There were a lot of big events happening in the cryptocurrency space this week, from major corporate acquisitions to key regulatory updates and new technological breakthroughs. Here’s a comprehensive look at the headlines that impacted the cryptocurrency landscape.

Marathon Digital spends $100 million to buy Bitcoin

Marathon Digital, one of the leading Bitcoin mining companies, has significantly expanded its Bitcoin holdings by purchasing $100 million worth of the cryptocurrency. The acquisition brings its total holdings to over 20,000 BTC and implements a new “full-hold” strategy. The policy means that Marathon will keep all mined Bitcoin and make strategic purchases on the open market on a regular basis.

Key Highlights:

Increased Holdings: The company now ranks second among public companies in terms of Bitcoin holdings, behind only MicroStrategy.

Strategic Rationale: Marathon CFO Salman Khan cited the current favorable macroeconomic environment and increased institutional support for Bitcoin as reasons for the acquisition. He also noted that the recent price drop provided a timely opportunity for them to increase their holdings.

MicroStrategy founder Michael Saylor praised the move and suggested that companies consider holding Bitcoin as a strategic reserve. This sentiment reflects the growing trend of companies adopting cryptocurrencies as part of their financial strategies.

Franklin Templeton and SBI Plan to Launch Spot Bitcoin ETF in Japan

Franklin Templeton and SBI Holdings have partnered to launch a spot Bitcoin ETF in Japan, marking a significant expansion in the availability of crypto investment products. The plan involves the creation of a new digital asset management company, with SBI holding a 51% stake and Franklin Templeton holding a 49% stake.

detail:

Expansion into digital assets: In addition to Bitcoin, the company is also working on tokenizing a variety of assets, including real estate and government bonds.

Regulatory Approval: The project awaits approval from Japan’s Financial Services Agency, highlighting Japan’s strict regulation of the digital asset space.

The launch of the ETF is part of a broader move to make digital assets more accessible to institutional and retail investors, especially in Asia.

Coinbase Prime Transfers $262.4 Million of Ethereum into BlackRock ETH ETF

In a notable transaction, Coinbase Prime transferred $262.4 million worth of Ethereum to BlackRock’s iShares Ethereum ETF wallet. The massive transfer marks BlackRock’s strategic expansion into Ethereum through its ETF products, a major move following the recent approval of eight Ethereum ETFs by the U.S. Securities and Exchange Commission.

Transaction details:

Total holdings: BlackRock currently holds 79,699 ETH, worth approximately $277 million.

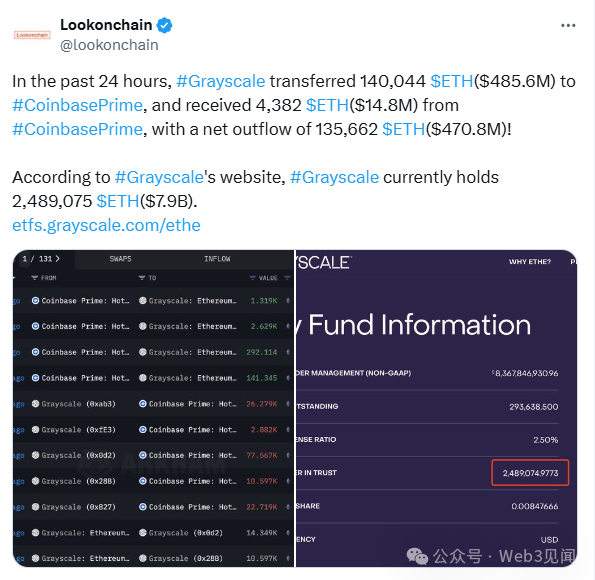

Market Impact: The large inflows into the BlackRock ETF contrasted with the large outflows from the Grayscale Ethereum Trust, which transferred 140,044 ETH ($485.6 million) to Coinbase Prime, resulting in a net outflow of 135,662 ETH ($470.8 million).

These moves caused the price of Ethereum to fall, highlighting the volatility and liquidity of the cryptocurrency market.

Source: Lookonchain

Senator Cynthia Lummis Introduces Bitcoin Strategic Reserve Act

Senator Cynthia Lummis is about to introduce a groundbreaking bill that would establish Bitcoin as a strategic reserve asset for the U.S. The bill seeks to include Bitcoin in the Federal Reserve’s reserves, similar to how the Fed currently holds gold and foreign currencies.

key point:

Strategic Reserve: The bill aims to leverage the unique properties of Bitcoin to stabilize the U.S. dollar and enhance national financial security.

Legislative challenges: The bill would require bipartisan support and face scrutiny over volatility and regulatory issues associated with cryptocurrencies.

The proposal could significantly change the U.S. approach to digital currencies and could affect the global financial system.

Loomis hinted on social media that a big announcement was imminent, writing, "Big things coming this week. Stay tuned!"

BitcoinOS brings zero-knowledge proof to Bitcoin and enables Rollups

BitcoinOS has achieved a major technical milestone by implementing zero-knowledge proofs (ZKP) on the Bitcoin network. This advancement enables the use of rollups, a layer 2 scaling solution that increases transaction efficiency and reduces costs while maintaining the security and decentralization of the network.

Technical impact:

Enhanced Scalability: ZKP facilitates faster and cheaper transactions, expanding the utility of the Bitcoin network.

Decentralized Innovation: The technology supports the development of trustless bridges, enhancing interoperability between different blockchains.

This breakthrough will significantly enhance the functionality of Bitcoin, making it a more versatile and powerful platform for a wide range of applications.

in conclusion

This week’s developments highlight the rapid evolution and increasing complexity of the cryptocurrency market. From major corporate initiatives and regulatory developments to technological advances, the cryptocurrency space is becoming increasingly integrated into the global financial system. Stay tuned for more updates and in-depth analysis next week.