The cryptocurrency market remains volatile, with many investors weighing whether to sell now to preserve profits or continue to hold or even increase their holdings to take advantage of rising prices in the near future. short to medium term.

Although the cryptocurrency market has gradually recovered from the last bear market, every bear market eliminates some projects. Therefore, choosing high-quality cryptocurrency projects that are able to survive bear markets and thrive in the future is especially important.

This article analyzes the top 200 cryptocurrencies based on several key factors including liquidation, technological innovation, industry leadership, Token economics, etc. Detailed criteria will be introduced in the following section of the article.

Through meticulous analysis, we have selected the 12 most investment-worthy cryptocurrencies on the market. Our top three list will be updated weekly based on the latest developments in the field of cryptography and blockchain.

List of cryptocurrencies worth investing in July 2024:

- Bitcoin - a decentralized peer-to-peer cryptocurrency

- Toncoin - blockchain is tightly integrated with the Telegram messaging software

- Cardano – Ethereum's main competitor

- Maker - an important decentralized finance project

- Ethereum - leading smart contract platform

- Solana - high-performance smart contract blockchain platform

- Kaspa - scalable layer 1 blockchain based on BlockDAG architecture

- BNB – the main cryptocurrency used in the Binance ecosystem

- XRP - effective digital currency exchange tool

- Uniswap - the largest decentralized exchange (DEX) on Ethereum

- Notcoin - TON blockchain project, originated from a popular clicker game

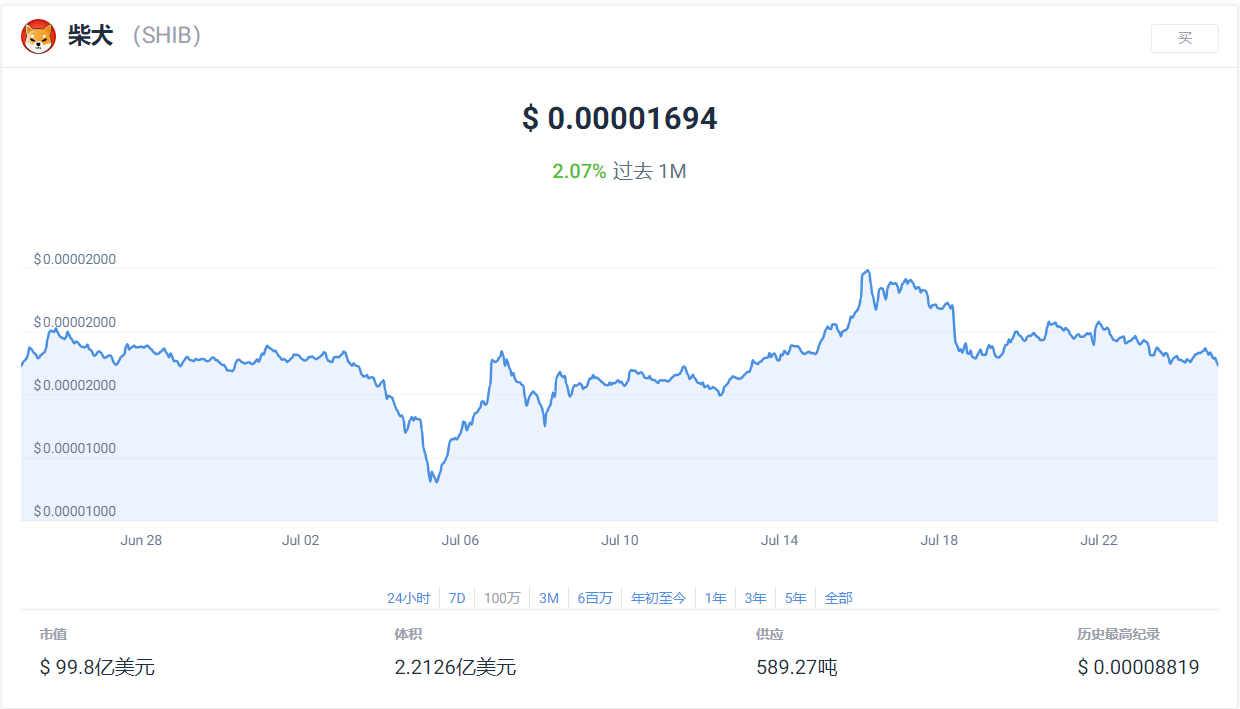

- Shiba Inu – The second largest meme coin on the market

Research crypto worth investing in now

We have started focusing on three crypto projects that have made significant progress recently or are about to have significant events. This information will be updated weekly to reflect the latest developments in the cryptocurrency and blockchain space.

Before diving into the list of recommended cryptocurrencies, it is worth emphasizing that choosing which cryptocurrency to invest in is just the first step in your digital currency investing journey. Choosing the trading platform and subsequent hosting options is equally important.

We recommend that after purchasing cryptocurrencies on an exchange, the best practice is to transfer them to a hardware wallet for safe storage. Purchasing on Kucoin and storing it on the Ledger hardware wallet is a good start.

1. Bitcoins

Bitcoin is a decentralized peer-to-peer digital currency that was first proposed in 2008 and began operating in 2009. The founder of Bitcoin is a person named Satoshi Nakamoto Nakamoto, whose true identity is unknown. disclosure.

Bitcoin introduced blockchain technology, providing a completely decentralized and extremely secure payment method. It uses a proof-of-work mechanism, which increases the difficulty of modifying transaction records or performing double spending. The network is maintained by Miners, who secure the network by adding blocks and receiving Bitcoin as rewards.

BTC can be transferred anywhere in the world 24 hours a day without going through any intermediaries. Users can manage their Bitcoin themselves by holding their private keys without relying on financial institutions such as banks.

Despite the emergence of countless cryptocurrencies and blockchain platforms, Bitcoin remains one of the largest cryptocurrencies by market Capital .

Why Bitcoin?

Bitcoin has gained 22% against the dollar over the past 14 days, leading a broad rally across the cryptocurrency market. Bitcoin's rise in price has coincided with the political situation in the US becoming more unstable, including an assassination attempt on former President Donald Trump.

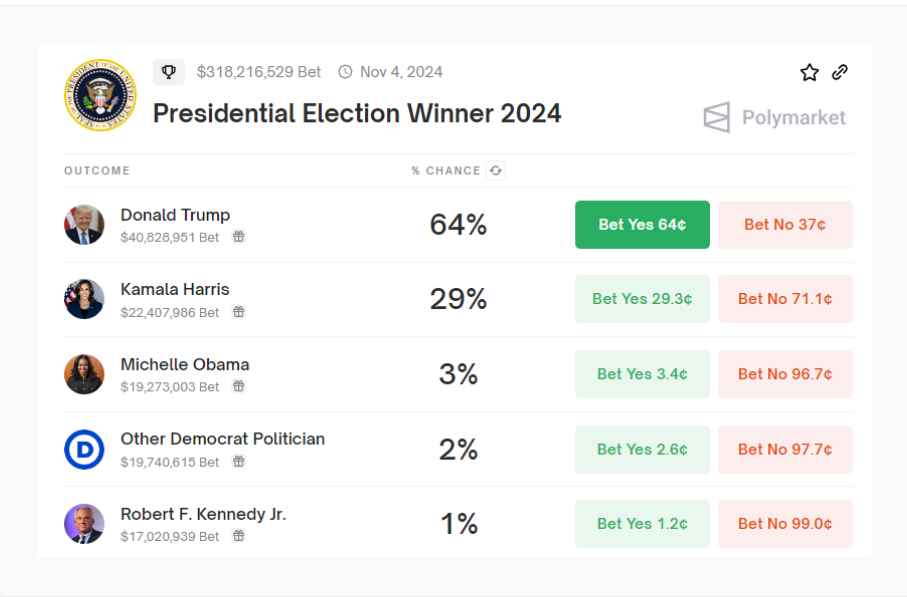

Many analysts believe the assassination may have increased Trump's chances of winning the November presidential election, with blockchain prediction market Polymarket seeing his chances of winning the election rising to 71% from around 60%. % before the incident. After the initial reaction, Trump's chances of winning the election against opponents including Kamala Harris and Michelle Obama were 64%.

The Bitcoin market has reacted positively to the possibility of Trump becoming the next US president, as Trump has a friendlier attitude towards Bitcoin and other cryptocurrencies than his rival and incumbent president JOE Biden .

If Trump becomes president, this could mean the end of Gary Gensler's tenure as chairman of the US Securities and Exchange Commission (SEC), which is good news for the cryptocurrency market . Trump's successor will likely be more open to blockchain-based financial products.

Trump said in 2019 that Bitcoin and other cryptocurrencies "are not real money" and are "very volatile and based on fantasy." But since then, his statements have taken a more positive direction. In June this year, Trump wrote on Twitter: "We want all Bitcoin made in America!!!" and said "Bitcoin mining could be our last line of defense against central bank digital currencies."

Trump is even planning to attend the Bitcoin 2024 conference in Nashville, Tennessee on July 27.

Additionally, Bitcoin spot ETF net Capital are increasing, and although daily net Capital were mostly negative from the second week of June to the second week of July, we observed inflows of over $2.8 billion since then. This shows that institutional investors consider buying BTC at current prices a good investment opportunity. At the time of writing, BTC is trading just 8% below its All-Time-High .

2. Toncoin

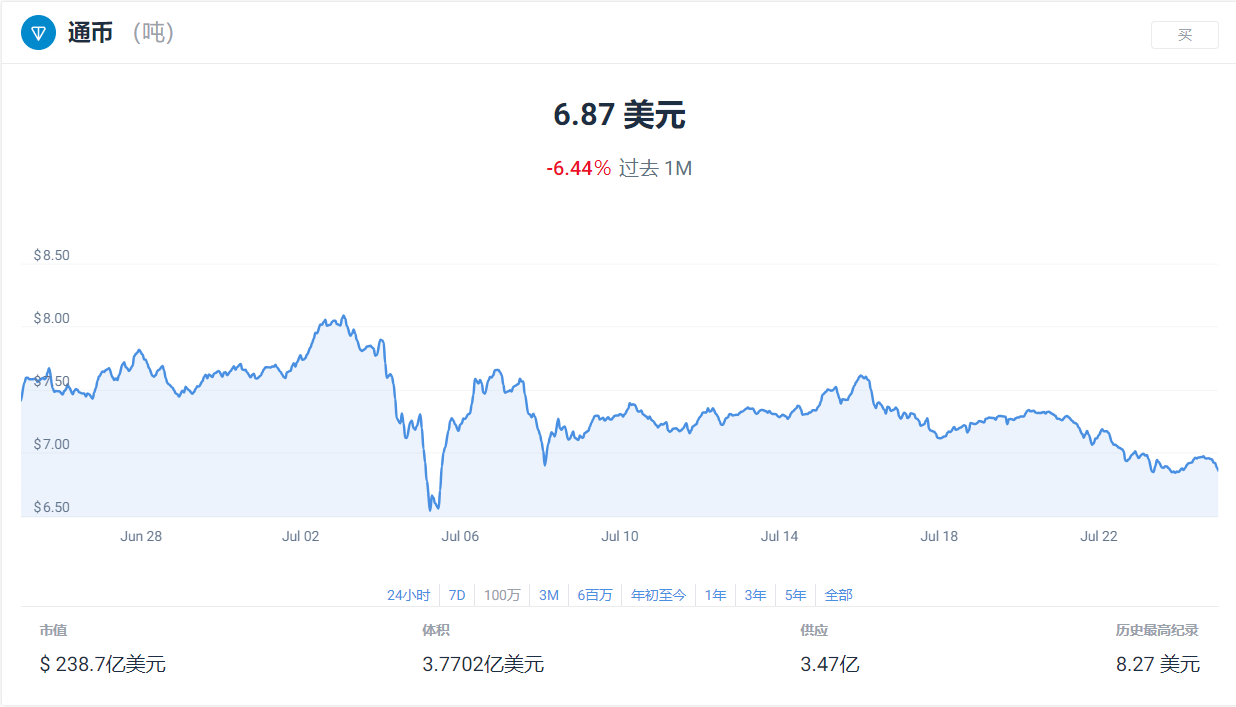

Toncoin is a blockchain project originally designed by the Telegram team. Although Telegram abandoned the project due to a legal dispute with US securities regulators, community members recognized the potential of the platform and decided to continue development under the name Toncoin.

Toncoin development is currently led by the TON Foundation, an organization with no official connection to Telegram. Notably, Telegram is integrating many functions powered by the Toncoin blockchain into its communication services, such as the Telegram app now integrating the TON Space wallet.

Technically, Toncoin is a scalable blockchain with smart contract functions and proof-of- Stake consensus mechanism. Its initial Token Issuance uses a proof-of-work mechanism to ensure fairness.

Why choose Toncoin?

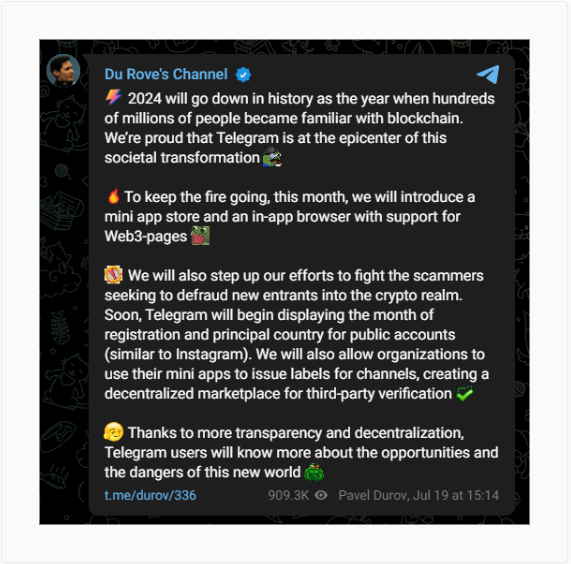

On July 19, Telegram founder Paul Durov announced that Telegram will launch an integrated decentralized app store and Web3 browser, while emphasizing combating scams targeting blockchain newcomers. .

According to DeFi Llama, Toncoin is one of the fastest growing blockchain ecosystems in the world, with a Total Value Locked of $768 million, up from just $13 million at the beginning of the year. The main drivers of this significant growth include Telegram's vast user base and deep integration with the open network, as well as the various incentives the team has introduced in recent months.

Additionally, the upcoming Airdrop of Hamster Kombat, a globally popular game that has attracted more than 250 million users since March, is expected to drive further growth. This integration and the upcoming native Token Issuance are expected to push TON prices even higher.

3. Cardano

Cardano is a decentralized blockchain platform founded by Ethereum co-founder Charles Hoskinson to provide a more secure and scalable infrastructure for smart contracts and decentralized applications (dApps). Launched in 2017, the platform uses a unique Proof of Stake consensus mechanism called Ouroboros, which is more energy efficient and secure than the traditional Proof of Work system.

Cardano 's native cryptocurrency ADA is used to support transactions and operations within the network. The development of the platform is based on academic research and peer review, striving to build a scientific and rigorous blockchain ecosystem. Its layered architecture separates account values and transaction reasons, improving system flexibility and security.

Why choose Cardano?

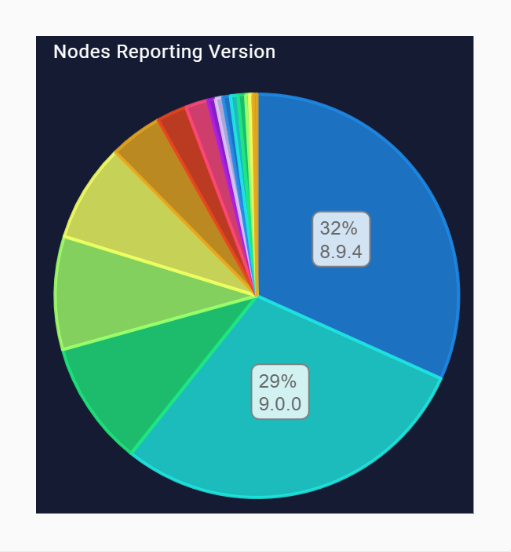

Earlier this month, Cardano released a Node 9.0 validator node software update in preparation for the upcoming Chang Hard Fork . This update is considered a major improvement that will introduce a decentralized governance mechanism. Currently, 29% of nodes have been upgraded to the new version, representing an important step towards wider adoption.

Additionally, Cardano price has been very strong recently, with ADA increasing 26% from July 8 to 16, showing growth potential.

4. Maker

Maker is a decentralized finance protocol running on Ethereum that manages Dai, a Decentralized Stablecoin pegged to the US dollar. Users can use assets like ETH as collateral and lock this asset in a Maker smart contract minting Dai.

The Maker system requires the value of the collateral to exceed the value of the minted Dai , and users need to monitor the value of the collateral continuously to avoid liquidation. The MKR Token is the Governance Token of MakerDAO, a decentralized autonomous organization that oversees the Maker protocol.

Why choose Maker?

MakerDAO recently announced the Spark Tokenization Grand Prix, a public competition to invest $1 billion in Tokenize real-world assets (RWA) through the Maker platform. A number of key asset management institutions have lined up to participate, demonstrating widespread support and trust in the Maker platform.

5. Ethereum

Ethereum is a blockchain platform that supports smart contracts, allowing developers to build complex applications such as decentralized lending protocols and non-fungible Token (Non-Fungible Token). The project was proposed by Vitalik Buterin at the end of 2013 and officially launched in July 2015.

One of the first uses of Ethereum is to support the issuance of custom Token that can be traded on the Ethereum blockchain. Many projects have been successful in raising Capital through initial coin offerings (ICOs) and other Token Sale .

Currently, Ethereum has a vibrant decentralized application (DApp) ecosystem that includes decentralized finance (DeFi), Non-Fungible Token markets, publishing platforms, and decentralized exchanges, making it becomes a high-quality investment option in 2023.

ETH is the native asset of the Ethereum blockchain, incentivizing users to maintain network security. Initially, Ethereum used the Proof of Work (PoW) mechanism, then switched to the more environmentally friendly Proof of Stake (PoS) in September 2022.

Why choose Ethereum?

With an Ethereum ETF expected to be listed on the US market soon, ETH has become one of the most followed Cryptoasset in the short term. After the US Securities and Exchange Commission (SEC) approved the 19b-4 filing for the related Ethereum ETF, the price of ETH increased to around $3,900. Although the price has dropped since then, once the ETF actually begins trading, it is expected to trigger bullish activity in the ETH market once again.

Considering the market reaction when the first Bitcoin spot ETFs began trading in the US earlier this year, BTC prices rose from around $45,000 to a record high of over $73,600. While it is difficult to predict the specific impact that the Ethereum spot ETF will have on ETH, the market is generally optimistic about it. According to the latest news from Bloomberg analysts, the SEC may approve the listing of an Ethereum spot ETF on July 15.

6. Solana

Solana is a smart contract platform known for its unique architecture that allows it to process thousands of transactions per second at extremely low costs. Solana achieves this goal by combining a unique proof-of-history algorithm and a Proof-of-Stake consensus mechanism. As a cryptocurrency, SOL is favored by the market because of its low transaction costs (Medium less than 0.001 USD per transaction).

Solana was founded by Anatoly Yakovenko in 2018, with its mainnet launched in March 2020 and widespread adoption in 2021. Despite its value falling during the 2022 bear market, Solana remains one of the the most attractive ecosystem in the crypto space and its potential cannot be underestimated.

Why choose Solana?

Asset management companies VanEck and 21Shares have applied to launch the Solana spot ETF in the US, both seeking listing on the CBOE BZX exchange. 21Shares plans to use Coinbase as the fund's SOL custodian, with funds stored in independent wallets on the Solana blockchain. Notably, the fund will not collateralize the SOL due to regulatory requirements.

Outside the US, 21Shares has launched an exchange-traded product (ETP) 100% backed by SOL, allowing holders to receive returns from Staking. The product is traded on the Swiss Stock Exchange, the Stuttgart Stock Exchange and the Amsterdam Stock Exchange.

While there are currently active Solana ETF applications, the path to a Solana ETF may be more complicated than the recently approved Ethereum ETF. It is important to note that the US securities regulator SEC has stated in at least two lawsuits that SOL is an unregistered security, and unlike Bitcoin and Ethereum, there is currently no Futures Contract market Solana futures are regulated in the US.

7. Kaspa

Kaspa is a decentralized cryptocurrency project focused on high scalability and fast transactions. Kaspa uses DAG instead of traditional blockchain technology, and is committed to rapid block confirmation to provide a more efficient and user-friendly experience. This first-layer blockchain combines proof-of-work (PoW) with a directed acyclic graph (DAG) to optimize the completion of blocks, making the Kaspa network superior to other PoW chain in terms of consumption. energy consumption and transaction processing efficiency.

Why choose Kaspa?

Kaspa had a great week, up 19.5% against the dollar. The main driver of this growth was the announcement by crypto mining company Marathon Digital that it has been mining Kaspa since September 2023. The company purchased 60 petahashes worth of Kaspa mining hardware ( Mining Rig). Bitmain KS3, KS5 and KS5 Pro), although only half of them are currently active. The company projects that when all the mining hardware is deployed, it will account for 16% of Kaspa 's global Hash Rate .

Adam Swick, Chief Development Officer at Marathon Digital, said: “ Kaspa 's technological innovation and its active community enable us to diversify our revenue streams and increase our profit per kWh. While Bitcoin has its own unique value, Kaspa 's innovative technology provides us with a valuable opportunity to support and accelerate innovation in proof-of-work.”

8. BNB

BNB is a Token launched by the Binance cryptocurrency exchange in 2017. This Token has two main purposes: first, holders can benefit from a series of incentives when using the Binance exchange, including reduced trading fees, priority participation in Launchpad and Launchpool projects, and cashback when using Binance Visa cards; Second, BNB is the native asset of the BNB Chain blockchain. On this Ethereum variant-based platform, not only are there low transaction fees, but it also allows developers to easily deploy decentralized applications compatible with the Ethereum Virtual Machine. Formerly known as Binance Coin, BNB has undergone an extensive rebranding in recent years.

Why choose BNB?

Binance recently launched a new program called "HODLer Airdrops" to reward users who hold BNB in their Simple Earn product. Binance said they will Airdrop Token of projects that are about to be listed and have a large circulating supply through HODLer Airdrops. Binance promises that these projects will be small and Medium projects with solid foundations and active communities. Additionally, BNB holders who participate in Simple Earn not only receive the Airdrop but also enjoy other benefits of Launchpool, Megadrop program, and Binance VIP program.

9. XRP

XRP is a cryptocurrency launched in June 2012 and developed by David Schwartz, Jed McCaleb and Arthur Britto, co-founders of OpenCoin along with Chris Larsen. Initially, 80% of the XRP supply was donated to OpenCoin, which later changed its name to Ripple and held the majority of XRP in an escrow account.

XRP offers extremely fast transfer speeds and low costs, especially suitable for scenarios such as international money transfers. Unlike systems that use proof of work or proof of Stake, XRP implements the XRP Ledger Consensus Protocol, where each participant in the network can choose a set of validators they trust to maintain Maintain network security and stability.

Ripple has added XRP to some of its products, especially its On-Demand Liquidation (ODL) service, partnering with cryptocurrency exchanges to use XRP to make international money transfers more efficient. .

Why choose XRP?

As a core member of the XRP Ledger ecosystem, Ripple recently announced that it will launch a US dollar-pegged stablecoin on the XRP Ledger and Ethereum platforms. This stablecoin will adopt a traditional full-backing model, backed by US dollar deposits, short-term US treasury bonds, and other cash equivalents. To improve transparency, Ripple plans to publish audit certifications from third-party accounting firms on a monthly basis to verify full support of the stablecoin. This move is expected to significantly enhance the liquidation of the XRP Ledger and could bring new growth momentum to XRP.

10. Uniswap

Uniswap is a decentralized crypto exchange that promotes the automated market maker (AMM) model. This innovative design allows for the direct exchange of different Token on the blockchain without relying on traditional Order Book , greatly simplifying the trading process.

The Uniswap protocol is completely decentralized, and anyone can create a liquidation pool for Token, often allowing new Cryptoasset to be traded on Uniswap before entering crypto exchanges traditional. In addition, Uniswap is also one of the decentralized exchanges with the largest volume .

UNI Token are held by users of the Uniswap protocol, who can propose and vote on the protocol's proposals. UNI was initially Airdrop to early adopters of Uniswap, and currently the Token is available for trading on many decentralized and centralized exchanges.

Why choose Uniswap?

The UNI Token has performed well over the past week, with the price rising 12% to a multi-week high. At the same time, most cryptocurrencies on the market are decreasing in price. On chain data shows that the growth of UNI open interest is in line with the market trend, indicating growing investor interest in UNI. Additionally, Uniswap recently added support for ZKsync, allowing its users to transact on the efficient Ethereum layer-two network, which will bring lower fees and faster transaction times for Uniswap, which could boost positive feelings about UNI.

11. Notcoin

Notcoin originally appeared on the Telegram messaging program as a simple point-and-click game. By pressing the shiny coin image, players can earn points and activate bonuses to increase their odds of earning points. Notcoin Mini App also has basic social functions. Users can create "teams" and compete against other teams on leaderboards. These features have helped Notcoin quickly gain the attention of millions of users.

Currently, the Notcoin team has released a real Token on the TON blockchain platform, codenamed NOT. This Token is intended to serve as a community Token that rewards users for their activities in exploring the web3 ecosystem, participating in games, or contributing value to the ecosystem.

Why choose Notcoin?

Notcoin has partnered with DeFi project 1INCH and on- chain validation project Sign to provide startup accelerator services to teams on the TON platform, called Triangle. This accelerator program supports teams committed to improving TON's user experience and creating bridge applications between web2 and web3. Participants will be supported with market entry, investment and guidance services, and will have access to the Token management platform TokenTable and Sign Protocol to prevent misconduct. Additionally, 1INCH will provide support for DeFi integration. The accelerator program's first batch of members includes some of the industry's leading players, demonstrating Notcoin's growth potential.

12. Shiba Inu

Shiba Inu is a meme -based cryptocurrency founded in 2020 by a developer with the Pseudonymous "Ryoshi". The project is heavily inspired by Dogecoin and uses the Shiba Inu dog breed as its brand image. Unlike Dogecoin which has its own blockchain, Shiba Inu is issued as an ERC-20 Token on the Ethereum blockchain.

During the initial distribution of SHIB Token , half of the supply went to Ethereum founder Vitalik Buterin, even though he had nothing to do with the project. This action is considered by the project to be a Token burning initiative. Buterin then destroyed the majority of his SHIB and sold the remaining Token , with the proceeds used for charitable donations.

In 2021, SHIB 's popularity skyrocketed, and its market Capital became the second largest meme coin, behind only Dogecoin. In addition, SHIB is also one of the most popular low-cost cryptocurrencies today.

Why choose Shiba Inu?

The Shiba Inu project raised $12 million by issuing TREAT Token . The funds were provided by several international venture capital firms including Mechanism Capital and Big Brain Holdings.

The TREAT Token is designed to be the final new Token introduced into the Shiba Inu ecosystem and is intended to serve as a utility and governance Token for the new blockchain, improving the privacy of blockchain transactions.

The ecosystem's new blockchain will use fully homogeneous encryption (FHE) technology developed by Zama and is expected to run as a third-layer blockchain on the Shibarium platform.

Shytoshi Kusama, lead developer of the Shiba Inu project, said about the Capital: “We are excited to have strong support from VC firms, angel investors and brands cooperate to advance this ambitious decentralized project. These VC partners and their strategic collaborations bring credibility to our network and significantly enhance the contribution that Shiba Inu can truly make to our 'ShibArmy' community. ”