1) Initial supply: 5 billion

This initial supply is relatively large, which is why the price of TON coin did not go up for a long time at the beginning.

(2) Supply: No upper limit, will increase by about 0.6% each year

The inflation rate of TON tokens is relatively low, in fact, lower than the inflation rates of Bitcoin and gold, which are 0.85% for Bitcoin and 1.64% for gold.

(3) Current supply: 5.1 billion

Relative to the initial supply, only 100 million coins have been added in the past four years.

(4) Current circulation: 2.4 billion

The circulation rate is 47.61%. Among the top ten tokens by market value, the circulation rate is relatively low, indicating that there are more locked positions in the short and medium term, which is conducive to the increase of coin prices, but in the long run, there is greater selling pressure.

(5) Current price: USD 7 per coin (June 9, 2024)

In June 2022, the lowest price of TON was US$0.73. After a bear market, the price of the currency has increased by 7 times in the current bull market cycle.

(6) Market capitalization: US$17 billion

For the Solana public chain, which is also driven by strong capital, the current circulating market value of SOL tokens is 70 billion US dollars, so the circulating market value of TON is not large.

(7) Total market value: US$35.8 billion

At the peak of the last bull market, SOL's full circulation market value was US$150 billion, and it is currently US$90 billion, so the ceiling of TON's full circulation market value is still very high.

3.2 Token Distribution

TON's token distribution has also been full of twists and turns. At the beginning, some tokens were sold through ICO (Initial Coin Offering), but after regulatory intervention, the team adopted a more traditional PoW model for initial token distribution, that is, to fairly distribute tokens through hardware mining.

Since the TON public chain was designed with PoS as the underlying consensus from the beginning, the core team embedded the "Giver Contract" on TON to implement the PoW token distribution model.

The total amount of tokens allocated by PoW will account for 98.55% of the total supply, while the remaining 1.45% will be held by the core development team.

In June 2022, the last TON token in the contract with a total amount of 5 billion was successfully mined, which also means that TON’s initial token distribution task has been successfully completed.

Although the PoW token distribution model was adopted, the TON project team was mainly responsible for mining in the early stages. Therefore, TON tokens were basically concentrated in the hands of the project team.

One of the core problems currently facing TON is that the token issuance of the TON public chain is too large and the token distribution is concentrated. This is also one of the historical burdens left over from the Telegram Open Network era, but the TON Foundation and the community are doing their best to solve this problem.

On July 28, 2023, TON communities from different language backgrounds jointly established TBF (TON Beliver Fund).

The organization has launched a special smart contract, and the funds for interaction are divided into two parts: donations and deposits. All donations will be directly issued as additional rewards for deposits, while deposits will experience a 24-month full lock-up period, after which they will enter a 36-month linear unlocking period.

The fund received strong support from the TON Foundation on August 18. The foundation highly recognized this spontaneous token economic optimization behavior and publicly pledged to donate 1 million TON as support in the subsequent community vote.

Thanks to such support, TBF has been developing rapidly. Recent blockchain data shows that TBF's contract address has locked up 970 million TONs, and the annualized deposit rate is even more than 10%, which is almost twice the return of other staking methods on the main network.

3.3 Token Application Scenarios

The application scenarios of TON tokens are mainly divided into two types: public chain fees and Telegram service fees.

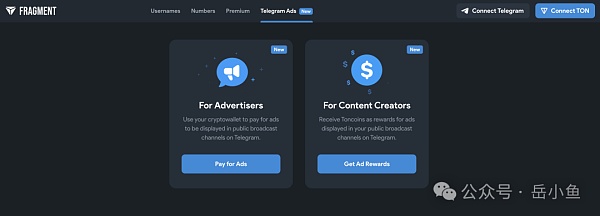

Telegram has built a platform called Fragment, where users can purchase various services of Telegram through TON, which mainly include 4 service scenarios:

(1) Purchase a username: Each username is an NFT and can be traded freely. The username is mainly used for social display;

(2) Purchase a mobile phone number: A mobile phone number is required to register a Telegram account, but users can further enhance their privacy by purchasing an anonymous number on the Fragment blockchain using Toncoin;

(3) Purchase membership: includes multiple advanced features within the Telegram app, such as more cloud space, voice-to-text, real-time translation, etc.

(4) Purchase of advertising services: Advertisers use TON to purchase advertising services and can run their marketing campaigns. The funds are equally divided between Telegram and content creators.

04 Ecological Analysis

The wallet is the entrance, DeFi is the infrastructure, and games are the biggest advantage of the TON public chain.

4.1 Wallet

The wallet is the user's entry point into the public chain ecosystem and is also the first application using the public chain.

Therefore, the user experience of the wallet determines the threshold for users to enter the public chain ecosystem.

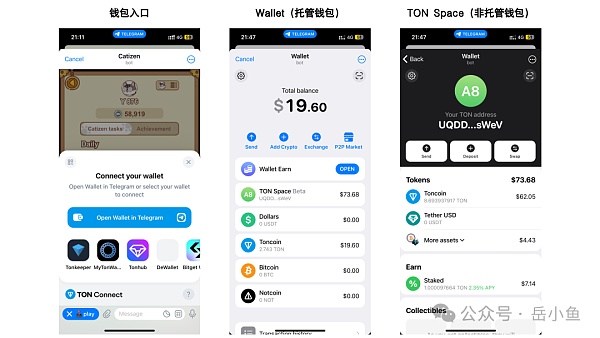

Currently, Telegram has deeply integrated a wallet robot called Wallet.

Wallet Bot is very simple and smooth. The emergence of Wallet Bot is a milestone in Telegram's transformation to Web3. Since then, a large number of Telegram Bots have been launched one after another. The current popular track is various cryptocurrency trading robots to help users improve transaction efficiency.

Wallet is a custodial wallet, and TON Space is a non-custodial wallet extended within Wallet.

When a user uses Wallet, the application actually assigns an address to the user's Telegram account. This address is still controlled by the Wallet application project, so it is a custodial wallet.

The advantage of a hosted wallet is that users do not need to understand the underlying logic of the blockchain and can directly use the wallet address to make payments. At the same time, when transferring money to other contacts on Telegram, no handling fees are charged and the money can be transferred in real time, because this type of transaction is not on the chain and is essentially a data flow. Wallet records the accounts of different users.

The disadvantages are also very obvious. Once the user's own Telegram account is stolen or the Wallet project runs away with the money, the user's assets will be completely lost. In addition, the custodial wallet cannot interact with various applications on the TON public chain.

Therefore, a non-custodial wallet, TON Space, was expanded within the Wallet application.

Users need to keep their own private keys, and the assets are completely controlled by the users.

Therefore, even if the user's Telegram account is stolen or the Wallet project runs away, the user's assets will not be lost. At the same time, with a non-custodial wallet, the user can interact with various applications on the TON public chain.

Of course, the biggest disadvantage of non-custodial wallets is that users need to be able to safely keep their private keys, which means that the risk of asset management is transferred to the users themselves.

In addition to Wallet Bot, the TON ecosystem has several popular wallets, including Tonkeeper, MyTonWallet, etc., but none of these wallets are as deeply integrated into Telegram as Wallet.

Wallet has obvious entrances in Telegram's personal information page, conversation chat box, and wallet connection component.

The maturity of the wallet application has laid the foundation for the development of various decentralized applications in the subsequent TON ecosystem. On the other hand, the wallet application meets Telegram's payment needs and complements Telegram's payment section.

Payment is the most basic, clear and high-frequency financial scenario.

4.2 DeFi

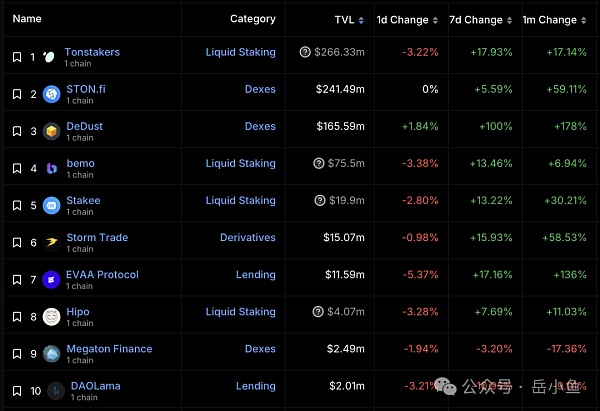

From the TVL (Total value locked) trend chart of the TON public chain, we can see that the TON public chain has risen rapidly since March this year.

The TVL here only includes DeFi applications, but DeFi is the infrastructure of the public chain, which represents the activity and amount of funds of the public chain. Therefore, we can see that the TON ecosystem is rising rapidly and experiencing explosive growth.

What happened at this point in March?

The main reason is that the TON Foundation began to vigorously promote the development of the TON public chain, such as announcing that the Telegram advertising platform will use Toncoin for payments, distributing 30 million TON tokens for liquidity incentives, and cooperating with Tether to launch the USDT stablecoin on the TON public chain.

These major moves are extremely beneficial to the TON public chain ecosystem.

On the other hand, now is the early stage of the bull market, but the industry still lacks sexy narratives, and the story of the integration of TON public chain and social giant Telegram is very attractive, so it has attracted market attention.

It can be said that the concentrated outbreak of TON ecology in recent months is the result of a combination of factors including timing, location, and people.

DeFi (decentralized finance) is an essential application of the public chain.

Once you have assets, you need various financial instruments.

The three pillars of the public chain are exchanges, lending platforms, and stablecoins.

We can see from the list of the top ten DeFi applications by TVL in the TON ecosystem that it basically covers applications such as exchanges, derivatives, and lending.

More importantly, the leading DeFi application is liquidity staking, which is a typical financial application of the PoS public chain. The leading financial application in the Ethereum ecosystem is also liquidity staking Lido.

4.3 Games

Games are the development direction in which TON can truly combine the characteristics of Telegram.

Currently, the TON Foundation is promoting a gaming project called Notcoin and making it a benchmark.

Notcoin is a Click-to-Earn project on the TON ecosystem. It uses Telegram robots to mine tokens by clicking on the mobile phone screen. Completing tasks (signing in, following Twitter, inviting friends, etc.) can increase the number of clicks.

It is precisely because of its simple and crude model that it attracts a large number of users. This game has more than 35 million users and more than 5 million daily active users.

Of course, it’s unclear how many users will actually stay, but this is a remarkable experimental attempt.

Compared with other GameFi projects, users of this size are definitely at the top. For example, the leading blockchain game Axie Infinity had 2.7 million daily active users at its peak, which is far lower than Notcoin's 5 million.

NOT tokens were simultaneously listed on the world’s top two exchanges, Binance and EURUSD. After listing on top exchanges, Notcoin’s market value continued to rise, and its wealth boom attracted more users to join the TON ecosystem.

In addition to Notcoin, there are many games with similar models, such as the popular cat-raising game Citizen and hamster-raising game Hamster Kombat. These games are basically the same as Notcoin. You earn coins by clicking and get more clicks by completing tasks.

The gaming track of the TON ecosystem is still in its early stages. The game mode is too simple, and subsequent user retention is bound to be poor.

Only by deeply integrating with Telegram and utilizing the social relationship chains accumulated in Telegram can we create more interesting games, such as the vegetable growing games, parking space grabbing games, and the enduring card games that were once popular in China.

05 Future Development

Compared with other public chain ecosystems, TON public chain has three core advantages:

(1) Active promoter

The TON Foundation and its related organizations have been actively promoting the development of the TON public chain ecosystem.

In the development of the public chain ecosystem, there are two schools of thought:

One is to govern by doing nothing, that is, the public chain project party will not intervene too much in the development of the public chain, but mainly build a fully free market, which is independently developed by the public chain ecology and community. A typical example is Arbitrum, which has now become the top Layer2 of Ethereum, with a TVL of more than 18 billion US dollars.

The other is strong guidance, where the public chain project party will dominate the development direction of the public chain ecosystem. The advantage of this is that resources can be concentrated on developing the ecosystem, and the development speed will be faster. The disadvantage is that spontaneous innovation in the ecosystem will be suppressed. A typical example is Solana, which is currently one of the top five public chains by market value.

TON adopts the second development model.

(2) Improved infrastructure

The project team behind the TON public chain is very active and strong. Some infrastructure applications of the public chain ecosystem have been embedded in the TON blockchain from the very beginning, rather than being separate applications like other applications built on the blockchain. These include decentralized storage, proxy layer, DNS domain names, payments, sites, etc.

(3) User traffic

Currently, Ethereum has less than 1 million daily active users, but Telegram has 400 million daily active users and more than 900 million monthly active users. Therefore, the TON public chain has huge user traffic. What the TON public chain needs to do is to build various application scenarios and successfully introduce these users into the Web3 world.

What is the biggest problem in the development of the TON ecosystem?

Many people think that encrypted social networking such as Telegram will amplify the risk of fraud, and that an overly free ecosystem will exacerbate various illegal crimes.

But the truth is, the use of blockchain technology can actually improve the ability to track and deal with criminal activities. Blockchain is a completely transparent and open database. Every transaction of the user is permanently disclosed on the chain. Therefore, it is easier to track various illegal transactions.

Compared to the problem of fraud, the complexity of cryptocurrency for new users is the main obstacle to its mass adoption.

Therefore, for TON, the strong guidance of the project party, coupled with capital promotion, has been deeply integrated with Telegram, basically completing the cold start of the project. How to successfully transition hundreds of millions of users to the Web3 world is TON’s biggest challenge, and it is also TON’s most imaginative narrative.