According to The Block , JPMorgan issued a report stating that cryptocurrencies will begin to rebound in August, but these rebounds may only be temporary.

Table of contents

ToggleCryptocurrency rally may be temporary

JPMorgan analysts say any rebound in cryptocurrency prices from this point on is likely to be temporary and strategic rather than the start of a lasting upward trend.

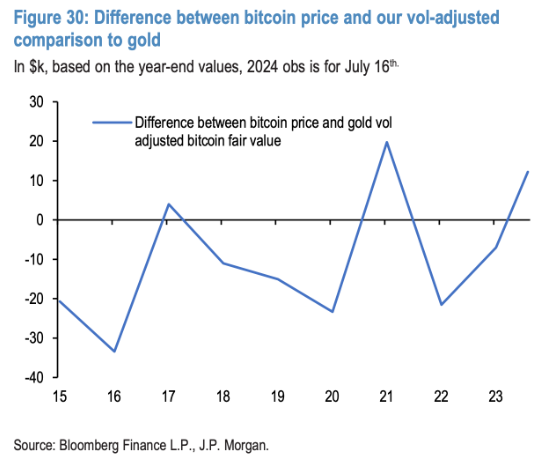

The chart below shows the difference between the price of Bitcoin and JPMorgan Chase’s volatility-adjusted gold price. Judging from historical data, its mean regresses near the zero axis. Bitcoin is currently priced at about $67,500, which is high compared to its production cost of about $43,000 and the volatility-adjusted price of gold (about $53,000). This limits the upside potential of Bitcoin prices in the long term.

Cryptocurrencies set to begin rebounding in August

As liquidations decrease after July, JPMorgan expects cryptocurrencies to rebound starting in August. Bitcoin futures have been weak recently due to the liquidation of Gemini and Mt. Gox creditors and the sale of seized Bitcoin by the German government. While these liquidations are likely to subside after July, JPMorgan expects Bitcoin futures to rebound starting in August, in line with the recent rise in gold futures.

Gold has frequently hit record highs recently, and JPMorgan Chase believes that momentum traders such as CTA (commodity trading advisors) have played an important role in the promotion of gold futures.

Gold's momentum signal spiked in July into overbought territory last April.

( Gold hits new highs, Trump pushes up gold prices, does Bitcoin have a chance to keep up? )

Trump may be elected president

JP Morgan analysts also made predictions about the U.S. presidential election in November. They believe that Trump may be elected and start a second presidential term. In addition to what ordinary investors believe, Trump is more supportive of encryption than the current Biden administration. Currency Corporations and Regulation. Trump’s potential trade policies may lead emerging market central banks, especially China’s central bank, to increase their diversified allocations to gold.