Bitcoin has recently shaken off the gloom of the downturn and has been on the rise since the Trump shooting incident. It has surged by more than 11% in the past seven days and once exceeded the $67,000 mark, setting a new high in a month. However, according to The Block, JPMorgan Chase analysis In the latest report, analysts believe that any rebound in cryptocurrency prices may be temporary and strategic rather than the beginning of a lasting upward trend.

JPMorgan analysts led by Nikolaos Panigirtzoglou noted in a report on Thursday that Bitcoin hit $67,500, which compares with production costs of about $43,000 and a volatility-adjusted price comparable to gold (about $53,000). , the price is already too high.

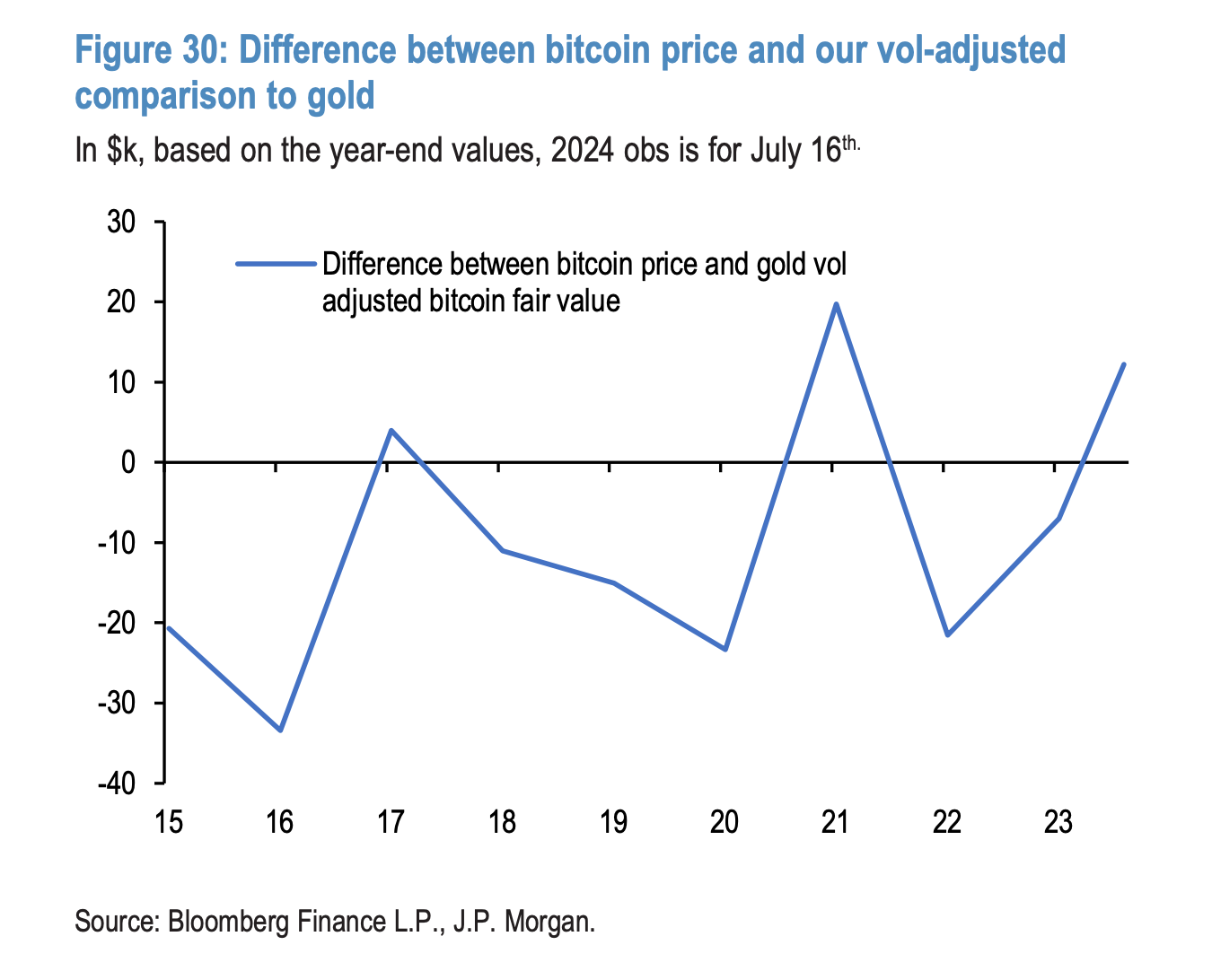

These JPMorgan analysts explained that the difference between Bitcoin’s price and JPMorgan’s volatility-adjusted price compared to gold “suggests a mean reversion near the zero line, thus limiting the potential for long-term upside in Bitcoin’s price.”

Analysts pointed out that Bitcoin futures have been weak recently due to the liquidation of Gemini and Mt. Gox creditors, coupled with the recent sale of seized Bitcoin by the German government, but these liquidations may disappear after July, and Bitcoin futures are expected to A rebound will begin in August, consistent with the recent uptrend in gold futures:

We believe that momentum traders such as CTA (Commodity Trading Advisors) played a significant role in driving gold futures higher, with 7 gold’s momentum signals surging into overbought territory last April.

Extended reading: Does the German government that “caused Bitcoin to plummet” regret it? Samson Mow revealed: They are considering buying back BTC!

Trump’s election is good for Bitcoin and gold

In addition, in response to the US presidential election situation, JP Morgan analysts believe that if Trump is re-elected as president, gold and Bitcoin are expected to benefit from Trump's second term.

Analysts pointed out that some investors believe that Trump is more supportive of cryptocurrency companies and more regulatory-friendly than the current Biden administration, and that Trump’s potential trade policies may cause emerging market central banks, especially China’s central bank, to increase their support for gold. Diversify your investments.