By Lars, Head of Research at The Block

In July, with the approval of the US spot Ethereum ETF and its successful listing, most indicators in the cryptocurrency market finally saw a long-awaited rebound. This article will use 11 charts to interpret the status of the crypto market in the past month.

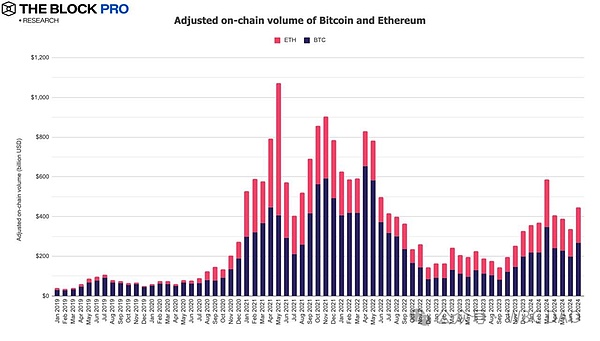

1. In July, the total transaction volume of Bitcoin and Ethereum after adjustment increased by 31.8% to US$445 billion, of which Bitcoin’s adjusted transaction volume increased by 34.7% and Ethereum’s increased by 27.7%.

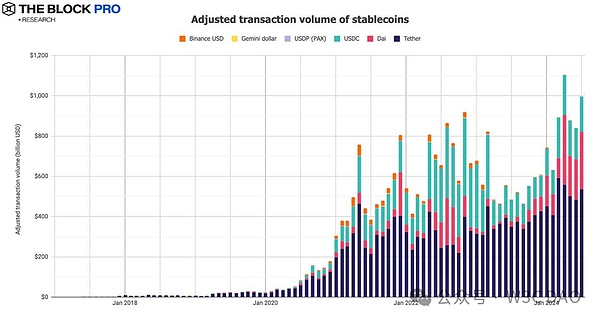

2. In July, the adjusted on-chain transaction volume of stablecoins increased by 18.8% to US$997.4 billion, and the supply of stablecoins issued increased by 1.2% to US$144.3 billion, of which USDT and USDC had market shares of 78.9% and 17.1% respectively.

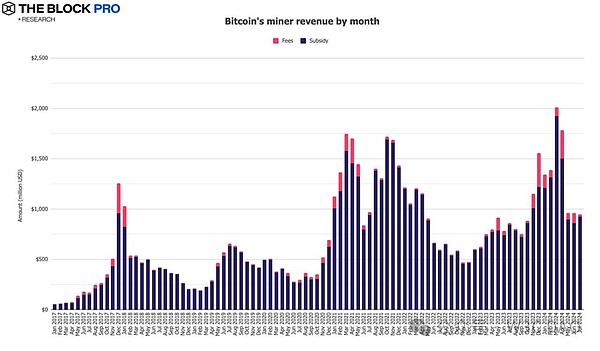

3. Bitcoin miners’ revenue reached $950.2 million in July, a slight decrease of 1.2%. In addition, Ethereum staking revenue also fell by 6.6% to $270.2 million.

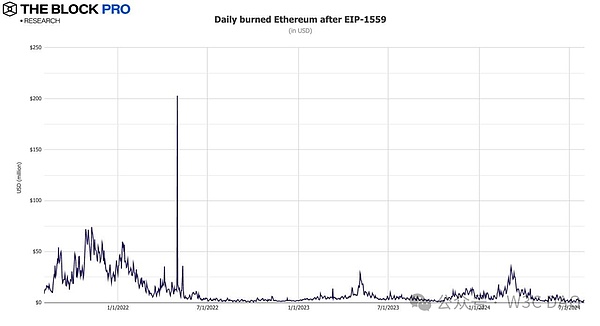

4. In July, the Ethereum network destroyed a total of 17,114 ETH, equivalent to $56.4 million. Data shows that since the implementation of EIP-1559 in early August 2021, Ethereum has destroyed a total of about 4.35 million ETH, worth about $12.3 billion.

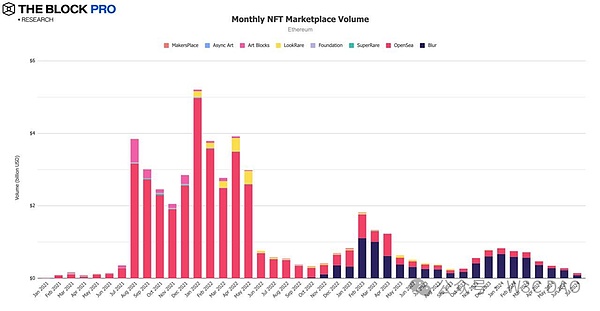

5. In July, the transaction volume of the NFT market on the Ethereum chain continued to decline significantly, falling by 49.6%, further falling to approximately US$140.3 million.

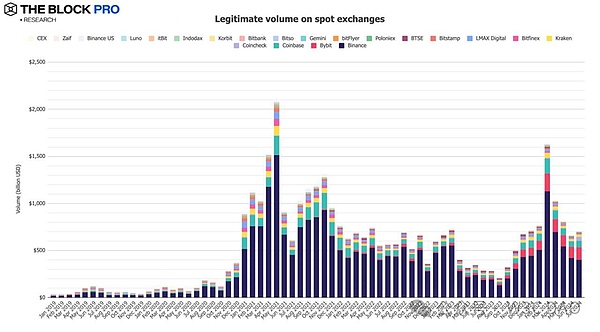

6. The spot trading volume of compliant centralized exchanges (CEX) rebounded in July, increasing by 6.7% to US$702.7 billion.

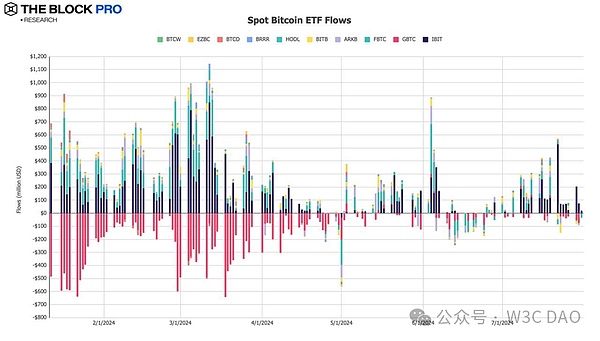

7. Net inflows into spot Bitcoin ETFs increased 473% in July to $3.15 billion;

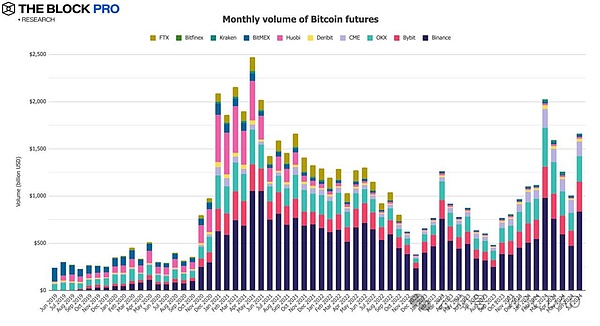

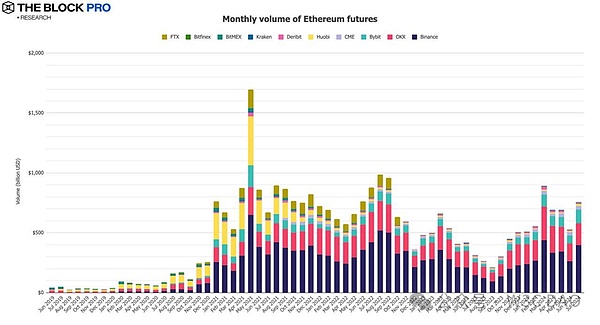

8. In terms of crypto futures, the open interest of Bitcoin futures increased by 15.6% in July; the open interest of Ethereum futures fell by 5.6%; in terms of futures trading volume, Bitcoin futures trading volume increased by 65% in July to US$1.66 trillion, and Ethereum futures trading volume increased by 43.1%.

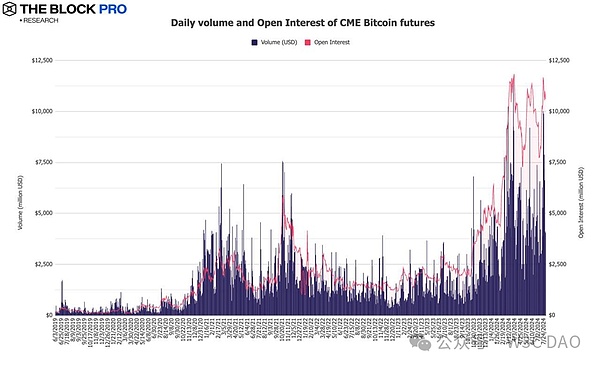

9. In July, the open interest of CME Bitcoin futures increased by 13.5%, rebounding to US$10.6 billion, and the average daily trading volume (daily avg volume) increased by 12.3% to approximately US$5.05 billion.

10. In July, the average monthly trading volume of Ethereum futures increased significantly to US$755.5 billion, an increase of 43.1%.

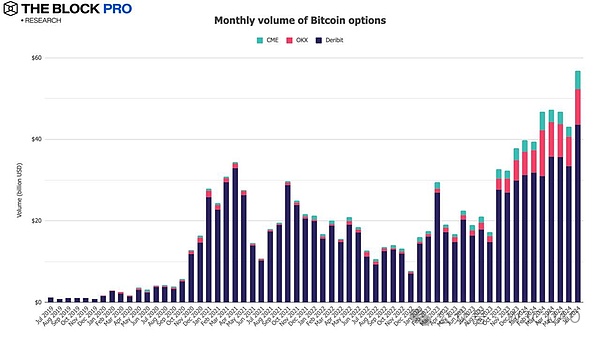

11. In terms of cryptocurrency options, the open interest of Bitcoin options increased by 35.9% in July, and the open interest of Ethereum options also increased by 7.1%.

In addition, in terms of Bitcoin and Ethereum options trading volume, Bitcoin monthly options trading volume reached US$56.9 billion, an increase of 31.9%; Ethereum options trading volume fell 8.1% to US$15.5 billion.