According to a report on July 19, as the listing date of ETFs approaches, competition among issuers is becoming increasingly fierce. In order to attract investors, several Ethereum ETFs that are about to be listed have announced that they will provide fee discounts or complete exemptions in the early stages of listing, with the discount period ranging from six months to one year, and the specific discount ranges from full exemption to about 50%.

In the cryptocurrency world, Bitcoin often gets all the attention as the reigning champion of cryptocurrencies. However, Ethereum, the world’s second-largest crypto asset, is quietly harbouring huge potential beneath the surface.

If you want to know more about the crypto and get first-hand cutting-edge information, please visit Weibo Dolphin 1 for more good articles .

While Bitcoin dominates the headlines, Ethereum offers a wealth of investment opportunities thanks to its intrinsic value and innovative applications. Despite high expectations for Ethereum’s recent Dencun upgrade, the crypto asset has yet to escape the clutches of the bear market.

As we edge closer to mid-2024, the price of Ethereum hit $3,401.13 on July 19, down 30.28% from its peak and 3.61% over the past month. However, this downturn has not dampened the enthusiasm of Ethereum enthusiasts, who see volatility not only as a risk but also as a harbinger of potential rewards.

According to the latest documents submitted to US regulators, seven of the 10 proposed spot Ethereum ETFs scheduled to be listed next week have explicitly announced fee reduction measures. This move is aimed at rapidly increasing the size of assets under management (AUM) by lowering the cost threshold for investors. However, not all ETFs have joined the fee war. Grayscale Ethereum Trust (ETHE) and Invesco Galaxy Ethereum ETF have chosen to keep the original fee structure unchanged.

It is worth noting that Franklin Templeton's Franklin Ethereum ETF (EZET) has emerged as a leader in the fee competition. The ETF announced that it will completely waive management fees within the first year of listing or before the asset management scale reaches US$10 billion. In addition, its benchmark fee is also set at 0.19%, the lowest among similar products.

In contrast, Grayscale Ethereum Trust (ETHE) has attracted much attention for its high 2.5% long-term management fee. However, Grayscale has also launched a new mini trust fund to meet market challenges with a more competitive fee structure. In the early days of the mini trust fund, Grayscale lowered the base fee of 0.25% to 0.12%, and the preferential period is also 12 months or until the asset management scale reaches US$2 billion.

ETH Price Analysis

If the market reaction exceeds expectations, Ethereum may rise further. In contrast, Ethereum's ETF is expected to have a greater impact than Bitcoin, which has achieved a significant increase since the launch of the ETF.

Ethereum has the advantage of having zero short-term inflation and 28% of its supply locked in staking. Echoing the optimism surrounding Bitcoin futures in 2017, Ethereum’s latest financial product could similarly surprise the market, potentially pushing its value to an impressive $6,500.

Current Market Conditions

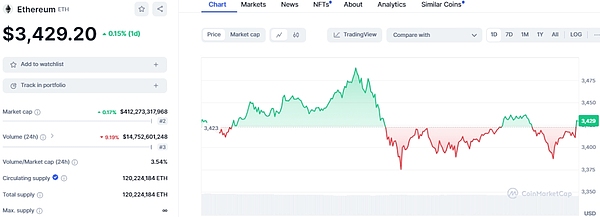

Despite a rebound of more than 23% from its recent two-week low of $2,813, Ethereum (ETH) is still facing bearish pressure. At press time, the cryptocurrency is trading at $3,429, reflecting an 11.66% gain on the week and a slight increase of 0.15% over the past day.

However, the monthly performance shows a 3.83% decline from its opening price of $3,580. A break above this threshold could change market sentiment, paving the way for ETH to break out of its bearish trend and set new highs. Further fueling this optimism is the expected launch of an Ethereum ETF next Tuesday, which could spark a surge in positive price action.

Meanwhile, ETH’s market cap remains strong at $412.27 billion with 120,224,184 ETH in circulation, maintaining its position as the second-largest cryptocurrency. However, trading volume tells a different story, falling 9.19% to $14.75 billion over the past 24 hours, suggesting a possible slowdown in trading activity.

The article ends here. Follow Weibo Dolphin Dolphin 1 for more good articles. If you want to know more about the relevant knowledge of the crypto and first-hand cutting-edge information, please consult me. We have the most professional communication community, publishing market analysis and high-quality potential currency recommendations every day. There is no threshold to join the group, and everyone is welcome to communicate together!