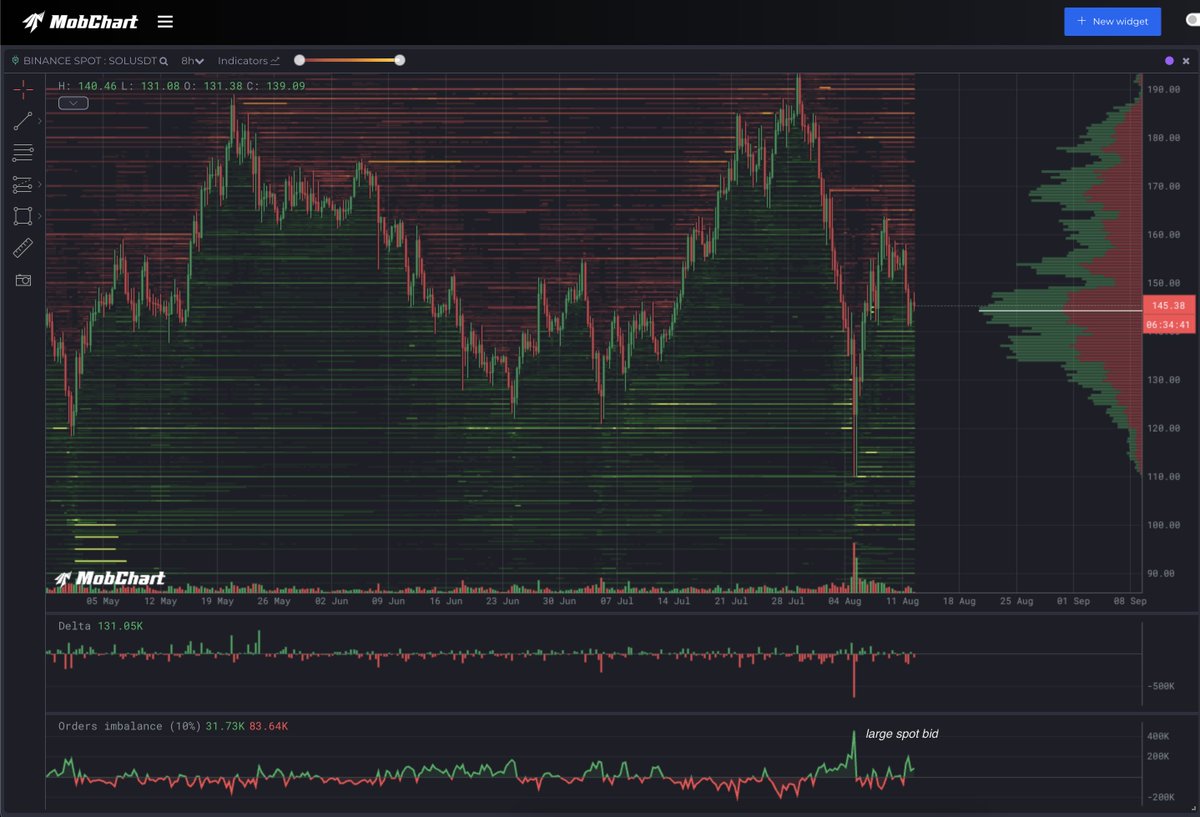

complete guide on finding trading opportunities in cryptocurrency derivatives

wanted to do this thread for quite a while and finally have some time to do so.

i will share my favorite systematic ways of finding new trading opportunities for both day and swing trading

/cont

before we get into things, it is important to realise that finding a trade opportunity is just the first part of the puzzle.

the key is being able to structure an actual trading idea around it.

I cover my approach in free blog and tradingriot bootcamp

before we get into things, this approach works the best for a highly liquid coins which has large mcap, open interest and daily volume and there in equilibrium for the most part.

this is not finding a "next gem 1000x coin" but rather taking advantage of variety of orderflow based setups

1/ funding rates

funding rates are probably the one thing everyone on the list which everyone knows about at this point; therefore, the edge in it is not that high/rare to happen.

very tldr for those of you that never heard about funding rates:

If funding is positive, it means that the perpetual swap is trading above the index price, and if funding is negative, it means that the perpetual swap is trading below the index price.

If funding is positive, longs pay a fee to shorts.

If funding is negative, shorts pay a fee to longs.

you will find more details here: tradingriot.com/cryptocurrency...…

funding is a great indicator of sentiment, and when at extremes, you can use it as an indicator of possible mean reversion.

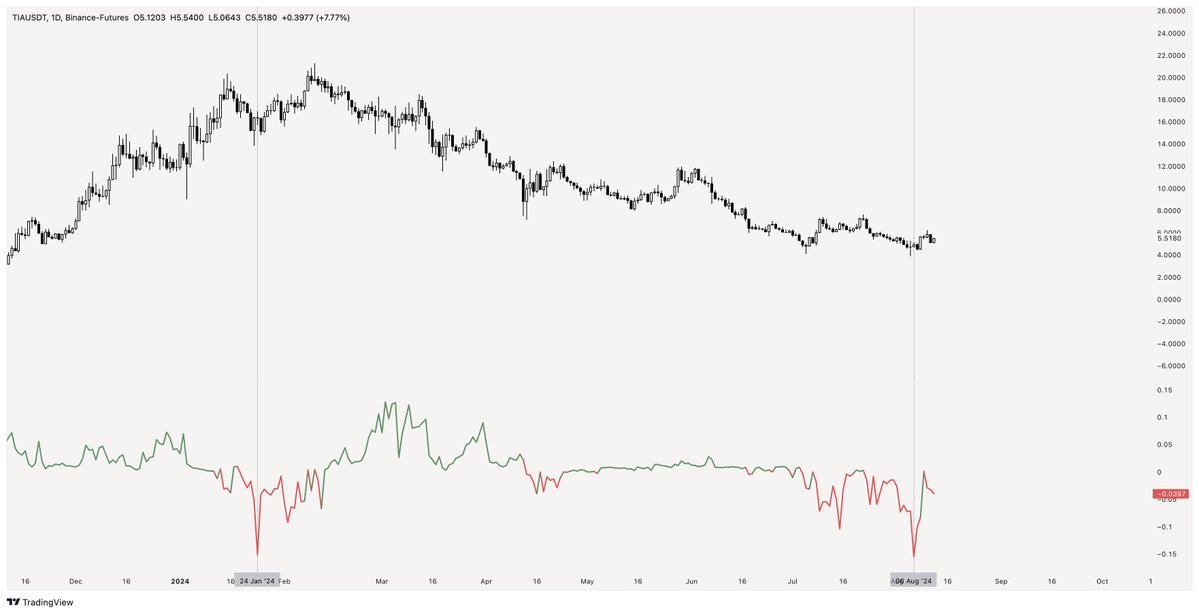

the example below shows a rally in TIA every time funding went extremely negative

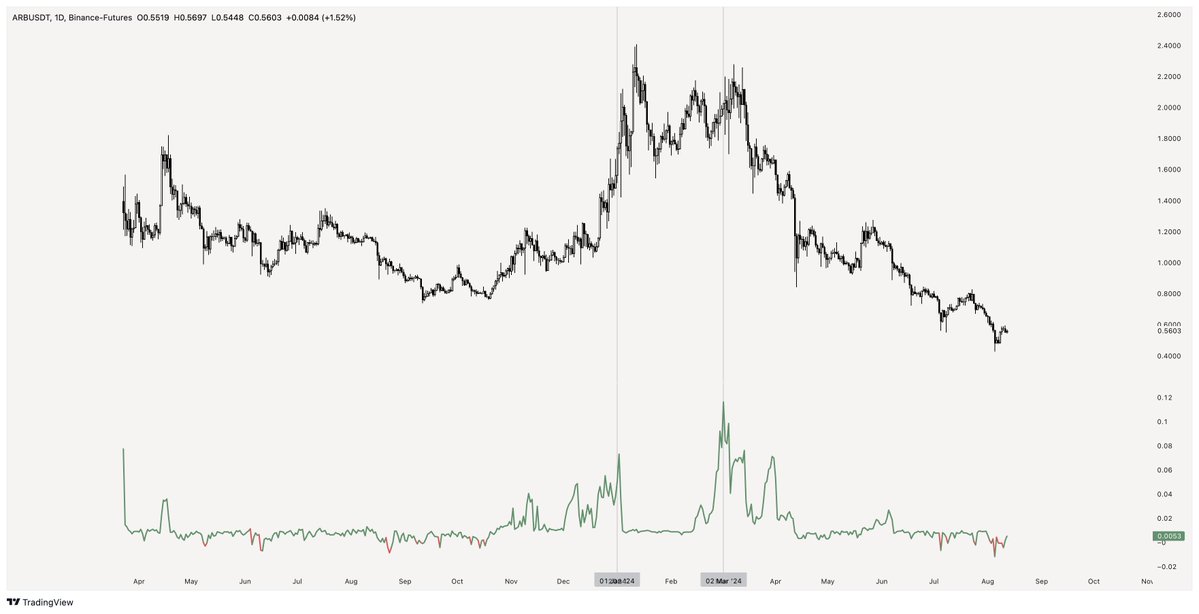

although most traders in crypto only look at funding when extremely low, the opposite is equally valuable

the example below shows a drop in ARB when funding went extremely high

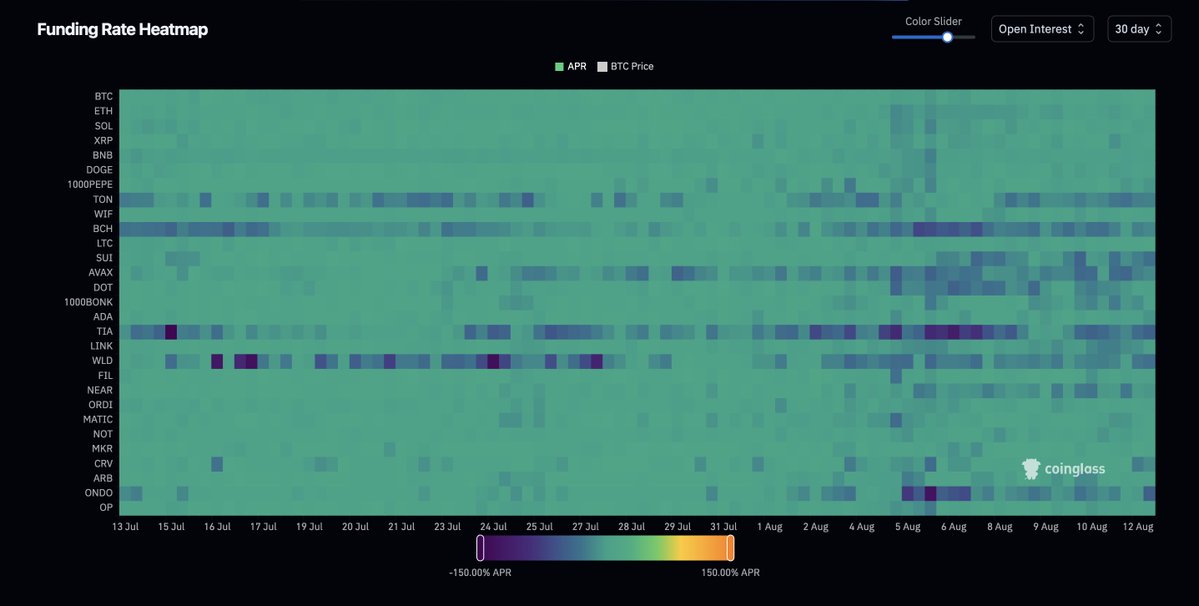

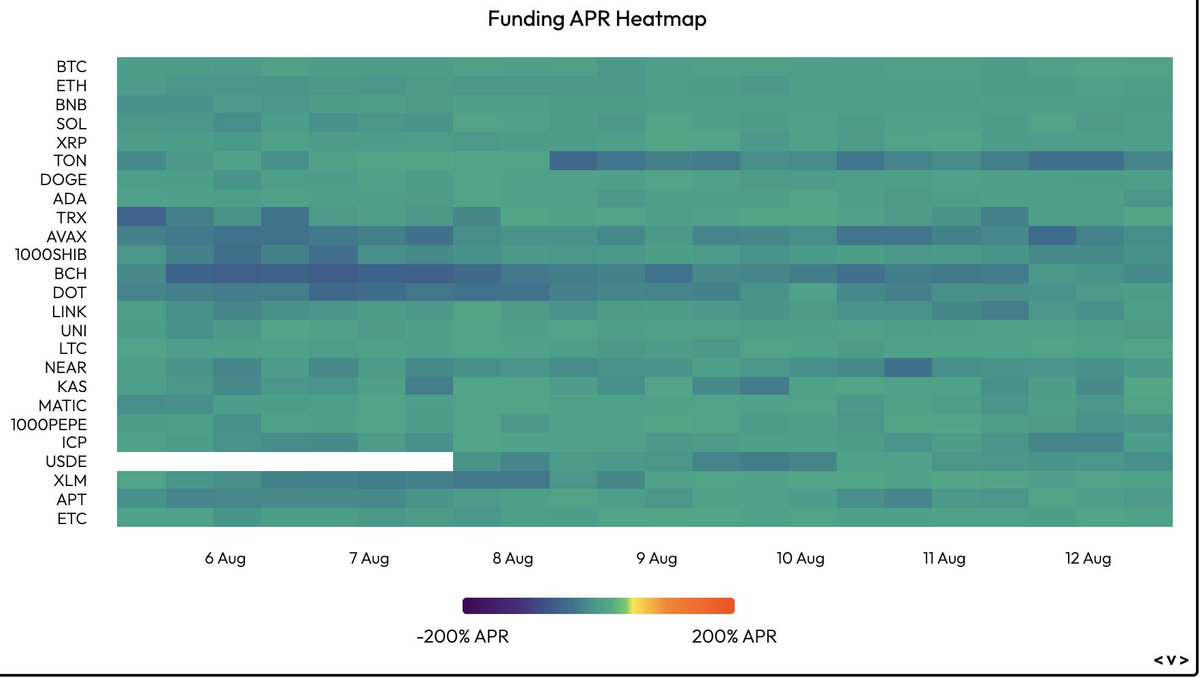

there are several websites that will show you data for funding rates or these funding rate heatmaps

my favorites are from @coinglass_com and @VeloData

2/ open interest

in a very dumb down explanation

open interest measures the number of outstanding contracts that exist for a given market. In other words, the positions people still have open that have not yet been closed. (more here: tradingriot.com/cryptocurrency...…)

in even a more dumb down explanation

open interest shows the amount of leverage in the market

although open interest can be used as a directional indicator (more on this time, maybe in another thread)

more often than not, an excessive amount of open interest or lack of interest leads to a mean reversion.

you can see open interest on many platforms, but my favorite is using @TRDR_io, which allows you to use a lookback, so it is much easier to spot relative changes in the open interest.

there are several sources for finding % changes in the OI which will lead to finding a possible trade opportunities, my personal favorite is screener on @laevitas1

3/ spot order book delta

for those of you who do not know what order book delta is, I have recently published a whole blog post explaining everything, so go and read that

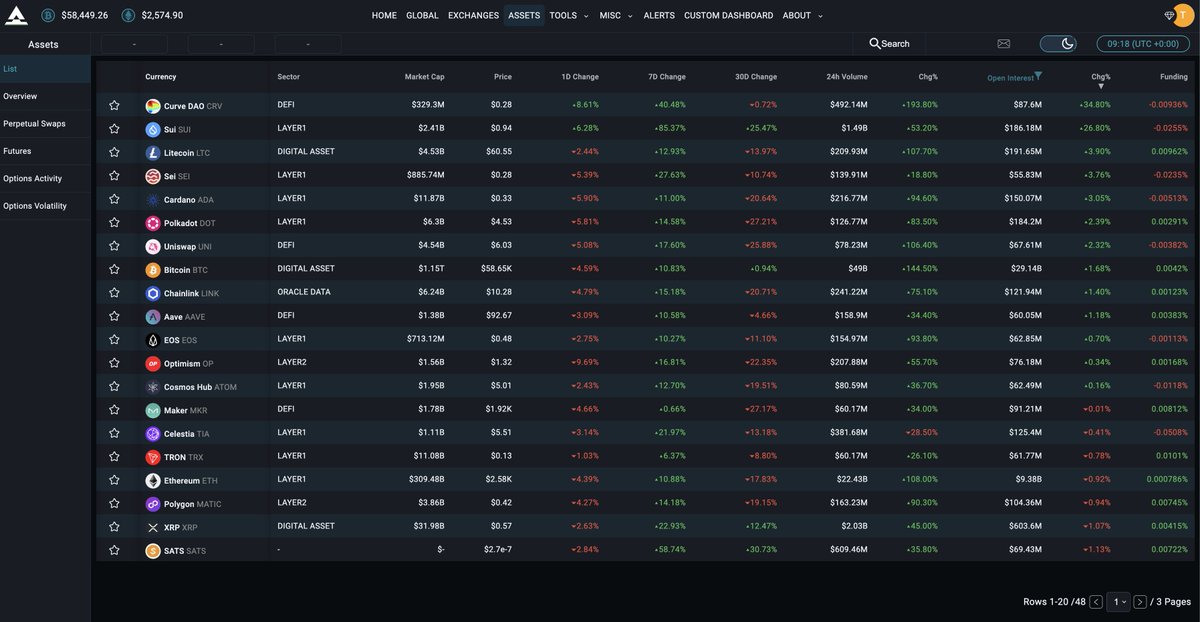

for finding opportunities in different altcoins, you can use the liquidity screener from @MobChartCrypto where you can apply various filters based on size/order strength and so on until you end up with something like this

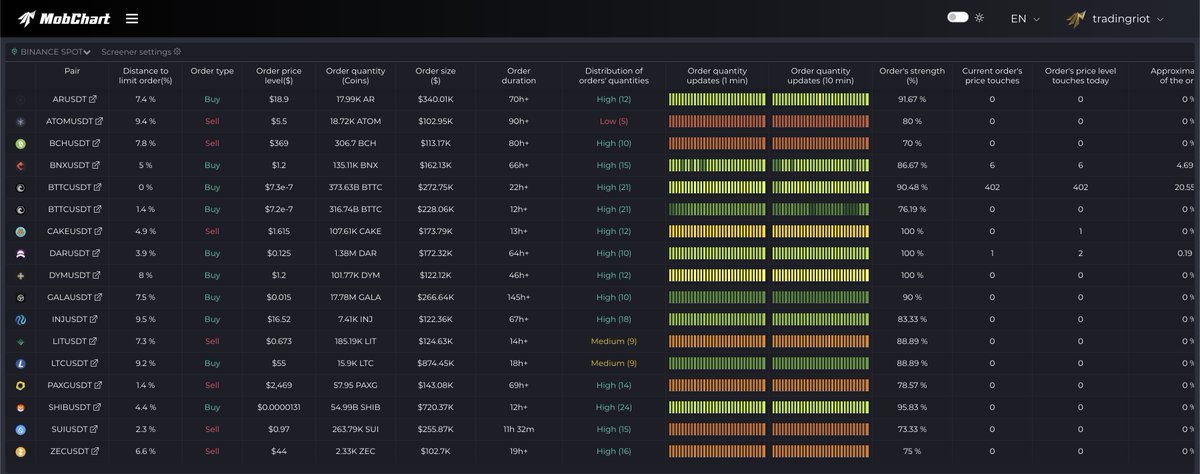

by using this screener you would be able to spot large bids or asks like this huge bid in SOL at the bottom

That concludes the thread; as I mentioned, this should be only the first part of your trading process, and you should put a large emphasis on execution and risk management as those are the only two that will matter in your long-term profitability.

before you leave here are some useful resources

free blog: http:/tradingriot.com

bootcamp - complete video guide on my trading process: http:/tradingriot.com/bootcamp

free read-only discord where I post trades and all important stuff: http:/tradingriot.com/discord

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content