Highlights of this issue :

1. Is the huge amount of shorts on CME worth fearing?

2. Hong Kong ETFs will only start to gain volume after two months

01

X Viewpoint

1.qinbafrank (@qinbafrank): There is still a lot of room for BTC ETF

According to the meeting notes of the Coinbase Summit, the CIO of BlackRock ETF said that 80% of Bitcoin ETFs were purchased through self-directed brokerage accounts, and financial advisors are still very cautious, which means that channels such as brokerages, banks, and financial advisors are not fully open, and they should still be in the early stages of learning about new assets and waiting for further clarification of regulations.

The problem with regulation is that the rules are set, but there is no good team to implement them and clearly define the boundaries. If the regulation is clear, it will push institutional investment from 1-2% to 5-10%, which should be a big improvement.

2. PANews(@PANewsCN): Two months from now may be the key node for the growth of Hong Kong ETFs

Reviewing the recent performance of Hong Kong virtual asset ETFs: banks have not yet distributed them, and multiple processes need to be fine-tuned.

It has been one and a half months since the six virtual asset ETFs in Hong Kong were listed on April 30, and the market is still in the running-in period. As of June 13, the total number of Bitcoins held by Hong Kong ETFs was 4,070, with a total net asset value of US$275 million. In terms of Ethereum spot ETFs, the total number of ETH held by Hong Kong ETFs was 14,030.

Industry experts analyzed that the trading volume and scale of Hong Kong's virtual asset ETFs are inverted, and the various stakeholders are "making up for lost time" due to the early approval of the ETF, with different institutions working together to clear bottlenecks.

Two months later may be the key point for increasing volume.

3. Crypto_Painter (@CryptoPainter_x): The subtle relationship between BTC spot ETF and CME's huge short positions!

CME refers to the Chicago Mercantile Exchange, which launched BTC futures trading at the end of 2017 with the commodity code: [BTC1!]. Subsequently, a large amount of Wall Street institutional capital and professional traders entered the BTC market, dealing a heavy blow to the ongoing bull market, causing BTC to enter a 4-year bear market.

As more and more traditional funds enter the BTC market, institutional traders (hedge funds) and professional traders that CME mainly serves begin to participate more and more in BTC futures trading;

During this period, CME's futures open interest has been growing, and it successfully surpassed Binance last year to become the leader in the BTC futures market. As of now, CME's total BTC futures open interest has reached 150,800 BTC, equivalent to about 10 billion US dollars, accounting for 28.75% of the entire BTC futures trading market;

Therefore, it is no exaggeration to say that the current BTC futures market is not controlled by traditional crypto exchanges and retail investors, but has fallen into the hands of professional institutional traders in the United States.

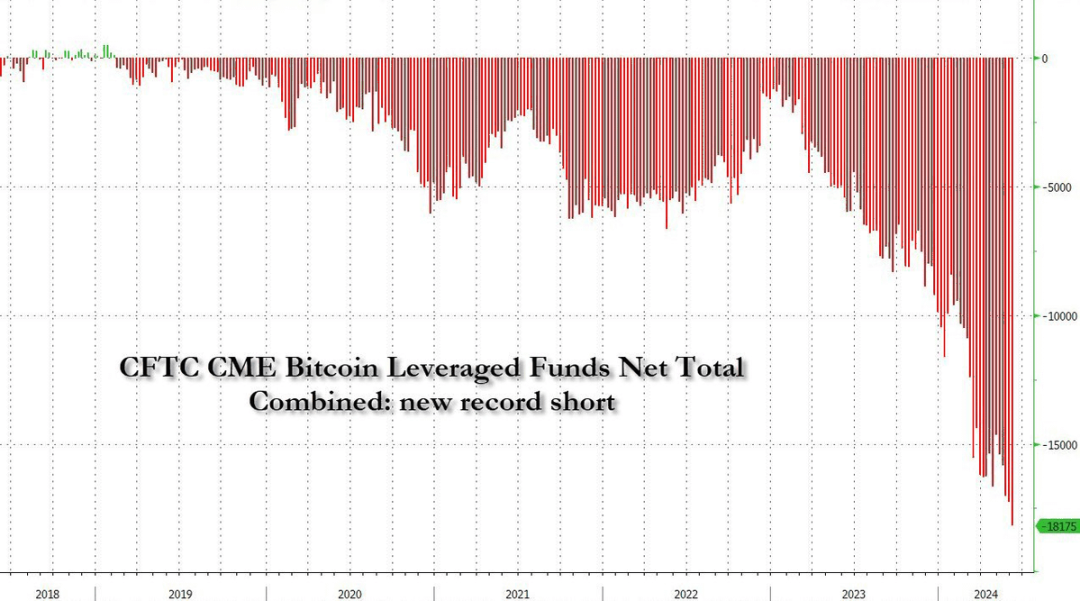

As more and more people have discovered recently, CME's short positions have not only increased significantly, but have recently broken through a record high and are still rising. As of the time I am writing this article, CME's short positions have reached 5.8 billion US dollars, and the trend has not shown any obvious slowdown;

Does this mean that Wall Street’s elite capital is short BTC on a large scale and is completely pessimistic about the future performance of BTC in this bull market?

If we simply look at the data, this is indeed the case. Moreover, BTC has never experienced a situation where it has broken through a historical high in a bull market and then remained volatile for more than 3 months. All signs indicate that these big funds may be betting that this round of BTC bull market is far less than expected.

Is this really the case?

Next, let me explain to you where these huge short positions come from, whether we should be afraid, and what impact this has on the bull market.

First, if you frequently check CME prices, you will find an interesting feature: BTC1! The price of this futures trading pair is almost always at least several hundred dollars higher than the Coinbase spot price. This is easy to understand because CME's BTC futures are delivered on a monthly basis, which is equivalent to the swap contract of the month in traditional crypto exchanges.

Therefore, when market sentiment is bullish, we can see that swap contracts often have different degrees of premium. For example, the premium of the second quarter contract in a bull market is often very high.

If we subtract Coinbase’s spot price from CME’s BTC futures price (they are both USD trading pairs), we get the following chart:

The orange curve is the trend of BTC price at the 4h level, while the gray curve is the premium of CME futures price relative to CB spot price;

It can be clearly seen that the CME futures premium fluctuates regularly with the monthly contract rollover (automatically moving positions to the next month's contract), which is similar to the swap contract premium of traditional exchanges in the crypto. They will have a higher premium when the contract is generated, and when the contract is about to expire, the premium is gradually smoothed;

It is precisely because of this rule that we can carry out a certain degree of futures-spot arbitrage. For example, when the quarterly contract of the CEX exchange is generated, if the market has just experienced a period of bull market and its premium has reached 2-3%, then we can take out 2 million US dollars and buy 1 million US dollars of spot respectively, and open a 1 million US dollar short order on the quarterly contract at the same time;

During this period, no matter how the price fluctuates, the short position will hardly be liquidated. As long as the premium is gradually smoothed out before the expiration of the quarterly contract, a stable 2% return of 1 million US dollars, or 20,000 US dollars, can be obtained without risk.

Don’t underestimate this little bit of profit. For large funds, this is a high return with almost no risk!

To do a simple calculation, CME generates a new contract once a month on average. Starting from 2023, the average premium is 1.2%. Taking into account the transaction fee of this operation, let's calculate it as 1%. That means a fixed 1% risk-free arbitrage opportunity every month over the course of a year.

Calculated 12 times a year, the risk-free annualized return is about 12.7%, which is already higher than the yield of most money market funds in the United States, not to mention earning interest by depositing the money in a bank.

Therefore, at present, CME's futures contracts are a natural arbitrage venue, but there is still a problem. Futures can be opened on CME, but where can spot be bought?

CME serves professional institutions or large funds. These customers cannot open a CEX exchange account to trade like us. Most of their money also belongs to LP, so they must find a compliant and legal channel to purchase BTC spot.

What a coincidence! BTC’s spot ETF has been approved!

At this point, the closed loop is completed. Hedge funds or institutions make large purchases on US stock ETFs and open equal short orders on CME, making risk-free fixed arbitrage once a month to achieve a stable return of at least 12.7% annualized.

This set of arguments sounds very natural and reasonable, but we cannot just rely on words, we also need to verify it with data. Are institutional investors in the United States actually engaging in arbitrage through ETFs and CME?

As shown below:

I have marked the periods of extremely low CME futures premium since the ETF was approved, and the sub-chart indicator below is the BTC spot ETF net inflow bar chart I wrote myself;

You can clearly see that whenever the CME futures premium starts to shrink significantly and is below $200, the ETF's net inflows also decrease. However, when the CME generates a new contract for the current month, the ETF will see a large amount of net inflows on the first Monday when the new contract starts trading.

This can explain to some extent that a considerable proportion of the ETF's net inflows are not simply used to buy BTC, but are used to hedge the high-premium short orders that will be opened on CME.

At this time, you can turn to the top and look at the data chart that counts CME futures short positions. You will find that the time when CME's short positions really began to soar by 50% was exactly after January 2024.

The BTC spot ETF will also officially start trading after January 2024!

Therefore, based on the above incomplete data, we can draw the following research conclusions:

1. CME's huge short positions are likely to be used to hedge spot ETFs, so its actual net short position should be far less than the current $5.8 billion, and there is no need for us to panic because of this data;

2. ETFs have received a net inflow of $15.1 billion so far, and it is likely that a considerable portion of the funds are in a hedging state, which explains why the second highest single-day ETF net inflow in history (US$886 million) in early June and the ETF net inflow for the entire week did not lead to a significant breakthrough in the price of BTC;

3. Although CME's short positions are very high, they have already seen a significant increase before the ETF was approved. There was no significant liquidation during the subsequent bull market from $40,000 to $70,000. This shows that there is likely to be funds among US institutional investors that are firmly bearish on BTC, and we should not take it lightly;

4. We need to have a new understanding of the daily net inflow data of ETFs. The impact of net inflows on market prices may not necessarily be positively correlated, and there may also be a negative correlation (large purchases of ETFs lead to a drop in BTC prices);

5. Consider a special case. When the CME futures premium is eaten up by this group of arbitrage systems one day in the future and there is no potential arbitrage space, we will see a significant reduction in CME's short positions, corresponding to which is a large net outflow of ETFs. If this happens, don't panic too much. This is simply the withdrawal of liquidity from the BTC market to find new arbitrage opportunities.

6. The last thought is, where does the premium in the futures market come from? Is the wool really on the sheep? I may do new research on this later.

02

On-chain data

Ember: Brother Sun is here to sell Altcoin again

Brother Sun is selling altcoins again: At 19:00 on June 17, Brother Sun transferred 6.224 million $CRV ($2.07M) to Binance. Among these CRVs, Brother Sun bought 5 million of them from the founder of Curve at $0.4 OTC in August last year. In addition, some small amounts of altcoins were transferred to Binance together with CRV: MATIC/TRU/GAL/PROS/WOO.

03

Sector Interpretation

According to Coinmarketcap data, the top five currencies in terms of 24-hour popularity are BEER, ZK, ANDY, STRK, and IO. According to Coingecko data, in the crypto market, the top five sectors with the highest growth are Avalanche Ecosystem, Trustswap Launchpad, FTX Bankruptcy Assets, Blast Ecosystem, and HECO Ecosystem.

Hot Spot Focus - A Review of New and Unique Products in Base Ecosystem: Onchain Summer is Coming

In the early morning of June 14th, Beijing time, Base officially issued a statement hinting at a cooperation with the world-class sports brand Adidas. For a time, speculation about a new round of Base Onchain Summer once again became the focus of market attention. Odaily will briefly review and introduce some representative products of the Base ecosystem in this article for readers' reference.

AlfaFrens: AlfaFrens is a new SocialFi application built on the Base ecosystem and Farcaster protocol. It was developed by Superfluid, a startup that supports on-chain asset flows. It allows users to subscribe to KOLs and access exclusive chat rooms with DEGEN tokens. It can be seen as a "copycat product" of Friend.tech and has currently conducted two rounds of airdrops.

Gemz: This social project that Jesse Pollak, head of the Base protocol, is following, once set off a "social fission craze" in April, but later it may have been inspired by the TON ecosystem game project Notcoin and transformed into a social fission game project of Tap2Earn. Currently, the number of people in the official Telegram channel is about 520,000, and the number of fans of the official account is about 430,000. No coins have been issued yet.

Drakula: This product has been mentioned before. It can be regarded as a "Web3 version of Tik Tok" short video social platform. It has previously received an ecological incentive prize pool of 20 million DEGEN. It still has a creator fund worth $1 million open to many creators. The platform also draws on Friend.tech's token fan economy model and has not yet issued any coins.

Bountycaster: This is a task program created by Linda Xie (former co-founder of Scalar Capital and product manager of Coinbase). It is also built on the Farcaster protocol. Users can publish tasks by adding the tag @Bountybot when sending content through clients such as Warpcast. Other users can take on corresponding tasks and get corresponding rewards. No coins have been issued yet.

BlackBird: Blackbird has chosen to build a bridge between restaurants, hotels and users, and has become one of the few "consumer-friendly applications" in the Web3 and Base ecosystems by serving users with programs such as FLY loyalty points. It completed a $11 million seed round of financing in October 2022 and a $24 million Series A round of financing in October 2023.

Unlonely: This is an on-chain live broadcast platform based on the Base ecosystem, which has previously received investment from institutions such as Multicoin Capital and Coinbase Ventures. The application innovatively creates a unique viewing experience for users by integrating gamified on-chain functions into live broadcasts.

Wrapshop: This is a shopping store application similar to the "WeChat Mini Program Mall", and is built on the Farcaster ecosystem. Users can build their own "Farcaster Eco Mall" in a few simple steps to sell some of their own physical or virtual products, including clothing, artworks, etc.

Bolide: A meme interactive product that previously received the 10th Base Ecosystem Builder Grants award. According to its official documentation, “The Bolide application is a smart self-hosted Web3 application that leverages the user experience of Web2 to unleash the power of Web3 and allows users to hold, track and trade their crypto assets as well as access all “Bolide Earn” features.

GAME: BASE ecosystem Meme project GAME previously announced that it will launch the first Meme Game in the MemeFi track to provide Meme holders with a gamified social experience. Players can engage in Meme PVP battles in the game and obtain GAME tokens. The first cooperation is RUNE ecosystem project DOG. Players who use DOG to play games can get GAME airdrops. Thanks to this, the price of GAME once soared by 40%.

Paragraph: An on-chain newsletter and publishing platform for the Base ecosystem, and the main platform tool for Base's official account to release news to the outside world. The platform allows creators to mint their works into NFTs, send newsletters directly to wallet addresses, or earn income through subscriptions. In addition, it has also integrated with social protocols such as Farcaster, Lens, and XMTP, enabling token-based channel creation and creating interactive channels for fan communities similar to "Knowledge Planet".

04

Macro Analysis

Willy Wo: Bitcoin bigwigs selling off caused the decline

The inflow of Bitcoin spot ETF shows that the market is constantly buying, and institutions are also buying, but the market trend seems to be going in the opposite direction, and it keeps falling. Who is selling? Entering 2024, market participants began to focus more on the inflow and outflow of Bitcoin spot ETF, as if these data have become the key to insight into the real dynamics of the market.

What matters is aggregate demand and aggregate supply.

First, let me tell you who is selling. The OGs are selling, and they own 10x more BTC than all ETFs combined. They sell every bull run. This pattern has been around for as long as the Genesis Block of Bitcoin.

To understand this phenomenon more intuitively, we can refer to the following figure: coin age x number of coins sold. This chart reveals OG's selling behavior in the market and its impact on market trends.

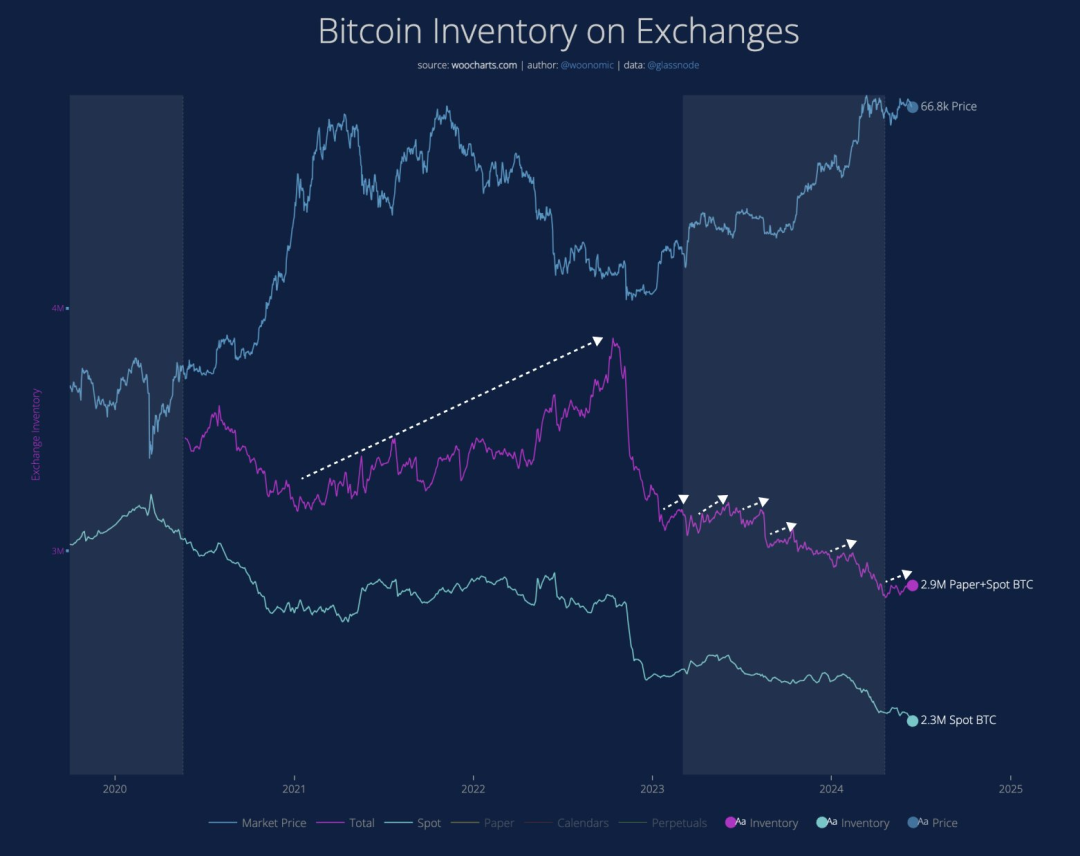

We are now in the "modern era" of Bitcoin. Since 2017, "Paper BTC" (referring to not real BTC) has begun to flood the market.

The futures market is also one of the key factors affecting market trends.

In the past, if you wanted to buy coins, you had to buy real BTC. In recent years, you can buy so-called paper BTC. This means that people who don't have real coins can also sell you that piece of paper.

Together you created synthetic Bitcoin.

This latent demand for BTC is shifted to paper BTC, which is met by counterparty traders who have no BTC to sell and only USD to stake.

In the past, Bitcoin’s price was able to grow exponentially because the only sellers were small sales from early holders and small amounts of newly mined coins sold by miners.

Now, you should pay more attention to the magic of "paper BTC".

The 2022 bear market was caused by the proliferation of “paper BTC” when in fact real spot holders were not actually selling.

During the current bull run, I have marked periods of increased paper BTC that were not accompanied by an increase in price.

We are at such a stage now.

Therefore, simply focusing on ETF purchases is not enough to fully grasp market trends. It is also necessary to pay attention to factors such as on-chain data, derivative data, and technology price trends.

All of these factors add to the complexity of demand and supply.

Analyzing them together is more of an art than a quantifiable science.

In this volatile market, everyone is just making logical guesses.

05

Research Reports

PANews: Hong Kong crypto ETFs have not yet gained momentum, and banks are unwilling to distribute them

It has been one and a half months since the six virtual asset ETFs in Hong Kong were listed on April 30, and the market is still in the running-in period. On the one hand, traditional banks have not yet distributed these virtual asset ETFs, but on the other hand, some brokerages are actively promoting the layout. For example, Victory Securities' VictoryX trading app has now opened the deposit and withdrawal functions of USDT and USDC to professional investors.

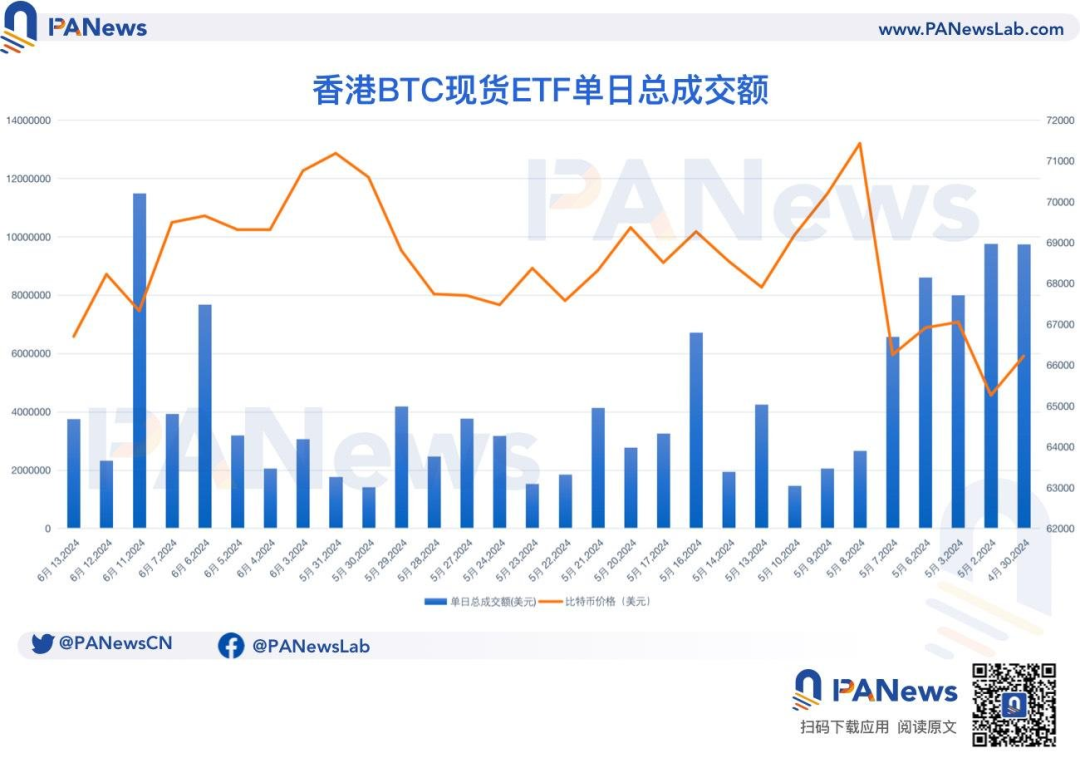

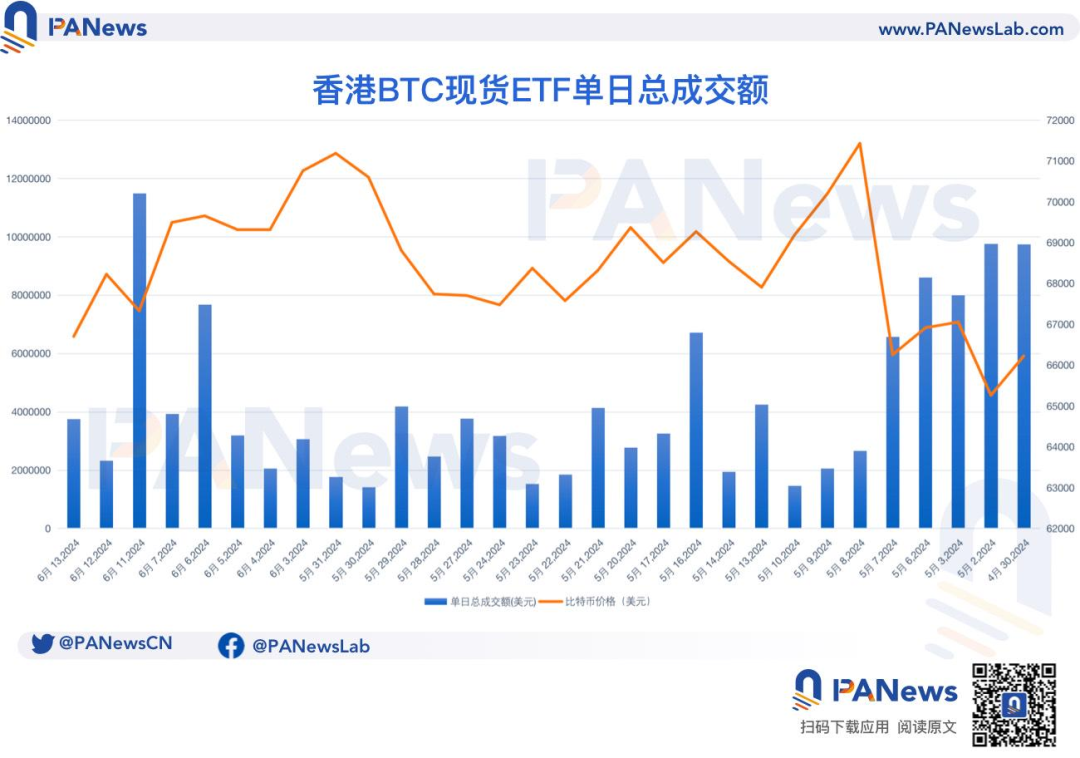

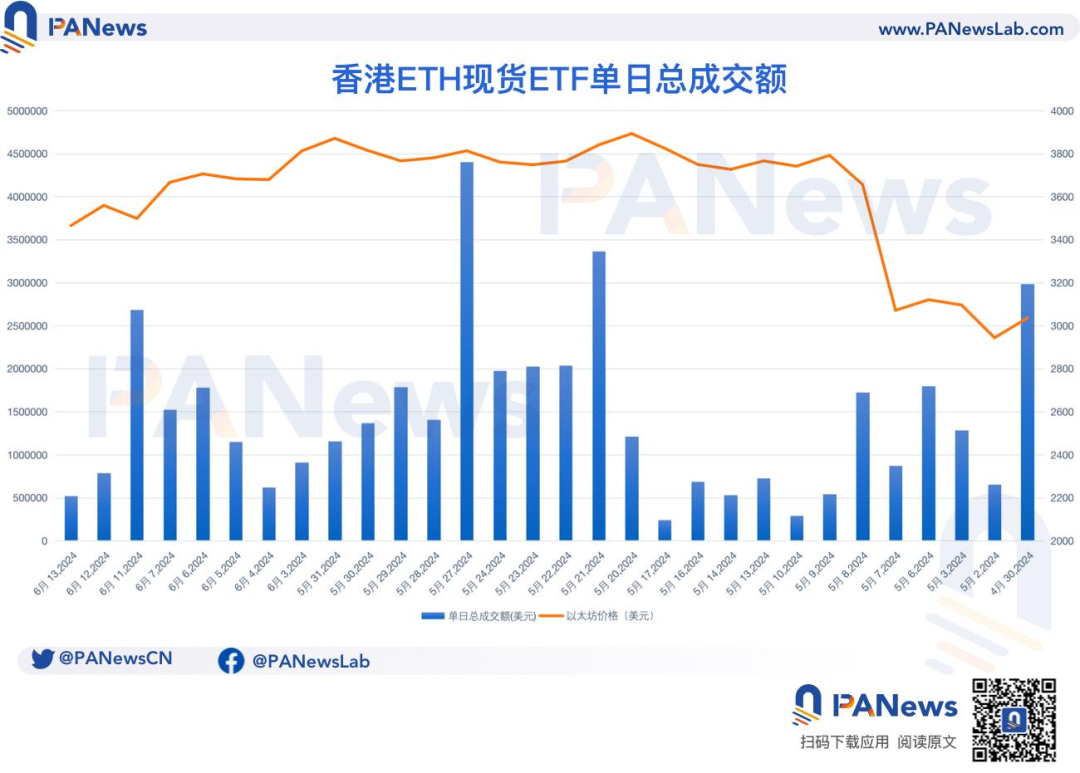

Specifically in terms of market trading volume performance, data from SoSo Value shows that during this period, the average daily total transaction volume of Hong Kong BTC spot ETF was US$4.3215 million, reaching a historical high of US$11.4984 million on June 11; the average daily total transaction volume of Hong Kong ETH spot ETF was US$1.4354 million, with the highest point occurring on May 27, which was US$4.4042 million.

Industry experts have analyzed that the trading volume and scale of Hong Kong virtual asset ETFs are inverted, and the stakeholders are "making up for lost time" due to the early approval of ETFs, and different institutions are working together to clear bottlenecks. Two months later may be the key node for volume growth.

1. After one and a half months on the market, how do the six virtual asset ETFs perform?

According to public data, the issuance scale of Hong Kong's three Bitcoin spot ETFs on the first day on April 30 reached US$248 million (Ethereum spot ETF was US$45 million), far exceeding the initial issuance scale of the US Bitcoin spot ETF on January 10 of approximately US$125 million (excluding Grayscale), which also shows that the market has high expectations for the subsequent performance of Hong Kong crypto ETFs.

Judging from the initial trading volume, the market's criticism of these six Hong Kong crypto ETFs is concentrated on their "poor" performance relative to US crypto ETFs: on the first day of listing, the total trading volume of Hong Kong's six crypto ETFs was HK$87.58 million (about US$11.2 million), of which the trading volume of the three Bitcoin ETFs was HK$67.5 million, less than 1% of the total trading volume of the US Bitcoin spot ETF on the first day (US$4.6 billion).

According to SoSoValue data, as of June 13, the total number of bitcoins held by Hong Kong ETFs was 4,070, with a total net asset value of US$275 million. In terms of Ethereum spot ETFs, the total number of ETH held by Hong Kong ETFs was 14,030.

Looking at the situation over the past month, from the perspective of the total daily transaction volume of Hong Kong BTC spot ETF, the total daily transaction volume on June 11 reached 11.4984 million US dollars, reaching a historical high, but it quickly fell back in the next two days. Since its listing, the average daily total transaction volume has been 4.3215 million US dollars. During this period, the average daily total transaction volume of US Bitcoin ETFs was 1.965 billion US dollars.

The highest point of the total daily transaction volume of Hong Kong ETH spot ETF was US$4.4042 million on May 27. Since its listing, the average daily total transaction volume has been US$1.4354 million.

2. Traditional banks have not yet distributed, and two months later may be the key to increasing volume

However, despite the listing of Hong Kong virtual asset spot ETFs for more than a month, no bank has yet listed them. Chris Barford, head of data and analytics at Ernst & Young Hong Kong Financial Services Consulting, told the Hong Kong Economic Times that traditional banks are concerned about anti-money laundering and know-your-customer (KYC) regulatory risks, so they are more cautious about participating in the distribution of products.

Some issuers admitted that banks and securities firms are regulated by different entities, and distribution in banks still needs to wait for the approval of the corresponding regulatory body, and the bank may need time to evaluate. Barford explained that talent shortage is a major challenge. The global market is facing a talent shortage problem. Talents who are more familiar with the world of distributed ledgers and virtual assets are needed, and combined with financial services and regulatory knowledge. While implementing technical solutions, it is necessary to reach the risk control level of traditional banks or financial institutions before these products can be more accepted.

At the same time, as traditional financial institutions, some Hong Kong securities firms are planning to provide trading services for virtual assets such as Bitcoin.

For example, Hong Kong-based brokerages such as Victory Securities, Tiger Securities, and Interactive Brokers have all launched corresponding services, allowing investors to trade virtual assets such as Bitcoin on brokerage apps. According to China Securities Journal, some brokerages said that revenue related to virtual assets may account for about a quarter of the company's revenue. According to PANews , although many brokerages support the purchase of the above-mentioned ETF products, some larger brokerages also do not actively recommend virtual asset ETFs to customers for regulatory considerations.

On May 6 this year, Tiger Brokers (Hong Kong) announced the official launch of virtual asset trading services, supporting 18 currencies including Bitcoin and Ethereum, becoming the first online brokerage in Hong Kong to support securities and virtual asset trading through a single platform. On June 17, Tiger Brokers (Hong Kong) announced that it had been approved by the Hong Kong Securities Regulatory Commission to upgrade its license and officially expand the service to retail investors in Hong Kong. At present, retail investors in Hong Kong can trade Bitcoin and Ethereum, as well as stocks, options, futures, U.S. Treasury bonds, funds and other global assets at an affordable cost through Tiger Trade, the flagship investment platform of Tiger Brokers, to achieve seamless allocation and management of virtual assets and traditional financial assets.

In addition, on November 24 last year, Hong Kong Victory Securities stated that it became the first licensed corporation in Hong Kong to be approved by the Securities and Futures Commission to provide virtual asset trading and consulting services to retail investors. Also on November 24 last year, Hong Kong Interactive Brokers also obtained a license for virtual asset trading for retail customers in Hong Kong, allowing trading in Bitcoin and Ethereum.

Investors need to open a virtual asset account to trade virtual assets such as Bitcoin on brokerage apps. Brokerages have set a low entry threshold for virtual asset trading, starting at $100.

Jupiter Zheng, a partner of Hashkey Capital's secondary fund, recently wrote that the trading volume and scale of Hong Kong's virtual asset ETFs are inverted. This actually reflects a "structural" undercurrent - the various stakeholders are polishing the process and unblocking the bottlenecks. Especially for physical subscription and redemption, it is necessary to promote the process and promote the running-in between different institutions such as dealers (PD), securities companies, custodians/exchanges, and market makers to unblock the bottlenecks. Two months later may be the key node for volume growth.

In addition, the key force for the scale of Hong Kong's virtual asset ETFs in the future will come from institutional investors. Ernst & Young's survey found that many institutional investors expect to increase their allocation to virtual assets in the next 2 to 3 years. If the assets under management exceed US$500 billion, most of them will invest about 1% of their assets in some form of virtual currency, and most family offices also dabble in virtual currency. Large investors believe that the return rate of virtual assets may outperform the market in the future, but the value is volatile. If this risk can be managed, virtual assets are an attractive asset class.

Looking ahead, although the current performance of Hong Kong virtual asset ETFs needs to be improved, the market potential of Hong Kong virtual asset ETFs is still worth looking forward to as more brokerages provide related services, the possibility of bank distribution increases, and institutional investors' interest in virtual assets increases.