After Bitcoin briefly rose to US$62,745 in the early morning of yesterday (9th), it began to fluctuate downwards. It once fell back to US$59,535 at 10:30 last night, and currently continues to fluctuate around US$60,000. At the time of writing, Bitcoin was currently trading at $60,661, down 1.01% in the past 24 hours.

Ethereum consolidates above $2,600

The trend of Ethereum is similar to that of Bitcoin. Although it once climbed to $2,644 at 8:15 this morning, the overall trend is still consolidating at the level of $2,600. It was trading at US$2,600.3 at the time of writing, down 2.26% in the past 24 hours.

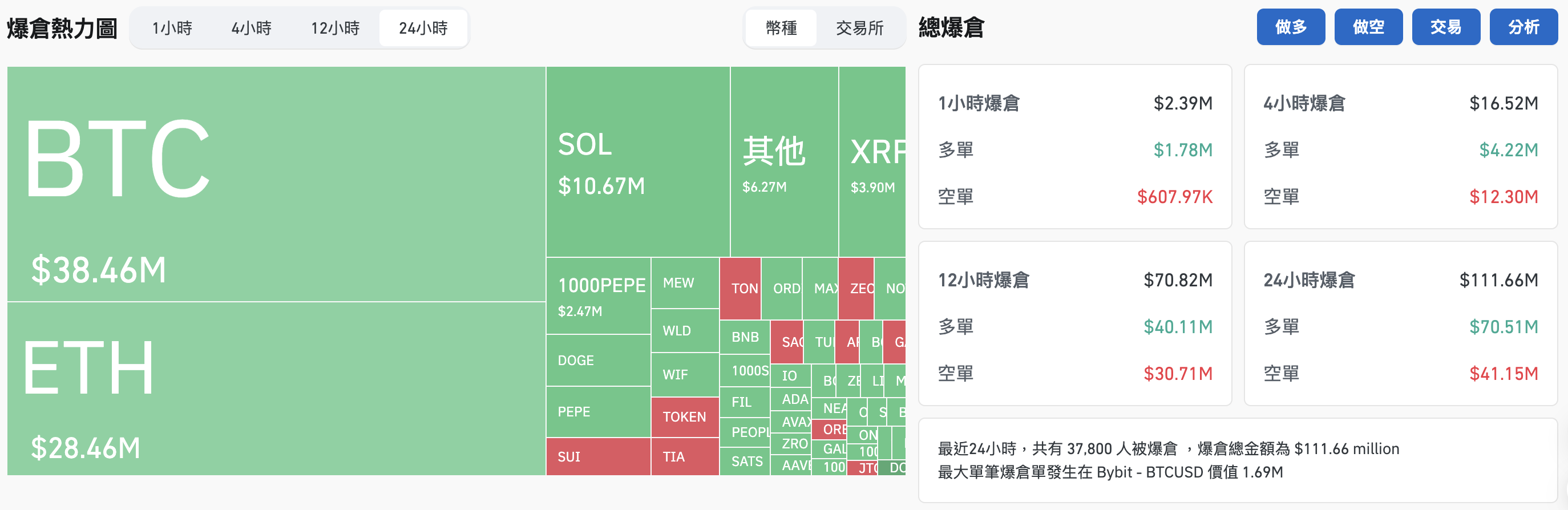

The entire network liquidated over 100 million US dollars in the past 24 hours

According to data from Coinglass, in the past 24 hours, the amount of cryptocurrency liquidation across the entire network was approximately US$111 million, of which long positions were liquidated at US$70.48 million, short positions were liquidated at US$41.15 million, and more than 37,000 people were liquidated.

Will Bitcoin form a V-shaped recovery?

Regarding the outlook for the cryptocurrency market, as Bitcoin rebounded to $60,000 in less than five days after falling to $49,000 on Monday, many analysts are optimistic that Bitcoin will continue to rise and form a V-shaped recovery.

Michaël van de Poppe, founder of MN Capital, issued an article stating that Bitcoin has indeed shown signs of a V-shaped recovery, and compared the adjustment and collapse caused by the sale of crypto assets by Jump Trading to COVID-19 (a black swan event). He believes :

As long as Bitcoin remains above $57,500, we will see new all-time highs in September or October.

Technical analyst @CryptoCon_ posted an article early this morning, pointing out that Bitcoin’s “Fibonacci extension” accurately predicted every local high in this cycle. He said:

The next 52% rise and 0.618 extension will push the price above the $100,000 mark to $109,236.

If the "1 month behind 2023" trend continues, breaking $100,000 before the end of the year doesn't look impossible.

However, not all cryptocurrency analysts share the same view. Some believe there could be further losses before Bitcoin hits a new all-time high. Analyst Peter Brandt wrote on the 9th that "there is a 50% chance that Bitcoin will fall below $40,000 before the second half of the halving ends."

Analyst Marco Johanning pointed out in the early morning of the 9th that Bitcoin's key resistance level is now $62,300, which may be a price level we can pay attention to.