Author: Greythorn

Introduction

Welcome to Greythorn Asset Management's monthly market update for June 2024. We are excited to share with you the market trends and analysis we observe. Our mission is to invest in breakthrough technologies and asset classes with the goal of creating significant value and having a positive impact on the industry. At Greythorn, we provide monthly updates on the cryptocurrency market, including detailed analysis of market dynamics, regulatory developments, and macroeconomic factors affecting digital currencies. For more details on our work and more information about us, please visit our website .

Market analysis

Bitcoin's July in Review: A Surge in Price and Sentiment

July has been a remarkable month for Bitcoin, with both price action and sentiment improving significantly from the previous month.

Investors continue to accumulate crypto assets, with the University of Wyoming establishing a Bitcoin Research Institute and Cantor Fitzgerald announcing plans to launch a Bitcoin financing business that would allow clients to leverage their BTC holdings. On the political front, Trump reiterated his support for the industry at the Bitcoin 2024 conference in Nashville, suggesting that all Bitcoin mining be moved to the United States, promising to fire SEC Chairman Gary Gensler, and intending to establish a presidential advisory committee on Bitcoin and cryptocurrency.

Source: Forbes

Senator Cynthia Lummis introduced a bill to establish a strategic reserve of Bitcoin, aimed at reducing the US debt. Meanwhile, reports indicate that Vice President Kamala Harris' team contacted representatives of the cryptocurrency industry, including those from Coinbase, Ripple, and Circle, to improve relations. Overall, July brought a wave of positive news and actions, boosting Bitcoin's market performance and sentiment.

Ethereum’s ETF Approval Drives Price and Sentiment

The end of July was a notable month for Ethereum, marking the approval and commencement of trading of the Ethereum ETF on July 23, 2024. The ETH spot ETF performed well on its first day, exceeding expectations. Net inflows exceeded $100 million, an impressive achievement considering the strong outflows from Grayscale's $ETHE fund. Total trading volume exceeded $1.1 billion, about a quarter of the first-day trading volume of the BTC spot ETF - performing better than expected. BlackRock's $ETHA traded a quarter of the volume of its $IBIT BTC fund on its first day.

Source: @JSeyff

However, the next day saw notable net outflows of between $113 million and $133 million, mainly due to heavy selling from Grayscale’s Ethereum Trust, which experienced $326.9 million in outflows.

Nonetheless, ETH is outperforming expectations, at least for now. This could indicate high expectations for net ETH spot ETF inflows next month, or a technical rebound after last week’s drop. Overall, July showed a surge in Ethereum’s price action and market sentiment, driven by factors including ETF approval and the evolving political landscape.

Source: TradingView

Altcoin: Mixed Performance and Sentiment

July was a mixed month for Altcoin performance and market sentiment.

Several Altcoin saw notable gains, including $MANTRA (+64.8%), $HNT (+53.2%), $JUP (+41.4%), $SOL (+33%), $TAO (+27%), and $PYTH (+23%), driven by positive news and developments within their respective ecosystems. For example, projects within the Solana ecosystem outperformed the market in July.

However, not all Altcoin have enjoyed such positive momentum. Some have experienced price stagnation or declines, including $FLR (-21.8%), $FTM (-16.7%), $LDO (-15.0%), $AKT (-13.9%), and $TON (-13.6%).

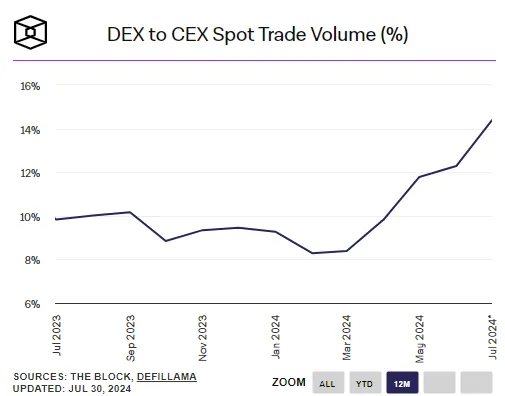

Overall, while some Altcoin have performed well in July, Altcoin have encountered challenges, and investors remain cautious but hopeful, possibly looking for signs of continued growth. Interestingly, decentralized exchanges (DEXs) like Uniswap and Curve have reached all-time highs in monthly volume relative to centralized exchanges (CEXs) like Coinbase and Binance. This surge comes at a time when CEX volumes are falling, while DEX volumes have reversed their downward trend in July.

Source: The Block

Macro Insights

Stock Market Correction: The Mid-July Selloff

The S&P 500 and Nasdaq experienced a notable sell-off in mid-July, following a strong uptrend at the beginning of the month. While this correction was sharp, it can be viewed as a natural adjustment from previous high levels. The market is currently at a crossroads, with mixed signals of economic slowdown and strong business conditions, coupled with political uncertainty. Investors remain cautious, seeking a balance between optimism and the reality of market volatility.

Source: TradingView

Fed Chairman Powell's latest statement

Federal Reserve Chairman Jerome Powell recently discussed the outlook for the U.S. economy , noting that no decision has been made on a possible rate cut in September. The Fed is closely monitoring risks to both sides of its dual mandate and will assess incoming data to guide future decisions. Although second-quarter inflation data added confidence, Powell stressed the need for caution to avoid weakening the economy too soon.

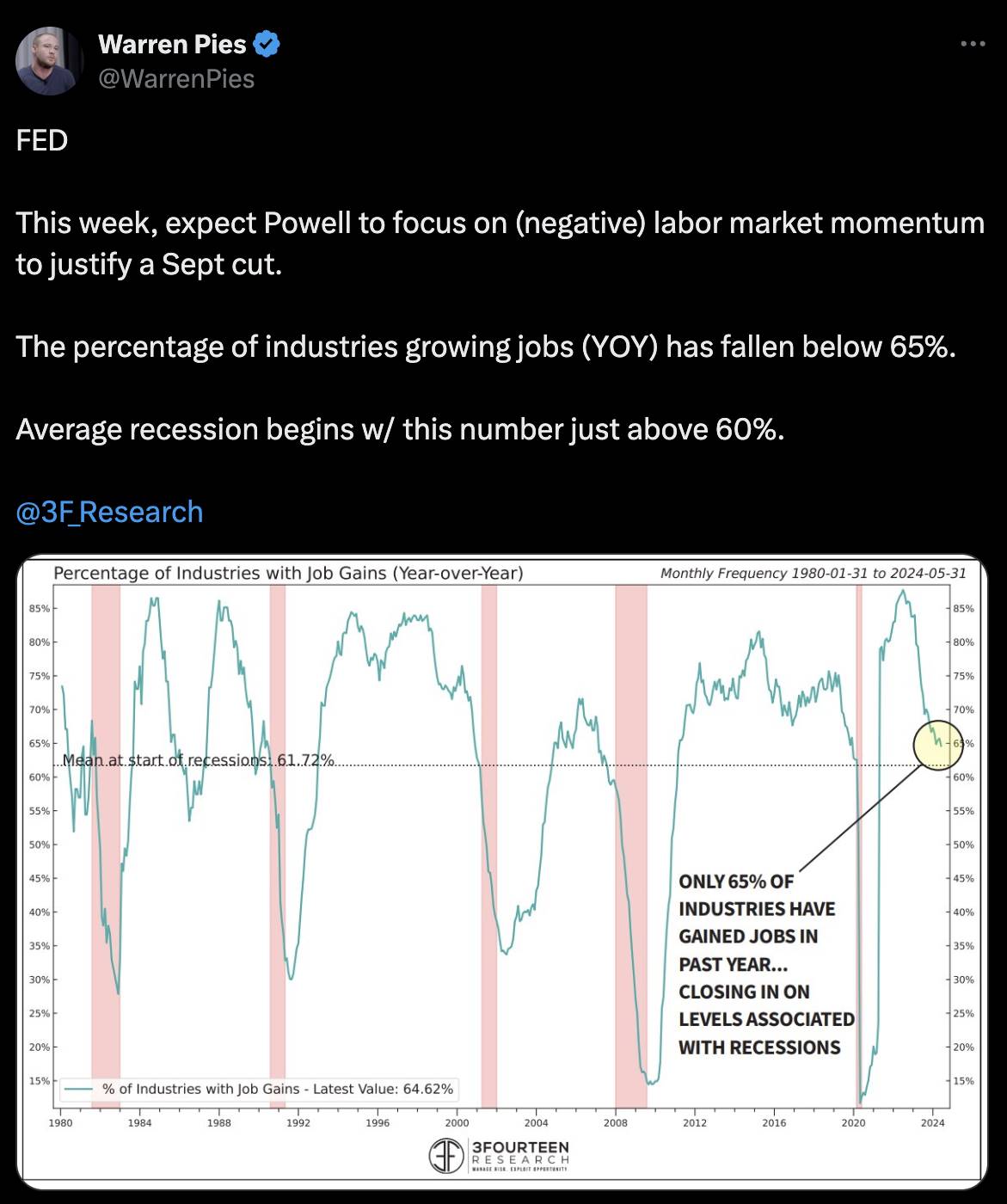

Additionally, U.S. job openings in June were 8.2 million, exceeding expectations (8.2 million vs 8.0 million), suggesting that the expected job market slowdown is still in its early stages. However, for the first time since the pandemic, less than 65% of industries experienced job growth, suggesting that there may be challenges ahead.

Source: Warren Pies

China policy focus: rate cuts and tech investment

China’s recent rate cut , though only 0.1 percentage point, suggests the government is cautiously stimulating the loan market. The change in this key rate shows the government’s focus on “quality growth” and its caution to avoid aggressive fiscal policy to prevent speculation. This means there may not be a strong impetus for cryptocurrency trading this year. The Third Plenum statement indicated a shift toward a “socialist market economy,” including flexible real estate rules and support for private companies. There was a special emphasis on technology, aiming to surpass that of the United States. This focus on technology, including web3 and blockchain, highlights China’s long-term strategy in economic strength and innovation.

Source: Reuters

Coinbase’s campaign finance violations

Coinbase could be in trouble for donating $25 million to the Fairshake super PAC, a possible violation of federal campaign finance laws. The massive donation draws attention to legal and regulatory risks in the crypto world at a time when Coinbase is negotiating federal contracts. The situation highlights the challenges crypto companies face in navigating political influence while complying with regulations. The controversy could have lasting effects on Coinbase and the crypto industry as a whole, underscoring the importance of strict legal and ethical compliance.

Japan embraces crypto ETFs, raises interest rates

Japan is about to launch its first crypto ETF , a major development driven by a collaboration between Franklin Templeton and SBI Holdings. This collaboration combines Franklin Templeton's extensive experience in traditional financial markets with SBI Holdings' expertise in the crypto space to provide Japanese investors with an innovative and accessible way to digital assets.

The launch of these ETFs is expected to generate a lot of interest, especially from retail investors. A key advantage driving this demand is the more favorable tax treatment of ETFs relative to direct holdings of cryptocurrencies, making them an attractive investment vehicle. By simplifying the investment process and reducing the tax burden, these ETFs provide individuals with an easier and cost-effective way to gain exposure to the booming crypto market.

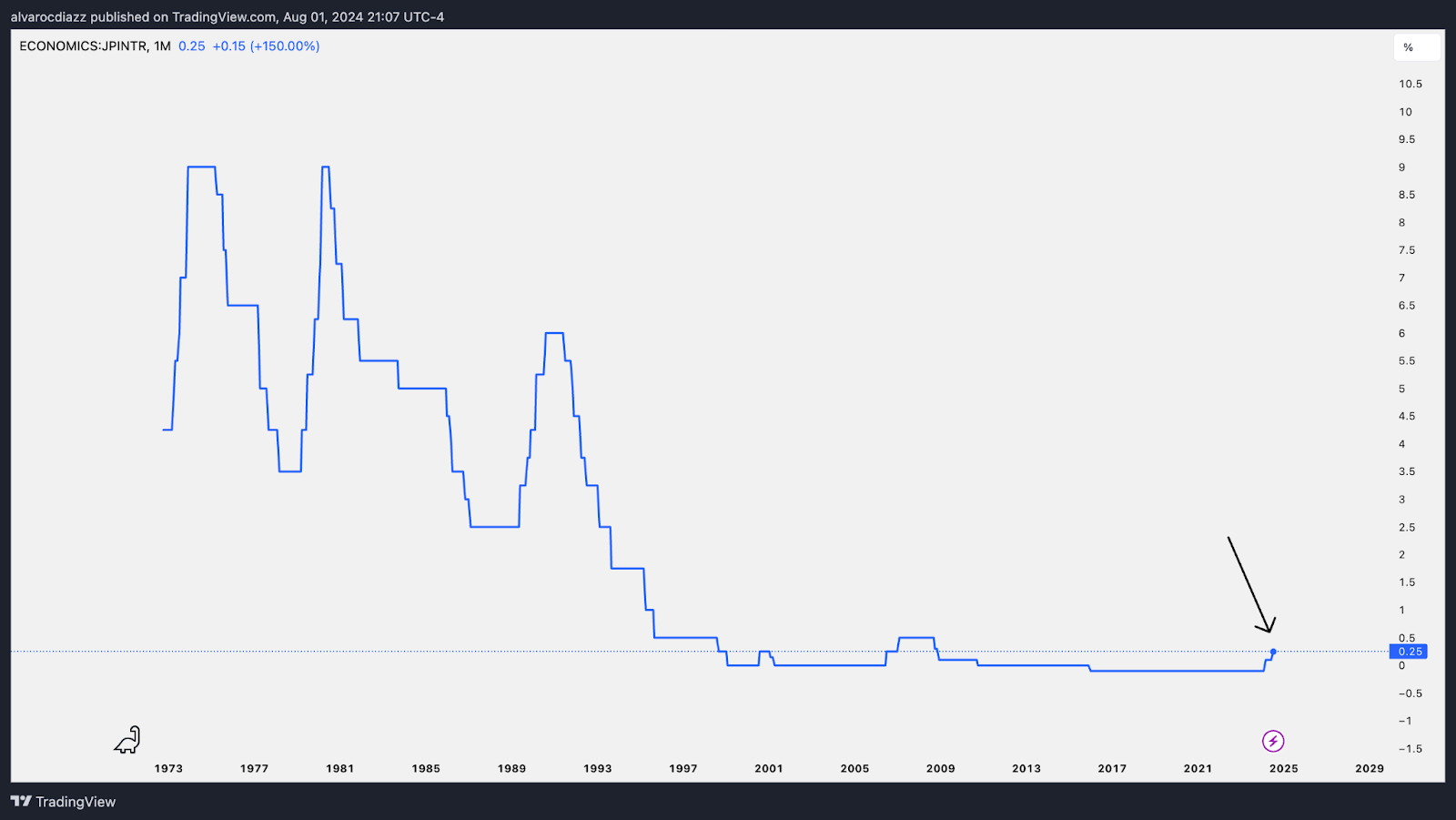

Interestingly, the Bank of Japan raised interest rates for almost the second time in 20 years, by 0.15 basis points. This move indicates a shift toward more active monetary policy management, supporting economic growth and affecting global markets. Japanese government bond yields rose and the yen appreciated against the dollar. This move is particularly interesting because Europe and China are both cutting interest rates. Japan is the only country that is still raising interest rates, perhaps because it is the largest holder of US Treasuries.

in conclusion

Looking back at July, we observed significant developments in both the cryptocurrency and traditional financial markets. Bitcoin and Ethereum showed volatility, driven by positive regulatory and political news and the introduction of new financial products such as ETFs. Altcoin had mixed performances, with some showing growth potential within their ecosystems,

While others face challenges. As we head into August, expect markets to continue to be volatile and filled with opportunities. We are committed to providing you with concise, insightful updates. The cryptocurrency space changes rapidly, and while we strive to provide a comprehensive monthly overview, we encourage you to do your own research to gain a deeper understanding.

Thank you for reading this month's update. We hope you found it helpful. Please follow our social media channels for more real-time updates and insights.

Disclaimer

This presentation has been prepared by Greythorn Asset Management Limited (ABN 96 621 995 659) (Greythorn). The information in this presentation should be considered general information and not investment advice and financial recommendations. It is not an advertisement and is not a solicitation or offer to buy or sell any financial instrument or to participate in any particular trading strategy. In preparing this document, Greythorn has not taken into account the investment objectives, financial situation or particular needs of any recipient. Before making any investment decision, recipients of this presentation should consider their own personal circumstances and seek professional advice from an accountant, lawyer or other professional advisor. This presentation contains statements, opinions, forecasts, projections and other material (forward-looking statements), which are based on various assumptions. Greythorn assumes no obligation to update this information. These assumptions may or may not be correct. Neither Greythorn, its officers, employees, agents, advisers or any other person mentioned in this presentation makes any representation as to the accuracy or likelihood of realization of any forward-looking statement or any assumptions underlying it. Greythorn and its officers, employees, agents and advisers make no warranty, representation or guarantee as to the accuracy, completeness or reliability of the information in this presentation. Greythorn and its officers, employees, agents and advisers exclude liability for any loss, claim, damage, expense or cost arising out of or in connection with the information in this presentation, to the extent permitted by law. This presentation is the property of Greythorn. By receiving this presentation, the recipient agrees to keep its contents confidential and agrees not to reproduce, make available, disseminate or disclose any information of its contents without written consent.