- The Ethereum Fear and Greed Index is gradually turning around.

- ETH token summary, on-chain signals, and false breakouts suggest a price surge is imminent.

At press time, the Ethereum [ETH] Fear and Greed Index is at 38, reflecting a shift in market sentiment to neutral from the extreme fear levels seen a week ago.

If you want to know more about the crypto and get first-hand cutting-edge information, please visit Weibo Dolphin 1 for more good articles .

At the time of writing, Ethereum is priced at $2,705, and this balance between fear and greed suggests that investor confidence is growing.

This sentiment suggests that Ethereum could soon test and potentially break through the $28,000 resistance level, highlighting the positive momentum for Ethereum and the broader cryptocurrency market.

ETH/USD approaches resistance

Ethereum recently broke through the $28,000 support level, which has become a key support point for the market to recover from this week’s crash.

The key question is whether the current price action will break through this resistance level, but Ethereum has gradually gained confidence, recovering from weekly lows and closing strongly. This rebound suggests that a breakout of support is imminent.

A brief break below $2.800 could be considered a false breakout, indicating a possible reversal as the price quickly moves back above this level.

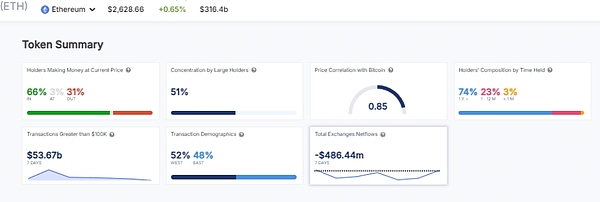

Token Summary

Recent analysis of the Ethereum ecosystem suggests that ETH could break through the $2,800 resistance level as confidence grows.

Currently, 66% of the total coin holders are profitable, and 51% of ETH is concentrated in the hands of large holders.

Ethereum’s price closely follows Bitcoin’s with a correlation coefficient of 0.85, and 74% of holders have held their assets for more than a year.

Last week, the total volume of transactions above $100,000 reached $53.67 billion. These factors suggest that Ethereum has a good chance of breaking through this key resistance level, reflecting growing confidence in the asset.

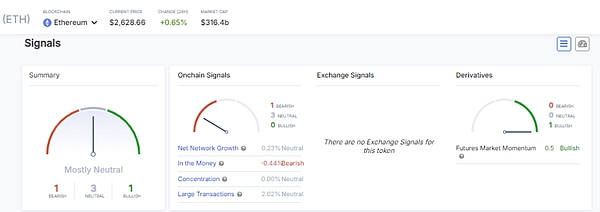

On-chain signaling

Ethereum’s on-chain metrics show a neutral stance on both buying and selling. Network growth is steady at 0.23%, while intra-price trading is down slightly at -0.44%.

Concentration and large transactions also remained neutral, with readings of 0% and 2.02%, respectively.

However, the futures market showed a small bullish momentum of 0.5%, indicating that Ethereum could soon break through the $2,800 resistance level as confidence in the asset grows.

End

The Ethereum blockchain is available to everyone and is designed to support scalability, programmability, security, and decentralization, allowing the creation of any secure digital technology. Its native digital currency, Ether (ETH), has attracted recognition and interest from investors, while developers appreciate its usefulness in developing blockchain and decentralized financial applications.

Bitcoin and Altcoin are positively correlated. If BTC price advantage is higher, Ethereum's price could surge as it is the second-highest coin by market cap. This possibility increases the likelihood that ETH will rise more than fall. Also, DeFi is about three years old, but most of it is based on Ethereum. ETH is collateral.

The more DeFi is used as an alternative channel for financing, the more demand there will be for ETH. The impact is net positive volume for institutional investors in the short term, and now the total locked-in maximum price of ETH in US dollars is rising, after statistics from DeFi Pulse showed that the total locked-in maximum price of ETH fell from more than $1.5 billion.

The article ends here. Follow Weibo Dolphin Dolphin 1 for more good articles. If you want to know more about the relevant knowledge of the crypto and first-hand cutting-edge information, please consult me. We have the most professional communication community, publishing market analysis and high-quality potential currency recommendations every day. There is no threshold to join the group, and everyone is welcome to communicate together!