Author: CRYPTO, DISTILLED

Compiled by: TechFlow

Coinbase just released their “Crypto Market Outlook” for Q3 2024.

Very informative, I have read all 60 pages, you can save yourself the process.

Here are the main points you need to know:

Market Value vs. Realized Value (MVRV):

The MVRV ratio is an indicator for assessing market sentiment and cryptocurrency price volatility. It compares the current market price of a cryptocurrency with the average price at which holders purchased it.

In a market correction, when the MVRV ratio finds support (not below), it is usually a good time to buy. Currently, the MVRV ratio has rebounded from the support level, indicating that the uptrend is still continuing.

Source: Glassnode

Bitcoin’s return on investment (ROI) from cycle lows:

Bitcoin has gone through four market cycles, each with bull and bear price swings. The current cycle started in 2022, and BTC has risen about 400% since the lows in November 2022. This cycle is similar to the 2018-2022 cycle, when BTC surged 2000% from the lows. We may experience a few months of sideways trading.

Source: Glassnode

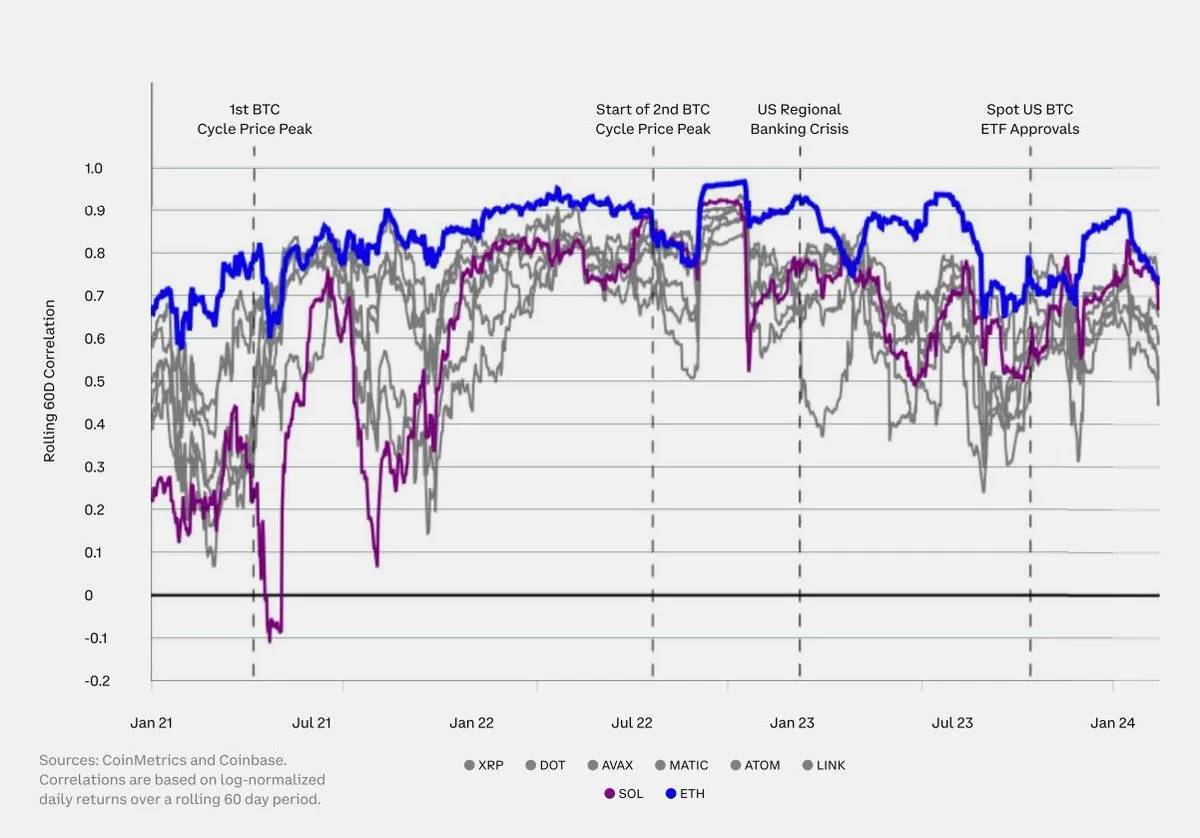

Cryptocurrency correlations are falling:

In the second quarter, the correlation between crypto assets declined, with ETH's correlation at 0.7 and some Altcoin below 0.5. This decoupling indicates that the market's understanding of fundamentals has deepened and returns have become more dispersed. It is expected that correlations will continue to decline with further regulatory clarity and institutional adoption.

Source: Coinbase

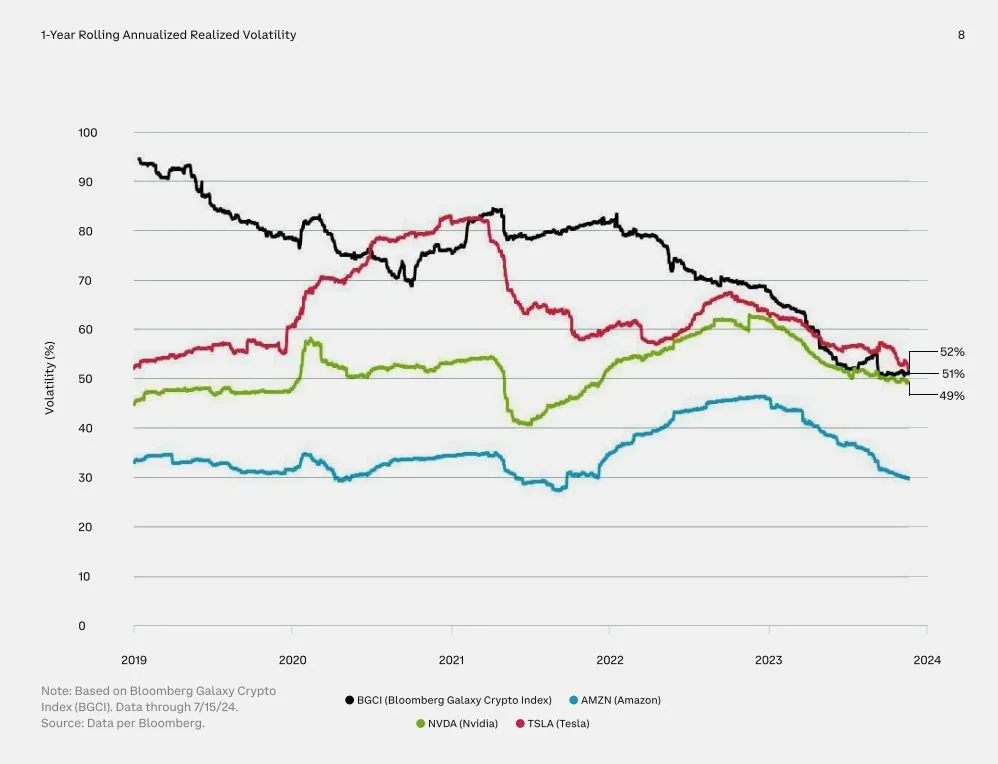

Volatility Perception vs. Reality:

The cryptocurrency paradigm is changing with the launch of spot cryptocurrency ETFs in the United States, expanding investor access and reducing volatility.

Perception: Digital assets are too volatile for many investors.

Reality: The crypto market’s market capitalization volatility is comparable to that of major tech stocks.

Source: Tephra Digital

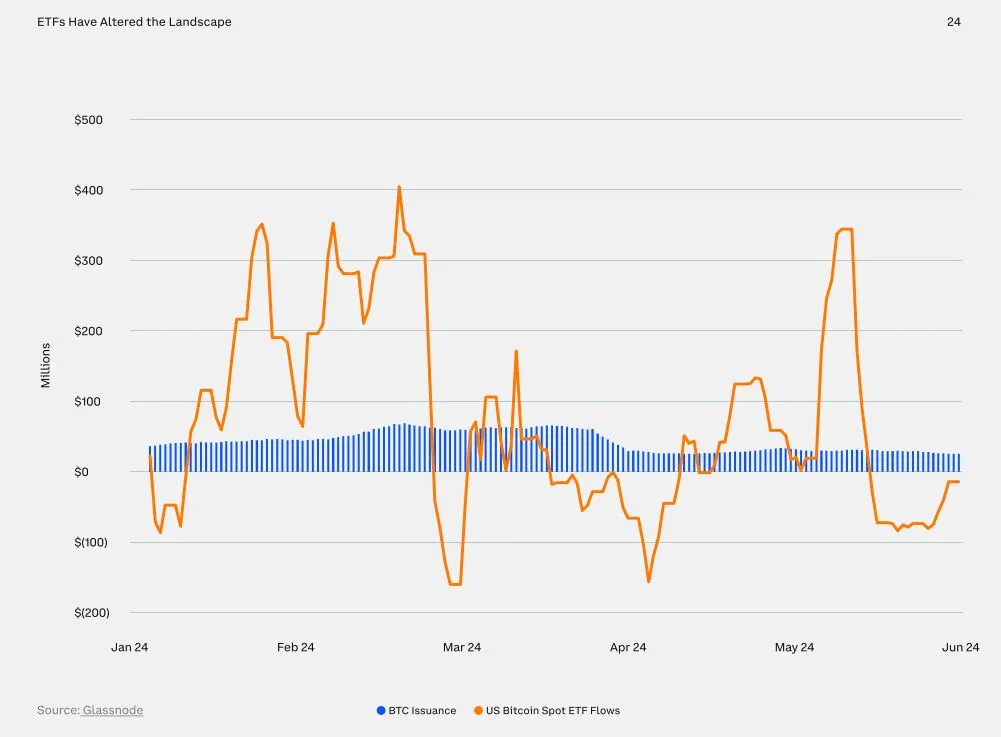

Impact of spot ETFs:

Spot ETFs have significantly increased demand for BTC, but supply is still limited to miner rewards. Since its launch, demand for ETFs has far exceeded the issuance rate of new BTC.

Source: Glassnode

Ethereum market cycle:

ETH has gone through two full market cycles. The current cycle began in 2022, and ETH has risen more than 150% since November 2022. This cycle is similar to the 2018-2022 period, when ETH surged 6,000% from its lows. However, ETH is facing significant short-term challenges. Time will tell whether ETF products can drive a sustainable long-term recovery.

Source: Glassnode

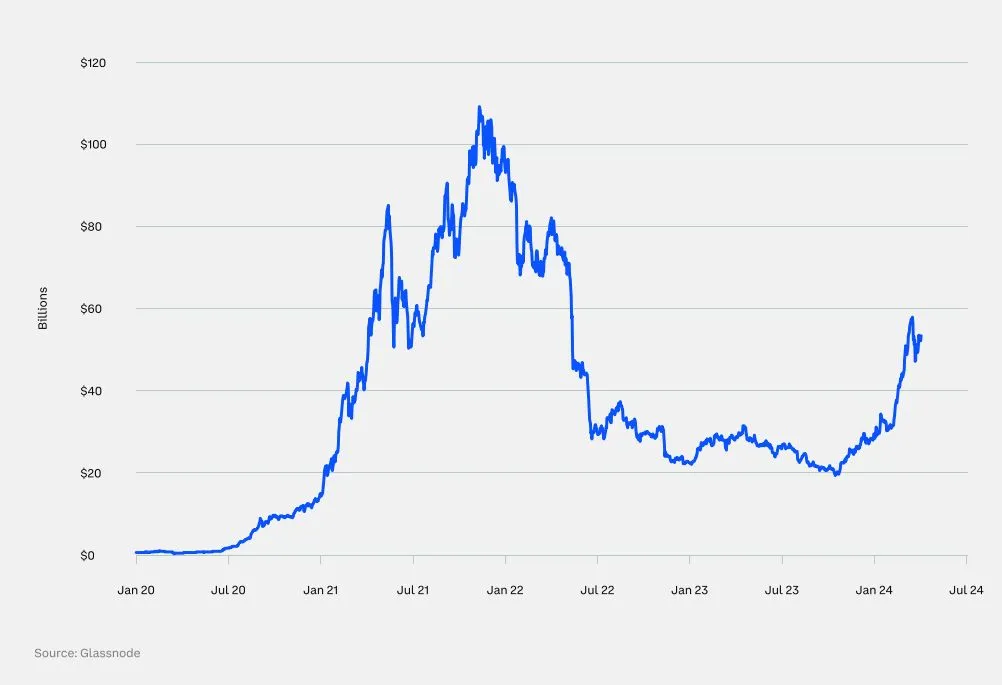

ETH Total Locked Value (TVL):

TVL tracks the value of Altcoin and stablecoins in smart contracts and decentralized applications (dApps), reflecting financial activity and liquidity. In the second quarter, TVL rose by 9%, showing increased activity on the Ethereum blockchain.

Source: Glassnode

FTX Cash Distribution:

FTX will soon distribute $16 billion in cash to recipients. If the recipients choose to reinvest the funds, this distribution could result in significant inflows into the crypto market. Important dates to note are the trustee vote on August 16 and the court approval deadline on October 7.

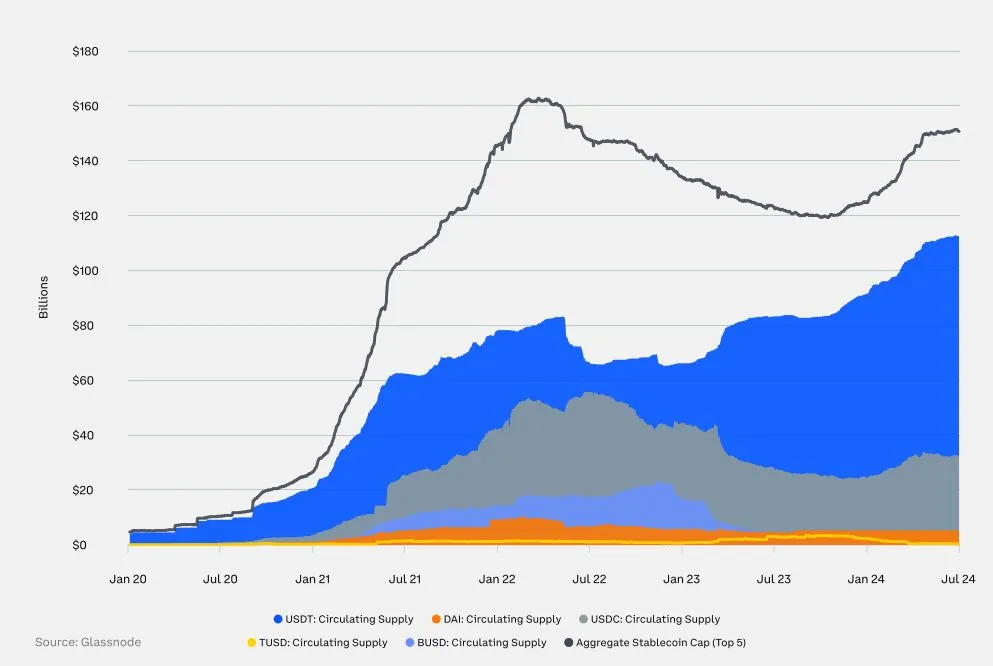

Stablecoins:

As of now, the market capitalization of stablecoins exceeds $160 billion, an increase of $2 billion in two weeks, and has exceeded the level before 3AC. Stablecoins, as a reflection of crypto liquidity, are a key factor in long-term price predictions. With the inflow of funds, the long-term bearish outlook is difficult to hold.

For the full Coinbase report, please refer to: Q3 2024 - Crypto Market Guide