Author: Saurabh Deshpande, Crypto Researcher; Translation: Jinse Finance xiaozou

Throughout history, money has served three key social functions. It has been used as a store of value (wealth), a medium of exchange, and a unit of account. While currencies have changed, their functions have remained largely the same. In general, there have always been two schools of thought - one that supports credit money or soft money, and the other that supports hard money. Credit money, like today's fiat currency system, is someone's liability.

The dollars or rupees you own are a liability of the government. If the government defaults, your money will not be able to buy essential goods and services.

On the other hand, hard money refers to money that is not a government liability. For example, precious metals such as gold do not lose value even if a government defaults. Instead, their value increases due to their perceived stability.

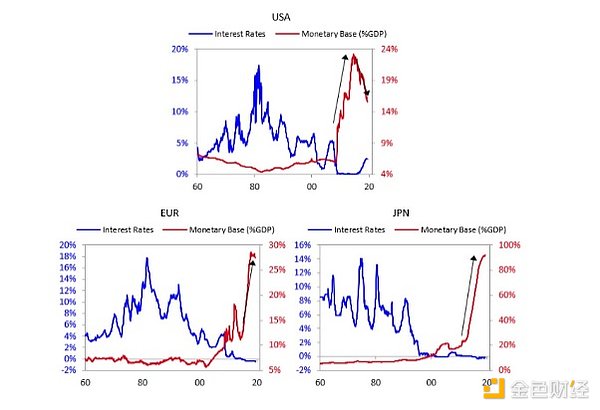

Bitcoin is the first digital currency that has successfully achieved non-sovereign hard currency. In 2009, Satoshi Nakamoto released Bitcoin when the world had just experienced a global financial crisis due to bad lending practices and unilateral interest rate decisions that affected the money supply. The strong dollar depreciated by more than 95%. Ray Dalio, a staunch supporter of macroeconomics, described in his article "Paradigm Shifts" how central banks respond to various crises by lowering interest rates and the impact of crises on various economies.

The chart above shows the decline in interest rates in developed countries since the 1980s. At the same time, the monetary base as a percentage of GDP has also grown. As a result, total output has not grown as fast as the money supply. When the money supply grows rapidly, it can lead to higher inflation, higher living costs, more debt burdens, and greater income inequality, regardless of whether household income growth is low. The high inflation environment we are currently in is a result of the policies adopted by central banks.

In this environment, precious metals, such as gold, stand out. Government intervention in the supply of gold is minimal. With less government influence, the supply of gold is more predictable than fiat currencies. This high degree of predictability allows gold to retain its value over decades, making it a store of wealth.

Bitcoin started out as peer-to-peer electronic cash, but over the years, like many innovations, it strayed from (or at least expanded upon) its original purpose of electronic cash and morphed into digital gold.

In 2018, I came across the interesting metaphor of “blockchain cities.” Blockchains are disconnected from the outside world and more like closed islands. Each island has its own priorities and characteristics, reflecting its own technological and social structure. Bitcoin islands always prefer security and decentralization over other aspects such as speed and programmability.

Decentralization is a broad term that contains nuances. Balaji Srinivasan proposed a way to measure decentralization by breaking down blockchain into different subsystems such as mining, clients, developers, exchanges, nodes, and ownership. He proposed that overall decentralization can be achieved by measuring the Gini coefficient and Nakamoto coefficient of the subsystems.

Many Bitcoin supporters, such as Jonathan Bier, believe that we can look at the degree of decentralization by how difficult it is for users to verify transactions themselves. The difficulty of verifying transactions is the reason why Bitcoin blocks are small (up to 4 MB). In order for blockchains to provide general programmability (not just on paper), developers must do some planning.

First, the language or system they use should be Turing complete, which means that given enough time and memory, the system is able to perform any computation that can be expressed algorithmically.

Second, gas metering needs to be optimized. Gas metering refers to how the system is designed to measure resource costs (e.g., maximum gas consumption per block and gas consumption of different operations). Ethereum's Solidity is a Turing-complete language, but it is often subject to gas limits. Bitcoin's scripting language is intentionally limited to ensure higher security. In addition, as Matt mentioned, it is a low-level stack language, full of unfixed bugs from the Satoshi era, and lacks key operators to make it very useful.

Islands like Ethereum and Solana have evolved into interconnected islands, benefiting from the development of interoperability. However, while Bitcoin Island remains steadfast in its security goals, it has not made any changes to its infrastructure that would make it easier to move to other islands. Bitcoin Island only allows residents of the island to hold, transfer or trade their BTC in exchange for inscriptions and runes with clunky UX.

BTC has been sitting in the golden nest because of the limited things it can do. Meanwhile, assets like ETH have a ton of opportunities to earn yield and passive income in the form of staking, re-staking, lending, etc. While other islands have modernized quickly as new infrastructure has been developed, Bitcoin remains a mighty old stubborn.

Don’t get me wrong, Bitcoin’s conservative approach does ensure its security and decentralization. More features usually bring complexity and a larger attack surface.

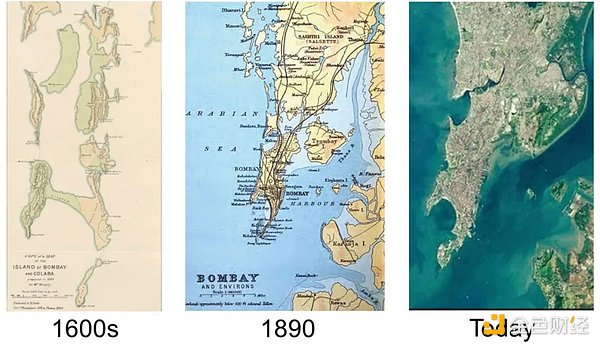

The idea of separate islands reminds me of my hometown, Mumbai. Once known as Bombay, it was originally made up of seven separate islands. The integration of these islands began in the 1680s and continued over the centuries. Today, when I walk through the bustling streets of Mumbai, there are few traces of the former separations. The city feels so unified that its past divisions are almost forgotten.

This shift in Mumbai raises an interesting question: Will we see a similar evolution in the Bitcoin space? Some teams are working in that direction.

This article will describe how some teams are building different ways for Bitcoin users to use BTC, beyond just holding it. I will first explain why we need better infrastructure to lay the foundation, and then delve into the various approaches taken by teams aiming to expand BTC's use cases. Finally, I will mention that the ultimate vision is both about social consensus and technical consensus.

Everything is going on, the team is building different auxiliary islands for Bitcoin Island and looking for solutions to modernize Bitcoin Island. Only if there is a social revolution among the islanders and they agree to change the rules, Bitcoin Island can be reformed permanently so that it can use the bridges to other islands as confidently as it uses the island's internal infrastructure.

1. Why do we need better infrastructure?

Existing blockchains like Ethereum, Solana, and even upcoming blockchains like Monad are built with developers in mind. They are built as platforms for developers to build applications. These chains provide comprehensive ecosystems with various learning resources, tools, frameworks, and features to support developers. Satoshi Nakamoto casually created Bitcoin without a well-thought-out API or clear documentation for learning how to develop Bitcoin.

There are three main reasons for continuously improving network infrastructure - better user experience, greater financialization, and scaled payments.

(1) Better user experience will drive activity and bring more revenue

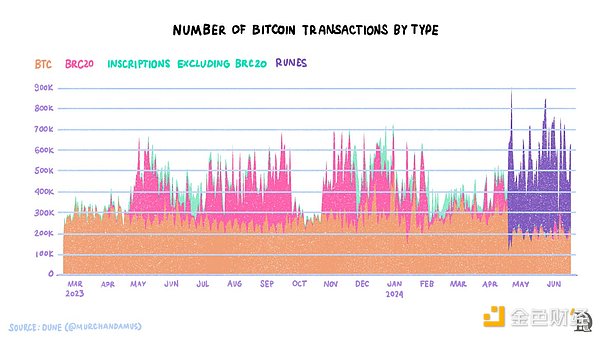

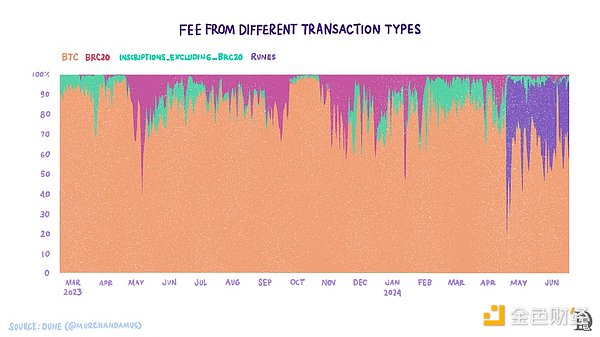

The Ordinals protocol is a way to leverage Bitcoin UTXOs that looks at individual Satoshis (BTC's smallest unit) differently, which has led to innovations like Inscriptions (NFTs on Bitcoin). Enthusiasm for ordinals and inscriptions has led to the evolution of alternative standards like BRC-20 and Runes. Inscriptions and Runes drive Bitcoin activity. Total daily transaction volume has increased by 70% for BTC transfers alone.

These new ways to transact in Bitcoin have helped increase transaction fees by about 40%. However, these new methods often spark heated debate in the Bitcoin community. One school of thought believes that Bitcoin should only focus on enhancing its core function as a decentralized payment system. They believe that stepping outside of this range could undermine the security, simplicity, and effectiveness of Bitcoin as a sound currency.

On the other hand, those who support a more flexible approach advocate expanding Bitcoin’s functionality to include non-payment use cases. They believe that this evolution is necessary for Bitcoin to remain competitive and relevant in the rapidly evolving blockchain ecosystem.

Is that enough? Not really. According to Token Terminal, Bitcoin miners have earned about $109 million in fees in the past 30 days. During the same period, applications such as Uniswap and Lido Finance have earned $90 million and $104 million respectively. The most recent halving was in April 2024, and the block subsidy received by miners was reduced by 50%. After the most recent halving event, the block reward (subsidy) was halved from 6.5 BTC per block to 3.125 BTC. This brings the total subsidy reduction for miners to 13,500 BTC per month (3.125*144*30). At $66,000 per BTC, the total is $891 million, so monthly transaction fees only account for about 12% of the subsidy loss.

Recent developments like runes are encouraging, but we need more. What challenges remain? Bitcoin’s user experience is nowhere near as good as Solana or Ethereum L2s like Arbitrum. On Solana, swaps take seconds and cost less than a penny. However, if you want to trade runes on Bitcoin, you have to pay several dollars in fees and wait for blocks to confirm your transaction.

In addition to this, when you buy runes, you must buy the full listed quantity. Buyers cannot modify the number of runes purchased. Another disadvantage is that runes cannot be exchanged for each other, just like we can exchange USDC for MKR on Ethereum. Traders must sell one rune in exchange for BTC and then buy another rune they want. The extra steps in the middle add unnecessary friction to the user experience.

The user experience of Runes trading is far from ideal. There is no way to use BTC as collateral or to lend it. Users must take BTC out of Bitcoin L1 and put it on other chains to use in financial applications.

(2) Increasing the financialization of BTC

First, Bitcoin has a market cap of nearly $1.3 trillion (at $66,000 per BTC). Like gold, Bitcoin is an external currency, meaning governments cannot manipulate the supply of Bitcoin. While the exact size of the gold loan market is unknown, some reports estimate it at $100 billion. Therefore, one of the most important reasons to build applications on Bitcoin is to borrow stablecoins using native BTC as collateral. A strong lending market would allow Bitcoin holders to earn yield on their BTC holdings.

Take staking as an example. Other native assets, such as ETH and SOL, have inherent staking uses in ensuring network security; approximately 27% of circulating ETH is staked in various staking protocols, with an annual yield of approximately 4%. Another approximately 4% of ETH is staked in re-staking protocols, and 67% of circulating SOL is staked. In addition, both ETH and SOL are widely used as collateral assets in their respective DeFi ecosystems.

Wrapped BTC (or WBTC) is the most widely used version of BTC in different DeFi ecosystems, with a market cap of about $10 billion, less than 1% of the total BTC in circulation. This shows the opportunity in the financialization of BTC.

Assuming similar levels of Bitcoin are used for staking or DeFi as Ethereum, around 30%, the amount is $390 billion. For context: the total value locked in all DeFi across all other chains is $101 billion. BTC is likely the most productive liquid asset. Right now, that potential is constrained by intentionally imposed technical limitations.

(3) Expanding BTC payments

The Bitcoin base layer was not designed with throughput in mind. If Bitcoin has to become the settlement layer of the Internet, we need faster transactions. As Mohamed Fauda said, there is a limit to the number of transactions that can be published using this method. At the maximum block size of 4MB, Bitcoin can support data at 6.66 kbps (4MB/10 minutes).

The Bitcoin network is currently unable to handle high traffic. During anticipated events such as the minting of Quantum Cat and the release of runes, users face a degraded experience. The poor user experience is not limited to those trying to mint inscriptions, but also includes those BTC senders and receivers.

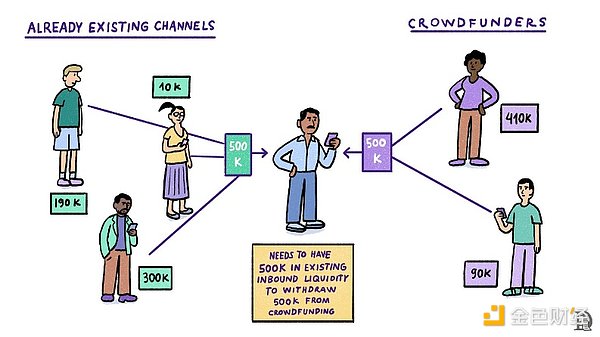

The adoption of the leading Bitcoin scaling network, Lightning Network (LN), is not promising. The capacity or liquidity of the network is around 5k BTC. This is the amount of BTC locked in all lightning channels. It affects the liquidity of the network, and the amount of BTC that can be transferred through the network.

Why is this important? Let's take an example to understand. Joel is raising $1 million to pay the workers on the coffee plantations in India, and he decides to use LN to receive donations. He can't just open his LN wallet to receive donations. He needs to have $1 million of inflows. Liquidity inflow refers to the amount of BTC locked in the channel by a counterparty. Sid is one of Joel's counterparties, and he has locked $10,000. Joel needs more counterparties like Sid, who have locked a total of $1 million, to receive donations worth $1 million. This poses a major challenge to network scaling, as inflowing liquidity is always limited by the opportunity cost of capital.

2. Challenges facing the development of Bitcoin

Bitcoin is as much a cultural or social phenomenon as it is a technological phenomenon. Social consensus is the last line of defense. For example, the 21 million hard cap can be modified by forking the code to increase the distribution tail by 1%. But for this change to take effect, all miners must mine on this fork, which they are unlikely to do. This is because the hard-coded cap has always been one of the main value drivers of BTC. If this cap is broken, value loss may occur. Miners are unlikely to mine on a fork that may lose value.

The lack of social consensus will render the technical effort required to change the codebase useless. The last time Bitcoin had a contentious fork was during the 2017 block war. The network split in two, with Bitcoin implementing Segregated Witness (SegWit) and Bitcoin Cash, which increased the block size. At the time, most miners chose the BTC camp.

For something to be considered money or a store of value, it must change infrequently. The main reason fiat currencies lose purchasing power over time is that central banks frequently use their power to increase supply. The unpredictability of unilateral central bank actions makes some currencies permanently weaker. Bitcoin culture resists change. Even something as non-controversial as Taproot took years to implement.

Implementing the above changes involves more than just changing Bitcoin. Bitcoin’s base layer also needs to be as simple as possible. Simplicity is critical to reducing attack vectors and improving stability. The main goal is to perform complex operations such as lending and minting stablecoins using BTC as collateral outside of the base layer (such as Ethereum L2).

3. Bitcoin L2?

What is L2? It should:

Provide L1 with sufficient data to verify and resolve disputes (if any).

There are no security assumptions outside of the base layer.

Allow users to unilaterally withdraw assets to the base layer or L1.

Since the current Bitcoin opcodes restrict it from verifying any proof, these conditions cannot be met. Therefore, all chains claiming to be Bitcoin L2 cannot be called L2.

Another aspect of L2 is to review the security assumptions of this layer with reference to the security assumptions of Bitcoin. Every blockchain has security assumptions, such as:

Most mining nodes are honest.

Nodes can independently verify blocks and reject invalid blocks.

Forks are resolved to the longest branch of the supporting chain, and so on.

The second layer (L2) should not extend the set of security assumptions of the base layer it is built on. For example, if the second layer has a centralized sorter that monopolizes block production, users need to be able to compete for block production at a tiny cost. L1 should be able to command L2 to release user funds as long as they have not been spent. For this stage, there are no such mechanisms even in Ethereum L2.

If we strictly follow the L2 characteristics mentioned above, even consensus Ethereum L2 like Arbitrum is not a true L2. Since the current set of Bitcoin opcodes prevents it from verifying any proofs, any chain claiming to be Bitcoin L2 cannot be called L2. The Lightning Network may be the only solution that meets the definition of L2. This article uniformly refers to these solutions as the Bitcoin extension layer.

4. Pros and cons of Bitcoin extension layer

Broadly speaking, there are two components to using BTC: 1) using a bridge, since there isn’t much available on Bitcoin, and 2) creating an environment or a chain on which investors’ applications using BTC can run.

To facilitate more use cases and greater scale, new layers may make security assumptions on top of Bitcoin. Users who want to use their BTC will want to make the lowest possible security trade-offs. Ethereum's scaling roadmap is a good reference to understand how Ethereum's scaling design space is evolving.

A few years later, Ethereum realized that rollups would be its scaling option. At this stage, we still don’t know which method is the best way to scale and make Bitcoin more programmable.

Whether storing data or choosing a bridge design, projects must make trade-offs between decentralization, security, speed, and user experience. The answers to the following questions constitute the design space for projects or companies building Bitcoin extension layers:

How do they implement the bridge from Bitcoin to the new chain?

How do they store data (data availability)?

How do they use Bitcoin L1 for settlement?

Do they expect to change the Bitcoin base layer to achieve their full vision?

What execution environment do they choose?

Does the Bitcoin extension layer facilitate the use of BTC in terms of gas and staking?

Different teams are making different trade-offs to provide better functionality and scale for BTC holders.

5. Bridging

BTC on Bitcoin cannot be transferred to other chains. Some infrastructure is needed to bring BTC to other chains. The typical bridge mechanism locks the user's BTC on Bitcoin and mints an equal amount of synthetic tokens representing BTC on the target chain.

What does a typical locking mechanism look like? This means that a user who wishes to transfer BTC from Bitcoin to any other chain sends it to a specific address on Bitcoin. The bridge operator controls this address. When the bridge operator detects incoming BTC, they mint an equivalent synthetic token representing that BTC and send it to the address specified by the user on the target chain.

The risk here is that if the bridge operator loses BTC on Bitcoin, then the tokens minted on the target chain will become worthless. We saw this risk firsthand after the FTX collapse. SolBTC was a wrapped version of BTC operated by FTX/Alameda. It became worthless because FTX did not honor its redemption promises after filing for bankruptcy.

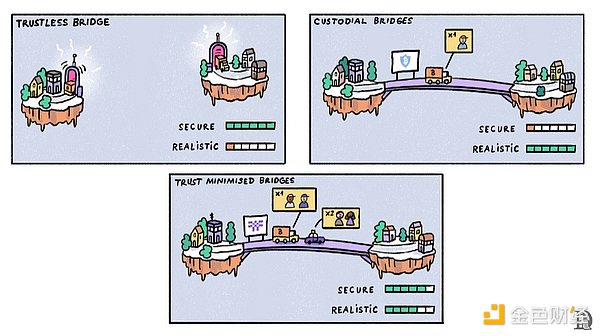

Therefore, everything the user does on the target chain is completely dependent on the bridge operator's security practices in controlling the user's BTC on Bitcoin. How to control the user's BTC determines different types of bridges. There are currently three types of designs in production.

(1) Trustless bridging

These bridges can only succeed if L1 can verify the proof submitted by L2. In the case of Bitcoin, this is impossible because it has no way of understanding anything that happens externally.

(2) Trust-minimized bridging relies on economic security

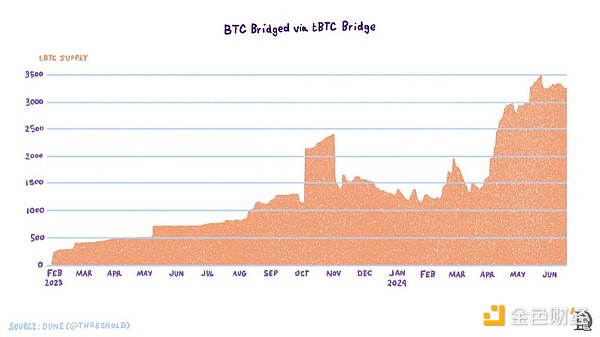

The next best option for BTC bridging is to have multiple public parties handle peg-in and peg-out. These parties secure users’ BTC on Bitcoin and mint/burn synthetic BTC tokens on other chains. One implementation is Threshold Network’s tBTC, which works with an “honest majority”.

This means that before an operator can perform any operation on a user's BTC, a consensus is required from the majority of operators running Threshold Network nodes. TBTC has no centralized intermediary, but instead randomly selects a group of operators running nodes on the Threshold Network to protect the security of the BTC deposited by users.

Who can become a node operator on the Threshold Network? The network has a governance token, T. Although T is used for governance, at least 40,000 T are required to become a node operator. As of June 25, 2024, the number of active nodes on the network is 139.

The tBTC Beta staker program aims to gradually decentralize the node network. Beta stakers can delegate their stakes among five professional node operators - Boar, DELIGHT, InfStones, P2P, and Staked. Beta stakers are expected to actively participate in node operations for at least 12 months. For example, they need to be highly responsive to network upgrades, preferably upgrading nodes within 24 hours of receiving a notice.

Whenever a user requests to mint tBTC, a new Bitcoin deposit address is generated. This address is dedicated to that user and is controlled by a node on the Threshold Network. Users can request to mint tBTC on networks such as Ethereum, Arbitrum, Optimism, Mezo, and Solana.

They need to provide two addresses - one is the Bitcoin recovery address (this is the address where their Bitcoin will be returned if there is a problem during the mining process), and the other is the target chain address where they want to receive tBTC. Once the request is made, the user must deposit BTC into the generated address and wait for the guardian to confirm their deposit. Once confirmed, the miner will send tBTC to the user's address on the target chain.

The network has about 3,500 bitcoins, or more than $200 million in locked value.

Given the capabilities of Bitcoin opcodes, trust-minimized bridges are arguably the best bridge implementation available today. The implementation of trust-minimized bridges depends on how multi-signatures are designed. Threshold Network’s tBTC, Stack’s upcoming sBTC deployment, and Botanix’s spiderchain are all examples of trust-minimized bridges.

(3) Managed bridging

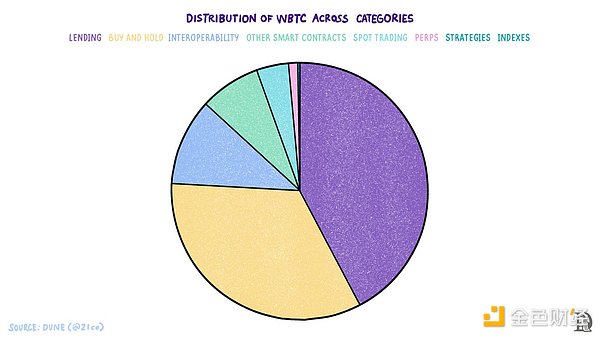

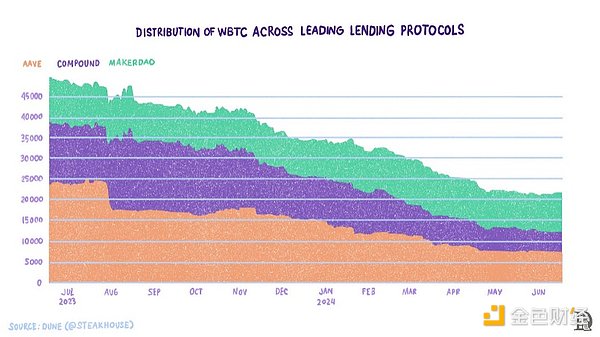

In this design model, a centralized provider locks the user's BTC on Bitcoin to a Bitcoin address maintained by a custodian. BitGo's WBTC is the most widely used BTC to other chain bridges. More than 150k BTC are bridged using WBTC. The current distribution of WBTC is shown below.

(4) BitVM

While these three types of bridges are already live and running, Robin Linus released the BitVM white paper in late 2023. BitVM proposes a new way to express Turing-complete smart contracts on Bitcoin. If a machine or a system can perform any computation in enough time, we say it is Turing-complete. As mentioned earlier, Bitcoin is not Turing-complete by design, and BitVM proposes a way to solve this without changing existing opcodes. It also proposes a bridge mechanism that is allegedly trustless.

The core idea of BitVM is to optimistically verify ZK (zero knowledge) proofs on Bitcoin. As long as there is no dispute about the transaction execution, it is assumed to be correct. The operation of this system generally assumes that there is at least one honest verifier. That is, if the execution is incorrect, there should be at least one honest verifier to challenge it.

So, as long as the ZK proof is not challenged, everything is fine. If there is a dispute, the challenger and the prover enter a challenge-response game on the chain, which results in an increased transaction load on the chain.

Liquidity management was another major flaw in early versions of BitVM. When users withdrew funds from the bridge, the system completed partial withdrawals and the bridge operator had to face liquidity. The operator would later be compensated from the bridge. As the amount of funds locked in the bridge increased, the operator had to maintain more liquidity to honor withdrawals. This put pressure on the operator and made the design extremely capital inefficient.

Assume that, on average, the operator needs to keep 10% of the TVL of the bridge as liquidity at all times. If the TVL of the bridge is $10 billion, the operator needs to keep $1 billion in liquidity at all times. As the bridge attracts more liquidity, the operator needs to have more BTC inventory on hand.

6. Execution Layer

The next piece of the puzzle in making BTC useful is the design of the chain to facilitate the use of BTC with the best possible user experience. Developers need to consider multiple factors when designing a chain.

Execution environment — Should it be an Ethereum Virtual Machine (EVM) compatible chain?

Being EVM-compatible has its advantages, such as having several years of tools available to developers, such as wallets and bridges to other EVM chains, and a familiar UX.

Ethereum's L2 has benefited from EVM compatibility. EVM-compatible L2s like Arbitrum and Optimism can quickly gather users and applications already on Ethereum. In contrast, L2s that are not EVM-compatible, such as Starknet, have difficulty gaining adoption.

However, the EVM also has its disadvantages. Since the EVM executes transactions in a serial manner, parallel processing is not possible. However, newer execution environments, such as the Solana Virtual Machine (SVM) and the upcoming Monad, support parallel processing.

Data availability — Similar to Ethereum, rollup solutions are also emerging in the Bitcoin space. Rollups come in many forms depending on how and where the data is stored. Some store state differences (the difference between two states of the chain after executing a batch of transactions) and validity proofs on L1, some store compressed transaction data on L1, and some only store validity proofs on L1 and store transaction data on other layers.

Chains like Stacks use Bitcoin as a checkpointing mechanism. The block time on Stacks is much shorter than Bitcoin. Stacks publishes the block data between two Bitcoin blocks to each Bitcoin block.

The execution layer can publish transaction data in the form of inscriptions on Bitcoin. Recall the days of the Bitcoin network's 6.66 kbps bandwidth. If a compressed file is 10 bytes in size, a Bitcoin block can theoretically contain up to about 600 compressed transactions. However, this maximum is almost impossible, as 4 MB blocks are a rare phenomenon, and even rarer is it that the entire 4 MB space is available for inscriptions.

The block size depends on the combination of SegWit and non-SegWit transactions. SegWit is short for Segregated Witness, which separates or isolates transaction data from witness data. The idea is that not everything stored in a block has the same value. Instead of limiting the block size to the traditional 1 MB, SegWit proposes a new limit of 4 million weight units. So if a block contains all non-SegWit transactions, the limit will be 1MB. But if it contains all SegWit transactions, it may be a 4MB block.

Several teams are building Bitcoin layers to take advantage of BTC’s massive liquidity. In this article, we examine six teams that have different tradeoffs and interesting designs. We’ll briefly describe how they work, their stage of development, and their traction to date.

(1) Babylon

Babylon is focused on expanding the use of BTC as a collateral asset. It brings a different approach than other Bitcoin layers (so-called L2) in the form of remotely staking BTC. This means that instead of locking BTC on Bitcoin to mint a synthetic version on a different layer, Babylon introduces the following mechanism:

Users lock their BTC in a self-custodial vault by creating a UTXO that can only be spent once, which can be spent when a pre-specified time (staking period) has passed, or when the user burns their staked UTXO via special EOTS (extractable one-time signatures).

After confirming the staking transaction, users can use their EOTS to verify blocks on the PoS chain in the Cosmos ecosystem to earn income.

If the user behaves honestly, they can unlock their BTC at the end of the staking period, or submit an unbinding transaction to Bitcoin.

· If dishonest behavior is detected, the user's EOTS will be disclosed to the public. How is this detected? Babylon's vigilantes ensure that there is at least one honest operator. It is a program suite that acts as a data relayer between Bitcoin and Babylon. The Submit program submits Babylon checkpoints to Bitcoin using OP_RETURN. The Reporter program scans the Babylon checkpoints and reports them to Babylon. If anomalies are detected, anyone (slasher) can submit a Bitcoin transaction using the public EOTS key to claim the malicious user's stake.

An obvious question is, why can't the user use the key to get the stake back themselves? The answer may be that when miners see this transaction, if someone else initiated the same transaction, the miner will choose the transaction with a higher fee. For example, if the stake in question is 5 BTC, the slasher can even share 4.99 BTC with the miner and still make a profit. In this case, most of the profit goes to the miner, not the slasher. However, the malicious user loses most of their stake, either to the slasher or to the miner.

Although Babylon offers an interesting approach to expanding the use of BTC, its mechanisms are quite complex. For example, slashers have not been successfully deployed on many PoS chains, although some have been around for years. In addition, although Babylon can utilize remote staking so that BTC can be used to secure other PoS chains, it requires bridging to support other BTC use cases, such as lending.

(2)Build on Bitcoin (BOB)

Ironically, Build on Bitcoin (BOB) is an Optimism-based rollup that is still settled on Ethereum as of June 2024. It claims to be an Ethereum L2 aligned with Bitcoin. BOB will be launched in four phases:

Phase 1 — OP stack rollup. At this stage, it is purely an Ethereum rollup. Fraud proofs are not yet available on mainnet. Fraud proofs are a mechanism that allows anyone to question the validity of transactions included in a rollup transaction package.

Phase 2 — Ethereum rollup with Bitcoin security. In this phase, BOB will utilize Bitcoin’s merged mining. Merged mining allows miners to secure or mine multiple chains together with the Bitcoin network.

Phase 3 — Optimistic Bitcoin rollup via BitVM. BitVM is not live yet. After improving the current version, BOB will start using BitVM for settlement on Bitcoin.

Phase 4 — ZK rollup on Bitcoin. After Bitcoin accepts opcodes that allow it to verify ZK proofs, BOB will settle on Bitcoin using ZK proofs.

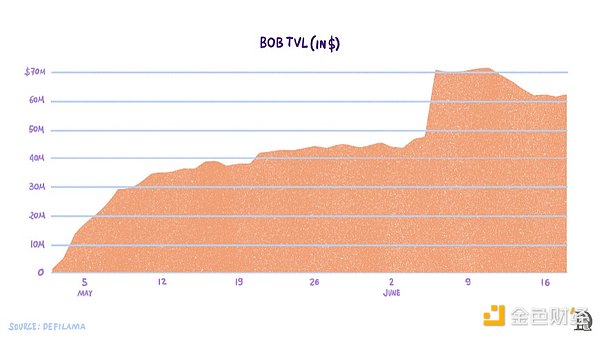

As of June 17, 2024, BOB has approximately $60 million in TVL, of which Sovryn DEX contributed approximately $20 million.

(3) Botanix

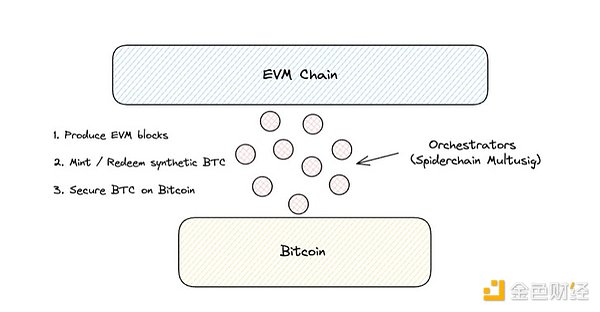

The Botanix team has brought a major innovation: Spiderchain. What is Spiderchain? It is a rolling multi-signature for coordination nodes on Botanix. Let's break it down. As we mentioned earlier, L2 requires a bridge and a chain to execute transactions. Coordinating nodes keep users' funds safe on Bitcoin and mint and burn synthetic BTC for users (on the EVM layer). Orchestrators run Bitcoin and Spiderchain EVM (Botanix) nodes.

Assume that there are N coordination nodes on the network. For each Bitcoin block, M (

Botanix's chain is EVM-compatible and secured by the PoS consensus mechanism. In addition to securing BTC on Bitcoin by participating in the rolling multi-signature network and facilitating the minting and redemption of synthetic BTC, the coordinator also participates in the block construction of the EVM chain. They publish the root hash (a compressed version of the Botanix EVM transaction) as the inscription of Bitcoin.

Readers must note that simply publishing Bitcoin data does not imply settlement. The difference is that the data published by external chains like Botanix in the form of inscriptions is stored in a place that is not verified by Bitcoin nodes (miners). The Bitcoin protocol is completely unaware of the existence of this data. Therefore, it is impossible to determine whether the transaction data published in the inscription is correct.

As of June 2024, Botanix EVM and Spiderchain are in the testnet stage.

(4) Citrea

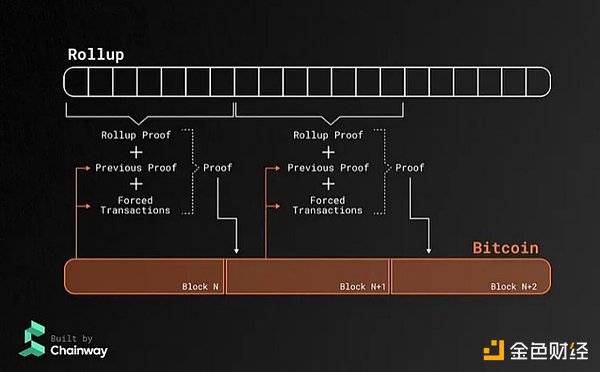

Citrea is developing a ZK rollup on Bitcoin. What does “on Bitcoin” mean? It means that it intends to use Bitcoin as a data availability layer. The company said that the most secure and incentive-aligned way to scale the Bitcoin blockchain is to shard execution with on-chain verifiability and data. Sharding execution means breaking up execution into smaller parts.

Citrea then aggregates the shards, or bundles of transactions, and publishes the state differences between the two bundles on Bitcoin, along with a proof called a proof of validity. The problem is, Bitcoin currently doesn’t have the ability to verify any proofs. Citrea’s final form will have to wait until Bitcoin has opcodes that allow it to verify ZK proofs.

In the meantime, it will use the BitVM implementation as a temporary solution for proofs and bridging BTC in and out of rollups. Of course, Citrea inherits the shortcomings of BitVM mentioned in the previous content. In the future, as BitVM improves, Citrea will improve its bridging capabilities.

As of June 2024, Citrea is still in the testnet stage.

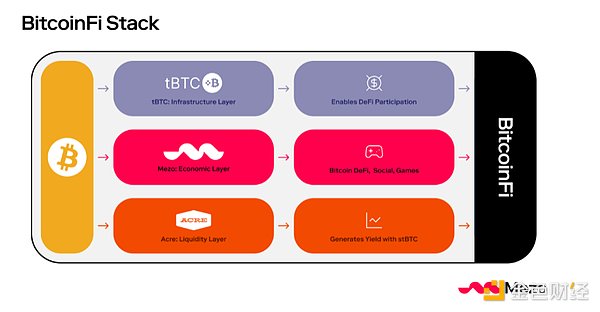

(5) Mezo

Mezo bills itself as the economic layer of Bitcoin, not Bitcoin L2. It uses Threshold Network's tBTC bridge to bring BTC in and out of the EVM chain - Mezo.

Mezo's development team has developed products such as tBTC, Fold, Keep, and Taho. The team has been developing applications around Bitcoin for many years. Mezo's goal is simple: to expand the use cases of BTC. It uses the following three mechanisms:

Allow Mezo users to earn interest by staking BTC to protect network security.

Allow users to pay gas fees with BTC and distribute it to veBTC and veMEZO stakers.

Build an end-to-end BitcoinFi experience.

What exactly does BitcoinFi and the economic layer mean? Most new chains, including EVM chains, rely on the existing user experience - the same wallets, bridge solutions, etc. Updating the user experience is almost never a priority. Mezo curated the entire user experience from scratch, which is something I rarely see. It includes:

A native stablecoin (mUSD) backed by BTC, so users don’t have to bridge BTC from other chains.

A long-tail lending protocol secured by BTC.

A fully integrated on-ramp and off-ramp (Fold compatible).

Integrated wallet experience (Taho compatible).

Combining all of these applications creates a unique end-to-end BitcoinFi experience:

Mezo is based on the Cosmos SDK and uses Comet BFT to reach consensus.

CometBFT is software for safely and consistently replicating applications across multiple machines. By "safe", we mean that CometBFT can still work even if no more than 1/3 of the machines fail in any way. By "consistent", we mean that every non-faulty machine sees the same transaction log and computes the same state. Safe and consistent replication is a fundamental problem in distributed systems; it plays a key role in fault tolerance for a wide range of applications, from currencies to elections to infrastructure orchestration. - Source: CometBTF documentation

It consists of two components - a consensus engine and a general API. Based on the Tendermint core, the consensus engine is responsible for block generation, verification, and finality. Tendermint is one of the earliest proof-of-stake consensus designs. It provides Byzantine Fault Tolerant (BFT) consensus and can accommodate up to one-third of malicious nodes.

The application programming interface — the Application Blockchain Interface (ABCI) — decouples the consensus engine from the application. A major advantage of ABCI is that, because consensus and applications are decoupled, developers do not need to use the same language used to build the consensus engine to build applications.

The interface acts as a medium for passing transactions to applications for execution. This functionality makes the system more modular and helps focus more application developers. Initially, Mezo will only be compatible with the EVM runtime.

Mezo’s economic design is such that as it grows in prominence, Bitcoin holders may benefit directly or indirectly. They can hold BTC on Mezo and receive staking rewards, or, if they choose to continue holding BTC, they will receive some benefits by taking BTC out of circulation (to pay Mezo’s fees).

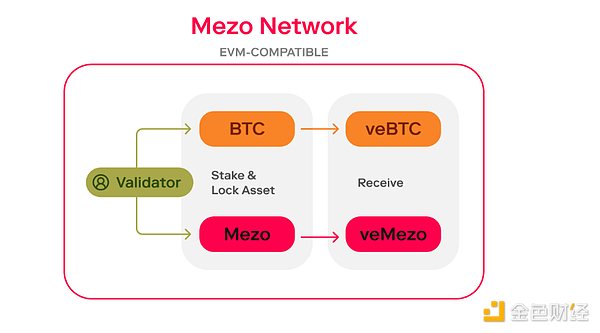

Mezo has a dual staking model, as shown in the figure below. Validators on the network can stake BTC and MEZO (the native token of the MEZO network). By staking BTC and MEZO, validators receive veBTC and veMezo respectively. "ve" stands for validator escrowed, and these tokens are usually locked in smart contracts. Token holders of validator escrow have governance rights, and network rewards and fee income are shared with them.

The longer the assets are locked, the more ve tokens are issued. veBTC stakers receive BTC, and veMEZO stakers receive MEZO rewards. Part of the MEZO rewards can be burned to increase BTC funds.

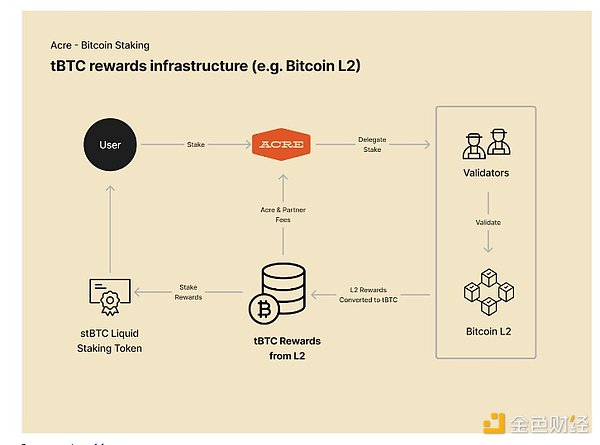

Yield is one of Mezo’s core products, as the fees paid by users are paid to validators who stake BTC. Mezo will further expand the scope of BTC staking by providing liquid staking with Mezo’s sister project Acre. When users deposit BTC into Acre, they receive a liquid staking token stBTC in return. BTC storage can be applied across chains and used in various DeFi applications. The yields generated through these activities are accumulated in the form of stBTC, which can be exchanged with BTC at a 1:1 ratio.

BTC, with a market cap of over $1 trillion, has not even scratched the surface of the lending market. The distribution of WBTC in the lending market is shown in the figure below. It shows that the amount of WBTC used in the top three lending applications has dropped from ~50k to ~23k between July 2023 and June 2024. The decline in the total amount of WBTC in lending applications can be attributed to the 48% drop in the WBTC supply, from 285k WBTC in May 2022 to just over 150k WBTC today. This decline is mainly due to the market realizing the risks posed by centralized parties after Luna, 3AC, and Alameda.

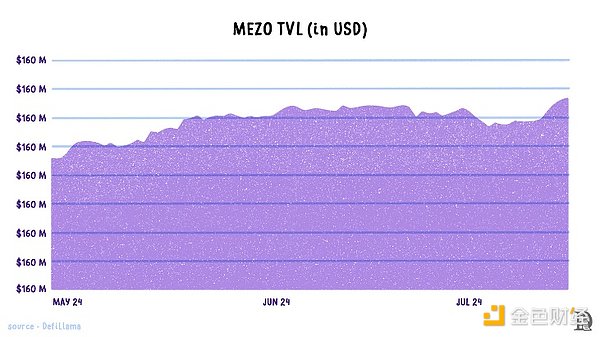

In the first phase of the launch, Mezo has begun accepting BTC deposits with three lock-up periods: two months, six months, and nine months. Deposits accumulate points in the form of HODL points. One BTC generates 1,000 points per day, and the multiplier is related to the lock-up period. The longer the lock-up period, the higher the multiplier. Users can also deposit other assets such as USDe, USDC, and USDT to boost their BTC deposits. As of July 2024, Mezo's TVL is $135 million.

In addition to rewarding holders, Mezo will also share some of its fees with the Bitcoin Core protocol.

(6) Stacks

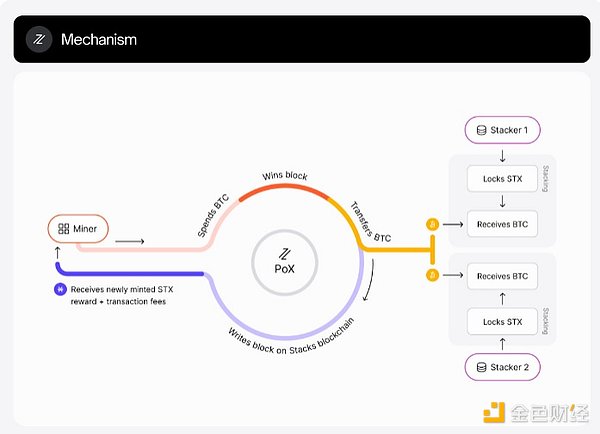

Stacks (formerly Blockstack) recently launched the long-awaited Nakamoto upgrade, which aims to solve problems such as constant forks and slow transactions before the upgrade. Stacks works based on the Proof of Transfer (PoX) consensus.

Therefore, Bitcoin miners interested in producing blocks on Stacks need to send some BTC. A miner, such as Alice, is randomly selected to produce blocks on Stacks. The BTC from this miner is given to those users who lock/hold STX, the native token of the Stacks chain. This is interesting because, although the reward is small, it is in BTC. On most chains, the reward is only given in the native token of the chain.

Once selected, Alice can generate Stacks blocks until the end of the Tenre (next Bitcoin block). Miners generate Stacks blocks and share them with signers for verification. Once more than 70% of signers receive the Stacks block, it is accepted by the Stacks network. We assume that Alice generates 10 Stacks blocks before the next Bitcoin block is mined, and Bob wins the term to produce Stacks blocks thereafter.

Bob takes the hash of the first Stacks block that Alice generated on Stacks and adds it to his block submission transaction for inclusion in the Bitcoin chain. Stackers detect this transaction. They include a term change transaction on Stacks that contains the hash of the last block Alice generated on Stacks, in this case block #10. This way, Bob understands that he must be building on the block before Alice (#10).

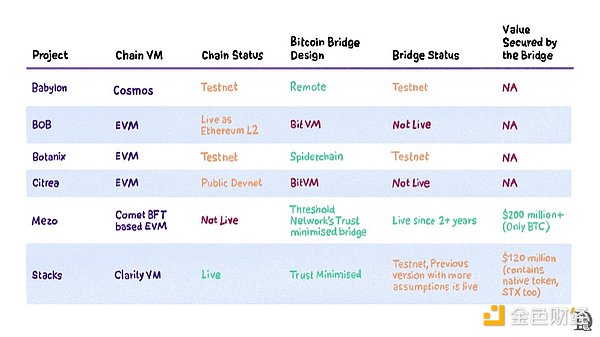

Although the development of the Bitcoin layer is still in its early stages, a comparison of the above chains is made here, considering chain design, bridge design, and the protection of USD value.

We have to mention that in addition to the teams mentioned above, there are many other teams (such as Alpen, Bison, BitLayer, Rootstock, SatoshiVM, and Soveryn) who are building extension layers for Bitcoin.

7. Relationship between L2 and L1

L2s benefit L1s in two ways: scale and cost. They provide users with a cheaper way to transact without sacrificing too much security (or any security in the case of L2s which are non-custodial, trustless bridges, and have no additional security assumptions).

Take Ethereum L2 as an example. According to Token Terminal, in the second week of June 2024, Ethereum supported 7.1 million transactions with revenue of $10.6 million. The cost per transaction for users was about $1.5. At the same time, five L2 platforms, Arbitrum, Base, Blast, Optimism, and Polygon, supported more than 70 million transactions with a fee of $2.75 million. The transaction fee was $0.03 per transaction.

We can argue about the quality of transactions (including whether they were bots) or the value of the transactions, etc. However, the fact is that Ethereum cannot support that many transactions.

But there is a downside. L1 is no longer directly connected to their customers or users. In the traditional world, it is usually the business closer to the end user that captures most of the value. Amazon is a good example. Its huge distribution network gives it an upper hand in competing with suppliers and manufacturers.

Dollar Shave Club disrupted the razor industry by breaking away from traditional retail channels and selling directly to consumers through a subscription model. This allows them to implement lower product pricing while retaining most of the value rather than sharing it with the entire supply chain.

Adding another layer between you and your customers is generally not a good idea. Why would L1 go this route? L1s aren’t losing customers by bringing L2s in. They are bringing B2B into a once strictly B2C business model. But there may still be a question — are L2s capturing most of the value? Are they passing enough fees to L1s?

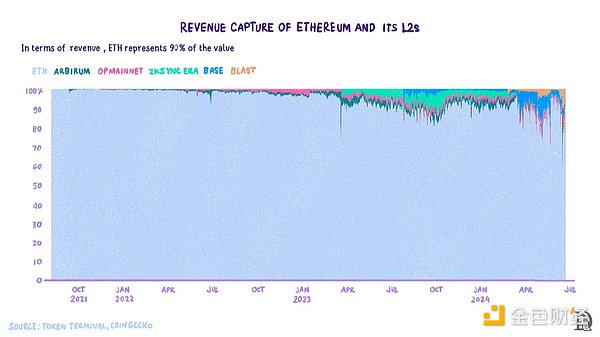

Fortunately, Ethereum has been on this path for the past three years, and we can observe the impact of L2 on Ethereum's value capture. There are two ways to understand whether L2 is a predator of the Ethereum ecosystem.

The first approach is to see if Ethereum loses revenue due to L2. We can test this by studying the change in Ethereum’s share of revenue in the Ethereum ecosystem. The following chart is about the revenue of Ethereum and the five leading L2s. Ethereum has always accounted for more than 90% of the revenue stream.

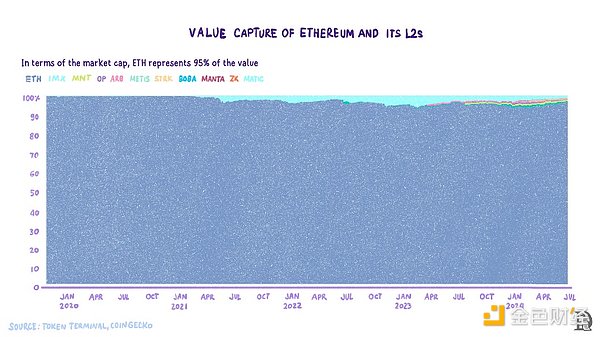

Another way is to look at market capitalization or price. Since value capture is almost always reflected in price, compared to the top 10 L2s by market capitalization, ETH accounts for more than 95% of the total market capitalization of the Ethereum ecosystem.

Ethereum cannot support so many transactions, but it still accounts for more than 90% of the ecosystem value, which shows that L2 is the right measure to scale Ethereum. As long as L2 is based on L1, healthy competition between L2 for L1 block space will indicate the healthy development of the base layer.

8. What happens next?

Think about the island metaphor again. When it comes to true L2, the two islands must cooperate to build a bridge. But this cannot be achieved without internal consensus among the Bitcoin Islanders. What is happening now is that those who want to be the L2 islands of Bitcoin Island are trying to ensure that the infrastructure is a stopgap measure.

So once Bitcoin Islanders agree that they need to connect to other islands in order to grow, L2 islands are there. Until then, it’s important not to try to find more complex ways to bridge or create L2, but to focus on using what already works, and using battle-tested infrastructure.

Everyone knows how Bitcoin Islanders are set in their ways and how they take security extremely seriously. Any changes made to the island are discussed exhaustively and thoroughly. Anyone who wants to suggest a change to Bitcoin can draft a Bitcoin Improvement Proposal (BIP). After informal discussions on various forums, the author incorporates feedback and makes changes to the BIP. The Islander Committee then provides the BIP with a date when it will be officially confirmed.

Some islanders understand the need to carefully modernize Bitcoin Island. Teams such as Botanix, Taproot Wizards, and Thesis are laying the foundation for adding opcodes to expand Bitcoin's programmability. BIP-420 (also known as OP_CAT), proposed by Ethan Heilman and Armin Sabouri, will open up a ton of exciting possibilities for Bitcoin. CAT is an opcode that was part of the original Bitcoin opcodes but was modified by Satoshi Nakamoto due to security issues that have now been mitigated as the Bitcoin execution environment has evolved over the years.

Opcodes allow two pieces of data to be connected together. It unlocks many possibilities from custom transaction types (such as dynamic escrow systems, smart contracts such as atomic transactions), various DeFi applications, and greater interoperability with external chains.

Teams like Starkware have pointed out that OP_CAT can bring STARK verification to Bitcoin. This means that Bitcoin can verify ZK proofs, thereby supporting rollups. This design paradigm not only allows for general design on Bitcoin, but also improves the scalability that Bitcoin desperately needs.

Other designs from the Taproot Wizards team, such as CATVM, are already in development. This design will use OP_CAT to create a trustless bridge. Unlike the current BitVM design, CATVM has no liquidity requirements. CATVM will enable decentralized trading of ordinals and runes, and its user experience is as good as other chains.

Segwit paved the way for Taproot, which in turn is essential to Ordinals. Ordinals and Inscriptions make BRC-20 and Runes possible. Recent enthusiasm among Bitcoin developers shows that there is growing support for reaching social consensus on BIP-420. It will also be backwards compatible, so the network will not require a hard fork to activate it. We are excited for it to go live and for us to witness a new era of true Bitcoin-native programmability.

After a long time, developer interest in Bitcoin has exploded. All the independent projects building around Bitcoin are like small islands of modernity surrounding the mighty Bitcoin island. With BIP-420, we may well have a way to fuse these islands together into one thriving, modern island.

With all the changes happening to Bitcoin, I expect that in the future we will be able to use BTC in different financial applications with little knowledge of its underlying layers. The integration of the Bitcoin layer will be as natural as we feel when we travel through Mumbai today, without realizing that this bustling metropolis was once seven separate islands of Bombay.