The bottom layer of the currency circle is asset issuance, which is essentially the establishment of casinos in various ways.

1. The explosion of casinos after Ethereum

ETH is the most successful asset issuance project. Although progress is slow, various gambling methods are emerging from ICO to NFT to the ERC20 ecosystem. But it finally ran out of steam after a few years.

And when the ETH model succeeds, from EOS to DOT to SOL, to ARB OP, hundreds of public chains are listed, which actually provides hundreds of new casinos.

There is no innovation in the gameplay of these new casinos. What can be done in the new casinos that claim to be the fastest can actually be done in the old casinos - especially now that the GAS is only 1, it can even be done more safely.

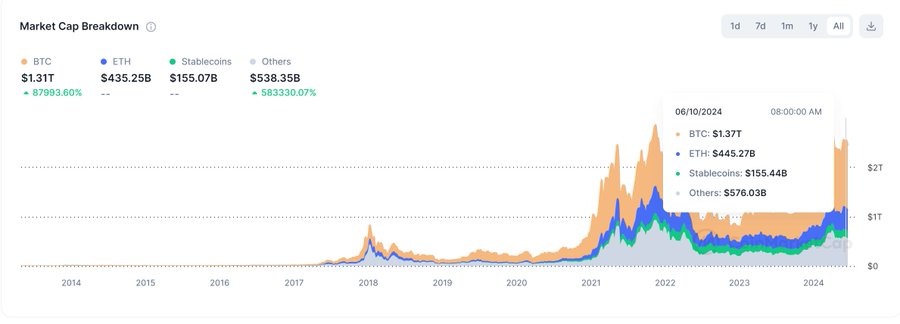

The number of gamblers in the entire region has not increased, and the total amount of chips purchased in casinos has only increased slightly compared with the peak of the bull market in 2021, from 136 billion to 150 billion.

What’s more interesting is that every new casino is still charging membership fees. The bosses and developers built the casino and issued an invitation to all gamblers. Buy my casino pass. Although it has no value, it may There will be other gamblers who want to speculate on this.

2. Casinos exploded, but gamblers decreased.

Now, we can see a situation:

From 2021 to now, 300 new public chain casinos have been opened, and each has launched its own casino pass gambling, but what each casino does is basically the same as the old casino: DEX, lending and MEME, there is nothing new. thing.

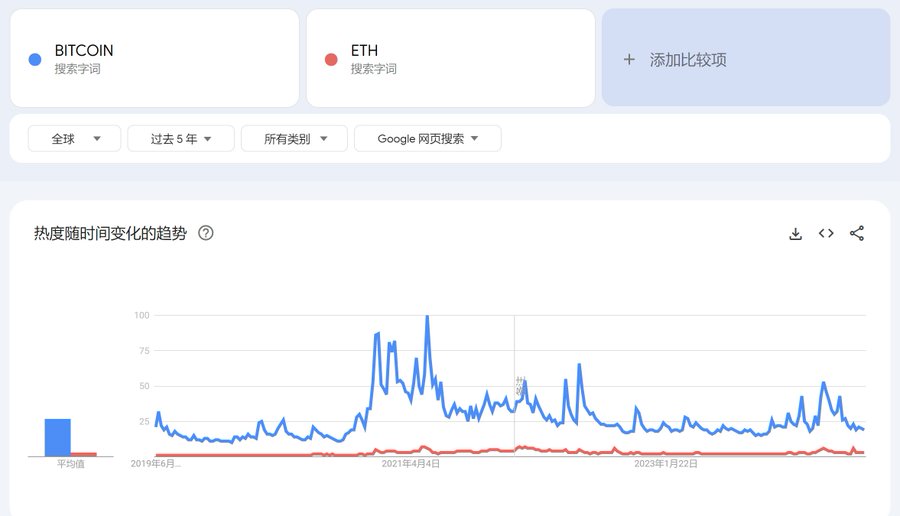

The key point is that the number of gamblers has not increased, but has decreased. According to the GOOGLE index, we can see that there are far fewer people paying attention to BTC and ETH than expected. It is basically similar to the bear market. This wave of BTC looks magnificent. The bull market did not attract much attention. Even before and after the adoption of ETF, it was only a little better than the deep bear market.

BTC, ETH search popularity trends on Google

As for the search volume of ETH, I originally thought that it would be relatively high because of the expectation that the ETF would be approved, but it does not seem to be the case. It is very sluggish - therefore, perhaps after the approval of the ETH ETF, most of the PRICE IN has been achieved.

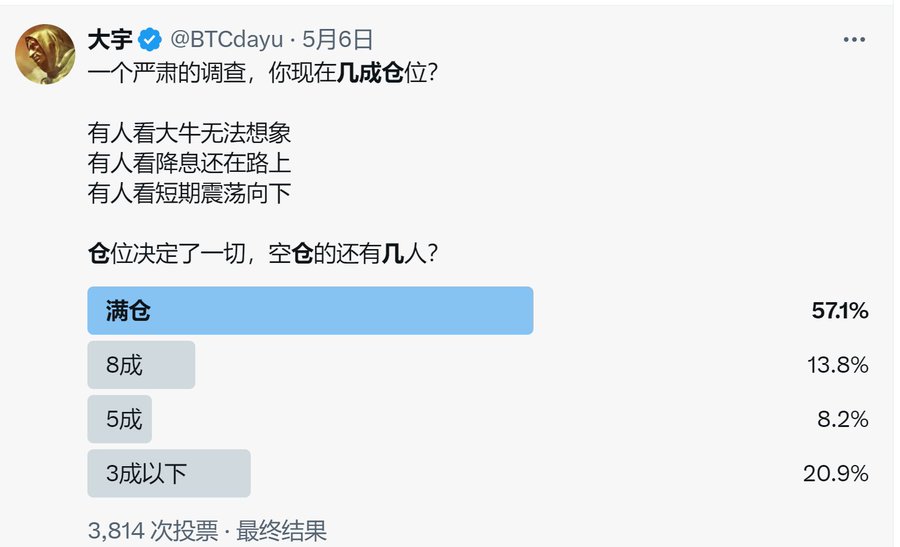

I still remember that I did several surveys on Twitter in April, and found that what was shocking was that the ratio of full positions to 80% positions was relatively high, as shown below:

The author investigated the position status on Twitter

I have conducted several different surveys on multiple platforms, including internal WeChat groups, and the overall results are consistent.

The proportion of full positions is about 70-80%. In hindsight, this survey is still very meaningful - because if everyone is on the bus, they are all waiting for the Altcoin pull, and the Altcoin itself I have already mentioned in the previous article Their terrifying selling pressure has been measured from multiple angles. For example, the selling pressure in May was 3 billion, and in June it should be around 2 billion, and it will continue to grow in the future.

3. Why did the copycats fall so hard?

Because everyone from project developers, market makers to exchanges to retail investors knows that Shanzhai is a speculative game, and of course MEME is even more so. So when everyone is on board, as long as it does not rise, it is dangerous for Shanzhai.

Investment is a friend of time, while holding a copycat is the enemy of time.

This may be why I think it is not appropriate to participate in any pledge. If you participate, you will easily become a person who provides profits. For example, those who participated in RBN pledge were severely deceived by the dealer - this coin was pulled through AEVO, and the other side deceived people into pledging. , I deceived the first sister @heyibinance , and harvested the leeks. It doesn’t matter whether the subsequent projects will be successful or not.

Countless cottages are surging on the road, and every breath of air warmly invites you to get on the bus. However, the blindfolded donkey running wild is now overwhelmed, with sluggish steps and scars, and it is really impossible to hold on.

The exquisite model of low circulation and high fdv combined with the intensive coin issuance in the bull market met the leek with a yellow face and thin skin and gleaming eyes. The scene was terrible.

4. Is "One Yang Changing Three Views" outdated?

A traditional view is that "one Yang changes three views", but I think this statement has actually become outdated inadvertently.

A few years ago, people were still in an ignorant period when they were just starting to fall in love. Pulling the market was indeed the most effective way. But by this year, if you play MEME on the chain, you will find that pulling the market can attract attention, but more and more people People can now calmly look at the project side's independent efforts.

It’s not that the leeks have become better, but that they are really afraid of being cut. The reason behind Yiyang’s change of three views is actually that it takes a long-term upward trend for the three views to be formed. But now if you search among the currencies on the entire network, you will be very surprised. It’s hard to find a pile of 100-fold coins like Binance did in 2021. Basically, Binance would be thankful if it only had 100-fold coins.

As for the chain, let alone mention it. The lifespan of a MEME can be as short as a few minutes or as long as a few days. One second it was blowing to the sky, and the next second it was withdrawn from the pool.

There were too many cuts, so someone summed up the typical law of this bull market, that is, they do not take over each other.

Therefore, behind the expectation of “one Yang changes three outlooks”, there are three questions to consider:

If you are a banker, when Leek is cautious and fearful, how sure are you that your pull will not turn into someone else's shipment?

If you are a leek, are you sure that the banker is super rich and has a good pattern? If you only pull the market but don't smash it, you are full of love for the world? Could it be that he also wants to run away first?

If you are a VC and your 10x-100x chips are finally unlocked, are you willing to wait for the project side to do something, bankers to pull the deal, and retail investors to have FOMO, or are you willing to just sell it where you are?

If everyone thinks so, it will be difficult to copycat, it will be a highly tense drug running game.

5. Future Deduction: AI Vampire Crypto

There will be a copycat bull market, such as water overflowing after interest rates are cut, but that will take a long time, but by then, 90% of current project parties will have unlocked huge amounts, and it is estimated that more than 5 billion will be needed every month - and 50 It is difficult for the market to catch the selling pressure of 100 million yuan. I can see it, and others can also see it.

This will cause the market to run faster, and the people who are most qualified to run are the chips locked by VC and project parties, so considering that more and more project parties have been unlocked since March this year, then this will lead to Shanzhai is a complete game of running fast, and those who run slowly will fall into the poisonous circle.

Conclusion one:

If you want to play, it seems that you can only play with big coins such as BTC and ETH, or participate in Altcoin with very agile skills.

The point is, it is better to make less money than to lose big money - be cautious when getting into the market and avoid falling too much. If you are caught or the momentum is wrong, observe first. When you make money, remember to keep cashing in the profits.

This style of play will test your trading sense, but assuming there is still an opportunity for the market to rise, the mainstream currencies will definitely not be bad, and the risk will be relatively small. You can sell and make less, but you will not suffer a big loss.

What if it simply enters a bear market? Then everyone is miserable, nothing else.

I almost never do short-term trading, so it’s actually quite difficult to judge these things. The way to overcome this difficulty is to control the position. You hold the U firmly and don’t get in and out of the cross margin. It’s much easier to get in a little bit and get out a little bit. .

Conclusion two:

If no new casinos are opened in the crypto and there is no new traffic, the Deep Bear will be even more terrifying in the future.

After the adoption of BTC ETF, BTC has become a target of U.S. stocks. It is a high-risk risky asset. But at present, its attractiveness is far less than that of technology stocks in U.S. stocks. Nvidia continues to hit new highs, Apple, Microsoft, and GOOGLE. And so on.

There is actually a major logical change behind this - the time when the crypto was booming has passed.

A math problem:

You can think of ETH as "innovation at the level of human civilization", but unfortunately there are only a few valuable applications such as DEX and lending. Other things such as PREP DEX at the top may have a daily activity of several hundred, so what about this thing? It is really far away from “achieving innovation at the level of human civilization”.

This thing is now worth 400 billion.

Musk's Tesla is now worth 500 billion. It is a multi-faceted behemoth in the future with global autonomous driving systems + artificial intelligence robots + massive AI data.

Looking at BTC again, we people in the crypto can shout randomly: Bitcoin will be worth 1 million US dollars in the future!

But friends, after entering the US stock market, the current market value of BTC is 130 million. If it doubles again, it will be almost on par with NVIDIA - and now NVIDIA is generally considered to be the cornerstone of the AI era, and the AI era is considered to be the next step after the steam revolution and The third largest civilizational leap after the Internet.

Not to mention 1 million US dollars, even if it rises to more than 100,000 US dollars, surpassing Nvidia becomes unreasonable.

Now let’s summarize:

1. The valuation of some projects is not low. Compared with the value targets of US stocks, the valuations of BTC and ETH, the top value coins in the crypto, are already not low.

2. The ecological project bubble is huge. Ecological projects in the crypto generally have huge bubbles and huge selling pressure - people are not sober enough to stop playing Altcoin, but they are playing MEME because they were cut off by Altcoin.

The market value of Altcoin is 10 billion, there are 30 people alive on the chain, and the selling pressure of 500 million every month is waiting for you to digest it. Where is the value?

3. MEME is not sustainable.

MEME is consensus and emotion, and PEPE is the most eye-catching representative among them. But after it rises to billions of dollars, if you want to go up again, the amount of funds required will be larger and larger. There will be no massive funds like Musk in 21 years. The top KOLs use their social media to shout 100 billion to each other - I have seen this too many times among NFT families, and every time it is the one who shouts the loudest and cuts me the most.

As we all know, I love MEME the most because I am personally the most sensitive to emotions, communities, markets, and narratives, so I make a lot more money from it than value coins. But just because I understand MEME, I don’t think MEME can carry it. Start a round of copycat giants.

How speculative the mood of MEME is and how fanatical the participants are, how tragic the crash will be. Please believe this. This is the objective law of the world.

4. AI will continue to suck blood. The AI narrative of U.S. stocks is attracting big money from around the world, and they are revolutionizing. All this will continue in the context of low value and high bubbles in the crypto.

What if the U.S. stock market crashes? Sorry, the crypto will only collapse more miserably.

The last sentence summarizes: The adoption of ETH ETF will only be a short-term benefit. The combined efforts of the above-mentioned parties will most likely force the market to move in the direction of least resistance.