Original | Liu Jiaolian

BTC fought back overnight. After testing the 64k support (briefly punctured) yesterday, it rebounded quickly and strongly crushed 67k. Jiaolian took advantage of yesterday's big drop and followed the eight-character formula of adding positions when the price drops. It picked up leaks twice at 65k and 64k to cover the discounted chips. It should be noted that as reported last night [ “7.25 Jiaolian Insider: The market expects the Federal Reserve to cut interest rates by 100% in September” ], macro easing has stood in front of us like a huge wave, and BTC is currently in a small bull market before the power law cycle bull market. Every sharp drop and discount is a rare opportunity to cover positions. Life opportunities, spring nights of sweetness, miss one less time.

The yellow line that Jiaolian drew for himself in his heart, 70k, or 70,000 dollars, is a key watershed. Why? Readers who follow Jiaolian's articles carefully may still remember that about two months ago, on May 29, 2024, Jiaolian wrote an article called "The Calm Bull Market" , which pointed out that according to the power law model , the expected bottom of the next bear market at the end of 2026 is exactly 70k. For Jiaolian, every increase in position will definitely be held for more than 2 years. That is to say, all the increase in positions below 70k will be quite safe.

But I still have to remind you. Why use a subjective adjective like "peace of mind" instead of an objective word like "low risk"? Because the same fact can have very different or even completely different effects and feelings for different people. Honey to me may be poison to others. What a long-termist feels at ease with may be a nightmare to a short-term investor. Therefore, it is absolutely impossible to generalize.

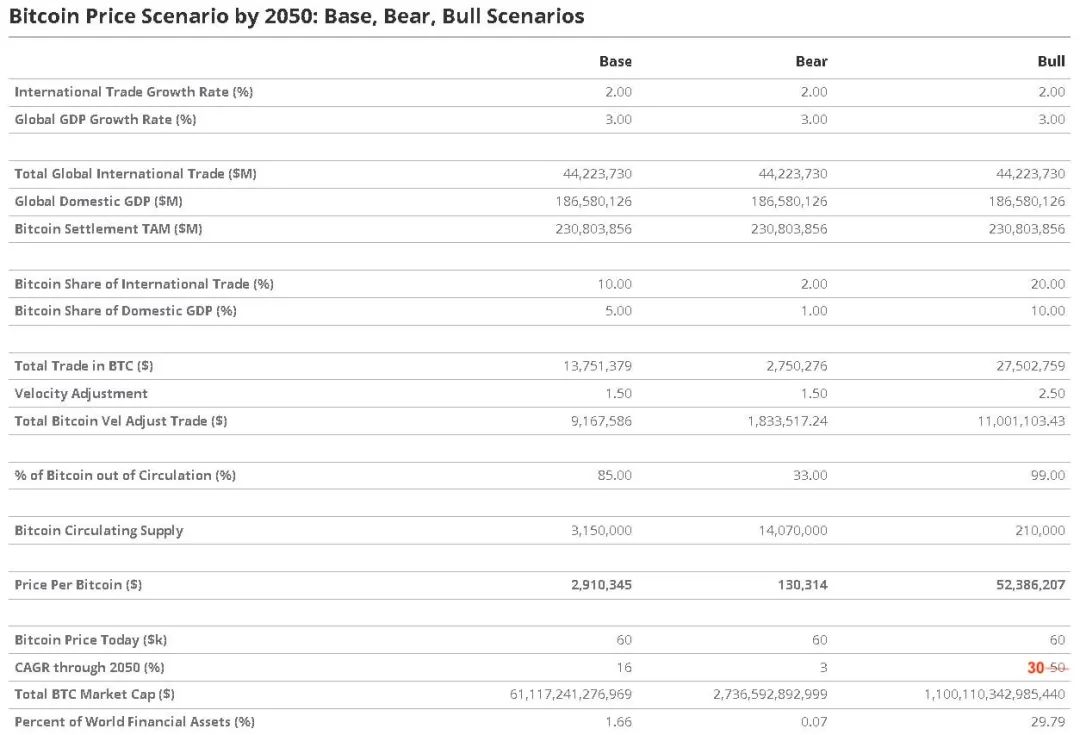

VanEck, a long-established American asset management company founded in 1955, released their predictions for the price of BTC by 2050 (see the table below). There are three scenarios: baseline scenario, $3.15 million; bear scenario, $140,000; bull scenario, $52.38 million.

The analyst's inference logic or calculation method can be read from the table.

First, they estimated the growth rate of international trade volume (2%) and the growth rate of global GDP (3%), and then assumed the share of BTC, calculated the settlement amount carried by BTC, and then used the Fisher equation to calculate the (Jiaolian speculates that this is because they introduced Velocity Adjustment), convert the BTC transaction volume, and then by assuming the proportion of BTC participating in circulation, finally calculate the estimated value of BTC price.

With the price estimate for 2050, we can calculate the so-called CGAR compound annual growth rate starting from today's $60,000: baseline scenario, 16%; bear scenario, 3%; bull scenario, 30% - note here, VanEck originally wrote 50%. However, after a simple calculation by Jiaolian, the CAGR of 50 for the bull scenario is suspected to be a typo, and it should be about 30. It may be that the analyst was nervous when making up the numbers, LoL.

Many people may be surprised by the absolute price figures. But if you look at the CAGR, it seems ordinary. The baseline scenario grows 16% per year, which is not even as good as Buffett's 20%. Not to mention the 3% in the bear scenario, which is not as high as the 30-year mortgage rate. The 30% in the bull scenario seems to have some meaning, but for many people who rush into the crypto with the dream of getting rich overnight, it is still not worth it.

Last night, when I was coaxing my baby to sleep, I talked about the basic laws of the economic society in today's era. I told my baby that today's era is the era of capital, and the economy is the economy of capital. The United States is a capitalist society, and we are a socialist society, but in order to develop the economy, we must accumulate and develop capital, make money with capital, and improve our lives. The only difference is that in capitalism, capital controls the people, and in socialism, people control capital. But if you want to live a good life, you can't abandon capital. Why? Because the speed at which capital makes money is much faster than the speed at which labor makes money.

Working is a typical way of earning money through labor, which can only satisfy your basic needs, but cannot make you rich. To get rich, you must do two things: start a company, or invest, or do both. Investing, in essence, does not mean starting a company yourself, but using money to support others to start a company, and then sharing the profits. Companies are industrial capital, and investments are financial capital. Today, all the capital in the world can be classified into these two categories.

I asked him to assume that he would earn 10,000 yuan a month after graduation. How many years would it take to earn a small goal (100 million yuan)? He calculated that it would take about 833 years.

The kid asked me, what if I could earn 10,000 yuan a day? I said, how many years would it take to earn 10,000 yuan a day? He quickly figured it out, and it would take more than 27 years this time.

I asked my child: How many job opportunities do you think there are today that earn 10,000 yuan a day? This is a job with a monthly salary of 300,000 yuan. My child thought about it and said, how many people can there be in the country? I said, it’s impossible. Among our 1.4 billion people, it’s good to have tens or hundreds of thousands of people with a monthly salary of 300,000 yuan (just salary income) or more.

I gave my child another math problem: If you spend 10,000 yuan to buy some BTC, and BTC doubles every year, how much money will you have in the second year, the third year, etc.? How many years will it take to reach a small goal?

The kid quickly calculated: 20,000 in the second year, 40,000 in the third year, 80,000 in the fourth year, 160,000 in the fifth year, 320,000 in the sixth year, 640,000 in the seventh year, 1.28 million in the eighth year, 2.56 million in the ninth year, 5.12 million in the tenth year, 10.24 million in the eleventh year, 20.48 million in the twelfth year, 40.96 million in the thirteenth year, 81.92 million in the fourteenth year, and 163.84 million in the fifteenth year, or 160 million, reaching a small goal. So you only need to hold it for 15 years, which is much faster than the 27 years of making 10,000 yuan a day!

At this time, I told my child that in reality, the growth rate of BTC over the past decade is really similar. Recalling the first bull market in mid-2011, BTC was at a peak of about 100 yuan, and the bottom was probably less than 10 yuan. Let's assume that your 10,000 yuan was bought at an average cost of 40 yuan. Today, in mid-2024, BTC is now about 60,000 dollars, which is exactly 400,000.

From 400,000 to 400,000, it has grown by 10,000 times. From 2011 to 2024, how many years? 13 years. In 13 years, your 10,000 yuan has become a small goal.

Finally, I conclude: Labor makes money slowly, because working makes money by addition. Capital makes money quickly, because capital makes money by multiplication. Which do you think is faster, addition or multiplication?

The baby fell asleep contentedly.

Financial problems are really suitable for primary school students to practice the four arithmetic operations.

The doubling of capital every year in the exercise above is called a CAGR of 100% in financial terms.

So we know that in the past 13 years, from 2011 to 2024, the CAGR of BTC is really over 100%. It is really amazing to have done 5 Warren Buffetts.

Then, looking back at the beginning of the article, the calculation model established by VanEck, in the most aggressive bull market scenario, the CAGR is also reduced by 70%, only 30%. Well, it can be said to be quite conservative, haha.

Jiaolian has mentioned many times in many articles, such as the article "Saving Bitcoin Gives You Financial Freedom" on March 19, 2021, that Jiaolian expects the CAGR of BTC in the future to be about 40% for a considerable period of time.

Why did Jiaolian draw the line at 40%? Because according to the eight-character formula, the position building period With a CAGR of 40%, the CAGR' converted from the P/L (profit/loss) of the position will be roughly half, or 20% - exactly the same as Buffett's long-term return of 20%.

Jiaolian thinks that the strategy of "Eight Characters + BTC" cannot underperform Buffett, right? Otherwise, how can BTC compete with the US stock market, and how can it siphon liquidity from the US stock market?

However, if the CAGR is 40% for 26 years, from 2024 to 2050, the value of the company will increase from $60,000 to $378 million, which seems a bit too scary.

That means that the high growth rate of 40% can be maintained in the first few years. As time goes by, the growth rate will gradually decline. By 2050, the average annual compound growth rate will be about 30%.

This is a simple truth that we have derived through mathematical model calculations: As for BTC, the earlier you enter and the longer you hold it, the greater the benefits you will gain.