Ethereum has failed to keep pace with rival cryptocurrencies this cycle, and its dominance has been challenged.

Despite Ethereum’s enthusiastic reception on Wall Street, the price of Ether (ETH) has failed to move in lockstep with rival cryptocurrencies this cycle.

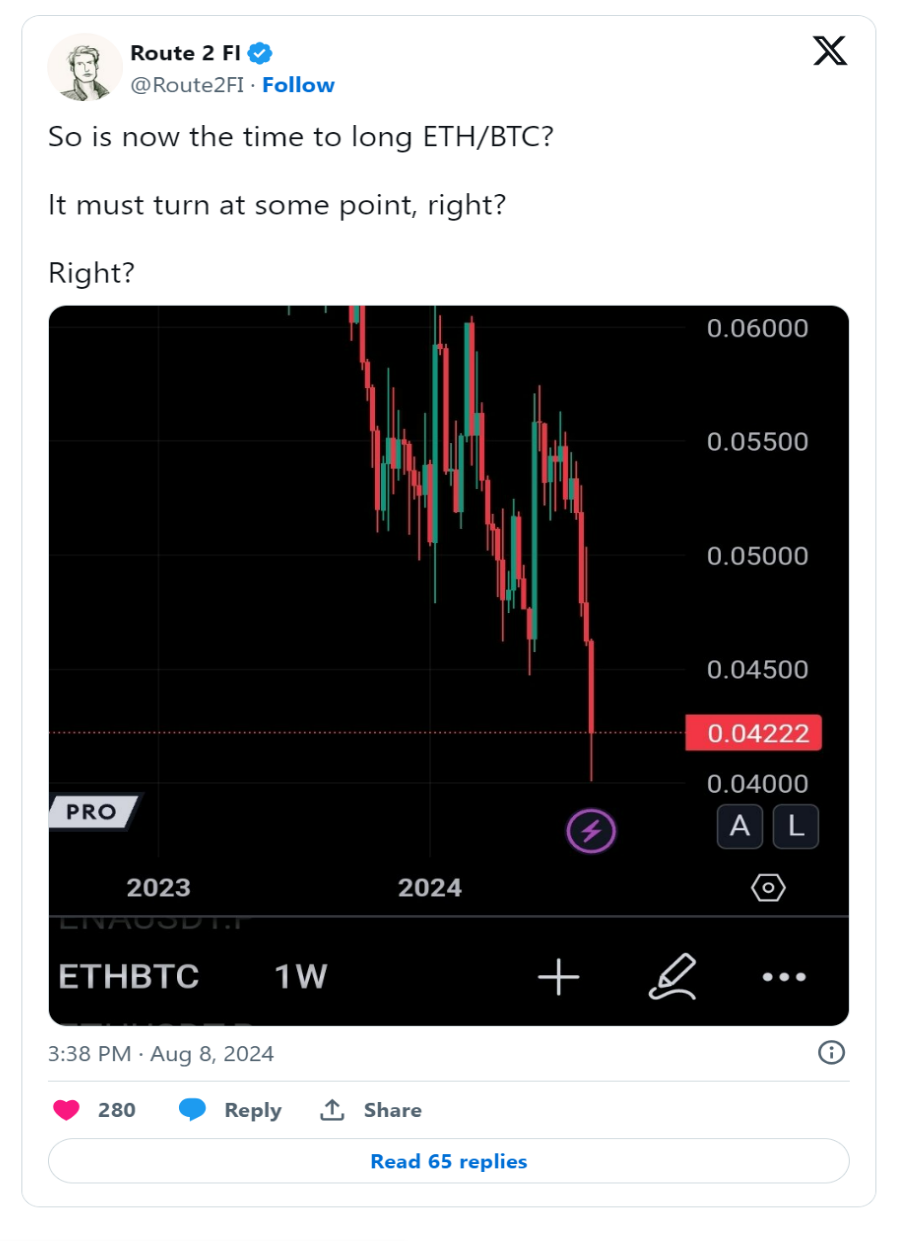

As the cryptocurrency market fell sharply on Sunday, the ETH to BTC exchange rate hit a yearly low of 0.041, according to TradingView data. Although digital assets, including ETH, have staged a solid recovery since then, the ratio remains at 0.043 at the time of writing.

Many people can’t help but find this trend unusual. In bull market years, when the dominant digital asset that has seen capital inflows flow from Bitcoin to riskier small-cap assets, it has often happened that alternative tokens surpass Bitcoin. In fact, in Bitcoin’s first quarter rally, alternative tokens like Solana and meme coins like PEPE and WIF proved this, but ETH did not.

“This shift challenges the long-held belief that network effects alone can sustain Ethereum’s dominance,” financial analyst Wesley Kress wrote on Twitter on Tuesday. “Ethereum has performed poorly this cycle and I think people are realizing it’s not the future.”

However, some other analysts believe that this pessimistic view is exaggerated. They say that time will be Ethereum’s best friend, especially if the new Ethereum spot ETF has time to gain popularity.

“There’s so much hype about the immediate impact this ETF could have on prices, and right now, there’s so much panic,” crypto influencer Crypto Kaleo said Thursday, noting that the Ethereum ETF has been live for 12 days, which is exactly how long it took Bitcoin to bottom out and rebound after the launch of its own ETF in January.

In theory, the launch of an ETF is positive news for the price of Ethereum because it enables various institutions to purchase Ethereum, which might otherwise be restricted by regulation.

However, according to Jonathan Bier, chief investment officer at FarsideUK, an ETF might not bring Ethereum the same level of success as Bitcoin.

“A big part of the success will be driven by people and entities moving their existing [Ethereum Trust] holdings into the ETF,” Beal told Decrypt. He said Grayscale’s Ethereum sales could be more severe than Bitcoin’s because investors will need to consider capital gains taxes when they sell their Ethereum Trust shares.

“At the same time, Ethereum investors are less loyal than Bitcoin investors,” he added. “Ethereum investors are always looking for the newest thing with the latest technology.”

Throughout the year, Solana has surpassed Ethereum in key metrics related to network activity. In late July, Solana surpassed Ethereum in total transaction fees for the first time.

Additionally, several market-related on-chain metrics also show a wavering investor interest in Ethereum alongside Bitcoin. According to CryptoQuant, Bitcoin’s “realized market cap” — a measure of new investor capital inflows into Bitcoin — has increased by $187 billion so far this year, compared to Ethereum’s $127 billion.

“Bitcoin has outperformed Ethereum on some of the network’s fundamental metrics,” Julio Moreno, head of research at CryptoQuant, told Decrypt. “For example, the ratio of the number of transactions in the Ethereum network to the number of transactions in the Bitcoin network has also fallen as the ETH/BTC price ratio has fallen.”