Author: Clibmer, Jinse Finance

Recently, Sui, the project token of L1 public chain Sui, has rebounded from the bottom, with a one-week increase of more than 140%, which is a unique performance in the period of general decline of Altcoin. Such a brilliant performance has caused heated discussions in the community about the true value of Sui, and the co-founder of crypto venture capital Mechanism Capital and former Goldman Sachs executive and founder of macro research institution Real Vision even published an article to respond to the market value comparison of Sui and SOL.

This shows that investors do not want to miss the next public chain project like Ethereum, Solana, and Polygon. This article will also take this opportunity to re-examine Sui and explore the reasons behind the rise of its tokens.

A 140% increase in a single week, outstanding performance gives the community high expectations

The name Sui, pronounced swē in English, is derived from the Japanese word for the element water.

In March 2022, Mysten Labs, a Web3 infrastructure startup founded by four former Meta engineers, announced its Layer 1 public chain called "Sui". Mysten Labs said that Sui is a permissionless proof-of-stake (PoS) blockchain network with no theoretical limit on throughput per second. The network will also support smart contract development through the Move programming language, allowing developers to build decentralized applications on Sui.

Sui is designed to scale horizontally and support a wide range of DApp development at high speed and low cost. Its goal is to deploy decentralized applications (DApps) through a smart contract architecture that is superior to blockchain competitors such as Ethereum, in order to "bring the next billion users to Web 3."

The development team of the public chain Sui and the Web 3 infrastructure company Mysten Labs also raised a total of US$336 million in 2021 and 2022. At that time, the post-investment valuation exceeded US$2 billion. Investors included a16z Crypto, Jump Crypto, Binance Labs, Franklin Templeton, Coinbase Ventures and other well-known institutions.

In May 2023, Sui was officially launched on the exchange, and the project token has since fallen to as low as $0.37. However, with the advent of a new round of bull market, Sui has also ushered in a wave of explosions, and rose to a record high of $2 at the end of March this year, an increase of about 440% from the lowest point. However, it soon fell all the way as the crypto market cooled, falling to as low as $0.46, a drop of 77%. Therefore, judging from the rise and fall, its overall performance is average among similar projects.

However, Sui's recent gains have been quite explosive.

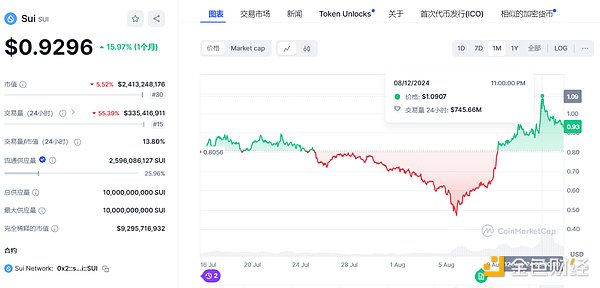

From the price trend of Sui on CoinMarketcap, we can see that Sui reached a low of $0.46 on August 5, and then rose sharply, reaching a high of $1.12 on August 12. In just one week, Sui's price rose by 143%.

This increase not only ranks first among similar projects, but also ranks first in the current situation where Altcoin generally fall sharply. At the same time, this performance has also attracted heated discussions in the community, and some people even regard it as the next Solana killer.

Community member @apadinbase said that he buy the dips Sui at the bottom of $0.57, and was surprised by the huge increase. He previously thought that Sui was like SOL in 2021, and also said that UI Capital would promote itself as the Solana killer in order to pursue profits.

In response to this view, Andrew Kang, co-founder and partner of crypto venture capital firm Mechanism Capital, said he did not think Sui's market value would reach the level of SOL. Raoul Pal, former Goldman Sachs executive and founder of macro research firm Real Vision, also said that if Sui wants to prove itself worthy of being the next big hit, it needs to effectively compare with SOL by breaking the downward trend.

Behind the rise: internal and external factors work together

MechanismCapital co-founder Andrew Kang was the first to give his insights on Sui's rise, saying that Sui has shown multiple bullish signals. Kang listed five reasons to support this prediction:

1. Raoul Pal, who serves on the advisory board, posted a series of posts in support of Sui;

2. There is a demand for large-scale over-the-counter transactions in the market;

3. Despite the massive unlocking, holders remain relatively strong;

4. Sui price trend is positive and no pullback occurs;

5. Recent performance upgrades to Mysiceti may bring interesting new applications.

In my opinion, Sui’s sudden explosion is the result of multiple internal and external factors.

First of all, Sui is positioned as the Web3 foundation layer, and is also committed to building the underlying infrastructure of crypto games. Sui's TVL has continued to grow since October last year, and is currently about $633 million. Its project ecosystem has reached 86, and projects with TVL exceeding 10 million account for nearly 10%.

On the other hand, the Sui project has been active. In early August, Mysten Labs announced the launch of a new consensus engine, Mysticeti, which can reduce the latency of the Sui blockchain to a certain extent; in July, Sui integrated the blockchain node runner of Amazon Web Services; and in June, Sui reached a cooperation with the hosting service provider Copper.

From a time perspective, the direct reason for Sui's recent rise is the overall recovery of the crypto market and the rise in BTC prices. On August 8, BTC rose by about 12% throughout the day, while Sui rose to $0.86 on the same day, an increase of about 40%. Since then, the market has fluctuated slightly, but Sui has continued to rise.

In addition, Sui's continued rise was also indirectly affected by the community's shill and the bullish remarks of MechanismCapital co-founder Andrew Kang. After his remarks were made on the morning of August 12, Sui rose to a stage high of around $1.117 in the afternoon and evening of the same day. After that, it fell back. As of the time of writing, Sui's price was $0.93.

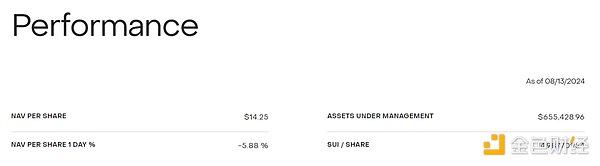

In terms of news, the biggest positive is the crypto investment trust service launched by Grayscale for Sui on August 7. As of August 14, the asset management scale (AUM) of Grayscale Sui Trust, a trust product of Grayscale Sui, exceeded US$650,000, and the net asset value per share rose to nearly US$15.

Bitget Research Institute also published a statement saying that before the sharp rise, Sui's open interest volume had started to rise from a low level, indicating an influx of hot money.

In addition, on July 8, OKX cooperated with Sui to launch a learn-and-earn activity, which indirectly increased the influence and liquidity of the Sui project.

The above are all positive effects summarized after Sui's rise, and cannot be the direct factor for Sui's explosion. However, the project has also had other positive events recently. For example, on August 13, CoinList launched a staking fund, and the first batch of five supported crypto assets included Sui, and it will also provide digital asset passive income services to US accredited investors.

In addition, ZAN, a Web3 brand under Ant Financial, announced a partnership with Mysten Labs. ZAN will provide technical support for Mysten Labs' KYC infrastructure and RPC node services. In the first quarter of last year, Mysten Labs announced partnerships with Alibaba Cloud and Tencent Cloud.

Conclusion

It is normal for a project to soar or plummet in the short term in the crypto market. What is really worth paying attention to is whether the project itself has long-term value . Just like Ethereum, Solana, and Toncoin, it has both market popularity and moats. Judging from Sui's current performance, it does give investors hope at a time when blue-chip Altcoin are generally sluggish, but it is too early to regard it as a Solana killer. Therefore, as a former Goldman Sachs executive said, it is only possible to compare Sui with SOL when it completely breaks the downward trend.