Author: Dan Morehead, founder of Pantera Capital; Translated by: 0xjs@ Jinse Finance

Blockchain’s Massive Political Turn

“Sometimes decades pass without anything happening, and sometimes decades pass without anything happening in a few weeks.” - Vladimir Ilyich Lenin

I have been investing in Bitcoin/Blockchain for over a decade. Nothing has happened to the SEC and major administrative agencies. Ten years of rational thinking has happened in just a few weeks.

It's like the shockwave of a sonic boom. A decade of correct thinking is now hitting politics.

In May, a presidential candidate expressed support for blockchain. A few weeks later, two of the three presidential candidates, ten US Senators, and members of the US House of Representatives attended a Bitcoin conference!?! The changes are absolutely huge.

So much has happened that it’s hard to actually summarize it all, but here’s a quick distillation of the main policy moves:

President Trump’s Bitcoin2024 Conference Speech: Policy Initiatives

1. Bitcoin is a “technological miracle”

“Bitcoin is not just a miracle of technology, as you know, it is a miracle of human cooperation and achievement.”

2. Bitcoin may surpass gold

“But I mean, this is the steel industry 100 years ago. I think you’re still in the early stages…

“It’s already bigger than ExxonMobil. Soon it will be bigger than the entire silver market cap…

“It could surpass gold someday.”

3. Trump’s “America First” policy

“The reason I’m here today to address the Bitcoin community can be summed up in two very simple words: America First. Because if we don’t do it, China will, and others will. Let’s do it, and let’s do it right. My vision is for America to dominate the future…

“I want America to be number one in technology, science, manufacturing, artificial intelligence, and space.”

4. Make the United States a global leader in cryptocurrency

“This afternoon, I laid out my plan to ensure that America becomes the cryptocurrency capital of the world and the Bitcoin superpower of the world, and we will get it done.”

5. The meaning of Bitcoin

“Bitcoin represents freedom, sovereignty, and independence from government coercion and control. The Biden-Harris administration’s clampdown on cryptocurrencies and Bitcoin is wrong and very bad for our country. It’s really un-American.”

6. Crypto-friendly policies and ending Operation Chokehold 2.0

"As President, I will immediately end Operation Chokehold 2.0...

“I will cut unnecessary regulatory burdens. And work every day to make America the best place on earth to do business, including cryptocurrency business.”

[“Operation Chokehold 2.0” is a term used by some in the blockchain industry to describe regulators’ attempts to sever the ties between blockchain companies and banking services, a move that has forced many projects to accept regulation.]

7. New Presidential Advisory Committee on Cryptocurrency

“Upon taking office, I will immediately appoint a Presidential Advisory Commission on Bitcoin and Cryptocurrency. Their task will be to design transparent regulatory guidelines for the benefit of the entire industry.”

8. Regulatory clarity for stablecoins

“As part of our efforts to provide regulatory clarity, we will create a framework to enable the safe, responsible expansion of stablecoins, allowing us to extend the dollar’s dominance to new areas around the world.”

9. Bitcoin is not a threat to the US dollar

“People who say Bitcoin is a threat to the dollar are totally putting the cart before the horse. I think that’s putting the cart before the horse. Bitcoin is not a threat to the dollar. The actions of the current U.S. government are what are threatening the dollar.”

10. Embrace new ideas

"Our nation has never prospered by attempting to censor new ideas and stifle the dreams of its people. America has always planted our flag on the next frontier and moved forward courageously."

—Donald Trump, Bitcoin 2024 Conference in Nashville, July 27, 2024

Plate movement

Ten things in a row that Donald Trump said that I totally agreed with? Wow.

This is why I am so bullish on the future of blockchain. All of these policies make perfect sense.

Regardless of who becomes the next president of the United States, there is a good chance that the United States will develop sensible cryptocurrency policy.

The most popular one, which I strongly support and will be the subject of our long-prepared letter on monetary reserves (which we will send out as the September Blockchain Letter), is:

US Strategic Bitcoin Reserve

“Many Americans don’t realize that the U.S. government is one of the largest holders of Bitcoin…

“The federal government owns almost 210,000 bitcoins, or 1% of the total supply. But for too long our government has been violating the cardinal rule that every bitcoin user knows by heart: ‘Never sell your bitcoins.’

“So as a final part of my program today, I am announcing that if I am elected, my administration, the policy of the United States, will be to retain 100% of all Bitcoin currently held or acquired in the future by the United States Government, we will retain 100%...

“This will actually be the core of the country’s strategic reserve of Bitcoin.

"Therefore, I will take steps to transform this tremendous wealth into a permanent national asset for the benefit of all Americans."

—Former President Trump, Bitcoin 2024 Conference in Nashville, July 27, 2024

Prior to President Trump's speech, third-party candidate Robert F. Kennedy Jr. gave a speech at the Bitcoin 2024 Summit, promising to significantly increase Bitcoin reserves.

“On my first day as President of the United States, I intend to sign an Executive Order directing the United States Department of Justice and the United States Marshals to transfer the approximately 200,000 bitcoins held by the United States Government to the United States Treasury and hold them as a strategic asset.

“I will sign an executive order directing the United States Treasury to purchase 550 bitcoins per day until the United States builds a reserve of at least 4 million bitcoins and occupies a dominant position that no other country can usurp. Our nation holds approximately 19% of the world’s gold reserves. This policy will allow us to acquire approximately the same percentage of our total reserves in Bitcoin. The cascading effects of these actions will ultimately value Bitcoin in the hundreds of trillions of dollars.”

—Robert F. Kennedy Jr., Bitcoin 2024 Nashville, July 27, 2024

Shortly after Trump spoke, Sen. Cynthia Lummis (R-Wyo.) read out her own legislative proposal, proposing an official U.S. Federal Reserve accumulation of 1 million bitcoins over five years.

“This is the Bitcoin Reserve Act. I read from the text that the U.S. Senate would establish a strategic reserve of bitcoin, a network of secure repositories, a purchasing program, and other programs to ensure transparent management of the federal government’s bitcoin holdings…

“When Satoshi Nakamoto mined the first Bitcoin in January 2009, he brought with him an asset that would change the world. This was our Louisiana Purchase moment.

“The Bitcoin reserve we will create will start with the 210,000 Bitcoins that President Trump just mentioned and will be placed in vaults stored in different geographical locations. This is just the beginning. Within five years, the United States will have collected 1 million Bitcoins - 5% of the world's supply.

“It will be held for at least 20 years and can be used for one purpose: to reduce our debt.

“Bitcoin will change this country. As President Trump just said: ‘We print too much money, we spend too much money.’ During the COVID pandemic, we printed as much money in 22 months as has ever been printed in the history of the United States. Well, no more.

“With a strategic Bitcoin reserve, we will have an asset that will reduce our debt in half over the period until 2045.”

—Senator Cynthia Lummis, Bitcoin 2024 Conference in Nashville, July 27, 2024

Bipartisan support

Reps. Khanna (D-CA 17th District) and Nickel (D-NC 13th District) also attended the meeting and stressed the obvious:

“I don’t really understand how this is partisan. Being against Bitcoin is like being against cell phones.”

—Congressman Ro Khanna, CNBC interview, July 26, 2024

Amen. Satoshi Nakamoto gifted this technology to the world.

“Keeping this issue within the realm of bipartisan consensus is really my main focus in Nashville, and it’s something I’ve been working on in Congress.”

—Congressman Wiley Nickel, Bitcoin Magazine interview, August 2, 2024

Sonic Boom

“Kamala Harris’ advisers have approached top cryptocurrency companies in a bid to ‘reset’ relations between her Democratic Party and the crypto industry, which has become a key backer of her rival for the US presidency, Donald Trump.

“Members of the vice president’s team have reached out to people at cryptocurrency companies about meeting in the near future, four people familiar with the matter said. Those companies include leading exchange Coinbase, stablecoin company Circle and blockchain payments group Ripple Labs, two of the people said.

— Financial Times, “Kamala Harris campaign seeks ‘reset’ with cryptocurrency firms,” July 27, 2024

Free at last

“Being able to bring resources and opportunities to those who need it most, to give them access to the market, that’s what Bitcoin is about. That’s what Bitcoin is about. Giving everyday Americans the opportunity to make their own decisions in their own homes. No matter where you live, whether you’re at the top of a mountain or in the bottom of a valley, having the opportunity to democratize our financial footwork is an absolutely essential component to achieving the American Dream. Whatever we can do, wherever we can do it, let’s do it well…

“One thing I will absolutely guarantee to do as Chairman of the Senate Banking Committee is to see your bill through the Banking Committee, and we will work to make it the law of the United States, so that Bitcoin is free in the United States, in the United States, it is free at last! It is free at last! Thank God Almighty, it is free at last…”

—Senator Tim Scott and Senator Cynthia Lummis at Bitcoin 2024, July 26, 2024

Most Americans

"'How did you go bankrupt?'

Another person responded: "Two ways. Gradually, then suddenly."

—Hemingway, The Sun Also Rises, 1926

It doesn’t take a political science major to understand why both political parties have suddenly turned to blockchain.

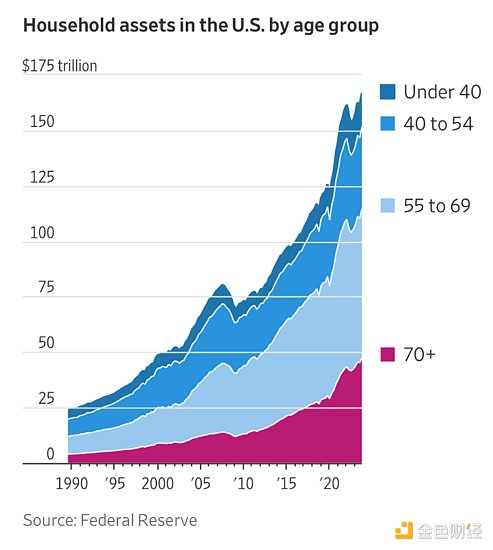

Most Americans are under 40 years old.

The consequences of the Federal Reserve's policy mistakes and Congress's money printing have fallen almost entirely on a minority of older Americans.

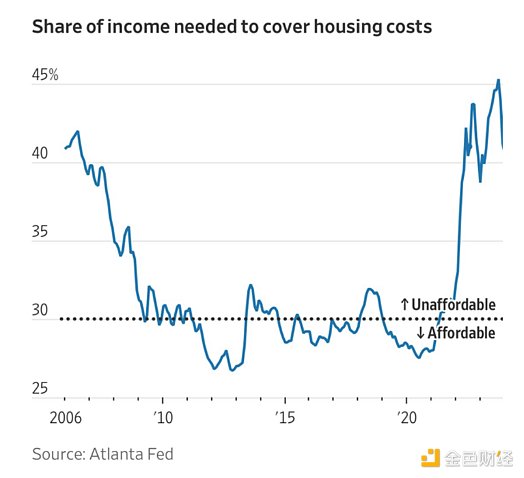

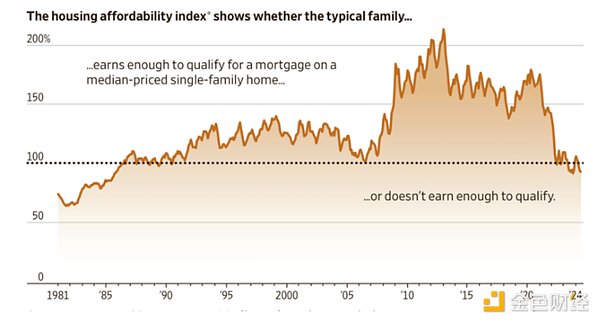

Most Americans are paying for these mistakes through housing costs.

Median-priced homes are more unaffordable than at any time since 1987.

They vote.

They vote.

#Buy Bitcoin.

“Bitcoin - The Great Asymmetric Opportunity”: Review of the Bitcoin 2024 Conference Panel

Roundtable members: Dan Morehead, founder and managing partner of Pantera; Anthony Scaramucci, founder and managing partner of SkyBridge Capital; Gary Cardone, managing partner of Cardone Digital Ventures

The most asymmetric and unmissable deal

Dan: “Anthony, we were at Goldman Sachs when they were doing the GSCI, and now everyone thinks commodities are an asset class. I was doing emerging markets research in the 90s, and now everyone thinks emerging markets are an asset class. In about five years, every institutional investor on the planet will have a blockchain team. They’ll have an allocation. It’ll be about 800 basis points. The reason I’m still so bullish on it, and the reason I think it’s still so asymmetric, is that no one has an allocation like that right now.

“This is the first trade that the ‘smart money’ missed, right? Individuals like you in this room did this, and almost all institutions have zero or less than 1% of their assets on the blockchain.

“Not only is it the most asymmetric deal I’ve ever seen, but I think it’s also the most unmissable deal I’ve ever seen. It may take longer than we think. It may have some ups and downs, but basically everyone with a smartphone will be using blockchain in 10 years. That’s obvious. So, that’s why I still think it’s still very asymmetric because institutions haven’t really figured it out yet.”

Is he still complaining?!?

Aaron: “You said it might take a decade to get to the market value of gold. We don’t know. It’s hard to predict, but why is it taking so long? Why is it taking so long to get there?”

Dan: “Aaron’s question is why I like this trade. We’ve been doing this trade for eleven years, and in those eleven years, Bitcoin has doubled every year on average… and he complained that it was taking too long. Now, **this** is a great trade!”

Blockchain’s political turn is the biggest news in crypto

Aaron: “Regardless of your personal views, if Trump wins, would this be orders of magnitude better for Bitcoin? Or as a Bitcoin holder, how do you feel about this?”

Dan: “I really think this is the biggest news in the crypto space…

“I think the former president’s change of opinion in May was the biggest event in crypto, because whether he was elected or another candidate was elected, everyone changed. The SEC launched an ETH ETF in a week. Everything changed. I really think this is a huge change, because now politicians see that crypto is popular. Think about it. Most Americans are under 40. They like crypto and they vote. So politicians can combine the two.”

Bitcoin’s killer app is Bitcoin

Aaron: “Bitcoin’s token economy is developing. Does Bitcoin need to develop? That’s the question. Does Bitcoin need to develop a strong token economy to be that asymmetric bet? Like if the token economy doesn’t develop, will Bitcoin’s growth be limited, or how do you view it?”

Dan: “I think it’s great to have some cool projects built on top of Bitcoin. Projects like Stacks are great, but people sometimes say, ‘What’s the killer app for Bitcoin?’ Bitcoin is the killer app for Bitcoin. There’s so much wealth being stored, so much savings, so much money moving across borders. So even if nothing else was built on top of Bitcoin, this would be an amazing development for the world.”