Whale build BTC positions at low levels, earning $19.9 million

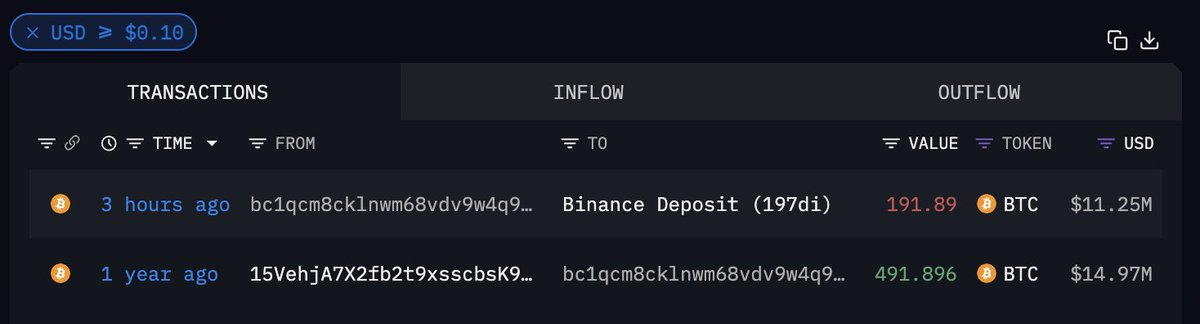

According to on-chain data, the whale address bc1qc...8un8 deposited 191.89 BTC purchased at an average price of $18,168 between July 2021 and November 2022 into Binance. If all are sold, a profit of $7.76 million will be made.

The address still holds 300 BTC, with a floating profit of US$12.14 million and a total profit of US$19.9 million!

Since 2021, the price of BTC has reached a high of US$70,000 and a low of US$16,000.

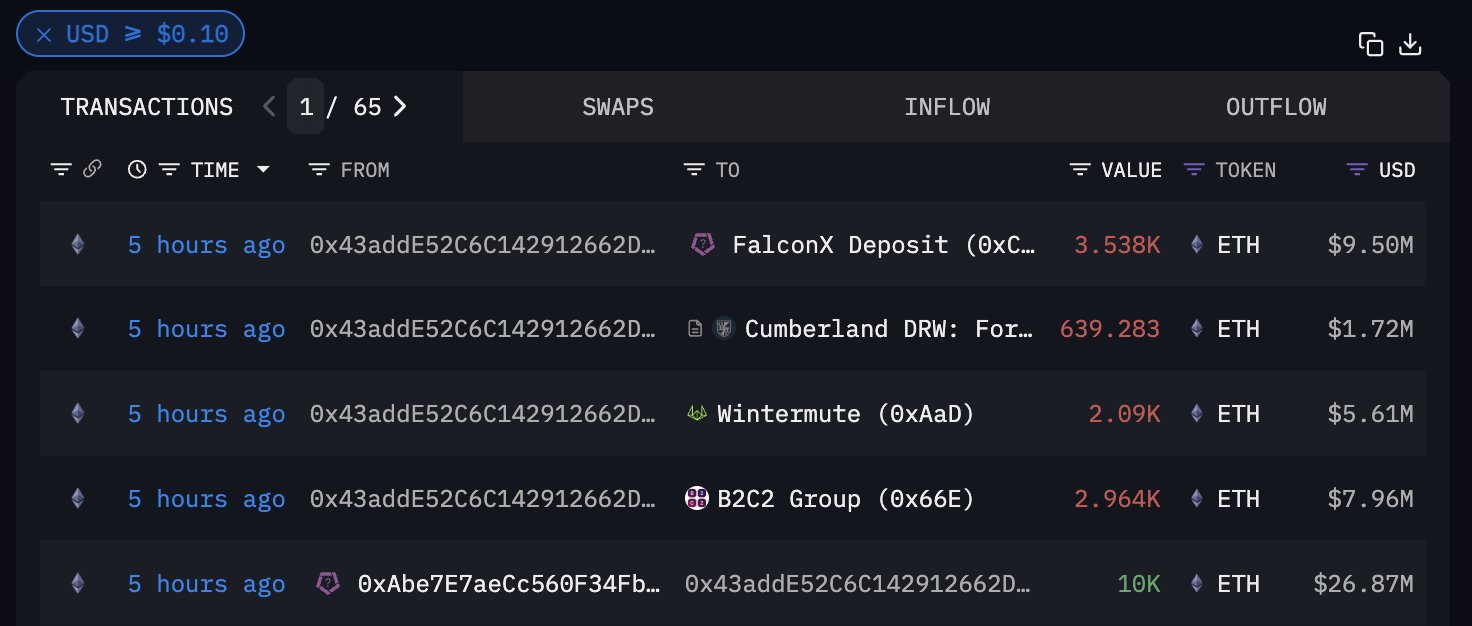

BlockTower Capital commissioned the sale of 9,231 ETH, with a total value of US$24.79 million

According to on-chain data, BlockTower Capital transferred 9,231 ETH to the three major market makers and exchanges in the past five hours, with a total value of approximately US$24.79 million.

- B2C2 Group: 2964

- Wintermute: 2090

- Cumberland DRW: 639

- FalconX Exchange: 3538

BlockTower is a cryptocurrency-focused financial firm whose founders previously worked at ConsenSys.

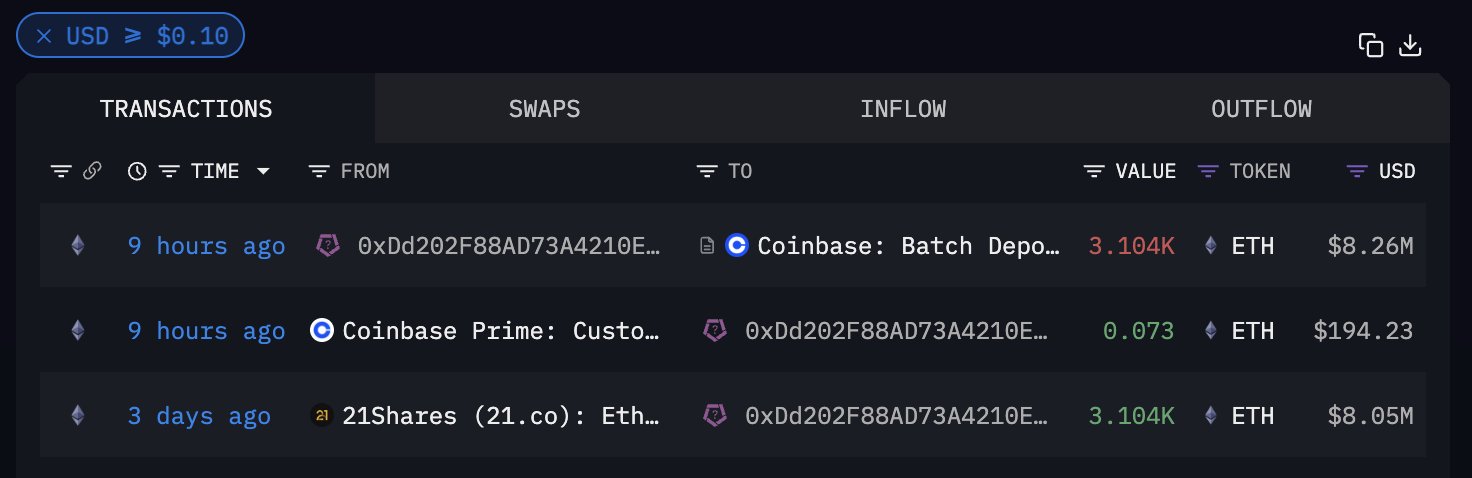

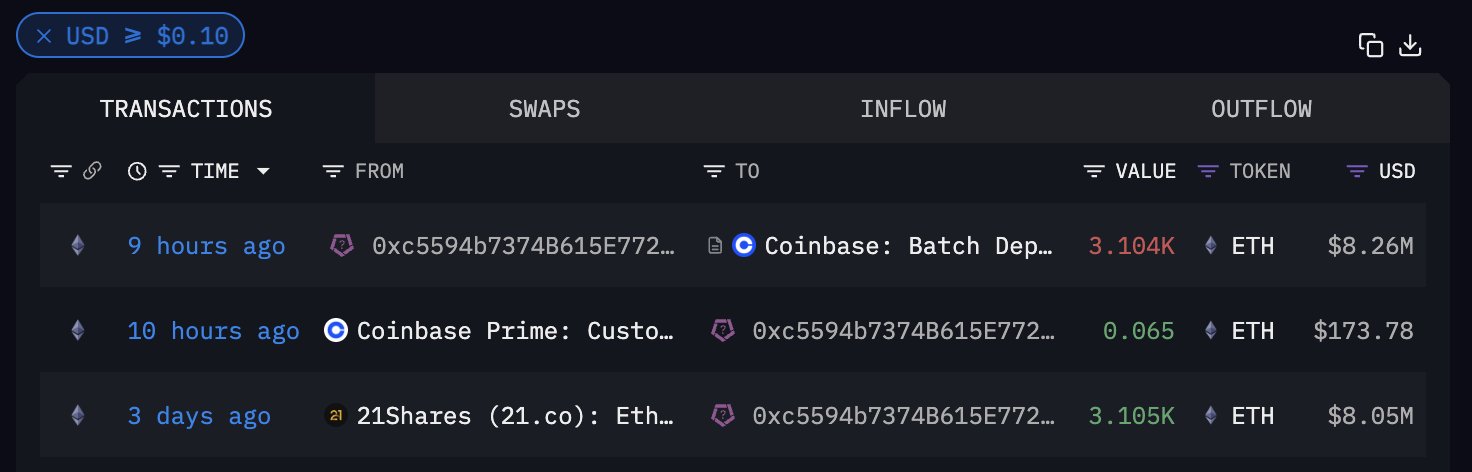

21Shares deposited 6,208 ETH to Coinbase, with a total value of $16.52 million

In the past nine hours, two addresses of 21Shares have deposited 6,208 ETH to Coinbase, with a total value of approximately $16.52 million, and an average deposit price of $2,662. The source of funds is the Ethereum Staking ETP AETH address.

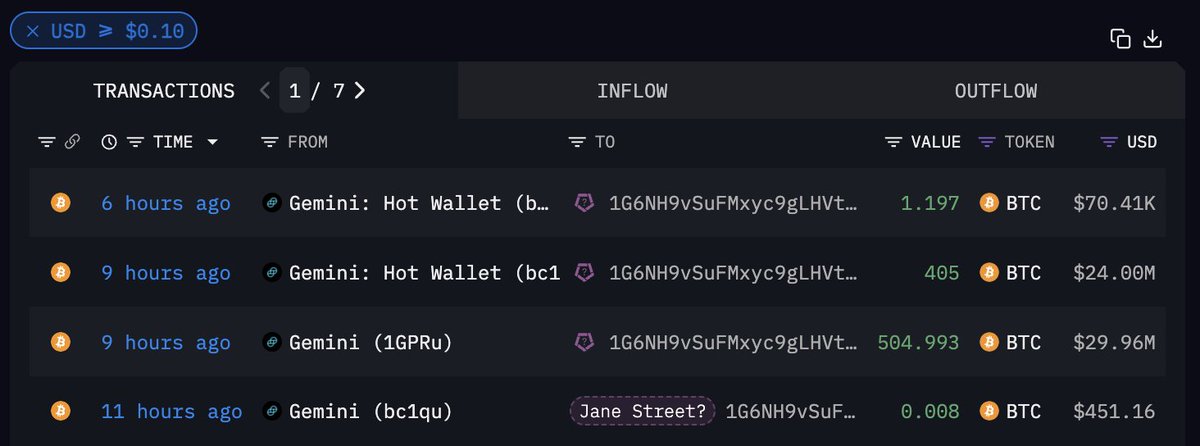

Quantitative firm Jane Street is suspected of hoarding BTC and once again withdraws a large amount of 911.19 BTC

According to the latest data, the mysterious quantitative trading company Jane Street seems to be hoarding BTC. In the past nine hours, the company has withdrawn a total of 911.19 BTC from Gemini, equivalent to approximately US$54.03 million, with an average cost of $59,296.

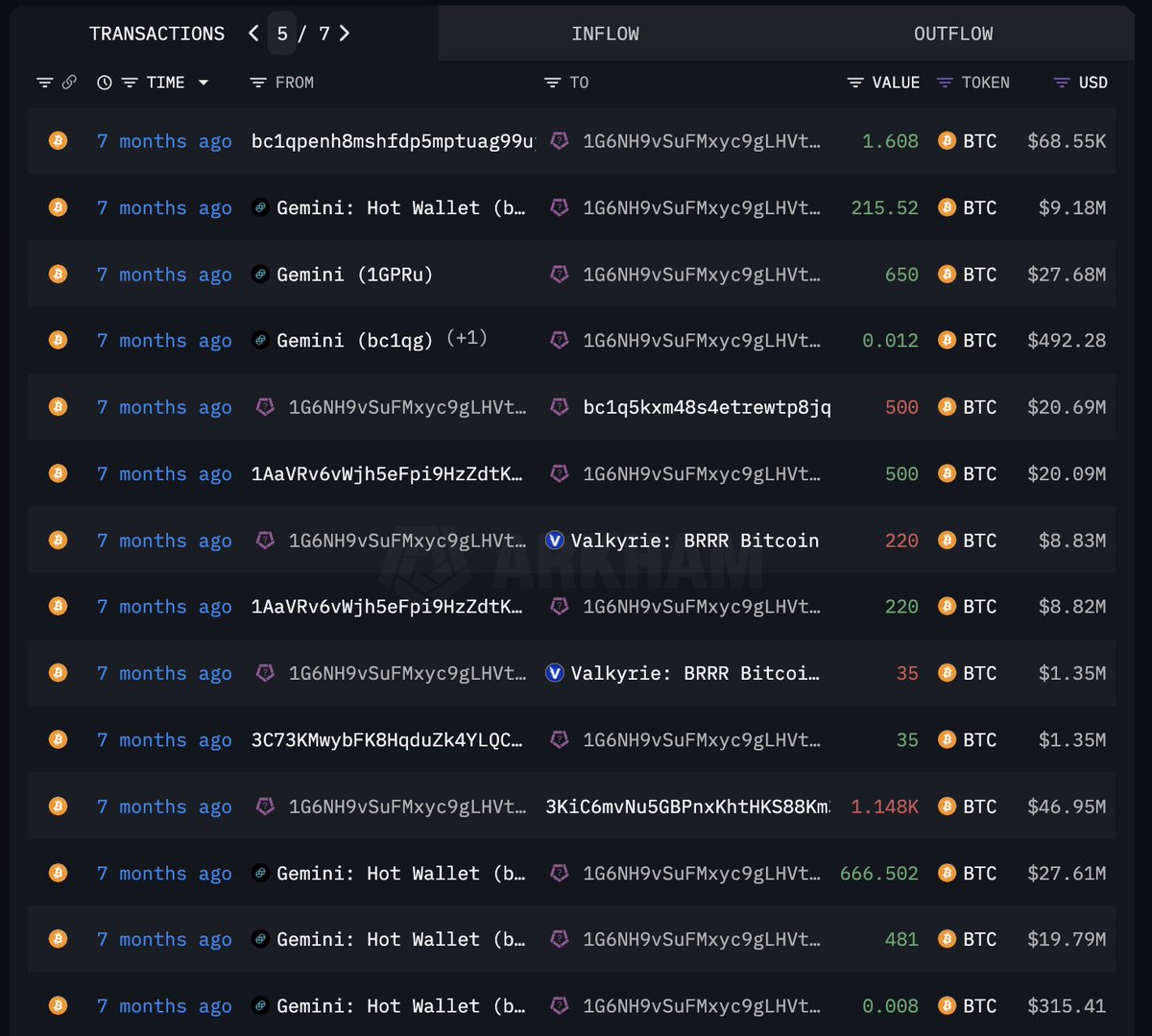

It is worth noting that seven months ago, Jane Street also had similar operations, withdrawing 865 and 1,147 BTC from Gemini on January 20 and February 1, respectively. The price of the coin was only $41,855 at the time. Currently, these BTC have a floating profit of 34.82 million US dollars.

The following pictures show the records of exchanges in January and February this year

The following pictures show the records of exchanges in January and February this year

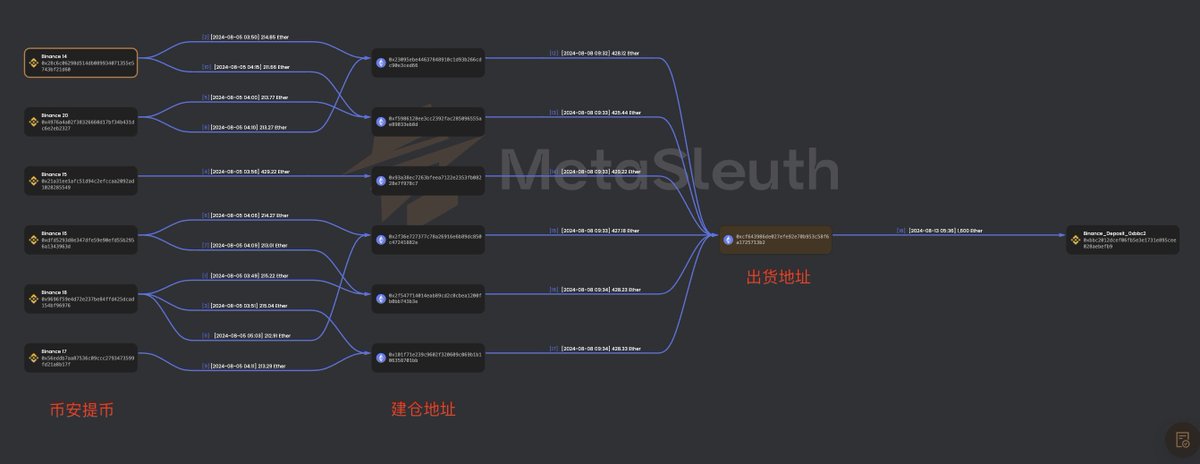

The whale made $860,000 in profit from ETH swing trading in eight days

According to on-chain data, six addresses that opened ETH positions two weeks ago transferred a total of 2,566 ETH (about $6.83 million) to the new address 0xcf6...713b2, which is suspected to be a profit-taking move. The average opening cost of these ETH positions was $2,325.

Currently, 1,600 ETH have been deposited into Binance an hour ago. If all are sold, a profit of US$540,000 will be made, and the remaining 966 ETH will still have a floating profit of US$320,000.

In just eight days, the whale made a cumulative profit of $860,000 through ETH swing trading!

Take profit address: https://platform.arkhamintelligence.com/explorer/address/0xcf643986de027EFE92e70B953C58f6A1725713b2

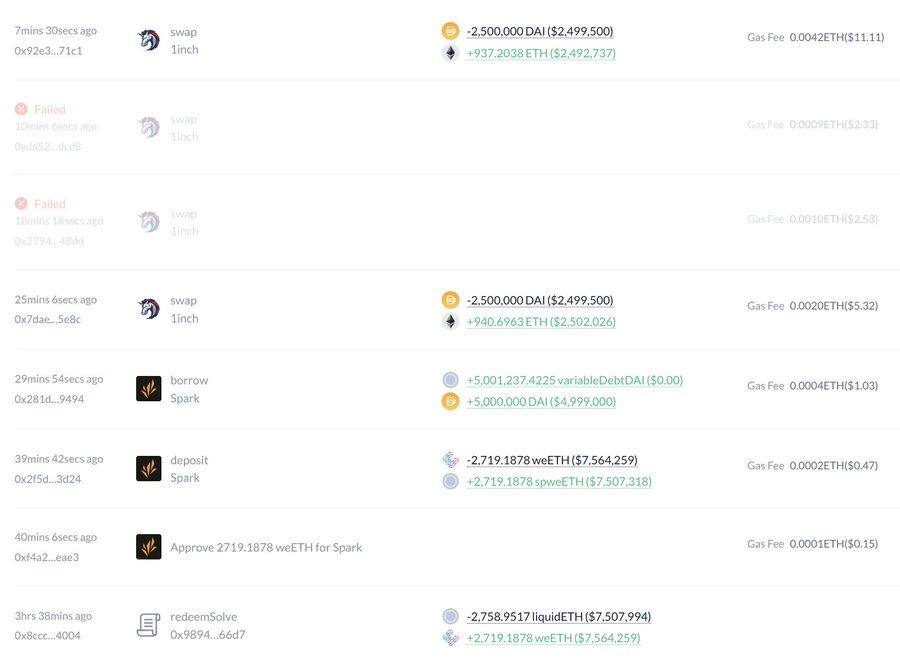

A whale has borrowed $11.8 million in stablecoins since August 11 and bought 4,459 ETH

On August 13, according to Lookonchain monitoring, the whale that was liquidated with 2,890 wstETH ($8.06 million) during the market crash on August 5 began to buy and long on ETH again. Since August 11, the whale has borrowed 6.6 million DAI, 2.7 million USDT, and 2.5 million USDC to buy 4,459 ETH ($11.8 million) at an average price of $2,646.

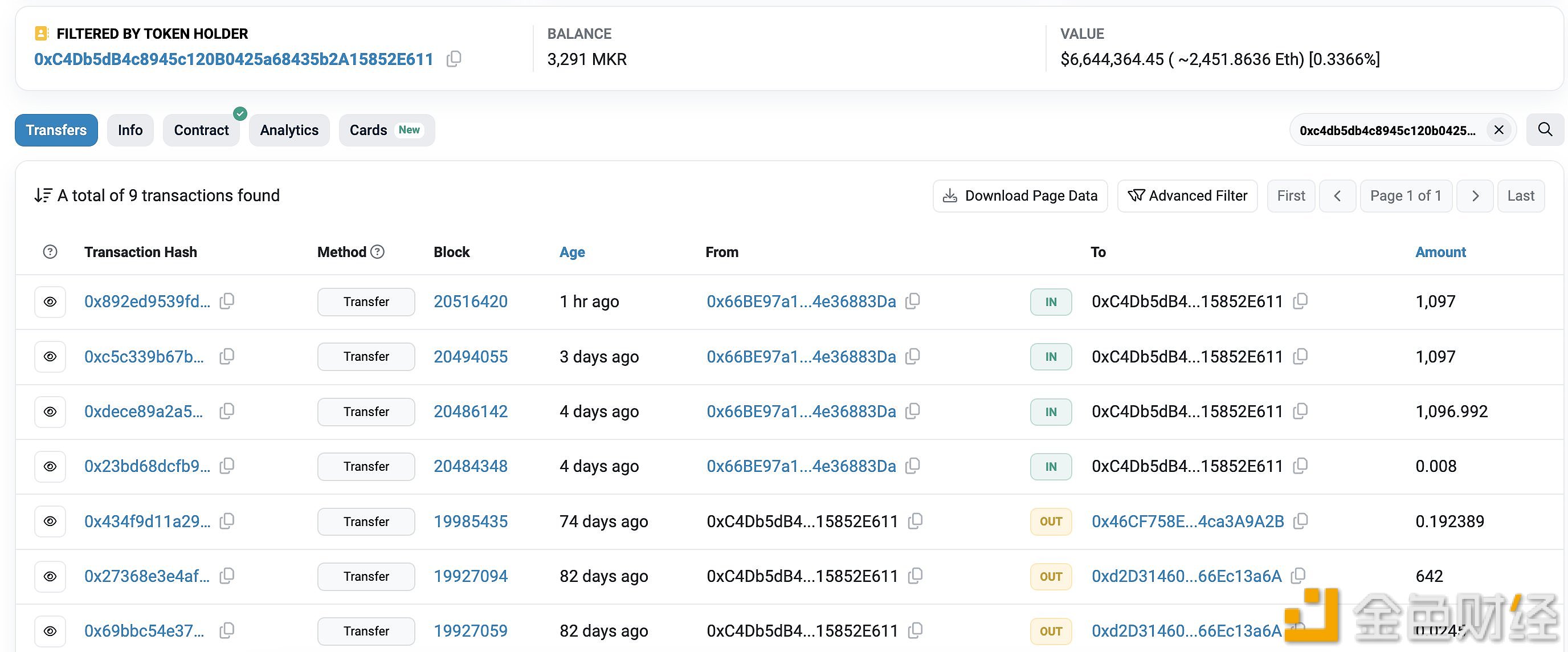

A whale bought 3,291 MKR from Binance in the past five days, equivalent to about 6.64 million US dollars

According to Lookonchain monitoring, the whale "0xC4Db" bought 3,291 MKR (US$6.64 million) from Binance through the wallet "0x16F6" in the past 5 days.

Data source:

1. https://x.com/ai_9684xtpa

2. https://x.com/EmberCN

3. https://x.com/lookonchain