Solana Liquid Staking Token (LST) is increasing SOL on-chain activity as TVL surpasses $5.5 billion.

Solana price is on track to post a 30% monthly return by the end of July and is expected to challenge its yearly high of around $210 in the coming weeks.

SOL/USD daily chart. Source: Trading View

While most of the community attributes SOL’s success to the craze surrounding its memecoin, its strong liquidity staking ecosystem is becoming a powerful on-chain narrative. Let’s see how this trend plays out on the Solana network.

Liquid Staking Tokens Are Leading the Way for Solana DeFi

Last week, Cointelegraph highlighted how Solana’s Total Value Locked (TVL) figures jumped 10% to $5.42 billion. As a result, transaction volumes increased and on-chain activity also increased.

It is observed that Jito and Marinade are the main protocols on Solana. Jito and Marinade are liquidity staking platforms with TVL increases of 40% and 30% respectively in the past month.

Solana protocol ranking. Source: Deflama

Liquidity staking is a process that combines the advantages of staking and liquidity. Through liquidity staking, holders can stake their tokens in a smart contract or staking pool to obtain tokens representing the staked SOL.

This token can be called a Liquid Stake Token or LST and can be used to earn yield on other protocols or for DeFi applications. $JitoSOL or $mSOL is a typical example representing Jito and Marinade protocols.

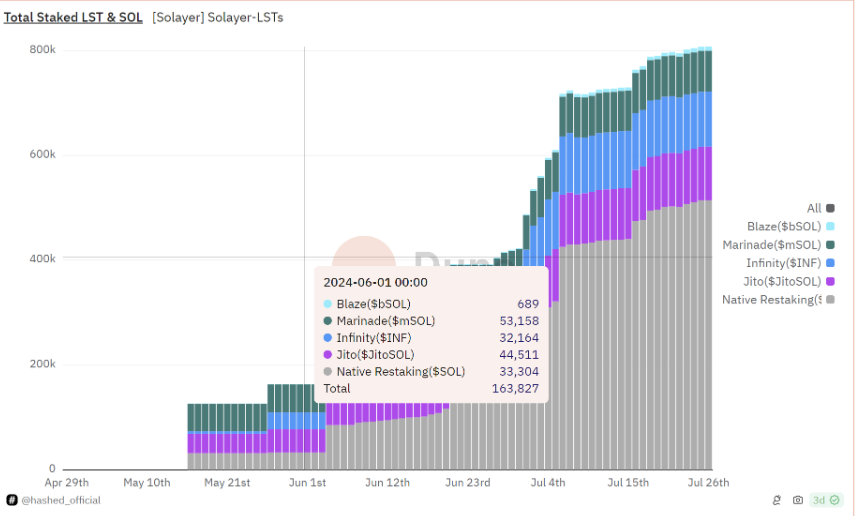

Data from Dune Analytics shows that the total amount of Solana deposited in liquidity-collateralized derivatives has more than doubled in 2024. The amount of staked LST increased from 163,827 to 807,712, a 393% increase between June 1 and July 26.

Total staked LST Chart: Source: dune analytics

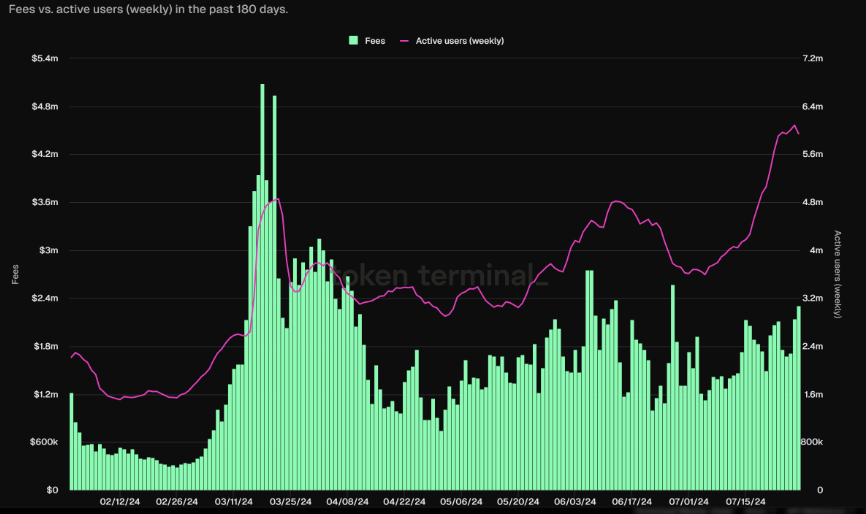

Data analysis platform Token Terminal also shows that Solana’s daily and weekly active users have increased by 21% and 59% respectively. As highlighted above, the growth in active users is in sync with the growth of Jito and Marinade’s TVL. Therefore, it can be inferred that memecoins are not the only project currently bringing users to the Solana network.

Solana daily active users (weekly). Source: Token Terminal

Will Solana Set a New Yearly High This Week?

Solana’s price action shows bullish momentum, with the community expecting the price to retest its yearly high of $210. As of the time of writing, SOL has broken out of a bullish double Double Botto pattern with the current overhead resistance at $202.

The overhead resistance is quite weak and there is a high chance of retesting the yearly high. However, Solana is currently experiencing a correction and has fallen below the $190 mark.

If Solana continues its bullish trend, its immediate retest target will remain in the $200-210 range. Conversely, if Solana loses its immediate support area of $180, the Altcoin could retest its previous swing lows of $165.

SOL/USD daily chart. Source: TradingView

Meanwhile, Wick, an options trader with 18 years of experience, is leaning bullish, suggesting that SOL/USD is once again leading the cryptocurrency market’s rally.

“Solana is performing as well as ever,” he noted.

“Now a breakout above the resistance set by the breakout arrow will usually start a whole new trend.”