As cryptocurrency prices generally fall, Ethereum transaction gas fees have also dropped significantly. According to recent data, the base fee paid by users has dropped to a staggering 0.82 Gwei, a clear sign of reduced Ethereum network activity.

Ethereum activity decreases

Ethereum still holds a huge share of the DeFi market, with a total locked value of $47 billion, according to DeFiLlama.

However, rival networks such as Tron [TRX] and Solana [SOL] have been eating into its market share, causing TVL to drop significantly by 17% since August 1.

Weaker DeFi activity also led to a drop in the number of daily active addresses.

Ethereum’s daily active addresses fell from 731,000 on July 22 to around 386,000 on August 11, according to AMBCrypto’s analysis of Santiment data.

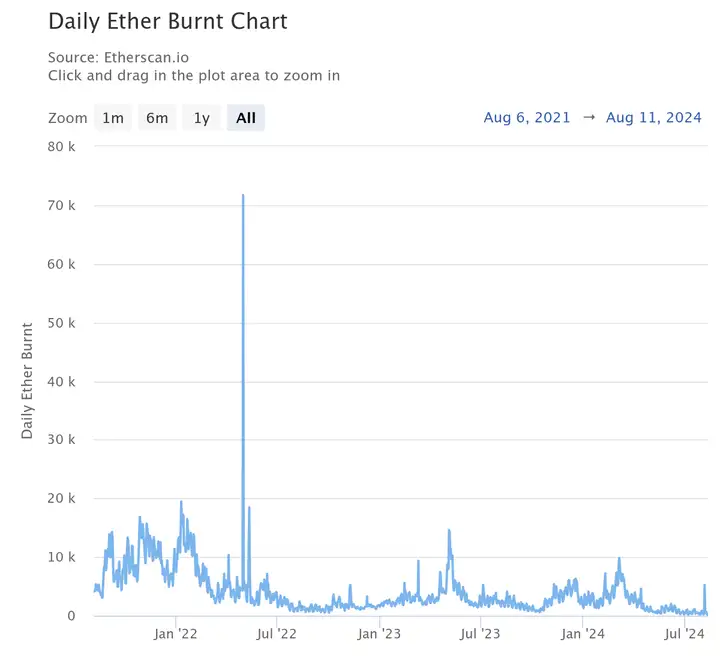

The decline in TVL and user activity means fewer transactions, which hinders the collection and destruction of gas fees. This has caused Ethereum's destruction rate to fall to its lowest level in many years.

AMBCrypto’s observation of Ultrasound Money data also shows that over the past seven days, a total of 3,885 ETH tokens have been destroyed, while 18,000 ETH tokens have been issued.

As a result, Ethereum has seen inflation, with a total of 14,206 ETH net entering the circulating supply.

Ethereum base fees are falling rapidly

Data from Ultra Sound Money shows that Ethereum’s base gas fee has continued to decline over the last week, finally hitting a multi-year low of 0.82 Gwei on Saturday, August 11. The sharp drop in gas fees can be attributed to the reduction in large transactions on the Ethereum network. On-chain data from IntoTheBlock shows that the number of transactions above $100,000 has dropped sharply, from 16,990 on Monday to just 2,620 on Saturday.

The drop in gas fees has also led to a decrease in the amount of ETH burned. This is based on the idea that the base fees paid by users are burned and removed from circulation to create deflationary pressure on the supply of ETH. Ultra Sound Money data shows that only 3,698 ETH tokens have been destroyed in the past seven days, while 18,065 new ETH tokens have been issued in the same period. This imbalance between destruction and newly issued tokens has led to a net increase in the circulating supply of Ethereum, which contradicts the expected deflationary outcome.

Why are gas fees so important?

The relationship between transaction fees, network activity, and the overall supply of ETH is a key factor that traders and users look at from time to time. Transaction fees on Ethereum are fundamentally tied to the level of network activity. As the number of transactions increases, so does the demand on validators to process and verify those transactions.

When there are a lot of transactions waiting to be added to the block in the network, if users want their transactions to be processed quickly, they have to pay higher gas fees. By doing so, they can ensure that their transactions are verified and completed in the next block.

Historically, rising gas fees, while negative for users, have been seen as a reflection of increased interest and activity in Ethereum. Such periods of high demand for the network are often associated with bullish market behavior. At its peak, users paid an average daily gas price of $196.638 in May 2022.

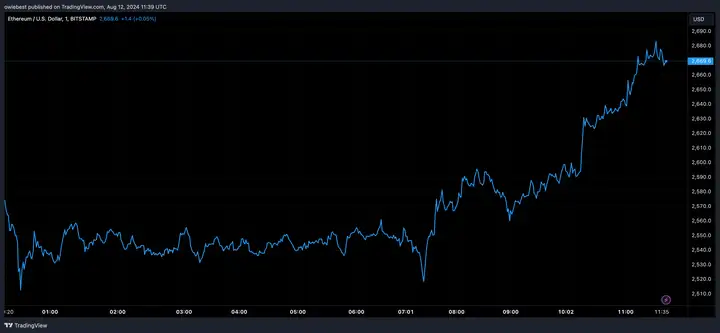

During times of lower activity, like what is currently being observed, reduced demand always leads to lower gas fees. While lower gas fees can be beneficial for users looking to save on transaction costs, they also reflect a period of low network activity. At the time of writing, Ethereum is trading at $2,681, up 5.69% over the past 24 hours.

Did ETH lose to SOL?

While Ethereum grapples with a decline in network activity, its biggest competitor, Solana, has seen significant growth in its DeFi TVL.

As of press time, Solana’s TVL is $4.72 billion, a nearly fourfold increase from around $1.4 billion on January 1.

Solana has also outperformed ETH in terms of price. While Ethereum has gained 39% over the past year, Solana has gained a whopping 487%.

After falling 13% over the past two weeks, ETH is trading at $2,681 at the time of writing.

However, traders are betting on positive price action, and Ethereum's funding rate has turned from negative to positive. This shows that more traders are holding long positions, indicating a shift in bullish sentiment. At the same time, demand driven by spot Ethereum exchange-traded funds (ETFs) is also a catalyst for further gains.

In simple terms

As Ethereum network activity decreases, Ethereum [ETH] destroyed 121 ETH tokens on August 10, after which its destruction rate fell to an all-time low, hitting the lowest level since the implementation of the EIP-1559 upgrade. In contrast, Ethereum competitor Solana's DeFi TVL has increased nearly fourfold so far this year. As the destruction rate continues to decline, it shows that the network's dominance in the decentralized finance (DeFi) market is constantly losing. However, investors betting on positive price action and bullish efforts have also driven a shift in bullish sentiment.

In summary, with the decrease in Ethereum network activity, its upside potential is limited in the short term, but as traders and investors make bullish bets, the shift in bullish sentiment will also provide support for further gains and the recovery of network activity. In the long run, as the market recovers and the demand driven by spot Ethereum exchange-traded funds (ETFs) will improve the situation of network activity and further catalyze the rise of ETH.