Author: Yashu Gola, CoinTelegraph; Translated by: Wuzhu, Jinse Finance

The German government recently missed out on an additional $124 million in gains by cashing out its Bitcoin holdings too early .

Bitcoin price rises immediately after German sell-off

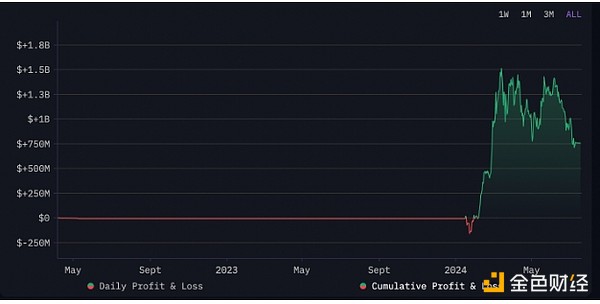

On July 13, the German state of Saxony completed the sale of 50,000 bitcoins seized from the movie piracy website movie2k, making a profit of approximately $2.87 billion. Compared to the acquisition cost of $2.13 billion in January, they made a profit of more than $740 million.

The German government's cumulative profits from Bitcoin sales. Source: Arkham Intelligence

However, shortly after the sale, the price of Bitcoin surged by 16.55%, mainly due to the assassination attempt on former US President Donald Trump, which increased the possibility of his re-election in November.

The likelihood of the Saxony government making the biggest payout was highest in March, when BTC hit an all-time high of around $74,000.

BTC/USD daily price chart. Source: TradingView

Theoretically, the sale of 50,000 Bitcoins in March could have brought the government a profit of $1.5 billion. At the same time, Bitcoin fell 12% during the German government's sale, causing the government to miss out on profits.

German Government Misjudged Bitcoin’s Potential

The Dresden prosecutors’ office ordered an “urgent sale” of Bitcoin in June because they believed the cryptocurrency’s value could fall by more than 10%.

“Valuables must be sold in accordance with the law as long as there is a risk of a significant depreciation in value of approximately 10% or more until the conclusion of ongoing criminal proceedings,” the office clarified, adding:

“Bitcoin always meets these conditions because of its huge and rapid price fluctuations.”

Furthermore, the office stressed that it is illegal for law enforcement agencies to speculate on the value of seized items, especially by waiting for the price to rise before selling them. Instead, their emergency sale of 50,000 bitcoins was intended to raise funds for the criminal case against movie2k.

“In this emergency sale, which is unprecedented in the Federal Republic of Germany, a fair market price was always achieved,” the Dresden Attorney General’s Office wrote, adding:

“The volume in the bitcoin market has been high.”

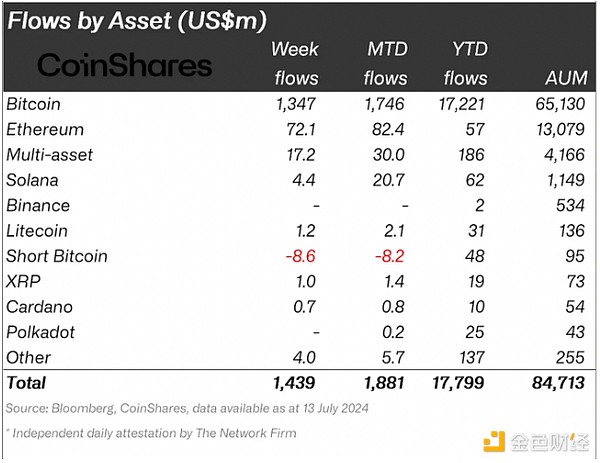

The announcement coincides with increasing demand for Bitcoin from ETF and other fund investors during the period of the German government’s Bitcoin sale.

“Bitcoin saw its fifth-highest weekly inflows on record at $1.35 billion, while short Bitcoin saw its highest weekly outflows since April at $8.6 million,” James Butterfill, a researcher at asset manager CoinShares, noted in a report for the week ending July 13.

Crypto net fund flows. Source: CoinShares

We believe investors increased their holdings due to price weakness caused by the German government selling Bitcoin and improved sentiment due to lower-than-expected US CPI.

Last year, the U.S. government sold some of its Bitcoin reserves seized from Silk Road, while countries like El Salvador officially accumulated BTC as a strategic reserve asset. However, recently there has been more discussion about the U.S. using Bitcoin as its own strategic reserve as early as 2028.