Bitcoin prices have pulled back slightly after surging to $60,000 in sync with global stock markets.

Bitcoin

$60,980

The company attempted to reclaim $62,000 on August 3 as the market edged higher following a new round of liquidations.

BTC price tests $60,000 amid stock sell-off

Data from Cointelegraph Markets Pro and TradingView show that the price of BTC on Bitstamp has rebounded 3% after hitting a multi-week low of $60,435.

It was a grim day for global stocks, with the Nikkei falling 6% adding to Wall Street's losses. U.S. jobs data that came in well below expectations added to the jitters.

Bitcoin itself lost nearly $5,000, abandoning several key support lines, including the short-term holder cost basis.

As a result, liquidations increased, with data from monitoring resource CoinGlass showing that total losses for cryptocurrency longs reached $230 million on August 1 and August 2.

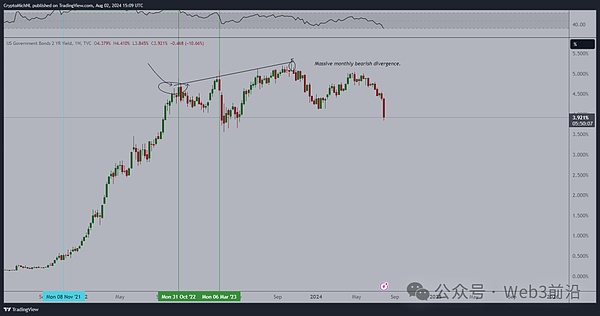

“Yields are falling off a cliff in the US market following a surprisingly poor jobs report,” Michaël van de Poppe, founder and CEO of trading firm MNTrading, wrote in a commentary on X.

"There is a general mild panic in the market as markets price in a severe recession in the U.S."

Van de Poppe believes that recent events may strengthen the odds that the Federal Reserve will cut interest rates at its next meeting in September, which is a key bullish catalyst for cryptocurrencies and risk assets.

“One thing is certain: the September rate cut is confirmed,” he concluded.

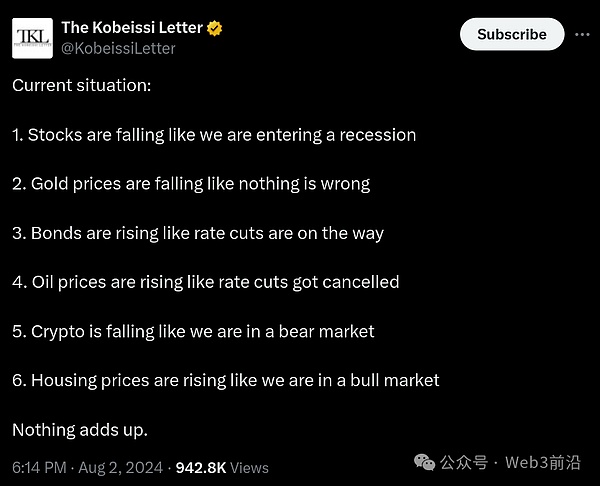

Trading resource Kobeissi Letter meanwhile sums up the macroeconomic situation as full of mixed signals.

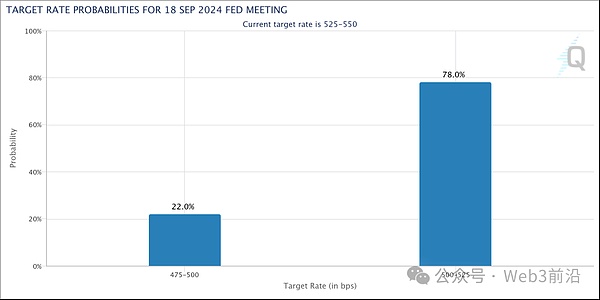

"Yesterday, the discussion was whether there would be a rate cut in September. Today the discussion is whether the cut will be 25 basis points or 50 basis points," part of its latest X report explained.

Data from the CME Group's FedWatch Tool showed that the market probability of a 0.25% rate cut that day was 78%.

Global liquidity provides reason for Bitcoin bull run

Despite the market shock, the bullish view on Bitcoin remains.

Jeff Ross, founder and managing director of hedge fund Vailshire Partners, said increased global liquidity will boost Bitcoin's future price action.

Ross uploaded a chart to X comparing the global M2 money supply to BTC/USD and the latter’s 50-week and 200-week simple moving averages (SMAs).

“Bitcoin forming an inverse head and shoulders pattern (on the weekly chart) on the backdrop of rising global M2 money supply? This would be super bullish from a TA and liquidity perspective,” read part of the accompanying commentary.

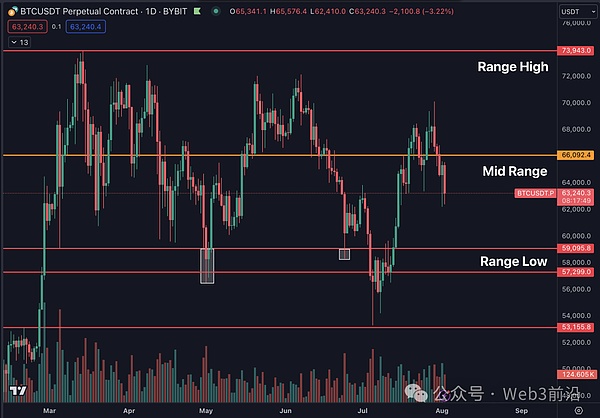

Even before the sharp drop, we reported that traders were increasingly expecting Bitcoin to retest the bottom of its long-term trading range.

“Bitcoin has been trading in this range for more than five months,” noted Daan Crypto Trades, a well-known trader.

“As the range continues, we are seeing lower lows and lower highs. The key levels for lows and highs remain $59,000 and $74,000.”

This article does not contain investment advice or recommendations. Every investment and trading action involves risk and readers should do their own research when making a decision.