Bitcoin Cash (BCH) showed significant growth in April, making it one of the best-performing assets.

But the recent decline not only nullified all that, but also widened the losses to a point where they could no longer be recovered.

Bitcoin Cash growth invalidated

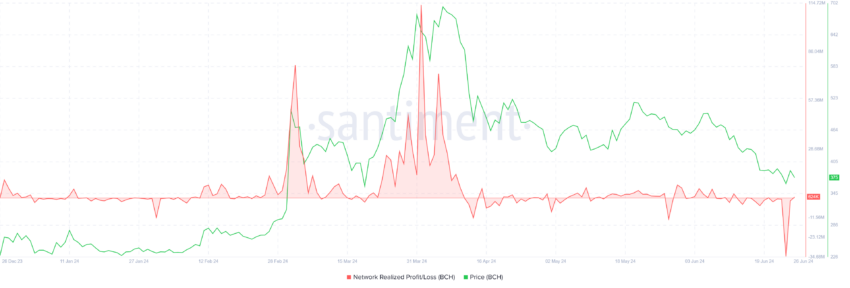

As the price of Bitcoin Cash fell, investors realized significant losses, which is clearly visible in the network realized profit/loss metric. This is likely to prevent investors from selling at a loss and encourage them to hold on to their investments until market conditions improve.

This strategy reflects the common approach of investors seeking to recover losses rather than materialize them in a declining market environment.

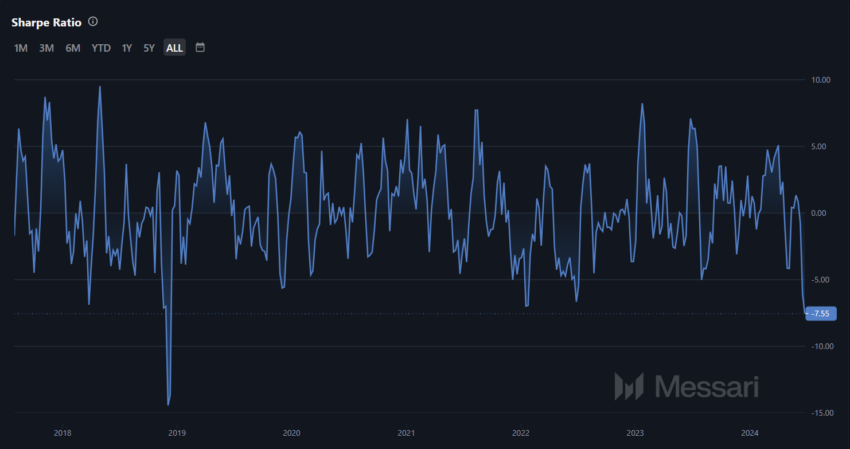

Additionally, Bitcoin Cash's Sharpe ratio hit a five-year low of -7.55. This shows that its attractiveness as an investment option has decreased compared to other assets.

The Sharpe ratio is a measure of risk-adjusted returns and suggests that Bitcoin Cash has had a poor return-to-risk ratio over the past five years. This indicator may further persuade potential investors who prioritize stable returns against a backdrop of significant volatility.

So while Bitcoin Cash faces significant obstacles such as high realized losses and low Sharpe ratio, investor sentiment remains divided. While some see current market conditions as an opportunity to acquire assets at a discount, others may be hesitant to invest due to the assets' risk-adjusted performance metrics.

Read more: How to Buy Bitcoin Cash (BCH) and Everything You Need to Know

However, most will stick to the idea of waiting for the market to improve before re-entering.

BCH Price Prediction: Another Cliché Chart

Unfortunately, the price of Bitcoin Cash has fallen significantly , plummeting from $501 to $375 at the time of writing. Bitcoin's namesake cryptocurrency has recovered slightly from its lows of $350, but still has a long way to go.

Considering the state of altcoins, it would be wise to stay away from the asset for now. A recovery is underway, but we will likely see confirmation of the same once BCH crosses $429.

A move towards support would be a sure sign of bullish conditions , making the altcoin a decent investment option.

Read More: Bitcoin Cash (BCH) Price Prediction 2024/2025/2030

However, if market conditions do not improve, Bitcoin Cash could fall to $344. A bottom at this level and a decline to $379 would invalidate the bullish logic.