Author: ASXN Source: X, @asx n_r Translation: Shan Ouba, Jinse Finance

The Ethereum ETF will be launched on July 23. There are many dynamics of the ETH ETF that are ignored by the market, while the BTC ETF does not have these dynamics. Let's take a look at the flow forecast, ETHE liquidation, and the relative liquidity of ETH:

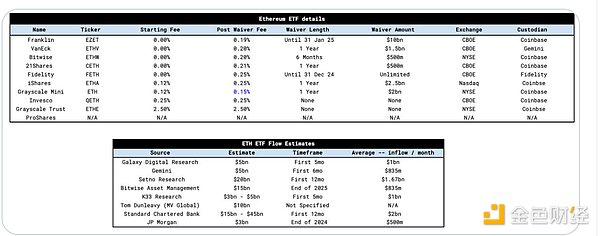

The fee structure of the ETF is similar to that of the BTC ETF. Most providers waive fees for a specified period to help accumulate AUM. As was the case with the BTC ETF, Grayscale maintains the ETHE fee at 2.5%, an order of magnitude higher than other providers. The main difference this time is the launch of the Grayscale Mini ETH ETF, which was not previously approved for the BTC ETF.

The MiniTrust is a new ETF product from Grayscale that initially disclosed a fee of 0.25%, similar to other ETF providers. Grayscale’s idea is to charge lazy ETHE holders a 2.5% fee while directing more active and fee-sensitive ETHE holders to their new product, rather than having funds siphoned into low-fee products like Blackrock’s ETHA ETF. After other providers reduced Grayscale’s fees by 25 bps, Grayscale made a comeback and reduced the MiniTrust fee to just 15 bps, making it the most competitive product. On top of this, they also moved 10% of ETHE AUM to the MiniTrust and gifted this new ETF to ETHE holders. This shift was done on a like-for-like basis, meaning it was not a taxable event.

The resulting effect is that outflows from ETHE will be more modest compared to GBTC, as holders will only have to transition to the mini-trust.

Now let's look at the process:

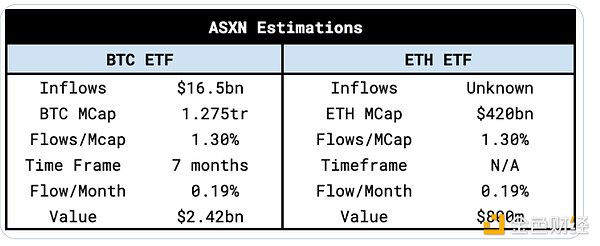

There are many estimates for ETF flows, some of which we have highlighted below. Taking the estimates and normalizing them gives an average estimate in the $1 billion per month region. Standard Chartered Bank gives the highest estimate at $2 billion per month, while JPMorgan Chase has a lower estimate of $500 million per month.

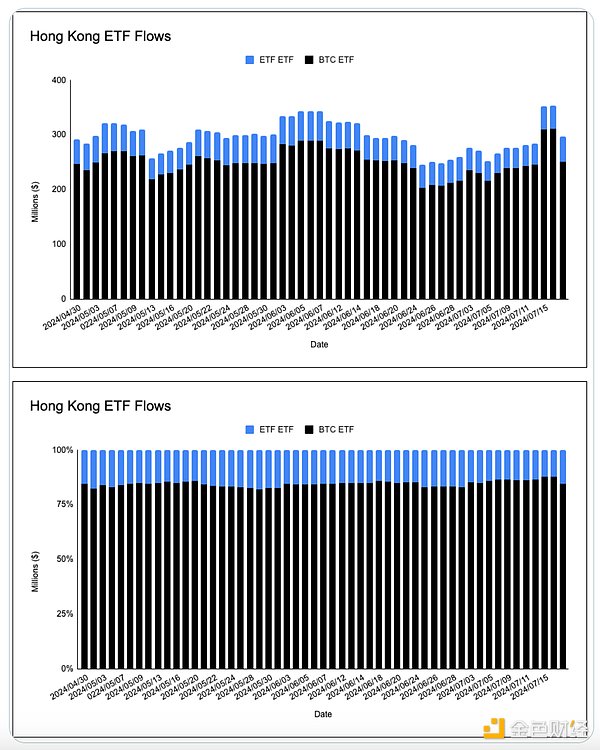

Fortunately, we have the help of Hong Kong and European ETPs and the end of the ETHE discount to help estimate flows. If we look at the AUM breakdown of Hong Kong ETPs, we come to two conclusions:

1. The relative AUM of BTC and ETH ETPs is overweight BTC and ETH, with a relative market value of 75:25 and an AUM ratio of 85:15.

2. The ratio of BTC to ETH in these ETPs is fairly constant and consistent with the ratio of BTC market cap to ETH market cap.

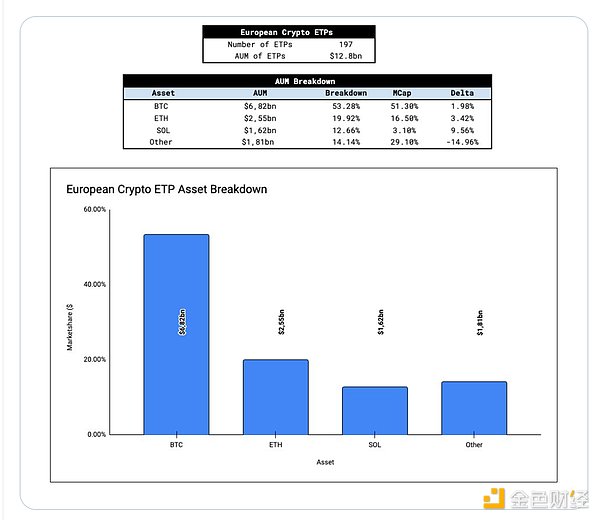

Looking at Europe, we have a much larger sample size to study — 197 crypto ETPs with $12 billion in cumulative AUM. After we crunched the data, we found that the breakdown of AUM for European ETPs roughly aligns with the market caps of Bitcoin and Ethereum. Solana is over-allocated relative to its market cap, at the expense of “other crypto ETPs” (anything not BTC, ETH, or SOL). Leaving Solana aside, a pattern begins to emerge — the breakdown of global AUM between BTC and ETH roughly mirrors the market cap-weighted basket.

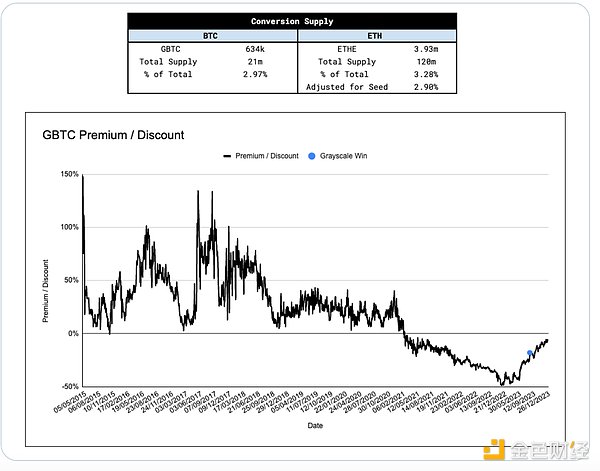

Given that GBTC outflows were the origin of the “sell the news” narrative, it is important to consider the possibility of ETHE outflows. In order to simulate potential ETHE outflows and their impact on price, it is useful to look at the percentage of ETH supply in the ETHE tool.

Once adjusted for Grayscale Mini Seed capital (10% of ETHE AUM), the current ETH supply in the ETHE vehicle as a function of total supply is similar to the proportion of GBTC at launch. It is not clear what the proportion of rotations to exits is in GBTC outflows, but if we assume a similar proportion of rotations to exit flows, then the impact of ETHE outflows on price is similar to GBTC outflows.

Another key piece of information that most people overlook is the premium/discount of ETHE to NAV. ETHE has been trading within 2% of par since May 24th, while GBTC first traded within 2% of NAV on January 22nd, just 11 days after GBTC converted to an ETF. The approval of the spot BTC ETF and its impact on GBTC is slowly being digested by the market, while the discount that ETHE trades at relative to NAV has been more reflected in the GBTC story. By the time the ETH ETF goes live, ETHE holders will have 2 months to exit ETHE. This is a key variable that will help stem ETHE outflows, especially exit flows.

At ASXN, our internal estimate is $800M to $1.2B per month. This is calculated by taking the market cap weighted average of monthly Bitcoin inflows and scaling it by ETH’s market cap.

Our estimates are supported by global crypto ETP data, which suggests that market cap-weighted baskets are the dominant strategy (we may see a rotation into BTC ETFs, employing a similar strategy). Additionally, given the unique dynamics of ETHE trading at par prior to the launch and introduction of the mini-trust, we are open to upside surprises.

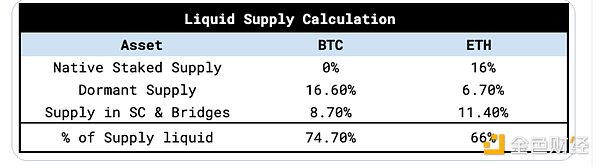

Our estimates of ETF inflows are proportional to their respective market caps, so the impact on price should be similar. However, it is also important to measure what percentage of an asset is liquid and ready to sell - assuming that the smaller the "float", the more price will react to inflows. There are two special factors that affect ETH's liquid supply, namely native staking and supply in smart contracts. Therefore, ETH has a lower liquidity and sellable percentage than BTC, making ETH more sensitive to ETF flows. However, it is worth noting that the incremental illiquidity between the two assets is not as large as some people believe (ETH's cumulative +-2% order depth is 80% of BTC).

Our estimates of the liquid supply show the following:

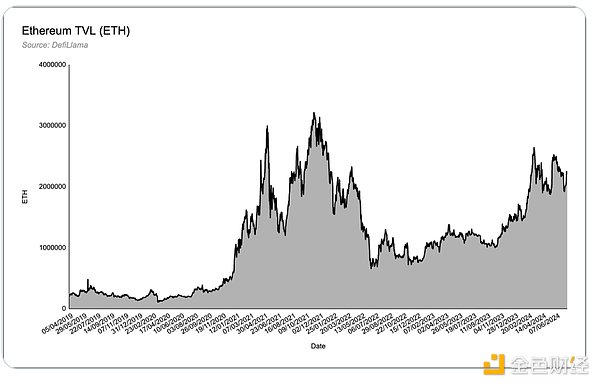

When we look at ETFs, it is important to understand the reflexivity of Ethereum. The mechanism is similar to BTC, but Ethereum's destruction mechanism and the DeFi ecosystem built on top of it make the feedback loop more efficient. The reflexive loop looks like this:

ETH flows into ETH ETF → ETH price rises → ETH interest rises → DeFi/chain usage increases → DeFi fundamentals improve → EIP-1559 burns increase → ETH supply decreases → ETH price rises → More ETH flows into ETH ETF → ETH interest rises → …

One thing that the BTC ETF lacks is the lack of an ecosystem “wealth effect”. In the nascent Bitcoin ecosystem, despite the low interest in ordinals and inscriptions, we do not see much of the proceeds being reinvested into base layer projects or protocols. Ethereum, as a “decentralized application store”, has a complete ecosystem that will benefit from the continued inflow of base assets. We believe that this wealth effect has not received enough attention, especially in the DeFi space. There is 20 million ETH ($63 billion) of TVL in Ethereum DeFi protocols, and as ETH trades higher, the TVL and revenues denominated in USD have surged, making ETH DeFi more attractive for investment. ETH has a reflexivity that does not exist in the Bitcoin ecosystem.

Other factors to consider:

1. What is the rotation flow from the BTC ETF to the ETH ETF? Assume that a non-zero portion of BTC ETF allocators are unwilling to increase their net crypto exposure but want to diversify. In particular, TradFi investors prefer a market cap weighted strategy.

2. How well does TradFi understand ETH as an asset and Ethereum as a smart contract layer? Bitcoin’s “digital gold” narrative is both easy to understand and widely understood. How well can Ethereum’s narrative (settlement layer of the digital economy, three-point asset theory, tokenization, etc.) be understood?

3. How will the above market conditions affect the flow and price trend of ETH?

4. The Ivory Tower lawsuit specifies two crypto assets to bridge their worlds - Bitcoin and Ethereum. These assets have crossed the proverbial zeitgeist. Given that TradFi capital allocators are now able to offer products that can charge fees, how does the introduction of a spot ETF change their view of ETH? TradFi's thirst for yield makes Ethereum's native yield through staking a very attractive proposition for providers, and we believe that staking an ETH ETF is a when, not an if. Providers can offer 0 fee products and simply stake ETH on the back end to earn an order of magnitude higher income than normal ETH ETF fees.