Markus Thielen, founder of 10x Research, said a Trump presidency would spell disaster for Gensler and his role as SEC head.

10x Research founder Markus Thielen predicts that U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler will likely resign within the first two months of 2025, after President Joe Biden ends his term in the White House.

In a July 21 market note , Thielen said SEC chairmen typically resign when a new administration takes office, adding that Trump’s entry would spell disaster for Gensler’s role as head of the agency.

He noted that Biden's sudden decision to abandon his campaign means Trump will almost certainly be sworn in as president in January 2025. However, other industry commentators disagree .

" With Joe Biden out of the US presidential race, there is no credible candidate who can truly challenge Donald Trump. The November election appears to have been decided without a vote. For Bitcoin, a pro-crypto government will take over the White House."

“Although SEC Chairman Gensler’s term ends on June 5, 2026, he will likely resign in January or February 2025,” Thielen wrote.

In February, Trump’s running mate, JD Vance, slammed Gensler as the “worst person” to regulate crypto assets, saying he took a backward and overly politicized approach to crypto policy.

Additionally, Thielen noted that the cryptocurrency market is set to see a series of bullish catalysts in the coming weeks, saying that “multiple reports and rumors” suggest that Trump will make a surprise announcement at a Bitcoin conference in Nashville, Tennessee on July 25.

“There is widespread speculation that he will declare Bitcoin a strategic reserve asset, which could trigger a parabolic rise in the price of Bitcoin,” Thielen said.

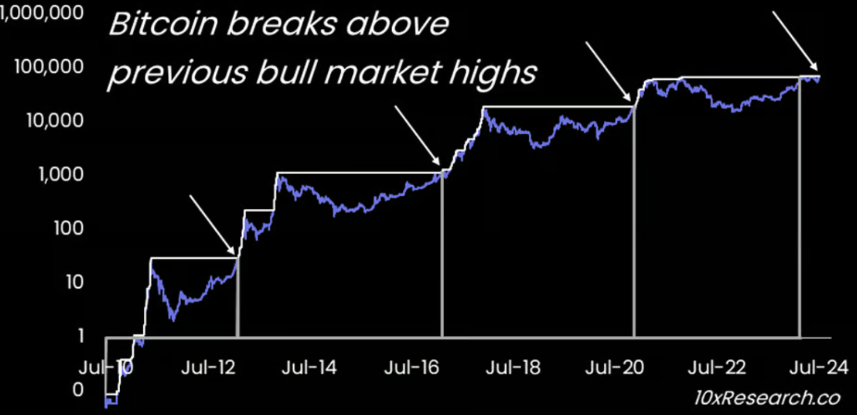

He warned investors not to take profits or seek to short Bitcoin ahead of Trump’s speech, and said Bitcoin’s previous bull run’s all-time high of $68,300 may be “defined as a floor for Bitcoin.” Bitcoin will trade in line with the “parabolic trend” expected in the coming months.

Historically, Bitcoin has traded higher after breaking out of its bull run all-time highs. Source: 10x Research

Meanwhile, several analysts told Cointelegraph that the future prospects for Bitcoin and the broader cryptocurrency market remain bright despite the current political turmoil in the United States.

After a wave of "forced selling" by the German government and a massive swing in bitcoin prices caused by the collapse of cryptocurrency exchange Mt. Gox to pay back its creditors, analysts believe the worst of bitcoin's recent price action is over.