Bitcoin (BTC) price has surged past $67,000, its highest in a month, after weeks of declines.

This price rise is coupled with improvements in several indicators of Bitcoin, a representative digital asset.

Why is Bitcoin price soaring?

On July 19, the price of Bitcoin rose about 5% to $67,386, its highest in a month since June 13. However, it has now fallen slightly and is trading at around $66,554 at press time.

Market analysts have linked this rise in prices to several factors, including the end to selling pressure from the German government. Recently, the German government sold 49,858 BTC in several transactions, generating approximately $2.8 billion.

Read more: Bitcoin (BTC) price prediction for 2024/2025/2030

Additionally, a recent Reddit survey alleviated concerns that creditors of hacked cryptocurrency exchange Mt. Gox would rush to sell off their Bitcoin payouts. More than half of respondents said they plan to hold on to their Bitcoin even after receiving their payout.

Additionally, the Bitcoin ETF is seeing new capital inflows , surpassing $1 billion this week. The recent decline in Bitcoin prices may have attracted new investors who were not previously exposed to the top cryptocurrency, according to Gemini's note.

“Investors allocating to Bitcoin spot ETFs are new market entrants who previously did not have direct access to physical Bitcoin, and may be using this market decline as an opportunity to increase their exposure to Bitcoin,” Gemini explained . I did .

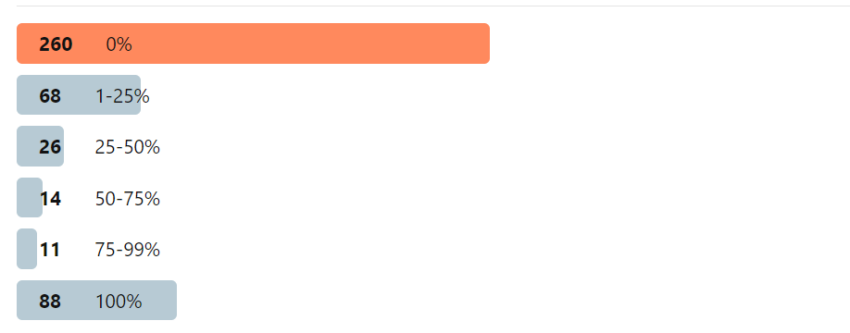

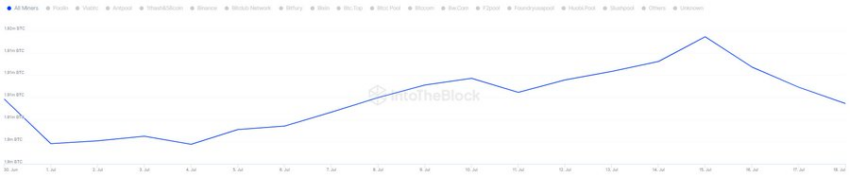

Additionally, the capitulation of Bitcoin miners appears to be easing as miners begin to accumulate assets again. Last June, BeInCrypto reported that Bitcoin miners sold 30,000 BTC worth about $2 billion in a record-breaking capitulation similar to the one following the collapse of the FTX exchange in November 2022.

However, this trend is reversing. Bitcoin miners increased their holdings this month, according to Into the Block. In particular, an additional 4,500 BTC, equivalent to approximately $300 million, was secured.

Read more: Creating Passive Income through Cryptocurrency Mining : How to Get Started

Additionally, IntotheBlock noted that the number of addresses holding more than 1,000 BTC has reached a two-year high. This indicator suggests that individuals and companies holding large amounts of BTC are starting to accumulate again.