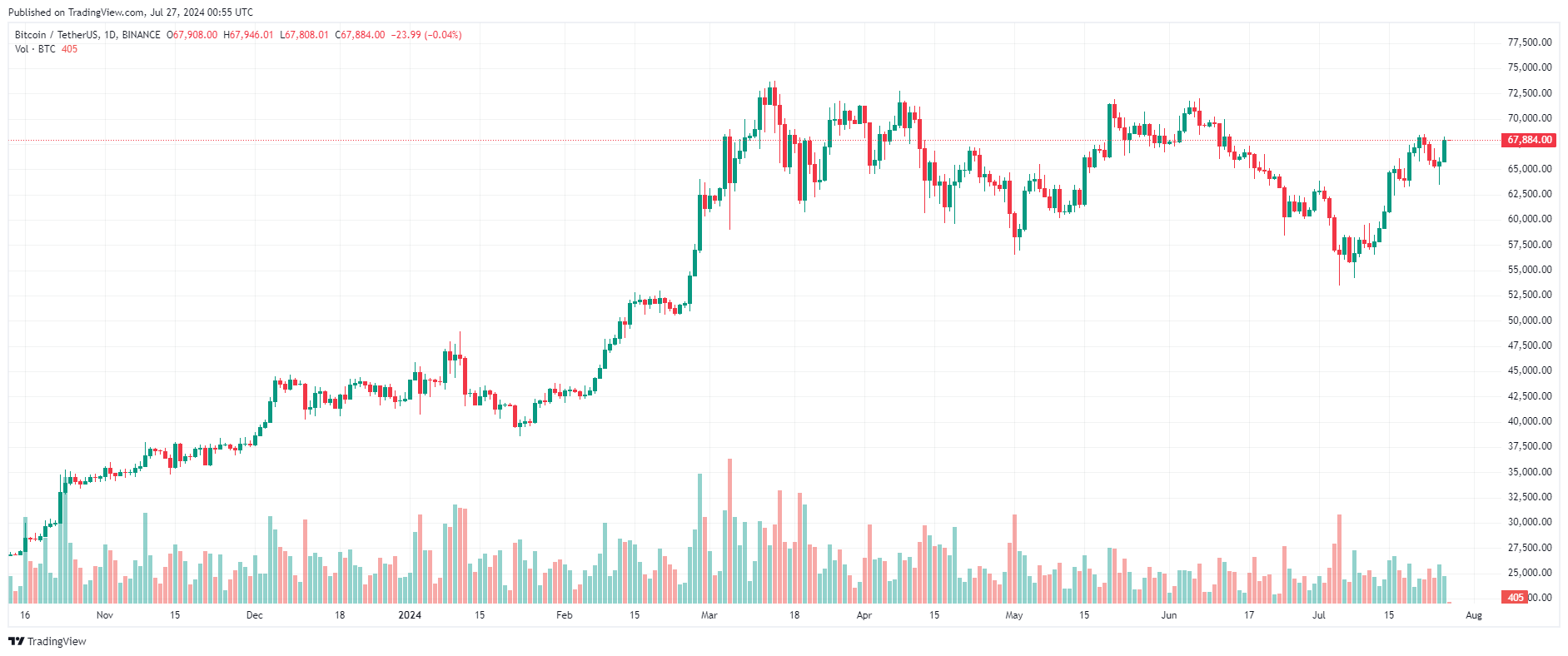

Bitcoin nears $68,000, recovering almost all of its losses over the past week.

BTC Price Chart – 1 Day | Source: TradingView

Stocks surged on Friday and Wall Street closed out a volatile week on a positive note as investors weighed fresh U.S. inflation data.

The Dow Jones Industrial Average rose 654.27 points, or 1.64%, to close at 34,589.34. The S&P 500 gained 1.11% to close at 4,459.1, while the Nasdaq Composite climbed 1.03% to close at 13,357.88.

Friday's move came from a combination of oversold sentiment, a stronger-than-expected GDP report on Thursday and the view that the Federal Reserve will start cutting interest rates due to the economic recovery, said Sam Stovall of CFRA Research.

“Today’s benign PCE report helped pull the market back from the brink. With this pullback, the rotation continues,” he added.

Investors continued to rotate into cyclical sectors and small- Capital companies, with the Russell 2000 up 1.67%. Industrials and materials stocks rose, lifting their respective S&P sectors by about 1.7%. 3M shares jumped 23%, leading the industrials sector. The stock had its best day since 1972.

Some tech names escaped the pain of this week’s sell-off, with Microsoft and Amazon both rising more than 1%. Meta Platforms jumped nearly 3%. The S&P information technology sector rose about 1%.

Wall Street also assessed the June personal consumption expenditures index, the inflation gauge favored by central bank policymakers. On a monthly basis, the PCE rose 0.1% and 2.5% from a year earlier, in line with estimates from economists polled by Dow Jones.

The positive inflation news has also raised investors' hopes for more rate cuts this year, with the federal funds futures market predicting cuts in September, November and December.

The data came at the end of a volatile week on Wall Street. The S&P 500 fell 0.8%, while the Nasdaq lost 2.1%. Both indexes posted their first consecutive weekly losses since April. Meanwhile, the Dow Jones Industrial Average rose 0.8%, posting its fourth straight weekly gain for the first time since May.

After hitting a local Dip around $63,456 the previous day, Bitcoin has turned around and bounced strongly.

The market has closed every day in the green, pushing the price closer to the $68,000 area at the moment with a growth of nearly 3% in the last 24 hours.

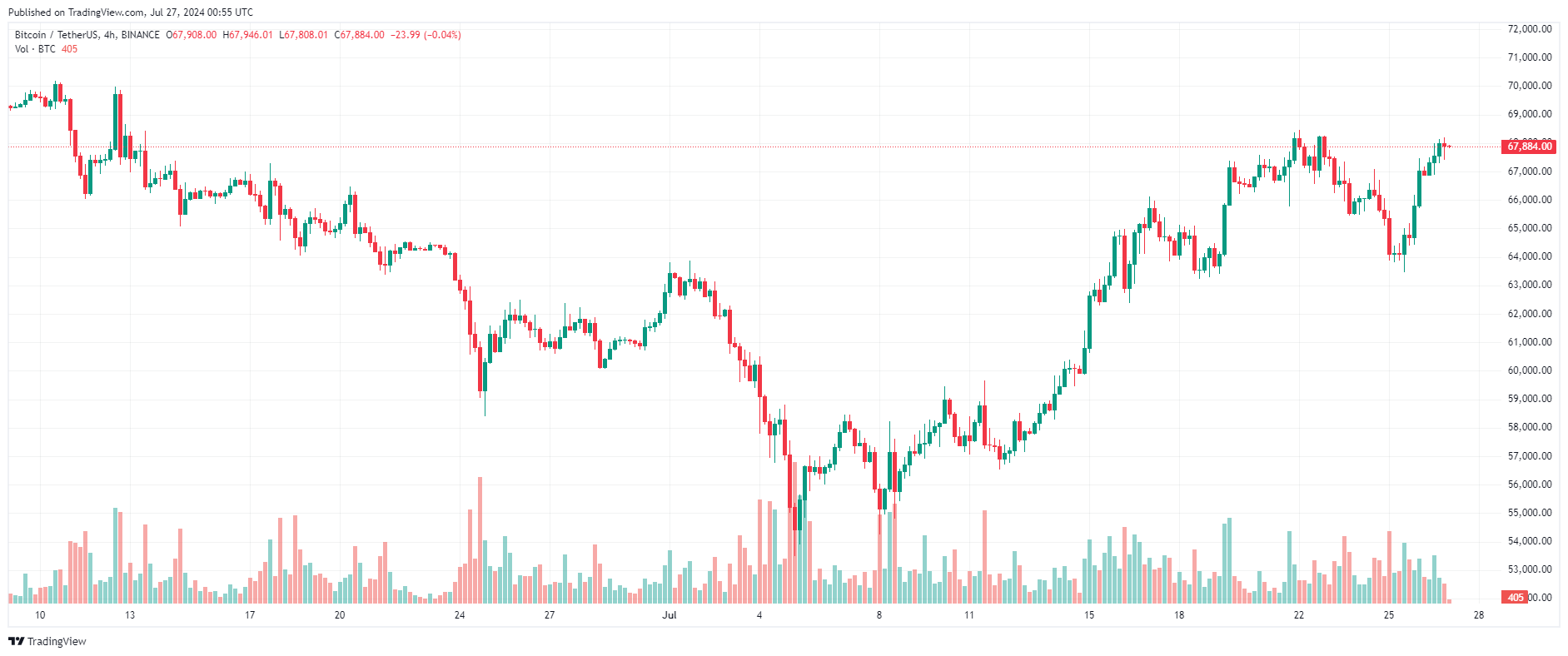

BTC Price Chart – 4 Hours | Source: TradingView

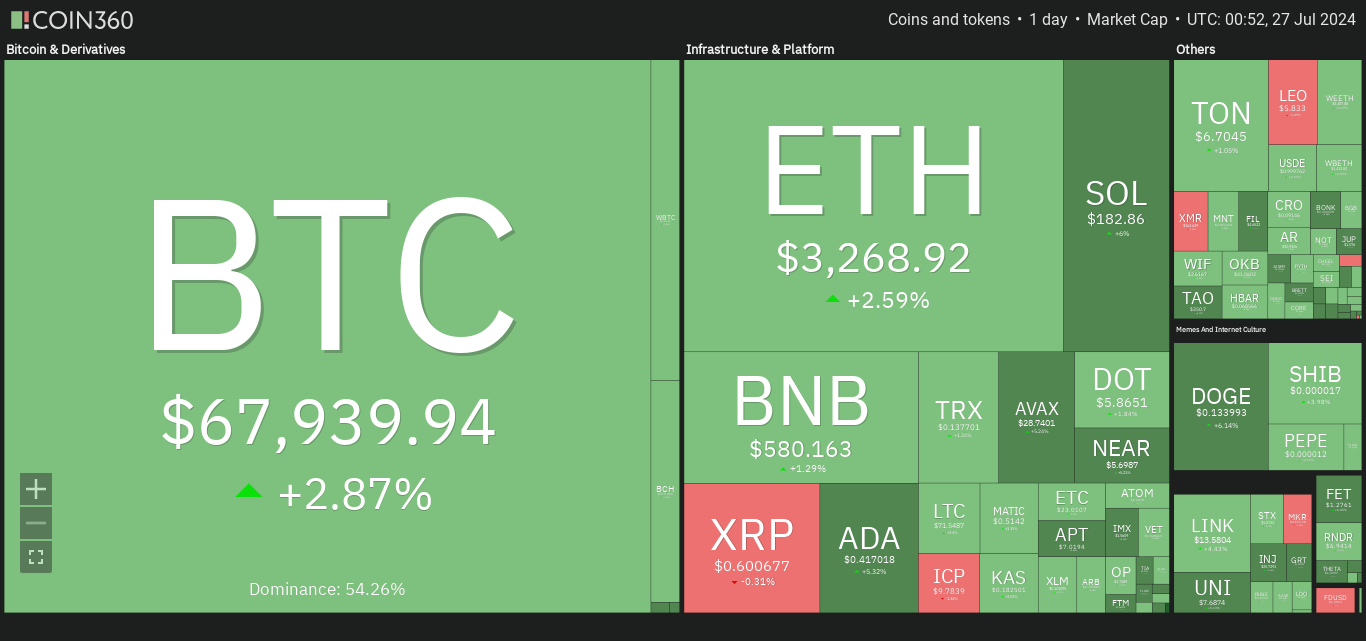

Altcoins surged yesterday.

Conflux (CFX) was the standout performer, rallying more than 17% in the short term, erasing all of its losses for the week.

Followed by eCash (XEC), Popcat (POPCAT), Jupiter (JUP), Filecoin (FIL) with gains of over 10%.

Other major projects such as Worldcoin (WLD), Akash Network (AKT), BitTorrent (BTT), Brett (BRETT), Bitcoin SV (BSV), Beam (BEAM), ORDI (ORDI), The Sandbox (SAND), Immutable (IMX), Axie Infinity (AXS), Theta Network (THETA), Ethena (ENA), Injective (INJ), Peg (Peg), Flow (FLOW), Solana (SOL),... jumped by 4-9%.

Source: Coin360

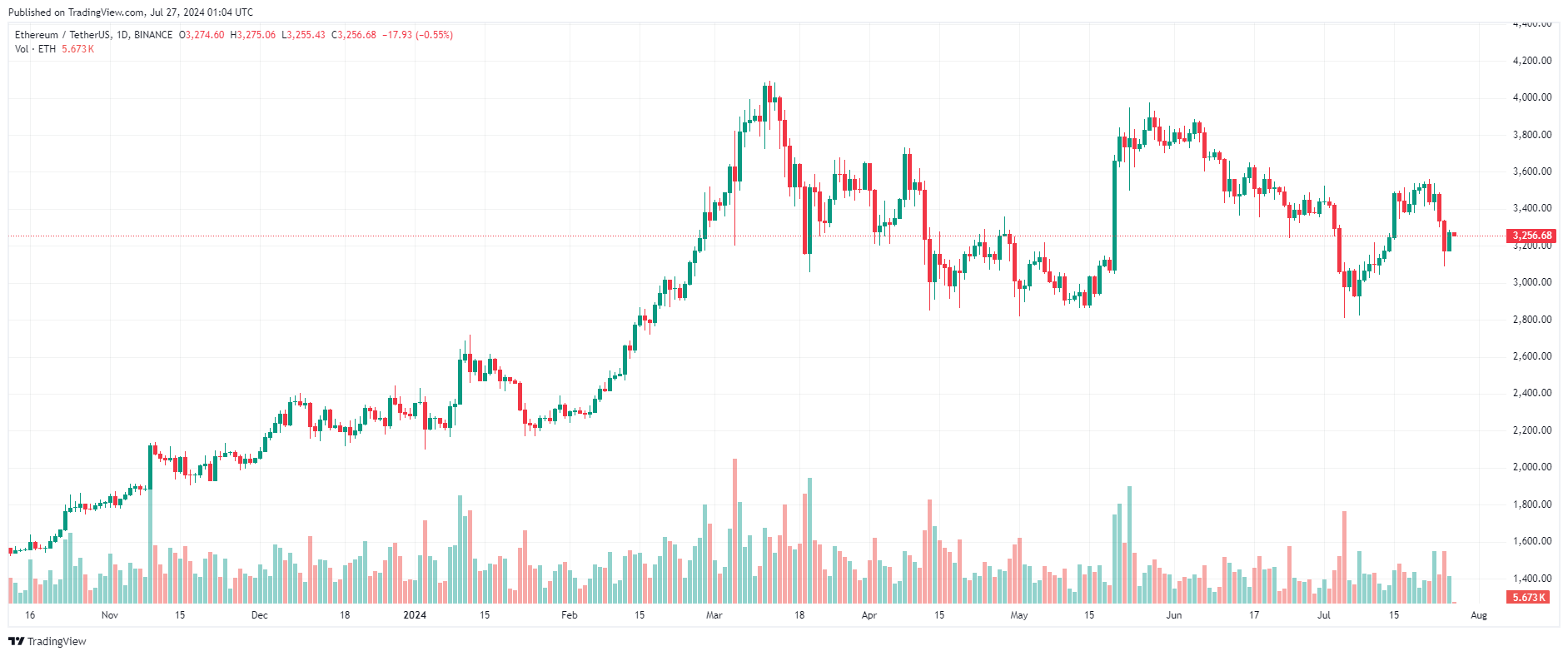

After falling for two consecutive days, Ethereum (ETH) has recovered back above the $3,200 mark.

The second-largest asset by market Capital has jumped nearly 2% over the past 24 hours and is currently trading around $3,250.

ETH Price Chart – 1 Day | Source: TradingView

You can XEM coin prices here.

The "Coin Price Today" section will be updated at 9:30 every day with general news about the market, we invite you to follow.

Join Bitcoin Magazine Telegram: https://t.me/tapchibitcoinvn

Follow Twitter (X): https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Viet Cuong

Bitcoin Magazine