STRK, the native token of ZK rollup platform Starknet, has seen its value fall over the past week due to continued downward buying pressure over the past few weeks.

If the current bearish trend continues, Layer 2 (L2) tokens are likely to break the all-time lows they recently fell to .

Starknet Could Fall Below All-Time Low

On July 5, STRK plummeted to an all-time low of $0.46. Although its value has since risen 14%, the L2 token remains at risk of losing this gains and falling below $0.40.

This is because selling pressure on altcoins is steadily increasing. As of this writing, STRK's Relative Strength Index (RSI) is trending downward and is far from the 50 neutral line at 36.77.

The RSI of an asset measures the speed and changes in price movement. It ranges from 0 to 100 and is used to identify overbought or oversold conditions in the market.

STRK's RSI of 36.77 indicates that market participants prefer selling over buying, putting downward pressure on the price .

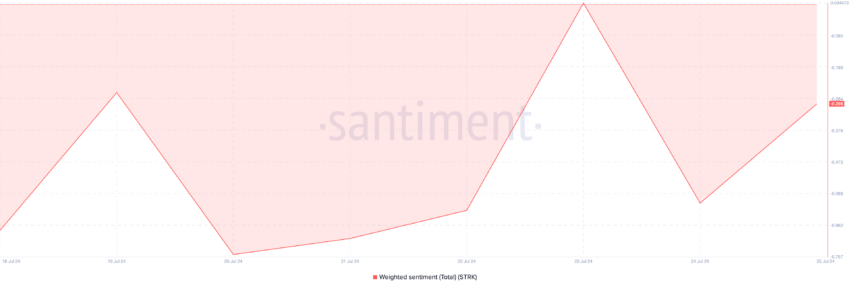

This level is close to the oversold threshold of 30, indicating that the asset may be undervalued and the price could rise when buying momentum returns. However, the negative sentiment that currently follows STRK may not be possible in the short term. At press time, STRK's weighted sentiment was -0.29.

Read more: An in-depth analysis of Starkware, Starknet, and StarkX

An asset's weighted sentiment indicator tracks the overall sentiment in the market for that asset. When the asset-weighted sentiment index is lower than 0, most social media discussions are fueled by negative emotions such as fear, uncertainty, and doubt. This is often interpreted as a harbinger of a price decline or confirmation of a downward trend.

STRK Price Prediction: Bearish Sentiment Thriving in Derivatives Markets

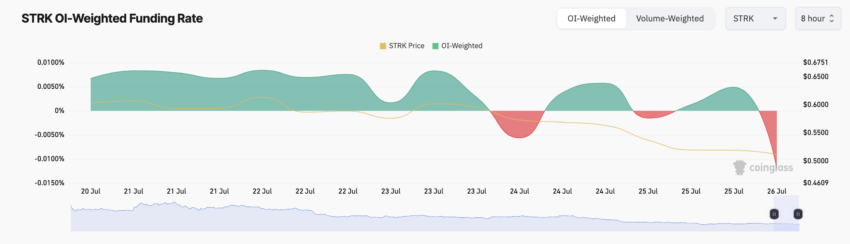

The bearish sentiment following STRK can be seen in the large number of short positions opened over a 24-hour period. According to Coinclass, the token's funding rate at press time is -0.01%.

A negative funding ratio for an asset reflects bearish sentiment. This means that there are more traders who expect the price of an asset to fall than those who buy it for profit.

If bearish sentiment persists and selling pressure continues to increase, STRK could fall as low as $0.19, a price level last reached in January.

Read more: The best airdrops scheduled for 2024

However, if sentiment switches from bearish to bullish , the token price could rise above $2 .